Robert Way

I have been recommending BYD Auto (OTCPK:BYDDF, OTCPK:BYDDY) since my first article on the company in September 2016. My article in March this year detailed the company’s current integral strengths.

Its greatest advantage is its comprehensive vertical integration. No other company in the world can match its capabilities. These range across battery manufacture, auto production, bus and truck manufacture, energy storage, and chip production. The new designs and new price areas for its autos coming out of the company is breath-taking. It has even developed a rail transit division which I covered in an article in May. From the base up, it has been investing heavily in lithium mining to try to ensure its ever increasing need for battery supply.

Its growth has unsurprisingly led to a long-term strongly rising stock price. It is now the world’s third largest auto company by market cap.

The 5-year stock chart from Charles Schwab illustrates this:

Bearing in mind the plans for the car divisions, investors who have missed out so far still have plenty of room for gain. Both in terms of international reach and of model range, BYD is rapidly becoming one of the world’s auto giants.

BYD’s Existing Overseas Auto Markets.

The existing addressed markets have illustrated the way in which the company takes advantage of its vertical integration. They have tended to be in countries where they already have operations in areas such as bus assembly and battery manufacture production. They have often started slowly with B2B deals for taxis. Such countries have included New Zealand, Singapore, Brazil, Costa Rica, the Philippines, Uruguay, and Colombia. Now they are ramping up from cautious B2B deals with the likes of taxi companies to large scale distribution for individuals.

They have looked particularly at smaller countries where the cost of entry to a market is not too great. This seems to be wise when you think for instance, of the world giants that have lost substantial sums trying to invest in the U.S. auto market.

My article in February this year gave details of this gradual approach. Latin America is a particular focus of this, as is noted also in this piece. Norway was a taste of what is to come in my opinion. It is a welcoming country for EV’s. BYD shipped 1,500 BEV’s as an initial consignment this year and found them snapped up rapidly. They were the relatively highly priced “Tang” SUV model.

Another example is Costa Rice where it is the No.1 EV brand with about 50% of the market. This year it is launching its “Yuan Plus” SUV model to add to existing models in the market there.

BYD’s New Markets now Emerging.

* The company recently announced they would be entering the Japan market in 2023. This will start early in 2023 with the “Atto 3” model and incorporate two further models by the end of the year. Japan may in fact be a tough nut to crack. The EV market has been slow to take off there as Tesla (TSLA) have found out. Smaller models from BYD (more suitable for Japan’s tight roads and small parking spaces) may be more promising.

Once again using their vertical integration advantages, BYD already have a presence in Japan. For some years they have been selling e-buses, forklifts, solar energy products and rechargeable batteries in the country. Japan seems a natural to be a huge EV market. It remains to be seen whether BYD can unlock the key to the door.

* BYD will be exhibiting at the Paris Motor Show in October in what is seen as their launch pad for France. It seems most likely that they will launch with the Tang SUV model which has been so successful in Norway.

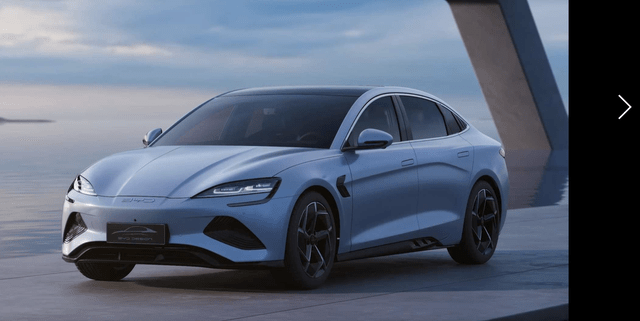

This is pictured below:

BYD Auto

* In the Netherlands BYD recently announced it had set up a dealership in the country. It fits well with the company’s strategy of picking up affluent smaller markets with an already existing strong presence of EV’s.

* In Australia, after some delays the launch of the “Atto 3” seems now to be up and running. It is recorded that the first orders have been shipped following government approval of the vehicle. The car is pictured below:

This right-hand drive model is being specially targeted for the Australian market. BYD say they have 4,000 firm orders now being shipped and have set aside production facilities for 3,000 per month up to the end of the year. If achieved that would give the company a monthly run rate of $120 million. That is small beer on the worldwide scale of BYD’s auto sales but a meaningful start to sales in a new market which I think will become dominated by EV’s quite rapidly now.

It seems as though the Atto will only be the beginning of the drive into the Australian market, as the announcement ceremony from the company’s Twitter page makes clear:

The Australian EV market seems to be finally opening up. It looks like fertile soil for BYD. Tesla has been having a very strong launch in the country the last year or so and dominates the market at present. It is thought that BYD have a major contract to supply Uber in the country but this has not been confirmed.

* In August BYD announced the setting up of an apparently large-scale distribution agreement for retail sales of its autos in Israel. First shipments are expected to arrive in Q3. This is yet another example of the advantages of the vertical integration model. Its auto distributor has already been acting for BYD for quite some years for the company’s e-buses.

* In August the company also announced the signing of a new distribution agreement for Germany and Sweden with the Hedin Mobility Group. They expect order deliveries to commence in Q4 and an ambitious programme of retail outlets is being set up throughput Sweden and Germany.

BYD’s China Market

The expansion overseas is based on the foundation of their success in the domestic market. In June this year, the company supplied 134,000 EV’s. Media reports (not confirmed) suggest they may supply 300,000 EV’s in a single month in the next few months. The 134,000 figure alone is a tripling of a month ago. They now have six car manufacturing plants in China itself.

In figures released at the start of August, it was announced that BYD had sold a new record 162,350 EV’s in the month of July. This was up 222% year-on-year. It was split almost evenly between BEV’s and plug-in hybrids.

In Q2 Tesla remained No. 1 in BEV’s with 254,695. BYD was No. 2 with 180,296. Volkswagen (OTCPK:VWAGY) was a faltering No. 3 with 118,000. Its latest management problems emphasise the scale of the problems there. BYD was the largest EV manufacturer if you include their hybrid range (or what they call NEV’s in their totality). Those sales have been flying on the back of their new DM-i technology.

At $128 billion BYD is the world’s third largest auto manufacturer by market cap. It is behind only Tesla at $963 billion and Toyota (TM) at $223 billion. VW has been going through a troublesome decade. Old market leaders such as Ford and GM seem unlikely ever to regain their old lustre. The next largest Chinese auto company, Great Wall Motors, is far behind BYD at $34 billion.

One advantage BYD has over Tesla is its very wide product range at different levels of the market. It seems that Tesla will remain offering only top of the range cars for quite some years. Tesla and VW have got nowhere so far in looking to come out with new lower-cost EV’s. We have heard nothing for a long time about Tesla’s “25K Model X” and VW now say they expect their lower cost BEV model in 2025. The way things are going with VW, that might even be optimistic.

Meanwhile BYD already have their low-cost “Dolphin” model selling at RMB 93,800 ($13,878). Their new “Seagull” model has been delayed somewhat but is expected to be delivered to customers before the end of the year. It is expected to have a base price of RMB60,000 going up to RMB 100,000. As their BYD EV range expands and sales balloon, their rivals will increasingly look like niche producers in the world EV market.

BYD are not just going low-cost though. The stylish new “Seal” model is set to hit the road in the next couple of months. This is illustrated below.

There were earlier reported to be 60,000 pre-sales of the model. Recent market talk says they had 110,000 pre-orders by the end of July but this is not confirmed. It incorporates the company’s LFP “Blade” battery in the new “CTB” cell-to-body structural battery system. This claims to provide improved battery utilisation and body rigidity and reduce weight, and thus costs. As with the Tang it illustrates the new very stylish models now coming out of the company.

BYD are even resurrecting the “Denza” brand. This was originally a 50/50 joint venture with Daimler (OTCPK:DMLRY) formed in 2010. It was not very successful and Daimler last year sold down their stake to just 10%. Now BYD have announced that they are opening 270 retail stores around China just to sell this brand. Market reports state that they have got 30,000 orders with pricing starting at RMB 335,000 ($49,500). Sometimes such reports out of China have somewhat exaggerated numbers. I would rather doubt they really have orders with a value of $1.5 billion (and that would be based on the lowest price variant) in the hold. Time will tell but the company at least seem to be very optimistic about the brand re-launch.

Other Chinese manufacturers have seen sales increasing the last few months but they have many deep-rooted problems. These include NIO (NASDAQ:NIO) which has seen a sudden decline in deliveries amidst serious supply problems and probably declining demand. Li Auto (NASDAQ:LI) has similar problems and XPeng (NASDAQ:XPEV) is suffering from chip shortages and declining margins. BYD’s expansion though is at a whole different level from its domestic competitors. Chinese government policy though seems to be fairly steady now focusing on long-term support for EV usage.

Possible Questions to the Thesis.

* As always with China, there are possible international geo-political problems.

* Insufficient supply of lithium for the company’s surging battery and EV production is an ever-present danger. BYD are however better placed than most on this with lithium mining investments in China and Chile and deals expected to be tied up in Africa.

* A change in Chinese government policy towards EV’s is always possible. Recent reports indicate though that the government will be further extending measures to help the auto industry during the COVID pandemic and taking into account the current economy uncertainty worldwide.

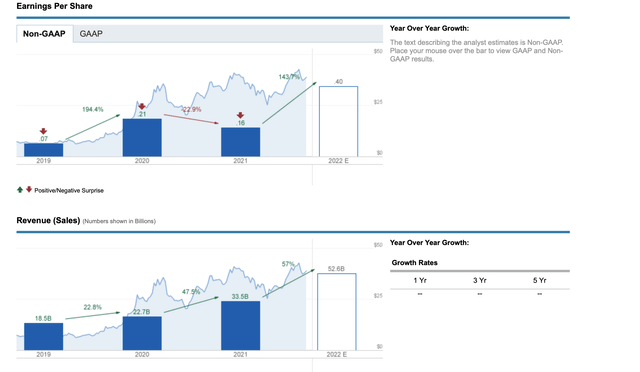

* As admitted by visionary chairman Wang Chuanfu at the recent 2021 annual shareholders meeting, profit margins did indeed drop last year. This can be illustrated as below, with information provided by Charles Schwab Inc:

This was in line with the problems common to the whole industry. It will be interesting to see to what extent BYD chase profitability or total revenue numbers in this environment. The company will no doubt continue to pursue substantial capital investment. I regard this as very much a positive. Fitch recently maintained their AAAsf rating on the company’s fixed rate note despite what they saw as a deteriorating asset outlook for the sector as a whole.

Conclusion

The company is completing its transition to becoming a purely NEV company as far as its autos go. The closing down of its substantial and extensive ICE production shows its determination to succeed as a new energy company. Its recently developed DM-i super hybrid technology has been very well received.

Its rapid expansion now of EV manufacture is based on the company’s extensive vertically integrated production capabilities. This vertical integration is its key strategic advantage.

The speed at which new models are coming out and the speed at which BYD is setting up distribution in countries around the world points to an imminent rapid revenue increase. We are now looking truly at a new world automobile giant which will dwarf giants of their past such as Ford (NYSE:F) and General Motors (NYSE:GM).

The company recently stated in preliminary figures that it expected income to increase 207% in the first half of the year. The sales figures achieved this year and the production figures being touted around for the near future indicate tremendous revenue growth for the company. It makes BYD a continued Strong Buy.

Be the first to comment