krblokhin/iStock Editorial via Getty Images

Generally speaking, I would not count myself a fan of the retail space. This includes supermarkets. Companies operating in this space have historically been subjected to significant competition from other brick-and-mortar firms. And more recently, the Internet has also been a contender. But one company that continues to defy expectations and that is just all around a high-quality operator, is Ingles Markets (NASDAQ:IMKTA). Despite seeing shares rise nicely during a down market, the company still seems to be trading on the cheap. While it is true that the stock is not as cheap as it was previously, it is still cheap enough to be considered a ‘strong buy’ in my book.

An amazing play in retail

Back in May of this year, I wrote an article that looked upon Ingles Markets in a very favorable light. In that article, I called the firm, which operates 198 supermarkets across six different states in the southeastern portion of the US, an excellent play on retail. I was particularly drawn to the company’s attractive growth, both on its top line and its bottom line. And I was amazed that this came during a time when the number of stores the company operates was not changing all that much. Add on top of this how cheap shares were at the time, and I could not help but to rate it a ‘strong buy’, meaning that I felt like it would significantly outperform the broader market for the foreseeable future. Since then, the market has continued to fall, dropping by 4% in all. But by comparison, shares of Ingles Markets have ticked down just 0.2%.

Although a modest decrease in price may not seem like much of a win for a high conviction prospect, the performance over a longer timeframe has been particularly great. From an article I wrote in January, shares have generated a return of 16.1%. That compares to the 13.5% decline seen by the S&P 500. Regardless of the timeframe you look at, the strength of the company relative to the broader market has been driven by continued strong performance achieved by management. Particularly noteworthy is the second quarter of the 2022 fiscal year, the only quarter for which data is now available that was not available when I last wrote about the firm.

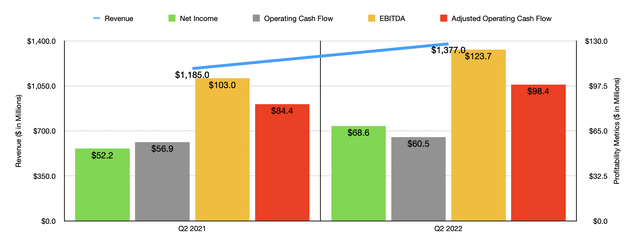

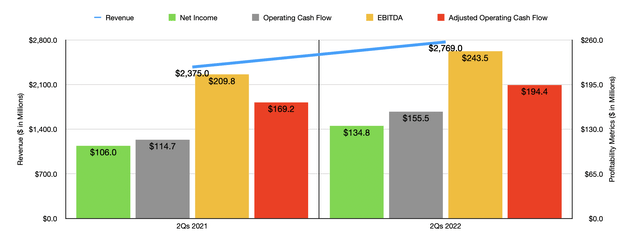

During that quarter, revenue came in at $1.38 billion. That represents an increase of 16.2% over the $1.19 billion generated the same time one year earlier. This rise in revenue was driven by a few factors. Excluding gasoline sales, for instance, total grocery comparable store sales increase by 10.1%, with five point 3% of that rise coming from an increase in the number of customer transactions and 5% coming from increased transaction size. This is not to say that gasoline was not a meaningful contributor to the company’s upside. In fact, gasoline sales rose by 53.2%, largely because of a higher price on that product. But grocery sales grew by 12.9%, while non-food sales expanded to the tune of 7.7%. Meanwhile, the sale of perishable items increased by 11% year over year. There is, of course, another way to look at this data. For instance, the vast majority of the increase for the company came from a $170.8 million rise in comparable store sales. Net store openings, by comparison, added $11.5 million to the company stop line. And other miscellaneous items hit revenue to the tune of about $2 million. This strong top line performance helped the company bring total revenue for the first six months of the year up to $2.77 billion. That’s 16.6% above the $2.38 billion reported one year earlier.

On the bottom line, the picture also continues to improve. Net income in the latest quarter was $68.6 million. That’s 31.4% above the $52.2 million generated just one year earlier. Operating cash flow rose from $56.9 million to $60.5 million. If we adjust for changes in working capital, it would have risen from $84.4 million to $98.4 million. Meanwhile, EBITDA for the company also expanded, rising from $103 million to $123.7 million. As was the case with the revenue increase, this rise in profitability helped to bring full-year results, covering the first half of the year at least, up relative to one year earlier. Net income of $134.8 million beat out the $106 million reported in the first half of 2021. Operating cash flow rose over this time from $114.7 million to $155.5 million. Adjusted for changes in working capital, this would have risen from $169.2 million to $194.4 million. Meanwhile, EBITDA also increased, climbing from $209.8 million to $243.5 million.

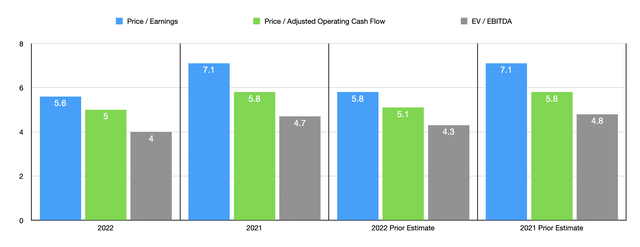

At this time, we don’t really know what to expect for the current fiscal year as a whole. But if the second half of the year looks very much like the first half did, we should anticipate in net income of $317.5 million. That should translate to operating cash flow of around $351.9 million and EBITDA of somewhere around $539.9 million. On a forward basis, this makes shares of the company quite cheap. The firm would be trading at a price-to-earnings multiple of 5.6. The price to operating cash flow multiple would be even lower at 5, while the EV to EBITDA multiple would come in at 4.

Even if we see financial results revert back to 2021 levels, the company would still be very cheap. For instance, the business would be trading at a price-to-earnings multiple of 7.1. The price to operating cash flow multiple would come in at 4.8, while the EV to EBITDA multiple would be 4.8. These numbers are almost unchanged from when I last wrote about the company, despite data for a new quarter coming into play. Also, as part of this analysis, I decided to compare the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 9.4 to a high of 79.4. In this case, Ingles Markets was the cheapest of the group. Using the price to operating cash flow approach, the range was from 4.2 to 25.2. And when it comes to the EV to EBITDA approach, the range was from 3.8 to 28.3. In both of these cases, our prospect was cheaper than all but one of the firms.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Ingles Markets | 7.1 | 5.8 | 4.7 |

|

Grocery Outlet Holding Corp. (GO) |

79.4 | 25.2 | 28.3 |

| Natural Grocers by Vitamin Cottage (NGVC) | 13.9 | 6.0 | 5.6 |

| Sprouts Farmers Market (SFM) | 12.6 | 7.6 | 5.1 |

| Casey’s General Stores (CASY) | 21.9 | 9.4 | 11.1 |

| Albertsons Companies (ACI) | 9.4 | 4.2 | 3.8 |

Takeaway

No matter how you stack it, Ingles Markets continues to fare well in this current environment. Although it would have been nice to see shares increase in price in recent months, the fact that they have held steady during a continued decrease in the market is a testament to the quality of the operation. Management continues to grow the company at a nice clip and its shares are incredibly cheap on both an absolute basis and relative to similar companies. Because of this all, I have decided to retain my ‘strong buy’ rating on the company for now.

Be the first to comment