Aslan Alphan

Introduction

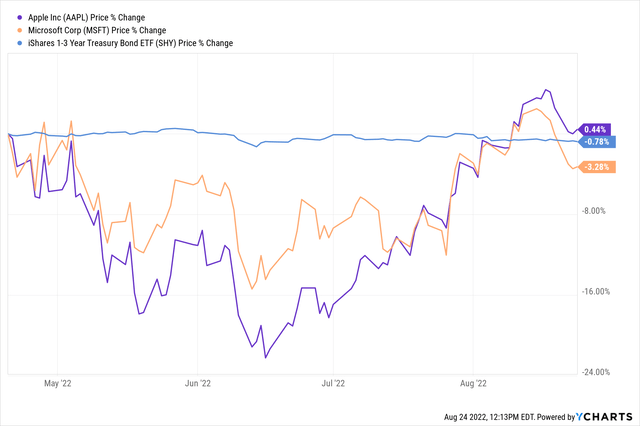

After bouncing up from June lows, Apple (AAPL), Microsoft (MSFT), and tech stocks, in general, have been rallying higher in recent weeks. We previously discussed the logical arguments for Apple and Microsoft being regarded as safe-haven investments –

Today, Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) are two of the most dominant tech titans on the face of this planet, and it’s only fair that they happen to be two of the largest companies across the globe based on market capitalization. Due to incredible business moats, robust financial performance, rock-solid balance sheets, and humongous capital return programs, Apple and Microsoft have etched themselves as safe-haven investments in the minds of retail and institutional investors alike.

Source: Apple Vs. Microsoft Vs. Treasury Bonds: Battle Of Safe Havens

YCharts

And investors seem to be piling into these tech titans again for perceived safety in the face of a slowing economy and a potential recession. However, we also laid out the reasons for why Apple and Microsoft may not be safe havens in the near to medium term. For brevity, I will just list those reasons here, but if you are inclined to do so, please read the detailed explanation in the note linked above.

- Demanding valuations

- Growth slowdown

- Buybacks becoming ineffective

- Rising interest rates

This note is an update on the battle of safe havens. In my view, Apple and Microsoft are actually riskier than they were in April 2022 [despite being at the same price levels] due to rapidly slowing sales growth, contracting margins, and worsening business outlook.

Apple and Microsoft Are Not So Safe

History shows that stock markets (i.e., equities) are not necessarily a fair reflection of the economy when looked at using short timeframes; however, the economy does impact investor sentiment (and, by extension, demand and supply of stocks). During the Fed’s July FOMC meeting, chair Jerome Powell seemed to be a lot “less hawkish” about the trajectory of future rate hikes – announcing the current Fed funds rate of 2.5% as the neutral rate and going back to being data dependent [no guidance for future rate hikes unlike in recent months].

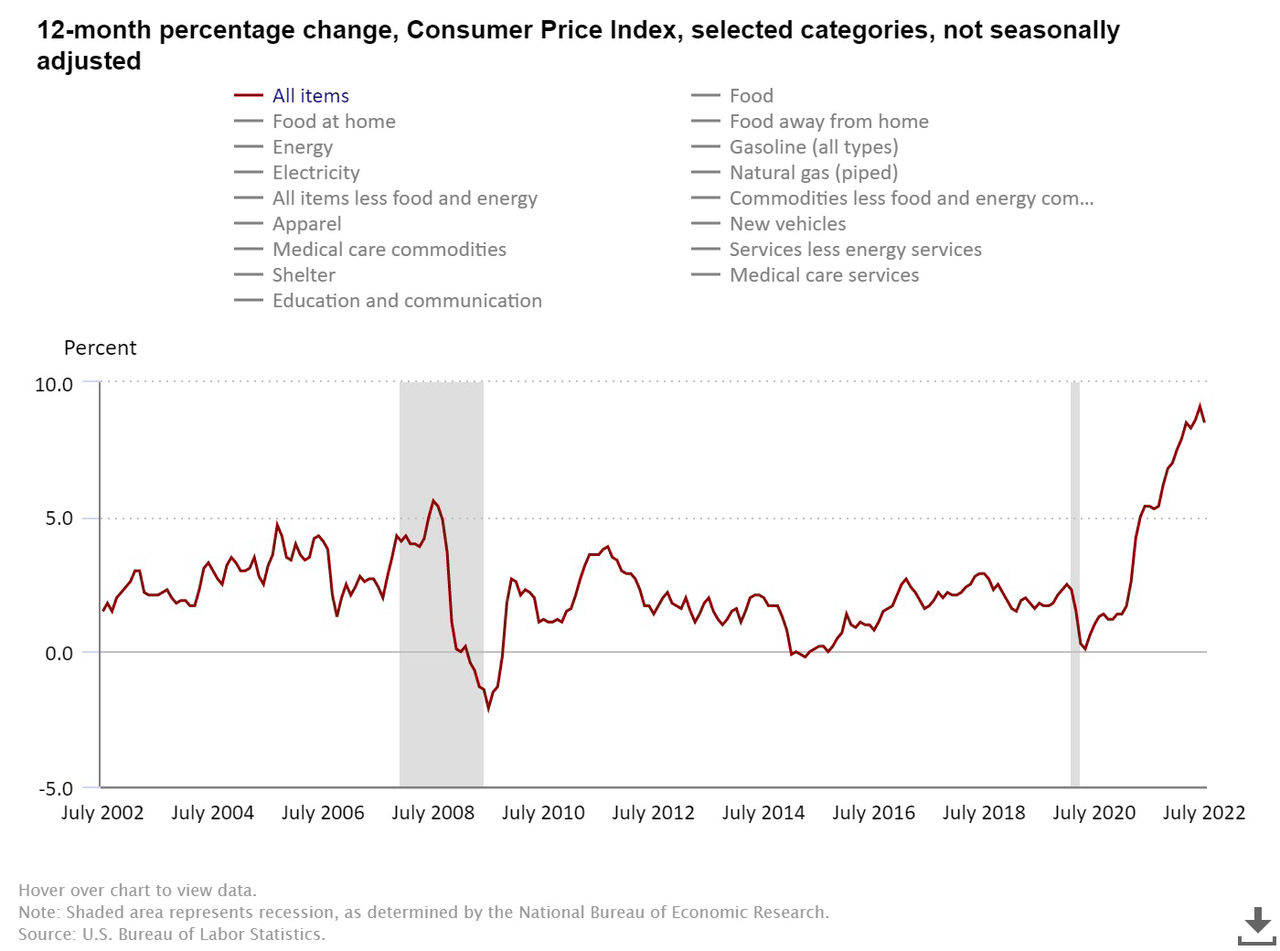

With inflation finally showing signs of easing up, the Fed could probably afford to go slower with its rate hikes. The clamor for a pause on rate hikes (and a potential Fed pivot) is growing amid rising concerns of a recession due to waning consumer confidence. And this is probably what the market is betting on with this recent rally in equities.

US Bureau of Labor Statistics

While the Fed’s monetary policy may no longer be supporting or boosting the economy (neutral rate), inflation remains hot, and we could be in for far more tightening. With the Fed’s inflation target of 2% and CPI sitting at 8.5%, I don’t see a Fed pivot in the near future. If the Fed does pivot in the next six months, it will happen only if something breaks in the economy and we are to find ourselves in a deep recession.

High inflation is hurting consumers’ pockets, and elevated costs of food, shelter, and energy are likely going to hurt discretionary spending even further in the coming months. Rising costs and slowing revenues are hurting profit margins, and corporate earnings look set to come under pressure in the second half of 2022. Let’s take a look at some of the mega-cap companies:

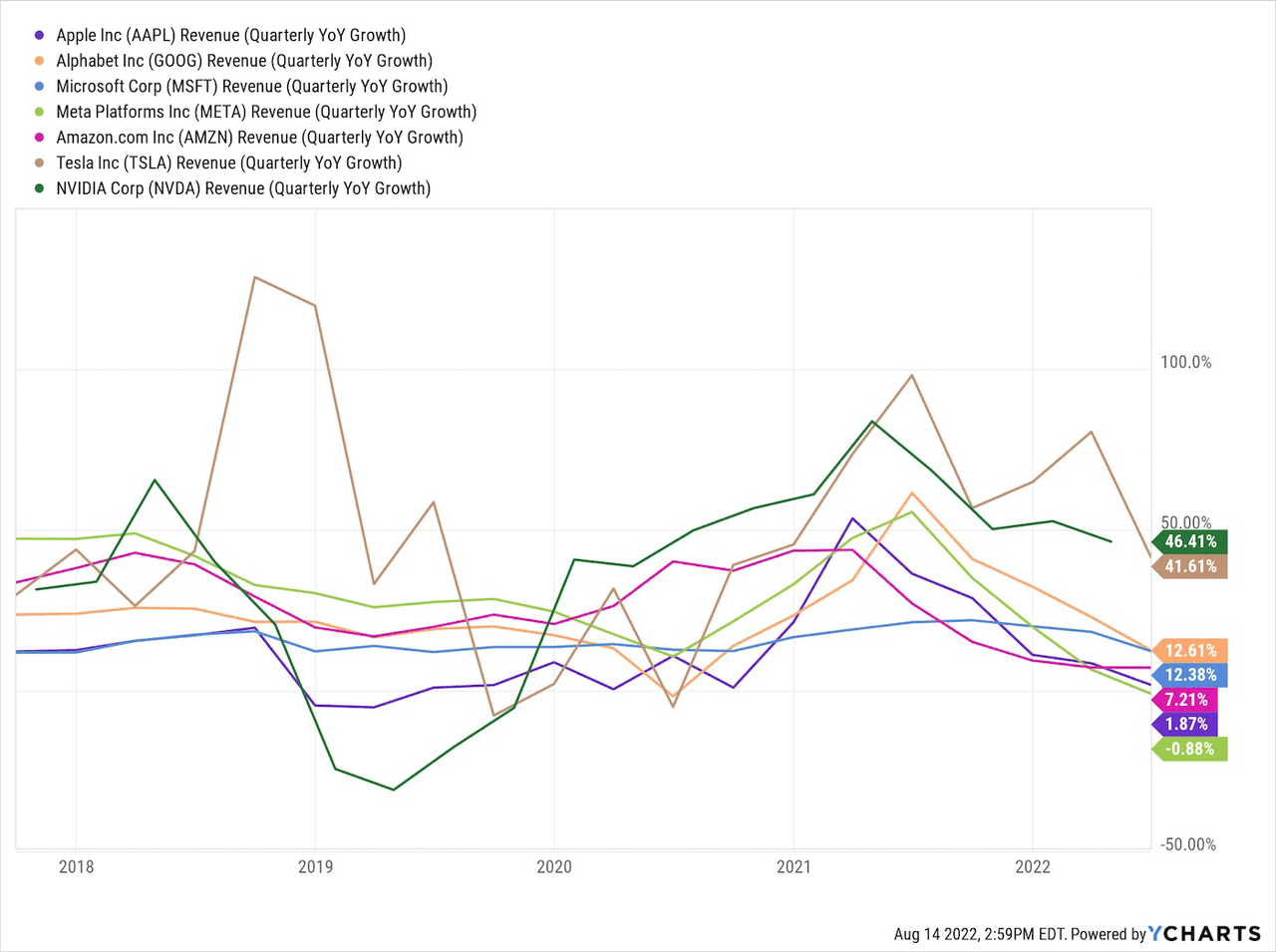

YCharts

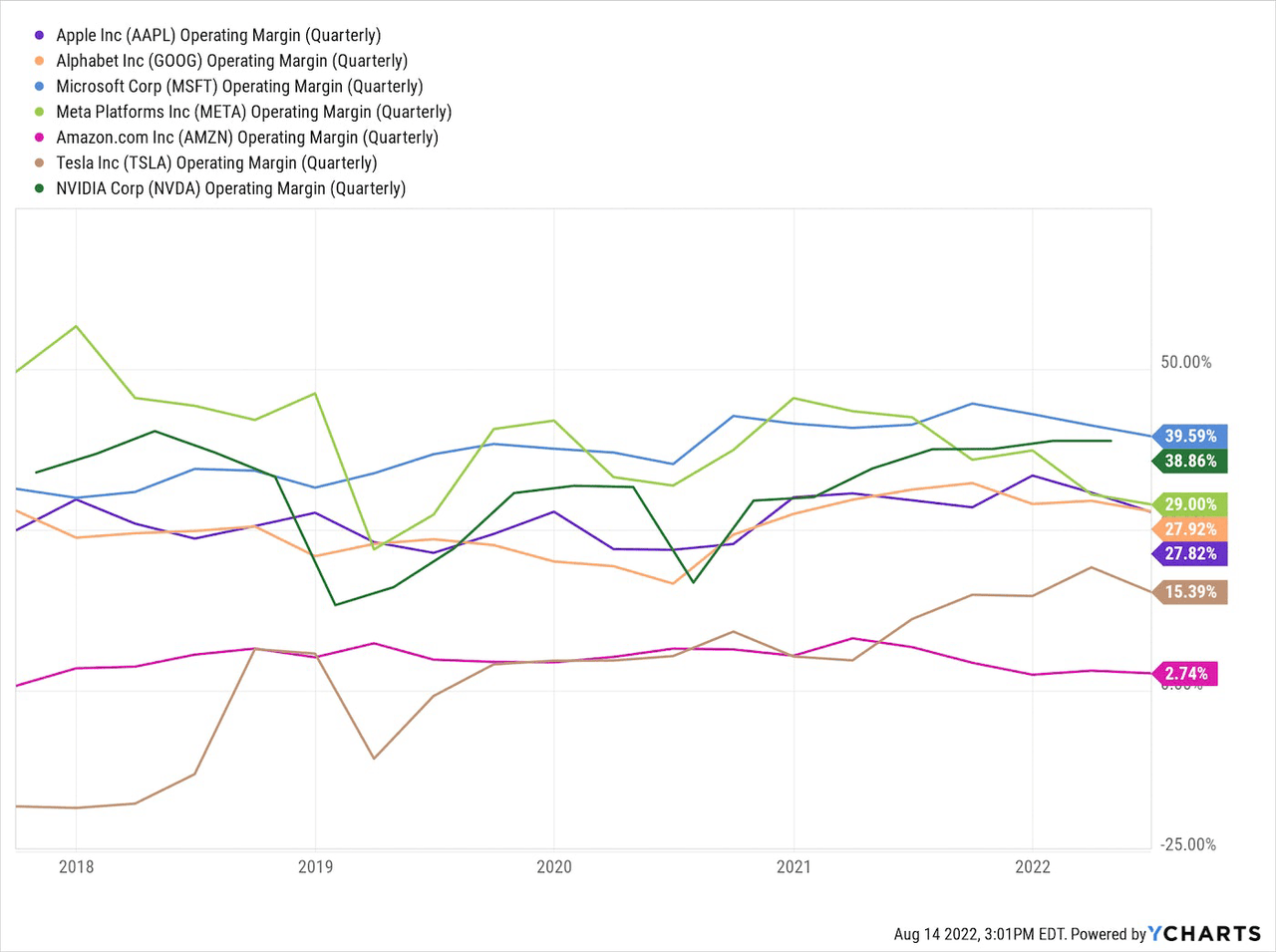

YCharts

The commonalities between these mega-cap tech titans are slowing revenue growth rates and contracting operating margins. Advertising giants – Alphabet [Google] (GOOG)(GOOGL) and Meta Platforms [Facebook] (META) – have explicitly warned about economic uncertainty causing a pullback in ad spending in their Q2 reports. Now, ad spend could be viewed as a leading indicator for future sales and profits for businesses. While stock markets do tend to climb up from such walls of worries, I don’t think current valuations would allow for a sizeable rally from here (especially if the Fed continues to hike rates [very likely due to elevated inflation]).

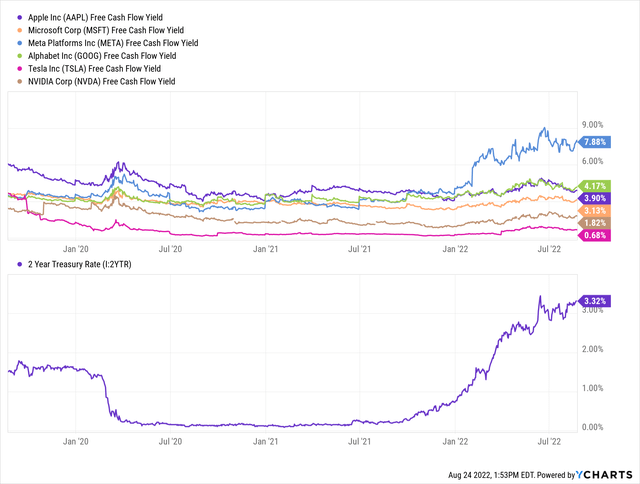

In Q2 2022, Apple’s sales grew at just 2% y/y, and yet its stock is trading at ~28x P/FCF, offering an FCF yield of just 3.8%. Considering 2-yr treasury rates of 3.32%, the risk premium offered by Apple is too low. Microsoft’s FCF yield of 3.1% is actually lower than 2-yr treasury rates; i.e., the market is telling us that Microsoft is safer than government bonds. For mega-cap tech stocks like Apple and Microsoft, the downside risk is greater than near to medium-term upside potential from current levels.

YCharts

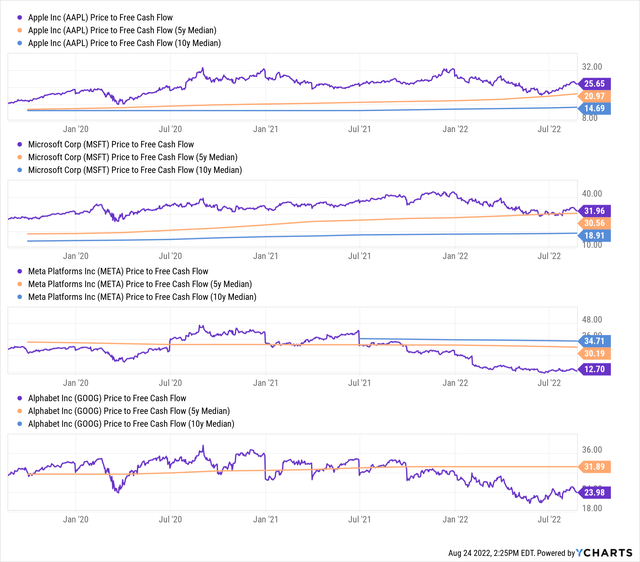

I am not saying these companies are overvalued. If interest rates were to stabilize in the 3-4% range, then a P/FCF multiple of ~25-33x makes sense. However, if interest rates were to climb higher or sales and margins were to decline, a de-rating of 30-50% could happen in these mega-cap tech stocks [just look at Facebook’s multiples (~12.7x P/FCF) to understand what could happen with other mega-cap tech stocks in a downturn].

YCharts

As mega-cap tech makes up a big portion of indices like the Nasdaq and S&P 500 (often referred to as the market), I don’t see massive upside potential from current levels. While the bulls deserved a relief rally after months of pain, this move looks stretched. The biggest red flag I see right now is the return of meme mania on Wall Street. Some characters are different, but the drama is still the same. This sort of activity indicates euphoric sentiment, and investors seem to be betting on yet another V-shaped recovery for the equity markets. I’ll discuss some meme stocks in my next note; however, let’s keep going for now.

The Fed’s quantitative tightening program (liquidity withdrawal and balance sheet contraction) is set to accelerate in the coming weeks as the fight against inflation rages on. Also, technically, the US economy is already in a recession, with two consecutive quarters of negative GDP growth in the books for 2022. In this uncertain macro environment, the probability of an earnings recession is rising rapidly, and the next couple of quarters could bring earnings pain for corporations.

As we know, both Apple and Microsoft are operating at the heart of multiple secular growth trends. However, none of them are immune to macroeconomic factors, and a recession will hurt their financial performance too. I understand the logic (robust FCF generation and strong balance sheets) behind viewing Apple and Microsoft as safe-haven investments during periods of heightened uncertainty. And I agree that some of Apple and Microsoft bonds are rated higher (less risky) than US government bonds. However, surging yields could change this perception very quickly, simply due to the immutable laws of money. At the end of the day, Apple and Microsoft can’t print new dollars. With rich valuations limiting potential upside, I don’t think investors should take on the medium-term risk attached to these so-called safe haven stocks.

What About Treasury Bonds, Are They Worthy Of An Investment?

If you are in the Fed-pivot camp, which would mean the economy sliding into a recession, then treasuries yielding 3-3.5% do seem like an attractive, safe haven investment compared to equities for the medium term (next 12-24 months). However, inflation is still very high, and the real return on bonds is negative. While there are buying limits with I-bonds (inflation bonds), I think they remain a good opportunity in this environment. We have an energy crisis brewing in Europe, and things could get worse come winter. Inflation could be sticking around for quite some time. Also, I said this at the end of 2021, and I will say it again – “higher inflation for longer” is the best possible outcome for our heavily indebted governments and central banks. More details here:

I think treasury yields will top out in the 3.5-4% range in this tightening cycle; however, the Fed may overshoot. Also, the Fed is about to step up its quantitative tightening program by offloading $95B worth of bonds per month starting from September 2022. Hence, I am not ready to start buying bonds just yet; however, if I had to choose between Apple, Microsoft, and 2-yr treasury bonds for the next 12-24 months, I would go with the 2-yr treasury bonds. In the current environment, I like the idea of buying inflation bonds and obliterated high-growth stocks with hedging strategies (i.e., proactive risk management).

Concluding Thoughts

According to the definition, a bear market ends with a 20% bounce off of lows, and we got this in recent weeks. Hence, by definition, the bear market is over, and a new bull market has started. However, I think it is still too early to call a bottom. A tighter monetary policy could lead to a growth slowdown and cause a recession. Despite the growing clamor for a Fed pivot, I still think inflation is too high, and the Fed will need to keep going for some time to come. The markets may go up with rates (as this has happened in the past), but these tightening cycles often lead to something breaking in the economy and eventually a crash in the stock market. Will this time be any different? I don’t know.

I don’t know where the market is headed next; nobody else knows either. The macro-environment remains challenging, and the Fed’s QT [quantitative tightening] program is just getting started. With Apple and Microsoft trading at lofty valuations despite an evident slowdown in revenue growth and significant moderation in operating margins, I think the near to medium-term risk/reward from current levels is unfavorable for bulls. Yes, there are tons of opportunities in beaten-down growth stocks, but if the large caps get hit (in an earnings recession), the smaller cap stocks will likely continue to remain under pressure. Hence, I plan to stick with The Quantamental Investor’s playbook for a bear market environment –

Build long positions slowly using DCA plans, and manage risk proactively.

Key Takeaway: I rate both Apple and Microsoft as “Hold” at current levels. With negative real interest rates, treasury bonds remain uninvestable for now.

Thanks for reading, and happy investing. Please share your thoughts, questions, and/or concerns in the comments section below.

Be the first to comment