photographicsolutionsuk/iStock via Getty Images

Defense companies have performed strongly over the course of this year and while supply chain issues are putting a damper on results, the current geopolitical environment does favor investment in defense stocks. We often see Lockheed Martin making it to the top of investor buy lists, but there are other companies that are also worthy of consideration. One of those companies is BAE Systems (OTCPK:BAESF) for which I will analyze the most recent results in this report. Important to note is that BAE Systems only provides half year and full year results. So, to kick off coverage for BAE Systems I will start by analyzing the H1 2022 results.

Book-to-bill Grows Significantly

BAE Systems

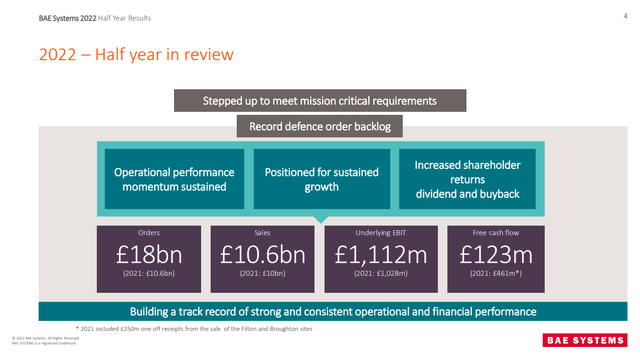

If you liked Lockheed Martin’s 1.3 book-to-bill ratio. You will love the book-to-bill ratio that BAE Systems has. Orders grew by nearly 80% while sales rose marginally leading to a 1.8 book-to-bill ratio for the first half of the year. On Seeking Alpha, we see some analysts making a buy case for companies pointing at book-to-bill ratios. If that is your golden metric topped with a generic defense thesis, then BAE Systems might be a more appealing buy than many other defense contractors. However, book-to-bill ratios are less meaningful when supply chains are dislocated as we see now and, in those cases, high book-to-bill ratios could also reflect underlying production challenges.

BAE Systems Faces Currency Headwinds

BAE Systems

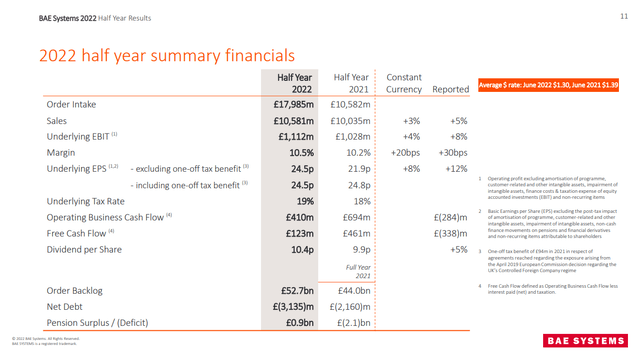

A detailed look shows that sales were up 3% on constant currency which provides a more meaningful basis for comparison and underlying EBIT grew by 4% pointing at some expansion in the margins. At the same time, we do see that currency headwinds did provide a 10 basis points headwind to the margins.

BAE Systems

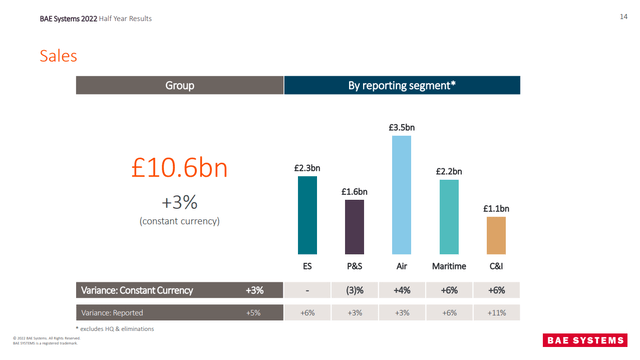

Sales by segment improved 3% on constant currency and most growth was recorded in Maritime and Cyber & Intelligence with appreciable growth at Air, which is the company’s biggest segment. In ES (Electronics Systems), revenues remained stable on a constant currency level due to supply chain challenges. The segment booked a book-to-bill ratio of approximately one, but had the segment performed without supply chain issues this would have been slightly lower than one. P&S (Platform & Services) revenues declined three percent due to lower ship repair activity.

BAE Systems

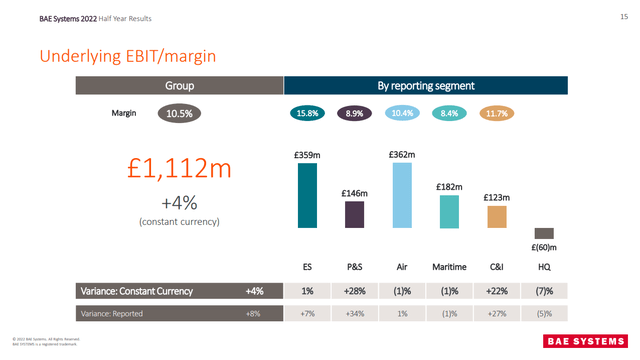

At ES, sales were stable and margins expanded on strong program execution and margins should further expand in the second half of the year due to the backloaded nature of the business. On P&S, sales declined but stronger operational performance in combat vehicle and ship repair services made up for the decline in sales with a 210 basis points improvement in margins. EBIT contribution from Air remained stable as sales improved but margins contracted slightly. That, however, is not necessarily a bad thing as we see that the cash flow from the segment improved 138%. So, the Air segment is at the mature point with full rate production and mature margins, but cash execution could unlock further value. Given the opportunities for F-35 and Typhoon sales, one can also wonder whether BAE Systems sees support to push its capacity up.

Maritime saw increased volumes translate into higher sales, but margin contraction resulted in stable EBIT while Cyber & Intelligence saw appreciable growth in sales and expansion in margins of 140 basis points driven by utilization of the services, program performance and beneficial acquisitions.

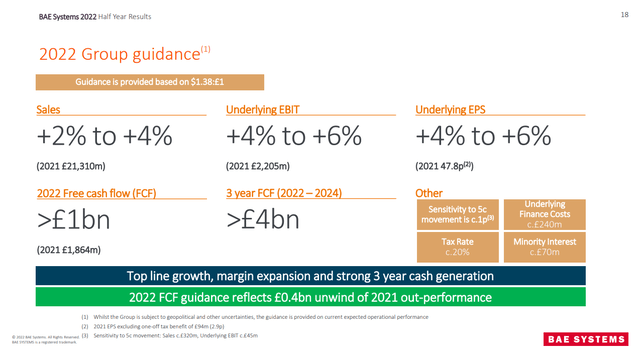

Guidance: Opportunities To Generate Cash

BAE Systems

For 2022, sales are expected to be up 4 to 6 percent. So, 2022 is a year where we see a focus on improving margins. The cash flow guidance of >£1 billion implies that the second half free cash flow generation should come in at £873 million or better. It is not quite comparable to the £1.9 billion seen in 2021 which included a £0.4 billion tailwind. The company sees 3-year FCF at >£4 billion. Just chopping that into three pieces gives >£1.33 billion. So, unless the 3-year target is extremely conservative we don’t quite see a path to get to those exceptional 2021 FCF levels on a consistent basis. However, we should note that in 2019-2021 BAE Systems guided for a higher than £3 billion cash generation and even excluding the £0.4 billion tailwind the company delivered almost 25% above the minimum set. If that is the kind of padding embedded into the guidance then there could be significant upside to cash generation which stood at £850 million in 2019.

Now, there are significant opportunities to generate cash or better said expand the cash flow into the future. In the near term some opportunities include Typhoon and missile sales and expansion of UK cyber and defense sales. While longer term there are export opportunities to Sweden, Type 26 global combat ship exports and continued Typhoon sales and sustainment for F-35. So, that should all layer into continued earnings growth prospects. Looking at the most recent 5% hike in dividends, it also seems that earnings growth is a pre-requisite for growing the dividends.

Conclusion: BAE Systems Stock Not A Strong Buy But A Steady Grower

I don’t consider BAE Systems a strong buy given that its free cash flow guide is somewhat soft. However, I do think there is further value to be unlocked in the years to come. One way is by translating the backlog into sales at a higher rate supported by significant near-term and long-term sales opportunities and secondly, there is a stronger focus on margin expansion. Coupling these two elements, we could see BAE Systems perform better over the longer term and in the near-term it does seem they are somewhat less impacted by supply chain issues. The 3.2% dividend yield is not necessarily the most appealing yield out there, but I still consider it to be a strong yield and given the dividend growth and share price appreciation this could be an opportunity for investors to set up a low-cost basis even after the stock already climbed 35% this year.

Be the first to comment