Riko Pictures/DigitalVision via Getty Images

On Monday the 8th, NVIDIA Corporation (NVDA) released a preliminary earnings statement warning of a significant revenue miss from earlier guidance. The company pointed to a substantial decrease in its gaming revenue, which dropped 44% sequentially and 33% year-over-year. I would have thought that news would have been a catalyst to drive Roblox Corporation (NYSE:RBLX) shares lower, but their stock price seems to be resisting gravity and is actually 5.5% higher over the last five days.

I suspect investors either think Roblox will dodge the recent downturn in gaming that caused NVIDIA to revise lower, or investors might not have put it together that NVIDIA’s announcement could be an ominous sign for Roblox. This leads me to think that Roblox’s earnings release, scheduled for the 10th, may catch investors off guard and serve as a catalyst to drive the stock lower. If you are a Roblox investor, you might consider taking some risk off the table heading into the earnings call.

NVIDIA’s Warning Could Apply To Roblox Too

NVIDIA recently pre-announced lower guidance as a function of a significant drop in gaming-related revenue. That is in stark contrast to the first quarter of 2022, when NVIDIA reported record revenue, about 50% of which was driven by strong revenue growth from their gaming-related business. NVIDIA and Roblox have different business models, but I believe Roblox is exposed to the same downturn in gaming that NVIDIA is currently absorbing: if consumers are cutting back on gaming hardware, I suspect they would be inclined to cut back on in-app purchases and “Robux.” Roblox may have similarly disappointing earnings news when they report on the 10th. Consider the following from NVIDIA’s recent press release:

“Our gaming product sell-through projections declined significantly as the quarter progressed,” said Jensen Huang, founder and CEO of NVIDIA. “As we expect the macroeconomic conditions affecting sell-through to continue, we took actions with our Gaming partners to adjust channel prices and inventory.”

Morgan Stanley analyst, Joseph Moore, identified a deceleration in gaming in May. As part of a discussion on his view of NVIDIA stock, he said:

“. . . We model a significant deceleration in gaming that should result in a modestly challenging 2023 . . .”

If the impact on NVIDIA’s gaming revenue is coming from macro headwinds and a general deceleration of gaming, I would expect Roblox to be exposed to the same challenges.

Roblox’s Revenue Streams Under Pressure

According to a Seeking Alpha article by Amanda Reaume, Roblox makes money in four ways: 1) taking a cut of Robux revenue; 2) advertising to their mostly teen and younger demographic; 3) licensing; and 4) royalties. In addition to the general gaming downturn NVIDIA has warned about, consider that advertising revenue for major tech companies has also been soft recently. The Wall Street Journal reported on August 7th that the downturn in advertising is spreading. Even with a business model that is somewhat diversified, Roblox still looks exposed to significant headwinds.

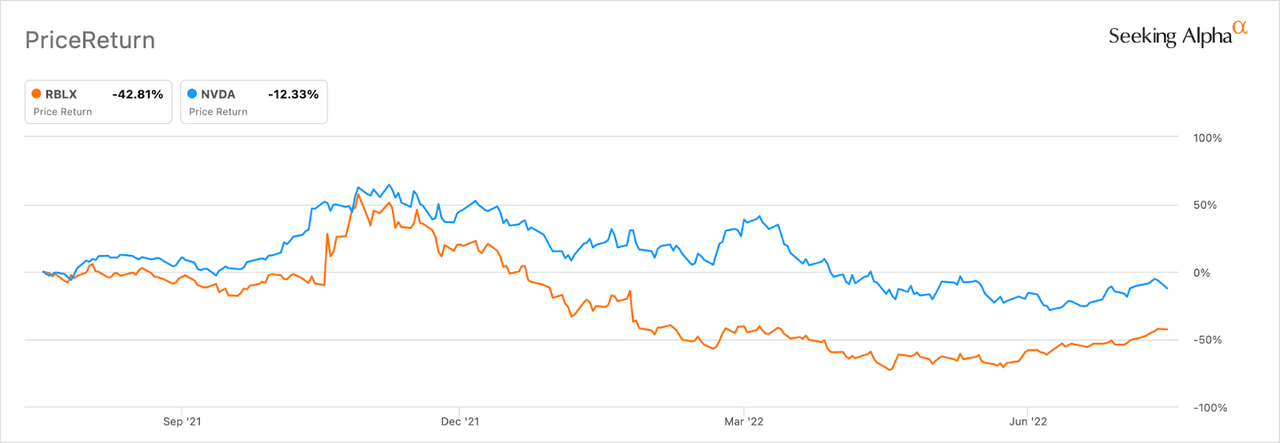

Roblox and NVIDIA Stock Track Together

Over the last year, Roblox and NVIDIA stock has tended to move sympathetically (see below). NVIDIA generates revenue from a range of applications for its hardware products, but Roblox is more purely exposed to the gaming industry. That suggests to me that Roblox stock could be more sensitive to surprising changes in the gaming market. NVIDIA stock dropped 6% in response to their pre-release news, while Roblox stock was mostly unchanged.

Seeking Alpha

The Quant Rating

The Seeking Alpha Quant rating for Roblox is a “hold,” but notice how dismal the company’s grades are outside of the “momentum” category. If NVIDIA’s news is a hint of what we might expect from Roblox, it wouldn’t take long for momentum to swing in the other direction. Roblox’s 29 billion dollar market cap earns the company an F rating from the SA quant. I agree with this rating. The company has reported four consecutive quarters of negative earnings and is looking at consensus estimates of four more quarters of lower negative earnings ahead. If a downturn in gaming and continued softness in advertising brings down future forecasts, Roblox’s current high valuation could come under further pressure.

Roblox Benefited From The Pandemic

Google trends search history for the term “Roblox” supports the theory that the pandemic boosted interest in Roblox. Search volume roughly doubled from March to April of 2020. Revenue jumped almost 82% in 2020 and nearly 108% in 2021. Although search traffic is still holding up at the moment, I think it’s reasonable at this point to consider the possibility that we are moving into a post-pandemic environment that reverses interest in Roblox to earlier levels. Roblox’s revenue already declined sequentially in the first quarter.

Valuation

NVIDIA cited a 44% sequential decline in gaming revenue. If even 50% of Roblox’s revenue is sensitive to the same deceleration in gaming, I would expect a significant downward surprise when Roblox reports earnings. Remember that NVIDIA’s announcement resulted in a 6% decline in their stock price while Roblox stock traded sideways. Roblox’s upcoming quarter revenue estimate is $626 million. If that figure comes in 22% shy of estimates, Roblox stands to miss quarterly revenue by almost $138 million. With 541.86 million shares outstanding, that amounts to around a 25 cents per share miss. Roblox doesn’t generate positive earnings per share, which makes them difficult to value, but the current EPS estimate for FQ2 2022 is -$.26, which gives you a sense of the potential impact a 22% miss could have.

Risks

It’s possible that gaming revenue will hold up better than the hardware that supports the games. After all, in a downturn, you can continue to play video games on your computer without upgrading your GPU. Google Trends searches for “Roblox” are currently holding up okay. This could suggest the company is resisting the types of headwinds NVIDIA is experiencing. It’s also possible that the Roblox demographic behaves in a different way than the NVIDIA customer base, which could insulate Roblox from the specific dynamics that NVIDIA is warning about.

Conclusion

Earnings calls can have a sizable impact on stock prices. NVIDIA’s dire warning about their gaming business has offered us a glimpse into what could be a disappointing earnings report from Roblox, a company that I suspect is more sensitive to the gaming industry than NVIDIA. With a dismal earnings record, a market cap that doesn’t seem tethered to reality, declining revenue, negative earnings, and the unwinding of the pandemic, I wouldn’t want to be holding Roblox shares when they release earnings on August 10th.

Be the first to comment