We’re nearing the start of the Q1 Earnings Season for the Gold Juniors Index (GDXJ) and one of the most recent companies to release its preliminary results is Great Panther (NYSE:GPL). Despite being up against easy year-over-year comps, the company reported another sharp decline in production. While production will improve in H2, its balance sheet remains weak, and its costs will remain well above the industry average. Given its status as a small-scale producer with razor-thin margins, I continue to see the stock as an Avoid.

Falcor/E+ via Getty Images

Great Panther Operations (Company Presentation)

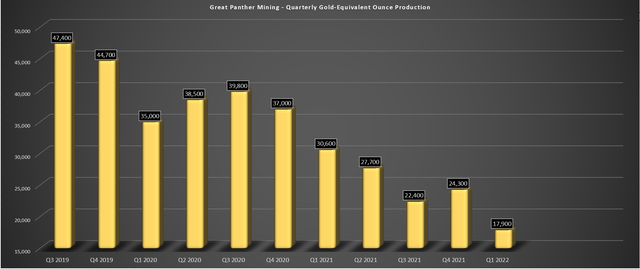

Great Panther released its preliminary Q1 results last week, limping into the new year with production of just ~17,900 gold-equivalent ounces [GEOs]. This was despite the company being up against brutally easy year-over-year comps, with Q1 2021 production of ~30,600 GEOs, down 12% from the year-over-year. On a two-year basis, we have seen production roughly halved from Q1 2020 levels. And while production will rebound, which may have some investors optimistic, the cost profile of its operations has changed due to inflationary pressures. Let’s take a closer look below:

Great Panther – Quarterly GEO Production (Company Filings, Author’s Chart)

Beginning with production, we can see that Great Panther reported its weakest quarter in years for production, with quarterly GEOs coming in at just ~17,900, a 20% decline from the previous multi-quarter low in production (Q3 2021: ~22,400 GEOs). This was partially related to its Guanajuato Mine Complex being placed on care & maintenance, where we’ve seen no signs of resolution with CONAGUA for permits, and an underwhelming year at Tucano, to say the least. The latter was evidenced by the production of just ~75,900 ounces last year, down from ~125,400 ounces in FY2020.

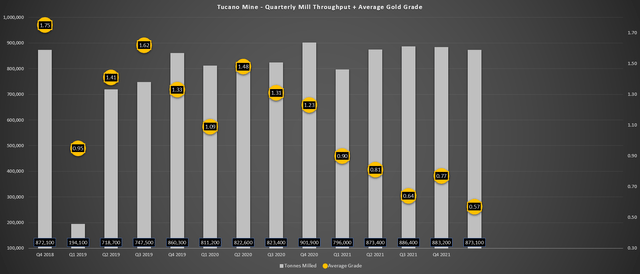

Tucano Gold Mine – Operating Metrics (Company Filings, Author’s Chart)

Looking at the Q1 results at the company’s primary operation, Tucano, gold production came in at just ~14,000 GEOs, a 39% decline from the year-ago period. This was due to significantly lower throughput and much lower grades, with ~873,100 tonnes processed at an average grade of 0.57 grams per tonne of gold. The lower production was related to a focus on stripping at the TAP AB, TAP C, and Urucum North pits, resulting in having to draw from lower-grade stockpiles. Meanwhile, rain levels were above average, which negatively impacted mine development.

Given the focus on stripping in H1 2022, the weak results are not overly surprising. Meanwhile, the company has begun working with a new mining contractor, MINAX, in order to overcome contractor performance issues with U&M. In addition, the company appears confident that it may see gold production from Urucum North Underground in 2023, where the company could mine much higher grades. Normally, these short-term headwinds might present a buying opportunity. However, I think the underground ambitions are overly optimistic, and this is still an operation with a very short mine life.

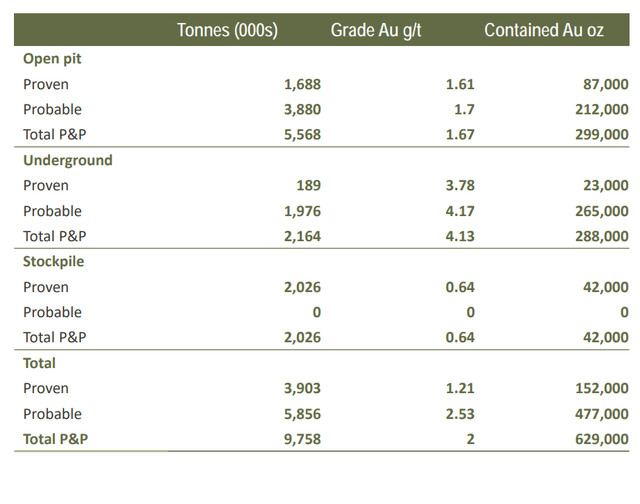

Tucano Reserves (Company Website)

As shown above, Tucano’s reserves stood at ~629,000 ounces as of September 2020, and we’ve since seen more than 100,000 ounces of mining depletion. This leaves the current reserve base closer to 500,000 ounces, which barely supports a 5-year mine life at a much lower ~100,000-ounce per annum run rate. The ~500,000-ounce figure also assumes that there’s no decline in reserves due to higher operating costs related to inflationary pressures, with labor, consumables, fuel, and materials cost putting a dent in profitability for gold producers in Brazil.

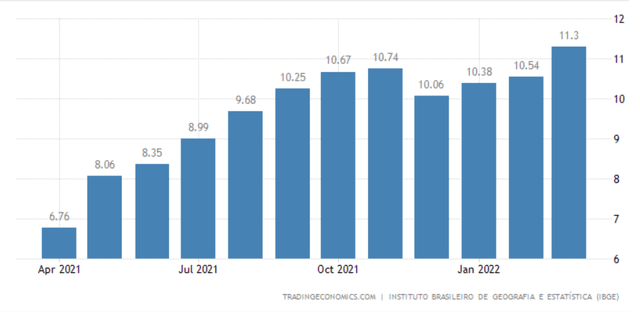

Brazil Inflation Rate (TradingEconomics.com, IBGE)

One could argue that this is not a company-specific issue for Great Panther, and this is true, but it is a much larger issue for companies with their primary operations in Brazil, with Jaguar (OTCQX:JAGGF) and Great Panther fitting this bill. This is because, as shown below, inflation rates continue to tick higher in Brazil, and are some of the highest globally. The above chart highlights this issue, with inflation hitting a new high of 11.3% in March, double the sub 5% readings in 2020 when the last technical report on Tucano was completed.

Therefore, even if Tucano were to return to similar production levels, we cannot rely on operating cost assumptions in the previous study, and it may be more difficult to convert resources to reserves with this hurdle of much higher operating costs. Assuming Great Panther had a 10+ year mine life, I wouldn’t be overly concerned. However, as discussed above, this is not the case, and the company isn’t exactly in great shape financially with less than $5 million in working capital to spend aggressively on exploration to grow its resource base.

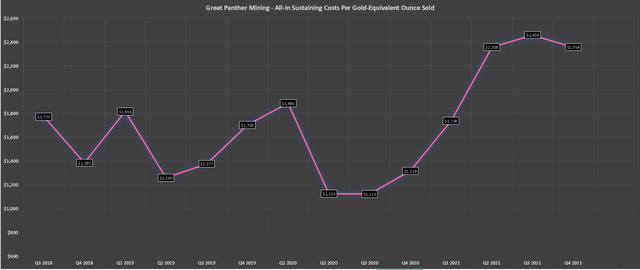

Great Panther Mining – All-in Sustaining Costs Per GEO Sold (Company Filings, Author’s Chart)

Some investors might argue that the higher gold price will more than offset the inflationary pressures, but this isn’t clear from Great Panther’s operations, and I would never model the spot gold price long-term to determine if an asset could maintain healthy margins. Looking at the chart above, we can see that the gold price has not offset the high costs at GPL’s operations as it stands, with all-in sustaining costs north of $2,300/oz in the past three quarters.

Besides, even if we assume all-in sustaining costs of $1,700/oz this year, which excludes corporate G&A, the all-in cost is closer to $1,825/oz, leaving Great Panther with razor-thin margins, meaning it’s unlikely we’ll see any meaningful free cash flow generation this year. So, while the company might be ambitious about its operations in the back half of the year and if it can start mining higher grades underground at Urucum North, I don’t see any clear path to how the company plans to fund this portal development later this year without additional share dilution. This is important because while production growth is great, it’s meaningless, in my opinion, if it’s coming at the expense of significant share dilution.

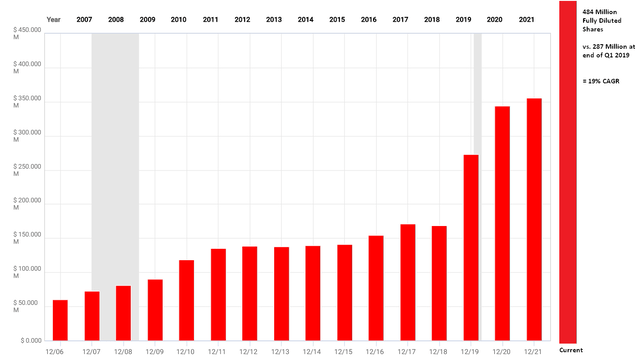

Share Dilution

While we’re on the subject of share dilution, Great Panther has seen a massive increase in its share count since Q1 2019, with its fully diluted shares up from ~287 million to ~484 million. This translates to a 19% compound annual growth rate and this is after the dilution from the Beadell acquisition to acquire the Tucano Mine, representing one of the worst track records of share dilution sector-wide.

Great Panther Fully Diluted Shares (FASTGraphs.com, Author’s Notes)

Unfortunately, with $0.2 million in net working capital at year-end, a $9 million fine from the Amapa State Environmental Agency with an accusation of environmental damage (massive fish mortality event), and an expensive year due to higher stripping, I am not confident that the company can get through the year without additional share dilution. This means that Great Panther’s share count could increase further this year and with the share price near multi-year lows, an equity financing would not likely be welcomed by the market, just as the last one wasn’t late last year (~88 million shares sold at US$0.26).

The risk of additional share dilution makes the stock even less appealing, with the investment thesis already being non-existent, given that Great Panther is a high-cost producer with razor-thin margins. So, while there are some turnaround stories that might be worth betting on, where companies are generating meaningful free cash flow at current gold prices, and finally emerging from the rubble, like Karora (OTCQX:KRRGF) was 18 months ago, Great Panther is not remotely similar, and remains an extremely high-risk stock.

Technical Picture

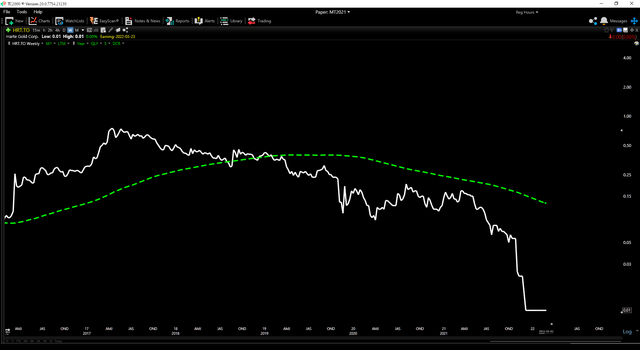

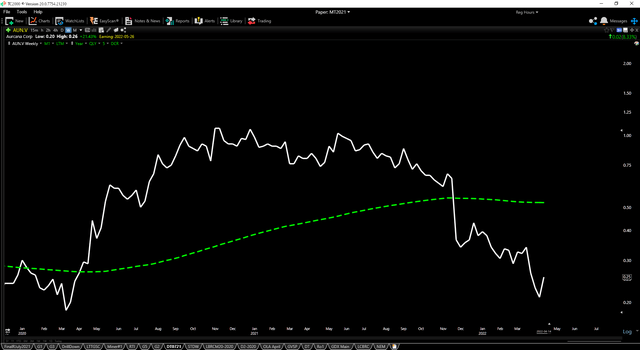

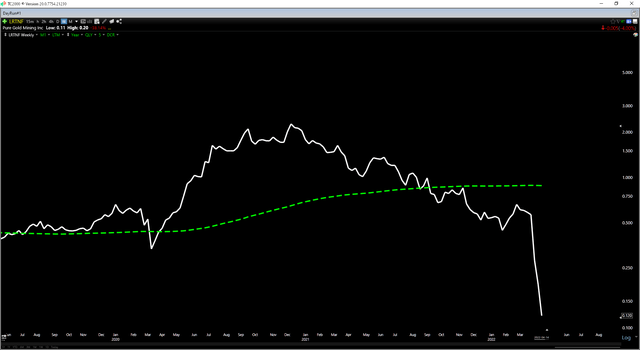

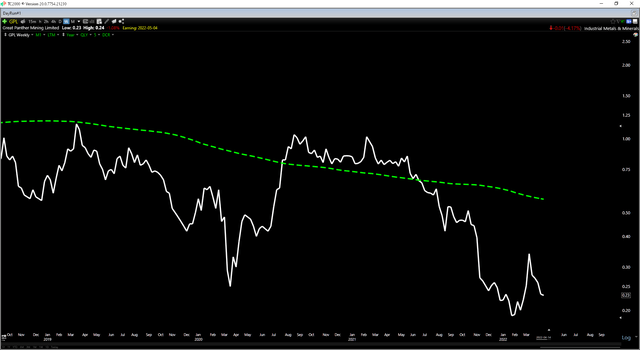

While there are no guarantees when it comes to technical analysis, one way to protect one’s capital in this sector when it comes to junior producers with weak balance sheets is to steer clear of them if they’re below their 150-week moving averages. As the charts below show of Harte Gold (OTCPK:HRTFF), Aurcana (OTCQX:AUNFF), and Pure Gold Mining (OTCPK:LRTNF), oversold can stay oversold for a long period of time. In fact, in the case of Harte Gold, the stock hit its initial oversold signal in May 2019 but fell another 60% over the following 12 months.

Harte Gold vs. Weekly Moving Averages (TC2000.com) Aurcana vs. Weekly Moving Averages (TC2000.com) Pure Gold vs. Weekly Moving Averages (TC2000.com)

In the case of Pure Gold and Aurcana, they registered similar oversold readings in September 2021 and December 2021, and while a 12-month period has not passed, they have seen drawdowns of 38% and 82%, respectively. While the market does not always know best, it often does in the case of companies with weak balance sheets that have low margins, and one of the reasons that these companies continue their steep downtrends is that they are continuously raising money using equity at lower prices in an aim to bolster their balance sheet.

This is a short-term fix, but at the same time, it does long-term damage. This is because the stock is now valued at the same figure it was at a 20% higher level in the instance of 20% share dilution. Great Panther is no stranger to 20% plus share dilution, with ~350 million basic shares outstanding to start 2021 and having ~449 million basic shares outstanding as of its most recent filing. Despite this significant share dilution (28% year-over-year from March 2021 to March 2022), its working capital balance comes in at less than $5 million, and its all-in cost margins are below 12% at current spot prices. Hence, I would not rule out further share dilution.

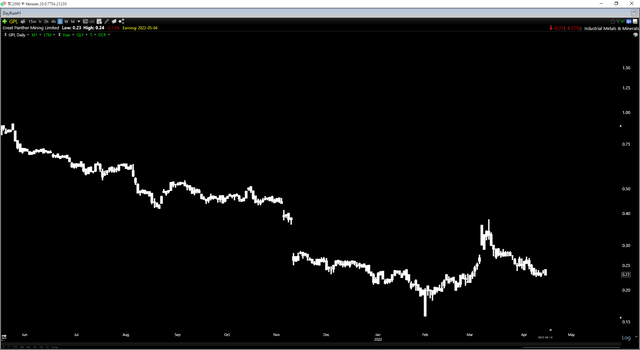

Great Panther vs. Weekly Moving Averages (TC2000.com)

If Great Panther was trading above its 150-week moving average, this might suggest that the worst was over, and at least provide some comfort that maybe this story was improving. However, as we can see above, Great Panther, like other examples of other junior producers where shareholders suffered significant losses, continues to trade below its 150-week moving average. This suggests an elevated risk of being long the stock. Hence, as long as Great Panther remains below this level (US$0.50), I don’t see any way to justify being long the stock.

Summary

It may be enticing to own a junior producer with a fully diluted market cap of ~$111 million with a production profile north of 100,000 ounces per annum. However, the valuation calculated today is irrelevant if there’s likely to be additional share dilution, which I would argue is highly likely. Meanwhile, the company has few if any redeeming qualities, and several risks. These include:

- a fine that hasn’t been resolved

- a weak balance sheet

- increased exposure to inflationary pressures being in Brazil (above-average inflation rates)

- the fact that it’s mining resources, not reserves, at Topia

- a short mine life at its primary operation, Tucano

To summarize, I think there are dozens of better ways to play the sector, and even after this decline, I continue to see Great Panther as an Avoid.

Be the first to comment