mikkelwilliam

Investment Overview

BioNTech (NASDAQ:BNTX) just released its Q322 earnings, and although management reported $3.5bn of revenues – I’m using euros and dollars interchangeably since the exchange rate is currently 1:1 – and lifted its FY22 forecast to $16 – $17bn – the elephant in the room gets harder to ignore with each set of quarterly earnings.

BioNTech has only one source of revenue – the COVID vaccine, Comirnaty, that it co-developed, marketed and sold in partnership with Pfizer (PFE), with revenues split equally between the two companies.

That source of revenue happens to be the biggest selling drug of 2021 and 2022, which is how BioNTech has been able to grow its share price from $15 – at the time of its IPO – which raised $150m and valued the company at ~$3.3bn – to $154 at the time of writing.

It’s a valuation supported by very strong numbers in Q322. $2.4bn operating profit, EPS of $6.98, and a cash position that stands at $13.4bn, with $7.3bn of trade receivables. But, the numbers are shrinking – operating profit was $4.7bn in Q321, for example, and net profit fell from $3.2bn to $1.8bn year-on-year.

BioNTech’s earnings per share of $29.47 across the first three quarters of 2022 matches the $29.22 achieved over the same period in the prior year, and if we estimate FY22 EPS to be ~$39, with Q4 EPS calculated as an average of the first three quarters, then BioNTech stock looks laughably cheap given the implied forward price to earnings ratio of ~4x.

The elephant in the room I’m referring to however is the likely sharp fall in sales of the Comirnaty vaccine in 2023. Management declined to provide any guidance for next year in its presentation or during the earnings call, and that will give the market jitters.

BioNTech did suggest that a public/private market will emerge in the second half of next year, however, and in this post I will discuss how it could potentially be a double-digit-billion revenue opportunity for the company.

Vaccine sales will inevitably dictate BioNTech’s market cap valuation through next year. Nevertheless, BioNTech was built to be a messenger-RNA powerhouse, not a vaccine specialist, and in a few years’ time the company may be better known for its oncology products than its vaccines.

It’s still very difficult to make the case for BioNTech being a >$35bn market cap company based on its ex-COVID pipeline, but investors should certainly consider the company’s >$20bn of cash, 20+ oncology assets, and private COVID vaccine market opportunity before dismissing its shares as an investment opportunity.

BioNTech is still one of the most important pharmaceutical companies globally, but the next couple of years may be a transitional period for the company. Although the share price could trade in a range of $150 – $200 on the promise of double-digit COVID vaccine revenues, my fear would be that a drop <$100 is the likelier scenario if management doesn’t find a way to provide bullish 2022 guidance when it announces FY22 earnings next spring.

BioNTech’s Vaccine Orders Dry Up

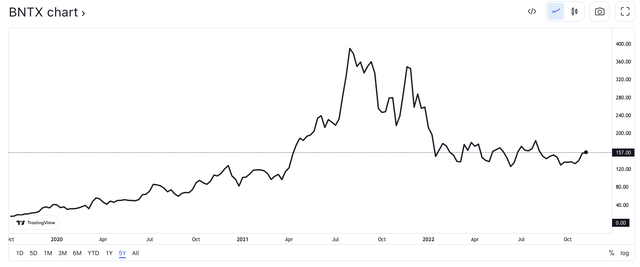

In early August 2021, when it became clear that BioNTech would earn ~$22bn from Comirnaty sales in 2021, and possibly as much again in 2022, the company’s shares achieved their peak price of $389, valuing the company at ~$94bn.

BioNTech share price performance since IPO (TradingView)

As we can see above, however, although by late 2021 the Omicron variant had caused a spike in COVID infections, this variant proved to be less deadly than previous versions, and as Pfizer / BioNTech met demand with supply – committing to supply 1.8bn doses to the EU and 1bn to the US – BioNTech’s valuation began to cool rapidly. With no other products to sell, and demand in its only market practically satisfied, the decline in the share price was almost inevitable.

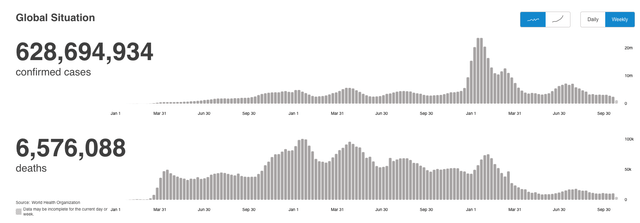

Today, in late 2022, it’s generally believed that the worst of the pandemic is behind us, and this is borne out by a steady fall in the number of cases and deaths, and the fact that, according to the World Health Organization (“WHO”), the Omicron strain now represents ~99% of all cases.

WHO COVID Tracker – cases and deaths (World Health Organisation)

At some stage, governments always were going to stop buying doses of messenger-RNA COVID vaccines, if for no other reason than the fact that governments do not have limitless supplies of cash. As such, by the time 2022 draws to a close, BioNTech is on track to have satisfied all of its purchase orders from the US, EU, and other territories.

BioNTech continues to carry out essential work developing vaccines against newer strains of COVID such as its Omicron BA.4 / BA.5 bivalent vaccine, and nobody can rule out the possibility that a newer, more deadly strain of COVID could be unleashed, which will require a fresh round of mass vaccination.

Looking ahead to 2023 at present, however, it seems as though BioNTech does not have any definite advanced purchase orders for its vaccine from any government or agency.

The Emergence Of A Hybrid Public / Private Market

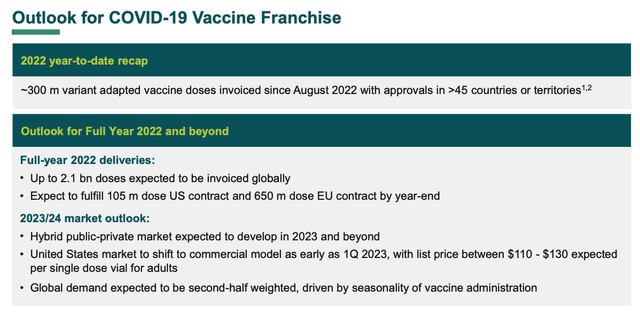

BioNtech outlook for COVID vaccine franchise (BioNTech Q322 Earnings Presentation)

As we can see in the slide above (taken from BioNTech’s Q322 earnings presentation) BioNTech management seems to believe it will satisfy all of its existing COVID vaccine orders by the end of 2022 – so what does 2023 have in store for the company?

Management believes that a “hybrid public/private” market will develop, one in which it will no longer charge a “not-for-profit” price of $20 – $25 per dose, but $110 – $130 per dose. It’s generally agreed by analysts and the market that this is the most likely scenario, but nobody quite knows what the shape of demand will look like.

Many people seem to think it will be at least similar in size to the global influenza vaccine market. According to the Centers for Disease Control (“CDC”) ~176m influenza vaccine doses were distributed in 2021/22, and 194m doses distributed in 2020/21. That implies a potential US market of $22.2bn per annum for COVID shots, taking the average of the last two years’ demand for flu shots, and using the midpoint of BioNTech’s forecast pricing.

185m doses represents more than half of the US population, or more than a quarter taking a two-dose regime – a figure which strikes me as quite high. Will >100m Americans purchase a COVID vaccine for >$100 in 2023? It may depend on whether COVID shots are included in healthcare plans, and the level of reimbursement secured. Widespread reimbursement would suggest that it will be the US government that’s footing most of the bill for private vaccinations.

If we take the figures at face value, however, likely the highest possible share of the market that Pfizer / BioNTech could claim would be 50%, let’s assume, given rivals such as Moderna (MRNA), AstraZeneca (AZN), Novavax (NVAX), and any other pharma that may develop a vaccine to compete in a private market. That equates to ~$11.1bn, and of course, BioNTech’s share would be half of that, so ~$5.05bn.

Then, we can speculate that the market in Europe – population of ~750m – will be as large as, if not larger than the US. According to a recent article in Reuters, that ~12m people in France have been vaccinated against flu so far this year, or ~18% of the population Let’s therefore estimate that 25% of Europe would demand a private COVID vaccine – ~188m people – representing a market opportunity of $22.5bn – the same as in the US. As such, an optimistic forecast might suggest that BioNTech’s revenue opportunity in a public/private market is ~$10bn.

Do revenues of $10bn support BioNTech’s current market cap valuation of $37.5bn? The forward price to sales ratio is <4x, which is lower than the average P/S ratio of e.g. Google (GOOG) (GOOGL), Johnson & Johnson (JNJ) and AbbVie (ABBV), and significantly lower than e.g. Microsoft (MSFT) or Eli Lilly (LLY), so broadly speaking, the market opportunity supports BioNTech’s current valuation and even suggests it could go higher.

Other Vaccines In BioNTech’s Crosshairs

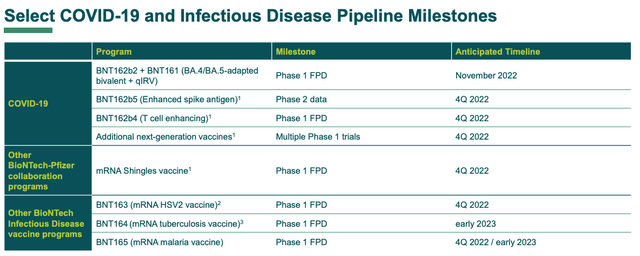

BioNTech COVID-19 & Infectious Disease pipeline (Q322 earnings presentation)

As we can see above, BioNTech continues to work with Pfizer developing COVID vaccines, while the two are additionally working on a Shingles vaccine, and BioNTech is developing it’s own in-house HSV2, tuberculosis and malaria vaccines.

We also can see that none of these new vaccines have made it beyond the Phase 1 trial stage, and it’s important to remember that BioNTech does not have the priceless first-mover advantage in these markets that it had in COVID. For example, GSK already has a shingles vaccine on the market, which earned revenues of nearly $2bn in 2020.

Nor is there any guarantee that BioNTech’s Phase 1 vaccines will make it to market. Despite their phenomenal success in developing messenger-RNA based COVID vaccines, neither BioNTech nor Moderna have yet been able to mirror that success outside of the virus.

As such, valuing the ex-COVID vaccine pipeline is tricky, but in an industry where almost all early stage drugs in development are statistically more likely to fail than succeed, and given that the ex-COVID vaccine markets are subject to a much greater level of competition, I would want to wait at least another year before including e.g. malaria or tuberculosis vaccine sales in my calculations when modeling a valuation for BioNTech.

Oncology Pipeline Will Be A Major Focus In 2023

Although I have made a case for BioNTech’s public/private market opportunity being as high as $10bn per annum, BioNTech itself has stated that it will take a while for that market to develop, and it will likely be deep into the second half of next year until we know whether my forecast above is accurate or not.

As such, the focus may switch to BioNTech’s oncology franchise next year. BioNTech has promised a “catalyst heavy” 2023, and many of those catalysts will be related to its large and diverse oncology pipeline.

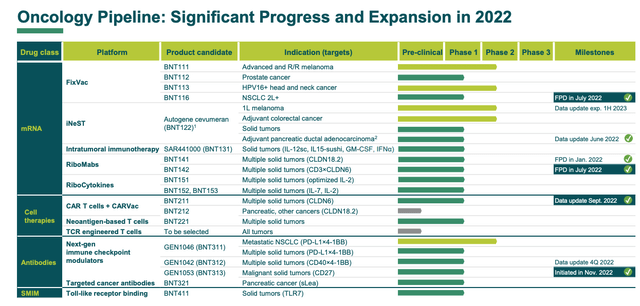

BioNTech oncology pipeline (Q322 earnings presentation)

There are some assets here that contain genuine promise. The FixVac franchise, for example. These assets are referred to as “cancer vaccines,” although they do not prevent disease like a traditional vaccine is designed to do, but contain antigens that are often expressed in certain types of solid tumor cancers, which – the theory goes – may help to enhance the efficacy of cancer immunotherapies.

BioNTech has been working with the pharma company Regeneron (REGN) and its immune checkpoint inhibitor Libtayo – a rival to the likes of Bristol Myers Squibb’s ~$7bn per annum selling Opdivo and Merck’s (MRK) ~$13bn per annum selling Keytruda. The targets include Melanoma, prostate cancer, and non-small cell lung cancer – major markets where there is high unmet need.

Immunotherapies typically only work in around one third of patients, and BioNTech’s hope is that its FixVac therapy, administered in the adjuvant setting, can help to increase that proportion. In a study of BNT111 plus Libtayo in 17 patients with melanoma, 6 partial responses were observed, hinting at the “vaccine’s” potential.

BioNTech also partnered with Roche (OTCQX:RHHBY) on a combo of Roche’s Autogene cevumeran, plus BNT122, with data from a Phase 2 study expected in the first half of next year. Then there are the RiboMabs and RiboCytokines classes, and the CAR-T cell therapies.

Cell therapy has made great strides in recent years, with the likes of Bristol Myers Squibb, Legend Biotech (LEGN), and Gilead Sciences (GILD) all seeing therapies approved targeting hematological cancers, with blockbuster (>$1bn per annum) sales potential. BioNTech is trying to make similar progress in solid tumors – although this is an incredibly complex and difficult challenge given how resistant solid tumor cancers are to therapies of any kind.

BioNTech is partnered with Danish biotech Genmab and French pharma Sanofi (SNY) for its next-gen immune checkpoint inhibitors (“ICI”), and as mentioned, oncology was BioNTech’s original focus, before its partnership with Pfizer and development of Comirnaty.

As impressive as the development of some assets has been, such as BNT211 showing an objective response rate (“ORR”) of 57% in testicular cancer patients, for example, there’s a very long way to go, and to date, no single data readout has suggested that BioNTech is close to a breakthrough of real significance.

With that said, the value of a successful personalized cancer vaccine (“PCV”) should not be underestimated. When Merck opted to pay Moderna $250m to continue its co-development of Moderna’s PCV MRNA-1457, Moderna’s share price jumped from ~$120, to ~$134, reflecting a ~$6bn jump in market cap valuation. The market clearly believes that PCVs could change the face of solid tumor cancer treatment.

Conclusion – Private Vaccine Market Dictates BioNTech’s Valuation In Near Term – Oncology In The Long Term

In its wildest dreams, BioNTech’s husband and wife founders likely never expected to develop a drug that looks set to deliver global revenues of >$70bn within a couple years of becoming a public company.

Those revenues were born out of necessity (the mother of invention) and with COVID cases down substantially and newer strains apparently posing less of a threat, the chances are that we will not see the same demand for COVID vaccines going forward.

The dynamics of a private market is something that BioNTech management was unwilling or perhaps unable to discuss on its Q322 earning call – all we know is that management expects such a market to emerge in the second half of next year.

I have speculated about what the market may look like and it’s my belief that its potential is sufficient to support BioNTech’s present market cap valuation and share price for the foreseeable future.

Management will have to set some targets for 2023 soon, however, or the market will become jittery. The reality is that the next phase in BioNTech’s development – its infectious disease and oncology franchises – is at too early a stage to support the valuation created by its only revenue generating asset.

Be the first to comment