Tunatura

Shares of Aquestive Therapeutics (NASDAQ:AQST) have fallen by over 90% since their $67.5M IPO was priced at $15 in 2018. So far in 2022, the company has lost two-thirds of its value after a number of negative developments including CEO resignation and dilutive secondary offering (with warrant sweetener) at lows in June.

At market capitalization of ~$80M (below my typical $100M threshold for initiating due diligence efforts) and with a dwindling pile of cash, Aquestive has certainly seen better days and the big question is whether management can get this growth story back on track.

My reason for revisiting is August 31st news that the company finally received tentative FDA approval for Libervant (diazepam) Buccal Film for acute treatment of seizures in epilepsy patients aged 12 years and older. In the past, I’ve pointed out that Libervant offers an appealing alternative to rectal and oral formulations of diazepam.

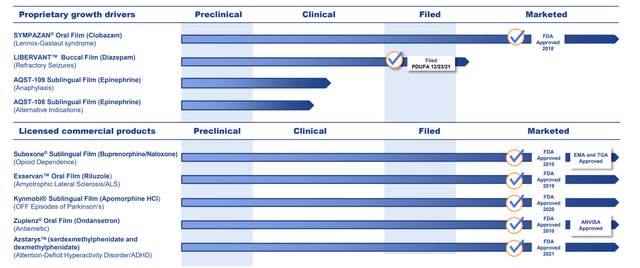

Couple that with the proven PharmFilm technology (validated with 7 FDA approvals), additional shots on goal in the clinic and it’s clear why I think at the least we should revisit the story to determine if there’s a near term opportunity for investors.

Chart

FinViz

Figure 1: AQST weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above, we can see share price hit a high of $9 back in 2020 due in part to sales growth across licensed products (Sympazan, Suboxone, etc). From there, shares fell below $1 in summer 2022 in response to delays with clinical timelines as well as regulatory setbacks and generic competition eroding revenues received from partnered products. As for technicals, my initial take is that share price appears buyable on pullback to 20 day moving average at $1. However, the stock may still be too speculative for me to recommend for readers and I need to dig deeper before I feel comfortable suggesting a specific strategy here.

Overview

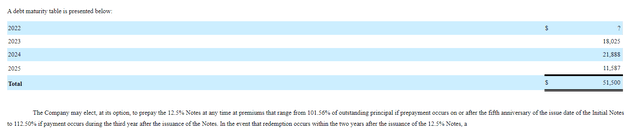

Founded in 2004 with headquarters in New Jersey (~150 employees), Aquestive Therapeutics currently sports fully diluted market capitalization of ~$80M and Q2 cash position of $17.7M providing them operational runway of under 2 quarters. Keep in mind they also have ~$51M in loans on the balance sheet as well (maturities for senior secured notes staggered out over the next 3 years).

10-K filing

Figure 2: Debt maturity table (Source: 10-K filing)

Currently, management is projecting $37M to $43M in non-GAAP adjusted EBITDA loss for full year 2022 after employing cost-cutting measures (previous range was $51M to $58M).

In my 2019 update, I touched on the following keys to bullish thesis:

- Pipeline appeared to offer several intriguing “shots on goal,” not to mention spreading risk across commercial, late-stage and early-stage assets. Management did this intentionally, trying to construct a portfolio that isn’t binary or dependent on any one event or readout (perhaps making the company a better bet for more conservative investors). Obviously, I was wrong on the latter point. Interestingly enough, the company started out originally as a contract developer and manufacturer, but in early 2014 management changed its direction to move toward becoming a proprietary product-driven specialty pharma company (gameplan is essentially to drive revenue growth that allows for investing in larger, more valuable and more complex targets using their technology).

Corporate Slides

Figure 3: Pipeline (Source: corporate presentation)

- Listening to the BIO CEO presentation helped me understand that several of these products are not simply “me too” knockoffs, but instead offer significant advantages to payers, caregivers and patients that should drive substantial commercial uptake IF the company could get them to regulatory approval and successful launch out of the gate.

- As for future potential, the CEO noted that the firm’s technology allows for delivering drug product sublingually or enterally, dissolving slow or fast, flavored in any way depending on geographic or demographic market. An example of where a strong value proposition is identified for caregivers, patients, and payers in the epilepsy space. There are 3.5 million sufferers of this condition with a third of them experiencing refractory breakthrough or cluster seizures where current standard of care is diazepam administered rectally. 92% of patients won’t interact with the drug and people want Libervant providing the same efficacy at a lower dose. There are over 1 million ER visits a year in this space because patients won’t interact with the old version of the drug.

- My focus in the article was also on Libervant, specifically clinical results including from an Adult Epilepsy Monitoring Unit study showed that diazepam buccal film (DBF) was successfully used and had similar bioavailability whether it was administered to patients between seizures or shortly after seizures. As the only currently approved formulations of diazepam were injected or rectally administered (nasal now approved as well), this looked to be an exciting value driver for the company as it provides a much-needed alternative in the marketplace.

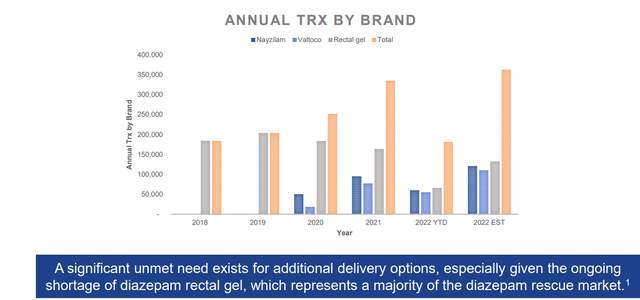

Corporate Slides

Figure 3: Seizure cluster acute rescue market shows promising growth for nasal sprays Valtoco and Nazyilam at the expense of older rectal gel formulation (Source: corporate presentation)

- To be fair, I also pointed out courtroom drama with competitors, especially regarding companies wishing to launch generic versions of buprenorphine/naloxone sublingual film (and thus challenging patents held by Aquestive and Indivior for Suboxone Sublingual Film). However, I argued that revenue generated by Suboxone made up a small portion of the company’s valuation and Dr. Reddy and Alvogen were ready to bring to market their generic versions in the near to medium term.

Let’s move on to recent developments and how they’ve impacted the story here.

Select Recent Developments

In December of last year, one negative development that crushed the share price was regulatory delay by the FDA for Aquestive’s New Drug Application for Libervant for the treatment of breakthrough seizures and seizure clusters. Simply put, the agency was not ready to take action by the agreed upon date of December 23rd but no further action was needed from Aquestive (they did not do anything wrong, to my eyes). CEO Kendall expressed his surprise as well considering that data package submitted satisfied all of CDER’s requests.

Fast forward to March of this year, the company announced license and supply agreement with China-based Haisco Pharmaceutical group to develop and commercialize Exservan (riluzole oral film) for the treatment of ALS in that region. Aquestive serves as sole manufacturer and supplier for the product under deal terms and received $7M payment upfront (also eligible for milestones and double-digit royalties).

Unfortunately, in April Aquestive made a move showing just how starved the company is for cash. Namely, it entered into a common stock purchase agreement for up to $40M with Lincoln Park Capital Fund. At least to my eyes, similar such agreements in small cap biotech land are a sign that companies could be on their last legs and are doing everything they can just to keep the lights on.

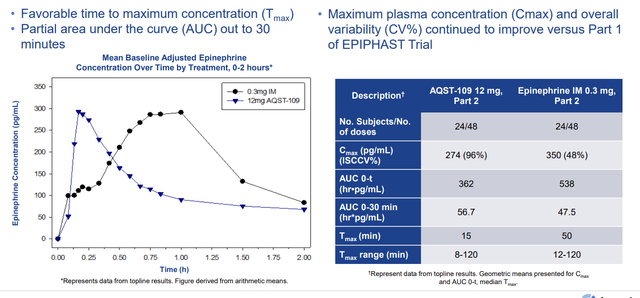

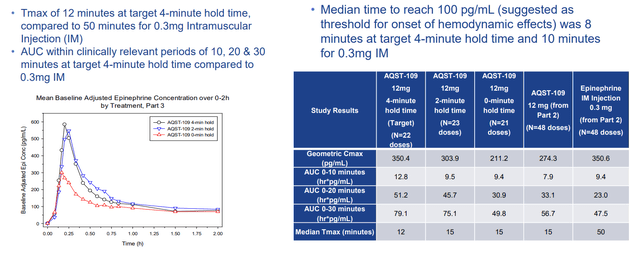

Also in April, the company announced positive topline results from Part 2 of the EPIPHAST study for AQST-109 (epinephrine oral film). Utilizing a replicate crossover design, Part 2 confirmed key pharmacokinetic and pharmacodynamic measures in a larger population of 24 healthy subjects. Drug candidate was well tolerated with no serious adverse events. Rapid absorption was observed with median time to maximum concentration (Tmax) of 15 minutes compared to 50 minutes for the epinephrine 0.3mg intra-muscular (IM) injection. The Area Under the Curve (AUC) within the clinically relevant periods of 10 minutes, 20 minutes, and 30 minutes, were comparable for both AQST-109 and the 0.3mg IM injection. Management contends that AQST-109 could be a solid alternative for patients who have needle phobia as well as in order to combat the challenges of delayed administration. The plan from here was to begin pivotal PK study by the end of 2022.

Corporate Slides

Figure 4: AQST-109 has comparable PK to existing epinephrine auto-injectors (Source: corporate presentation)

On May 17th, the company announced that President and CEO Keith Kendall was leaving (potential red flag). Daniel Barber from the Board of Directors stepped up to fill the roll (interestingly enough, he’s been involved with the company since 2007).

On June 8th, the company closed a direct offering with a single healthcare-focused institutional investor and certain executives (green flag to my eyes) consisting of 8.85M shares of common stock along with warrants to purchase up to 8.85M shares at purchase price of $0.96 for institutional investor and $1.09 for Aquestive’s executives. Total proceeds were $8.5M, keeping in mind that warrants have 5-year term and are exercisable 6 months from date of issuance. I will confess I have not heard of the brokers involved (Alliance Global Partners and Brookline Capital Markets).

Also in June the company reported positive Part 3 results from the EPIPHAST study of AQST-109 epinephrine oral film. Part 3 demonstrated maximum plasma concentration (CMAX) values that were consistent with the Part 2 findings, 0.3mg IM Injection, as well as those previously reported for approved injectable epinephrine devices (i.e. EpiPen). CEO Dan Barber notes that they have now achieved a Tmax of 15 minutes or faster in multiple studies, while clinical investigator reminds us that there is a niche opportunity and unmet medical need for an epinephrine treatment that patients can more easily carry and more quickly administer in a life-threatening emergency situation. The plan from here is to conduct a repeat dose comparative study in Q3, which paired with EPIPHAST study data will be the basis for end-of-phase 2 meeting with the FDA (to be requested in Q4).

Corporate Slides

Figure 5: AQST-109 shows rapid absorption with favorable PK in part 3 (Source: corporate presentation)

In August, the company announced appointment of Timothy Morris to the board of directors and Kenneth Truitt, M.D., as Chief Medical Officer.

Lastly, on August 31st Aquestive announced the FDA granted “tentative approval” for Libervant Buccal Film for the acute treatment of intermittent, stereotypic episodes of frequent seizure activity (i.e., seizure clusters, acute repetitive seizures) that are distinct from a patient’s usual seizure pattern in patients with epilepsy 12 years of age and older. “Tentative approval” means the FDA has concluded that Libervant has met all required quality, safety, and efficacy standards for approval but, due to an existing FDA regulatory grant of orphan drug market exclusivity for Valtoco diazepam nasal spray (Figure 3 above), a diazepam nasal spray product, Libervant is not yet eligible for marketing in the United States. Thus, final approval for Libervant cannot be granted until expiration or inapplicability of orphan drug market exclusivity for Valtoco. Another possible scenario, though I’m not sure how likely it is, would be if the FDA reverses its decision and determination that Libervant is in fact “clinically superior” to Valtoco. Management continues to believe that Libervant offers the distinct advantage of being able to be readily administered when needed without regard to food and hopes to meet with the FDA to clarify this and other points as demonstrated in the data. Keep in mind that Aquestive’s food effect study utilizing Valtoco showed that if administered after high fat meal, CMAX (maximum drug concentration) is reduced by 48% versus when administered in fasted state.

Other Information

For the second quarter of 2022, the company reported cash and equivalents of $17.7M as compared to net loss of $16.3M (that number becomes $14M when excluding one-time severance costs and $2M KemPharm one-time milestone). Adjusted EBITDA loss came in at $9.9M, versus $4.1M for Q2 2021. Total revenues fell slightly to $13.3M, keeping in mind that the company saw a 36% increase in Sympazan net revenue offset by reductions in manufacture and supply revenue as well as co-development and research fees. Accumulated deficit since inception is $256M (a number I consider more than reasonable).

For full year 2022 outlook revenue expectations were increased to range of $46M to $49M with non-GAAP adjusted gross margins of 70% to 75% (unchanged). Non-GAAP adjusted EBITDA loss narrowed to $37M – $43M from prior range of $51M -$58M.

I would imagine those warrants will be exercised by year end and the company will need additional funding on top of that, given current cash burn and weak balance sheet.

As for the conference call, CEO highlights one overlooked aspect of the story for its two acute rescue medications in that their patent protection extends to the late 2030s (long growth runway). He acknowledges that reducing cash burn is the key area of concern and in that vein, they have eliminated almost all commercial burn through continued growth and rightsizing their non-sales infrastructure. There are additional levers the company could pull in coming quarters to improve their financial situation, such as inking new licensing agreements with partners, expense reduction and refinancing the debt.

As for where they still wish to invest, the key asset is AQST-109 considering that 40 million Americans are at risk of experiencing severe allergic reaction yet only 3 million prescriptions are filled for injectable epinephrine. Perhaps this gap exists in part due to need for additional product options and one would think convenient thin film formulation carried in the patient’s pocket is a logical alternative. They refer to a survey of over 500 allergists, pediatricians and primary care physicians where 88% of respondents were concerned about patients and/or caregivers consistently having their autoinjectors on hand at all times. Another problem is that too often patients with at least some risk of anaphylaxis administer oral antihistamines in place of epinephrine autoinjector (these often fail to stop the allergic cascade that marks the beginning of anaphylaxis). As noted farther above, fast time to Tmax for AQST-109 is a key attribute of this drug candidate considering that other alternatives to injected epinephrine have failed to achieve levels comparable to EpiPen.

As for Libervant, they clearly shift the blame to the FDA who “did not meet its commitment on the PDUFA date”. To be fair, management is realistic that the problems facing Aquestive cannot be solved immediately, and it will take time to work their way to a place of improved strength and stability as a company.

Here are a few notes from the presentation at Wedbush PacGrow Healthcare Conference:

- Rapid Tmax for AQST-109 of 12 to 15 minutes versus 50 minutes for manual injector is a key differentiator. Data also demonstrates equal to or higher exposure (AUC) relative to injection (critical to stop progression of anaphylaxis). These two clinical features have been confirmed over a variety of administration conditions. Combine these with portability, ease of administration and highly favorable safety profile make this product potentially transformative in the space. Injection may give you a Tmax of 10 minutes or up to an hour or longer (not the case with AQST-109).

- Certain subset of patients will undergo recurring anaphylaxis (secondary to initial allergic event or refractory to initial dose) and that was characterized in Part 2 of EPIPHAST trial.

- End of Phase 2 Meeting in Q4 with FDA should help them align and proceed with pivotal adult study as well as begin with pediatric programs. They have all the infrastructure to launch the asset if they choose (sounds to me like partnership is still an option). Going after specialists seems feasible for a company of this size, but going after primary care market would necessitate a larger salesforce.

- AQST-108 takes a longer time (20 minutes, creating a different profile). This would allow them to use it in different places (indications have not been disclosed yet). In the allergy space, urticaria would make sense.

- As for Libervant, generally speaking the way to show superiority or differentiation versus competing product (Valtoco) is via better safety, better efficacy or unique contribution from patient care perspective. Management believes Libervant is very necessary and valuable to patients, but they take a step back from actually claiming superiority. They acknowledge the possibility of having to run a head-to-head trial. It’s clear management is frustrated, as they have been ready to launch for quite some time with commercial product ready, trade distributions in place, sales infrastructure, etc.

- Sympazan has grown quarter over quarter since launch, set to go revenue positive in Q3. It’s established their platform in the market to get it ready for Libervant. Sympazan has performed very well in subset of patients who have trouble swallowing.

- As for long term growth opportunities for PharmFilm technology, I appreciate that management acknowledges the company has been punished “for obvious” reasons. However, they are at an interesting point in the story as two acute rescue medications are moving forward and are indicative of where they best can add value (areas with high need of differentiated solution). So, acute rescue space is the logical area to continue finding additional opportunities in. Prodrug platform has a lot of utility and thus optionality.

- As for cash runway, they ended the quarter with just under $18M in cash. They are constantly reviewing how to extend runway (not providing guidance though). First, they look at non-dilutive options (partnerships, licensing, other structure transactions). ATM facility is in place with $35M of availability should they choose to use it.

Apart from Wedbush presentation, the call following FDA tentative approval for Libervant also had a few nuggets worth highlighting:

- Unfortunately, approval was labeled as tentative and FDA deemed that company has not sufficiently shown how Libervant is clinically superior to Valtoco (diazepam nasal spray currently holding orphan drug exclusivity). Management respectfully yet firmly disagrees with the FDA’s determination.

- Rescue drugs must work quickly and be effective across a wide variety of conditions. Products like Libervant and Valtoco must show rapid and extensive absorption under all conditions including whether a patient had a meal recently or hasn’t had a meal in hours. Libervant dosing regimen ensures patients get sufficient drug plasma concentrations no matter their fed state (why the label includes “can be taken without regard to food”). For Valtoco, management has been vocal about their view that the FDA should require drug plasma concentrations under fed conditions. In 2019, they even submitted a citizen’s petition to this end and FDA disagree with their view at the time (approved Valtoco without any food effect studies). No one knows what happens when the product is administered after a meal per prior data. Aquestive’s data concerning Valtoco, on the other hand, showed that peak concentrations (CMAX) dropped by 42% and Tmax doubled from 2 hours to 4 hours when patients were fed versus fasted. Patients are not always receiving expected levels of diazepam after administration of Valtoco (significant shortfall for a rescue medication where speed matters). Cross study comparison shows significant difference for Libervant, but FDA feedback was that Aquestive failed to include a Libervant film arm in the Valtoco food study and thus the data cannot be used to indicate whether there is a food effect in the Valtoco arm. Management felt this stance was counter-intuitive to patients’ interest and contradictory to previous FDA practice. They hope to meet with FDA quickly to discuss and are willing to run a food effect comparison study if necessary.

- Per Q&A, performing a comparative food effect study of Libervant versus Valtoco is a simple study to conduct and would take weeks to a couple months. There is a rapid path forward IF they decide to conduct the study. If they have to wait for Valtoco’s orphan drug exclusivity to expire, that would be January 2027 and Libervant’s patents go to the late 2030s. It sounds like partnering is certainly an option, but again current focus is on getting to full market access approval. Legal action is also a potential option, but food effect issue needs to be prioritized (FDA did not disagree, but they thought there was a better way for the data to be more meaningful to them).

As for institutional investors of note, I’m not seeing much in the way of well-known biotech specialist funds we follow owning positions here. On the other hand, there was a flurry of insider purchases that took place in June (potential green flag).

Chief Innovation and Technology Officer Mark Schobel owns over 880,000 shares and CEO Daniel Barber owns ~193,000 shares (nice to see some skin in the game). Schobel served prior as Global Head of New Technology and Product Innovation for the Consumer Health Business Unit at Novartis where he pioneered thin film delivery of systemic drugs (highly relevant experience).

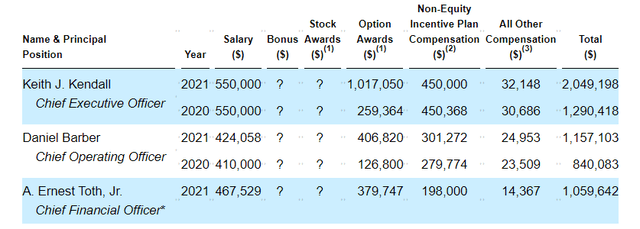

As for executive compensation, I see cash portions of salary as being too high considering the dire straits the company is in. If management is serious about leading by example, they should lower this significantly as we’ve seen other shareholder-conscious management teams like HOOKIPA Pharma (HOOK). On the other hand, stock and options awards are at levels I consider more than reasonable.

Proxy filing

Figure 6: Executive compensation table (Source: proxy filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and while I can’t say that’s the case here, I do wish they’d take more cost-cutting measures in that regard.

Moving onto useful nuggets from members of the ROTY community, veteran TDMInvest (known for his track record in finding out of favor companies) stated the following after Libervant approval decision:

AQST- The FDA continues its track record of bureaucratic entrenchment- who benefits from this nonsense? The worst part is that it took 10-months to reach this conclusion, as the PDUFA was last November. Such a waste. AQST is currently trading down on the news. I would not be surprised to see it reverse. Clearly this is not the news that investors wanted, but overall, it represents progress. AQST is undervalued just based on its existing commercial product. Current market capitalization at $66M with annualized sales just north of $50M, and good margins. It’s unclear to me as to whether this FDA determination opens the door for Libervant sales outside of the U.S. If so, that would be a meaningful interim plus for the company. Another potential “big deal” application is under development in the pipeline (AQST-109) and I continue to hold a substantial long position. As for the balance sheet, keep in mind they have identified assorted cash resources (commercial revenue, plus other vehicles) that appear to be adequate for the foreseeable future. There is the possibility of dilution, but it is at the bottom of the list of options, and management states they would do so only “under favorable conditions”.

Final Thoughts

To conclude, I continue to appreciate the diverse applications of Aquestive’s PharmFilm technology and agree they are best served by focusing on the acute rescue market as opposed to dabbling in therapeutics as they have in the past. The Libervant tentative approval decision by the FDA was clearly disappointing and while I hope the company is able to convince them of the drug’s differentiation with existing data, I would not be surprised if they have to run a head-to-head study. Also, the FDA is not known for its speed, so while the company may respond to them quickly, I’ve seen time and again how these appeal-type processes can extend far longer than originally projected.

Management language indicates they intend to pivot focus to AQST-109 and thankfully anaphylaxis is too big of an indication for orphan drug exclusivity to be an issue. If all goes well, they hope to file for approval by the end of 2023.

In the meantime, the balance sheet is weak and while commendable cost cuts have been made, there is much work left to be done (I would love to see another licensing deal inked or similar such alternative to tapping the ATM facility). The company’s debt load also makes it seem as if they are marching uphill, though thankfully maturities are staggered out over the next few years.

For readers who are interested in the story and have done their due diligence, I cannot in good conscience recommend a purchase of AQST shares at this time. While upside is very high should they improve the balance sheet and execute on key strategic objectives, the current situation is not one that would allow me to sleep well at night as an investor.

From a Core Biotech perspective (emphasis on next 3 to 5 years), I will use this article as a placeholder and overall very much enjoyed revisiting this story. I would consider revisiting by mid to late 2023 IF I see the balance sheet improve and management make progress on the regulatory front for Libervant (and for AQST-109 in pivotal study).

Key risks include weak balance sheet leading to further dilution at lows and company potentially not being able to service its debt load, as well as negative regulatory developments with the FDA if they are not able to come to terms on a path forward for Libervant. Disappointing clinical data for drug candidates including AQST-109 is always possible, though so far that is not area where the company has had any trouble.

Thanks again to ROTY veteran member TDMInvest for bringing this one back on my radar and spurring me to dig deeper. Let’s hope that later in 2023 this one is back on track and thus merits a potential revisit from my end.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. Look forward to your thoughts in the Comments section below.

Be the first to comment