Pgiam/iStock via Getty Images

“A talent for following the ways of yesterday is not sufficient to improve the world of today.”

King Wuling

A business creates value when it grows revenue and earns a return greater than the cost of capital. NVR (NYSE:NVR) is one of America’s great companies. The company is the skillful beneficiary of profound, supply-side secular trends driving home prices to high base levels. NVR has grown market share, while also growing shareholder value. Its business model derisks the company in the event of falling demand and weakness in the market, and its executive compensation policy aligns the interests of management with those of shareholders. This is a company that excels at creating shareholder value.

Recent Financial Results

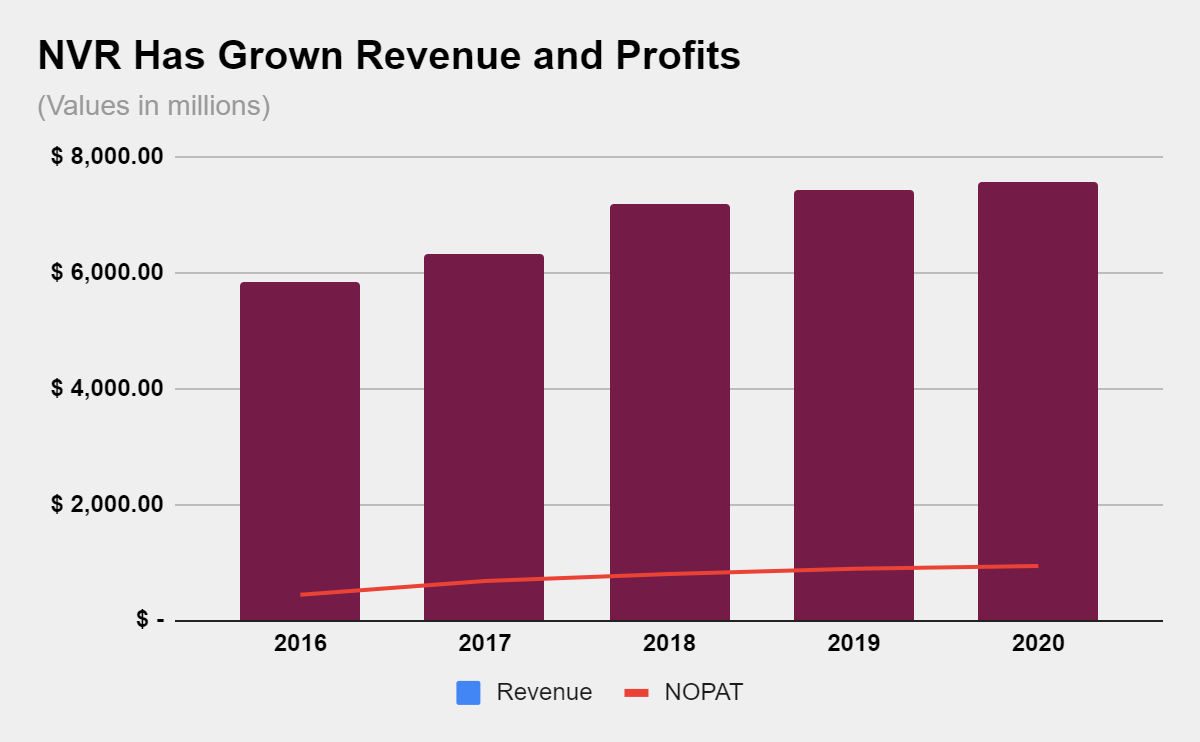

According to the company’s 2020 annual report, NVR grew revenue from $7.2 billion to $7.3 billion. NVR’s 3Q21 report showed a 21% increase in homebuilding revenue year-over-year, from $1.9 billion to $2.3 billion. Mortgage banking fees declined from $69 million to $59 million. Revenue was up 29% year-over-year after the first nine months of the year ended September 30, 2021.

Growth has been accompanied by greater profitability. In 2020, NVR earned net operating profit after tax (NOPAT) of $935 million, up from $888 million the year prior. Between 2016 and 2020, NVR compounded NOPAT at over 16% per year. In the current/trailing twelve-month (TTM) period, NVR has revenue of over $9 billion and NOPAT of nearly $1.3 billion.

The company’s improving profitability is reflected in its NOPAT margin. In 2020, that stood at 12.4%, and is currently 14.2%. NVR has improved its NOPAT margin every year since 2016 when it had a NOPAT margin of 7.5%. The company’s invested capital turns have risen from 2.7 in 2016, to 2.8 in 2020, and are at over 3.3 in the current/TTM period.

Consequently, NVR’s return on invested capital (ROIC) has risen from 20.4% in 2016 to 34.9% in 2020. ROIC is 47.3% for the current/TTM period. NVR’s asset-light model allows it to generate impressive ROIC and have a very efficient balance sheet, which, in the housing sector, is especially important given the dynamics that we will discuss below.

The Housing Boom Is Built On Solid Foundations

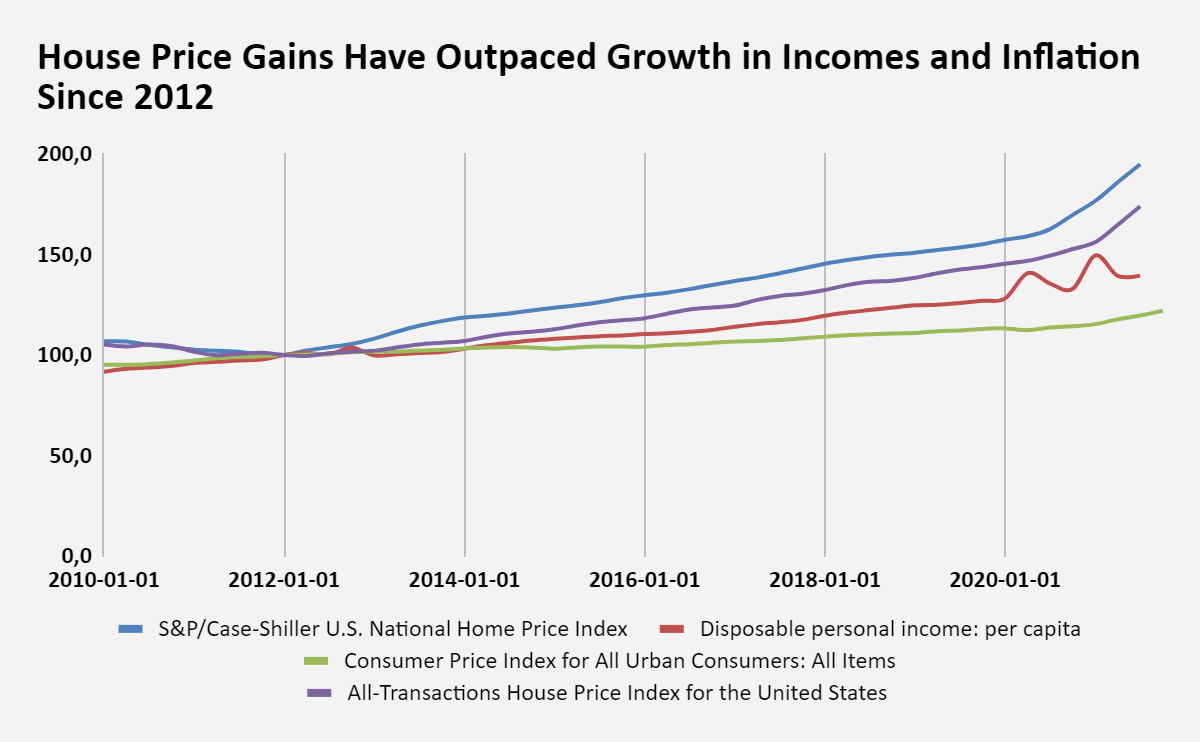

Any discussion on the housing market inevitably leads to the housing bubble that led to the Great Recession. Yet, there are good reasons to believe that the present housing boom is founded on strong fundamentals. Since its nadir in 2012, house price indices have rebounded, growing at a faster rate than per capita income and inflation. The S&P Case-Shiller National Home Price Index is up nearly 95% from its 2012 levels, and the FHFA’s All Transactions Price Index is up nearly 74%. That represents a compound annual growth rate (CAGR) of 6.9% for Case-Shiller and 5.7% for the FHFA’s index. In that time, per capita income has risen about 40%, compounded at 3.4% annually, while consumer prices are up 22%, or roughly 2% annually.

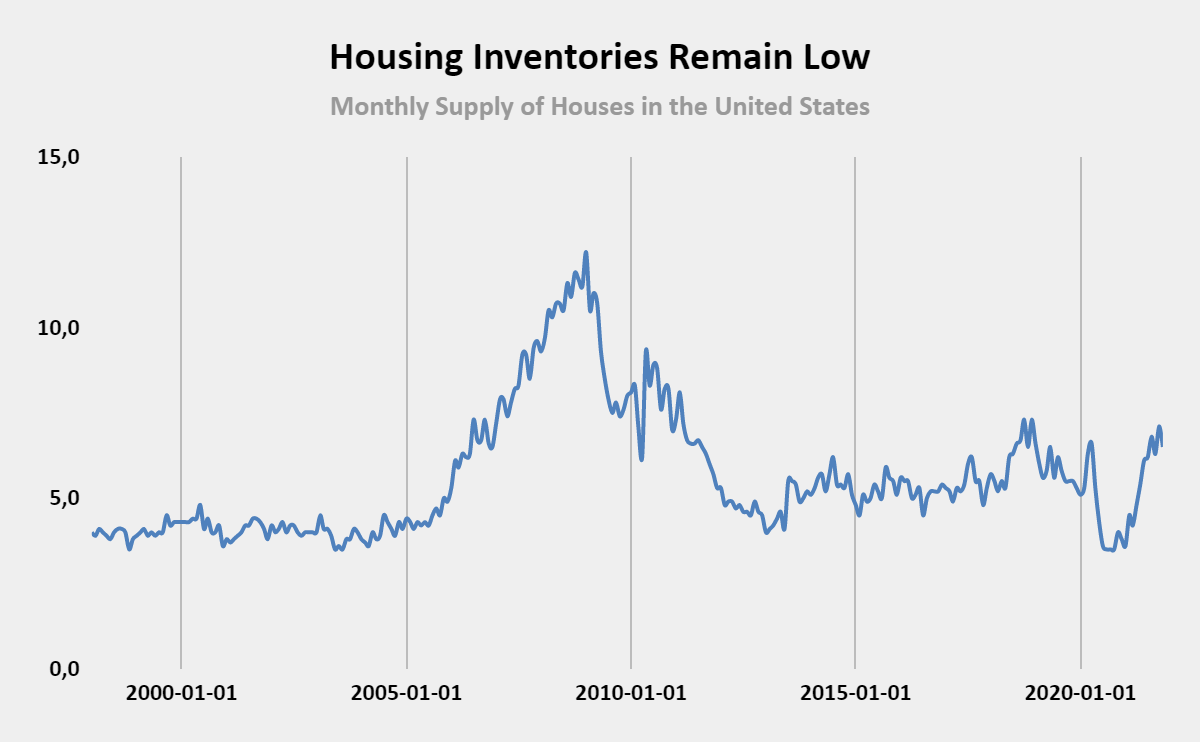

House price inflation precedes the pandemic, which only amplified a secular trend. Anyone arguing that “this time it’s different” nearly always sounds like an idiot, but… this time it’s different. As the Wall Street Journal pointed out, mortgage lending standards are much higher than they were in the mid-2000s, when “borrowers with poor credit histories” were able to “purchase homes beyond their means, sometimes with mortgages that required low payments in the early years of the loan. Too much new construction led to an oversupply of houses.”

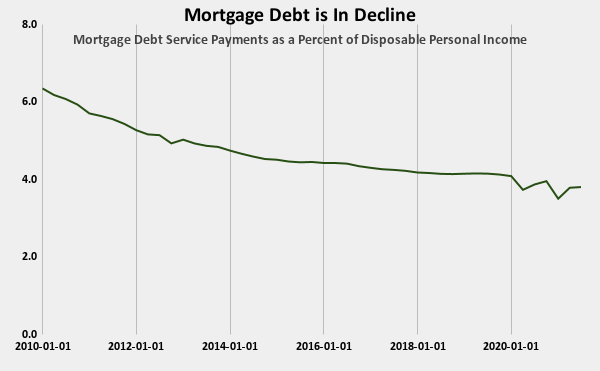

Today, the real problem is not loose mortgage standards, but barriers to entry. Economists have referred to this as a “debtless housing boom”, because of the decrease in home mortgages in the post-Great Recession era. Mortgage debt service payments have fallen from 6.3% of disposable personal income to 3.8% in the last decade. Consequently, it’s hard to argue that homeowners are eating up mortgage debt.

It is true that the pandemic poured rocket fuel on the housing boom, as workers embraced the fact that remote work gave them the freedom to move to bigger homes outside of traditional metropoles. The pandemic worsened affordability issues and widened inequality, even at a time of record-low mortgage rates.

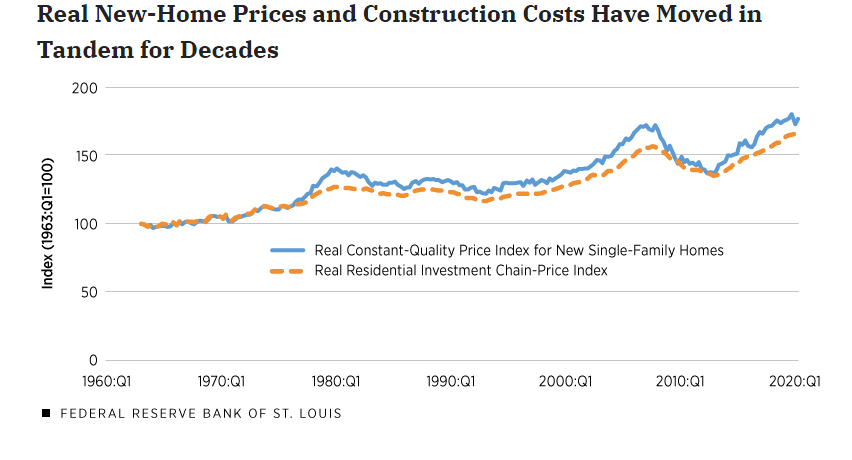

Construction costs (inc. the cost of land and improvements) are the key drivers of new-home price inflation and played an important role even in the housing bubble that preceded the Great Recession. This is especially true when local markets are competitive. According to the Federal Reserve, there is a close relationship between sales of new single-family homes of comparable quality, and the cost of residential construction, as the chart below indicates, growing by 0.98% and 0.91% per year, respectively.

This relationship is strong, not just in the long run, but in the short run, which suggests that the floor on house prices has risen and is likely to stay high.

Risks To Growth And Profitability

According to Clever Real Estate, in 2021, Americans needed an income of $144,192 to afford a home, well above the median household income of $69,178.

Typically, home buyers are advised to spend no more than 30% of their gross monthly income on housing. Some experts advise setting a limit of 2.5 times the annual salary. The dramatic rise in home prices has made this increasingly difficult to do. Clever Real Estate estimates that home prices are now 5.4 times more than the typical buyer’s gross income. That means just six cities in America have a healthy price-to-income ratio of 2.6 and below: Alabama, Birmingham, Cincinnati, Cleveland, Oklahoma City, Pittsburgh, and St. Louis. Cities such as Los Angeles, New York, San Diego, San Francisco, and San Jose, have a price-to-income ratio greater than 9.8.

The demand constraints have started to appear in the data. According to the National Association of Realtors, pending home sales for November 2021 were down 2.2% month-over-month. Pending home sales are a leading indicator of existing home sales, leading by a month or two. Existing homes sales in November were up 1.9%.

The Census Bureau estimates that sales of newly built single-family homes were down 14% in November compared to a year ago. October’s sales numbers were revised to their lowest point since the pandemic began.

Regardless of this, the median price of newly built homes sold that November was up 19% compared to the year prior.

Although we should expect some softening of housing price inflation, the base level will remain given rising construction costs. Nobel Prize-winning economist Robert Shiller has stressed that it is rare for house prices to go up along with stocks and bonds. He believes that supply- and demand-side changes will conspire to level off prices in the next two years, but, he said it is much too early to discuss a crash in prices. There are real supply-side reasons for high housing prices.

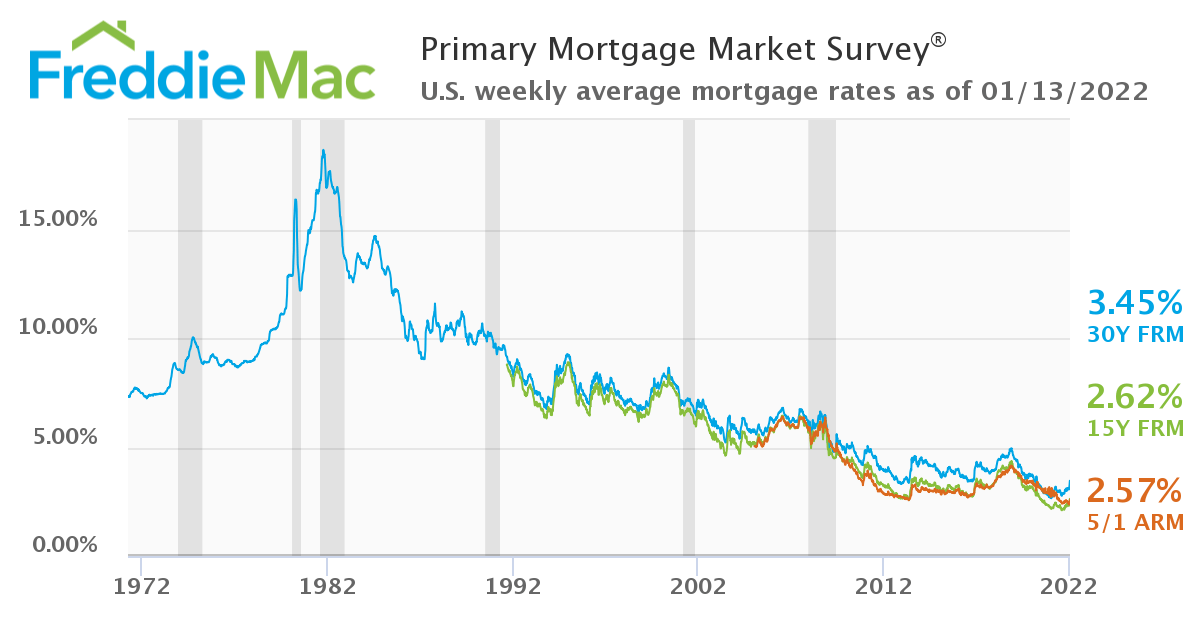

These risks seem outweighed by the reasons why demand will also remain high. Regardless of the Federal Reserve’s intention to increase interest rates, interest rates will remain at historically low rates. Secondly, remote work allows millenials and other buyers to buy homes outside of traditional metropoles where the price-to-income ratio is unfavorable.

We are living in an eight-centuries long supra-secular trend of declining real interest rates, and so, in the long run, rates are likely to remain low. Data from Freddie Mac shows that 30-year mortgage rates remain at historically low levels, even accounting for recent rises.

Management’s Interests Are Aligned With Those Of Shareholders

NVR’s executive compensation plan ties 50% of long-term stock options to NVR’s return on capital performance. Performance-based options are vested according to how NVR’s return on capital performance evolved with respect to its peers.

Research has shown that return on capital is a key driver of long-term corporate valuation. For shareholders, having a management that, since 2014, has had a compensation policy tied to return on capital, means that management is focused on the same thing that shareholders are: the creation of value. Not only has NVR grown ROIC from 20.4% in 2016 to 47.3% in the current/TTM period, the company has grown economic earnings from over $313 million to $1.14 billion in that period, or 24% compounded annually.

NVR Is Attractively Priced

With a share price of just over $5700 and an economic book value per share of just above $6400, NVR has a price-to-economic book value (PEBV) of 0.89. This implies that the company’s zero-growth value of the company is greater than the share price. The market expects NVR’s profits to decline by 11%, a conclusion which, given the company’s history of profitability and the secular trends fueling house price inflation and demand for new homes, seems incredibly pessimistic.

According to New Constructs, consensus estimates forecast the company’s earnings per share to grow 43% year-over-year in 2021, 21% year-over-year in 2022. This is essentially a freeroll decision: although there is uncertainty about the future, the market’s pricing of NVR means that the market has taken the risk out of the decision and presented investors with a no-loss decision. If NVR exceeds market expectations, there’s upside. The greater the disconnect, the bigger the eventual upside. A profitable company whose profitability is improving but which is priced for a decline in profits is a freeroll decision.

Investors should buy companies with growing free cash flow available at attractive prices. NVR’s free cash flow (FCF) has grown from $332 million in 2016 to $859 million in 2020, compounding at 20.9% per year over that period. The company has more than $1.2 billion in FCF for the current/TTM period or 5.8% of its market cap. With a current/TTM enterprise value of over $20.86 billion, NVR has an FCF yield of 6%. Not only is the company’s FCF growing, it is available at an attractive price.

Be the first to comment