PonyWang/E+ via Getty Images

Contrarian investing isn’t a popular thing to do, but is more often than not one of the easiest ways to generate market-beating long term wealth. In the words of Napoleon, the definition of a military genius is to do the average thing when everyone else is going crazy.

This brings me to Applied Materials (NASDAQ:AMAT), which has fallen to levels that most investors could not have imagined just earlier this year, when it hit a 52-week high of $167. This article highlights what makes AMAT a solid bear market pick for potential marketing beating returns, so let’s get started.

Why AMAT?

Applied Materials is a leader in materials engineering, with solutions that are used to produce virtually every new chip and advanced display in the world. It was founded over 50 years ago with operations in the U.S. and internationally in Asia and Europe.

I view AMAT as being a “pick and shovel” play for the semiconductor industry, as its expertise includes modifying materials at atomic levels and on an industrial scale, and its manufacturing equipment, services, and software serve the semiconductor, display, and related industries. It has an installed base of more than 43K tools with field service engineers and leading chip manufacturers worldwide.

This huge installed base and intrinsic relationship with semiconductor manufacturers provide AMAT with a strong moat around its business. That’s because chip manufacturers will depend more on AMAT as processes become increasingly intricate, considering the rise of 5G, AI, and autonomous driving technology. Moreover, AMAT has a robust R&D arm, which should serve as a key competitive differentiator as it seeks to build upon its lead in its key markets. These points were highlighted by Morningstar in its recent analyst report:

With semiconductor fabrication becoming increasingly complex, resulting in more process steps and new manufacturing technologies, collaboration between chipmakers and equipment providers is set to reach unprecedented levels. We expect Applied to leverage existing relationships and insights into future customer technology needs to take advantage of the proliferating demand for state-of-the-art chips.

The company’s scale and resources allow a research and development budget in excess of $2 billion to serve cutting-edge technologies. Recent inflections such as 3D architectures (including 3D NAND and FinFET transistors in logic/foundry) have been enabled by more advanced tools in deposition and removal.

As a result, these segments have grown faster than the broader market in recent years, and firms such as Applied have directly benefited, as they can outspend smaller chip equipment firms in R& D to develop relevant solutions and build on existing market leadership.

In the meantime, AMAT continues to demonstrate robust growth. This is reflected by AMAT’s 12% YoY revenue growth in the second quarter (ended May 1, 2022) to $6.25 billion. Notably, AMAT is also benefiting from strong operating leverage through its economy of scale, as operating margin improved by 200 basis points YoY to 30.3%.

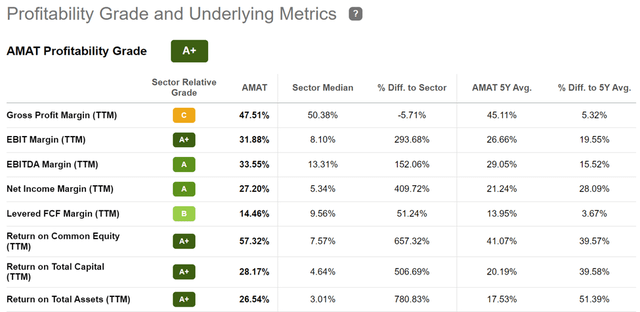

As shown below, AMAT maintains a strong A+ profitability rating, with EBITDA and Net Income margins that are far in excess of the sector median.

AMAT Profitability (Seeking Alpha)

Risks to AMAT include chip shortages, which has been the common refrain over the past several months. However, as management noted in this month’s BofA (BAC) Securities Global Technology Conference, AMAT is generally able to work through these challenges in a reasonable amount of time.

Looking forward, AMAT appears set to grow its competitive position with its recently announced acquisition of Picosun Oy, a privately held semiconductor company based in Finland. This acquisition is seen as broadening AMAT’s ICAPS product portfolio and customer engagements, as highlighted by management below.

Rapid growth in the number of connected devices is driving a tremendous need for innovation in the chips used to bridge the analog and digital worlds. Bringing Picosun’s talented team to Applied Materials will strengthen our ability to help customers add more intelligence and functionality to a wide variety of edge computing devices. – SVP and GM Sundar Ramamurthy

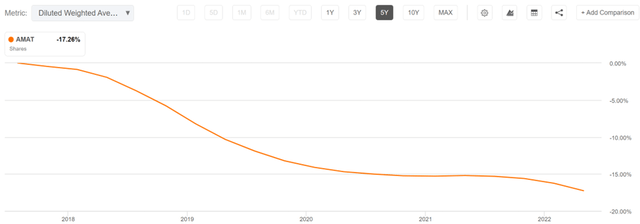

While AMAT currently yields a low 1.1%, it’s supported by a very low 13% payout ratio and a 5-year dividend CAGR of 19.6%. It should also be seen as a total return story, as AMAT has been rather aggressive in retiring its share count, with a 17% reduction over the past 5 years, as shown below.

AMAT Shares Outstanding (Seeking Alpha)

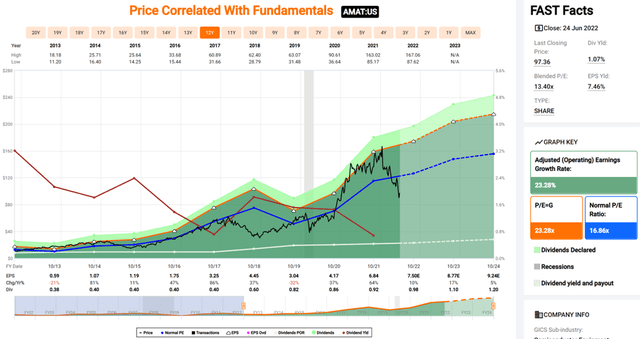

Meanwhile, I see AMAT as being fairly cheap at the current price of $97.36 with a forward PE of 13.0, sitting below its normal PE of 16.9 over the past decade. This is also considering the strong A rated balance sheet and expected earnings growth in the 14% – 27% range in fiscal year 2023. Sell side analysts have a consensus Buy rating on AMAT with an average price target of $142, implying a potential one year 47% total return.

Investor Takeaway

Applied Materials is a clear leader in the semiconductor equipment industry, with a number of catalysts that should continue to drive strong growth. This is considering strong trends in the technology industry given the rise of 5G, AI, and autonomous vehicles.

While chip shortages may present near-term challenges, I believe these are likely to be transitory in nature. With shares trading at a discount to its normal valuation, I see Applied Materials as being a potentially great long-term investment.

Be the first to comment