da-kuk

Investment Thesis

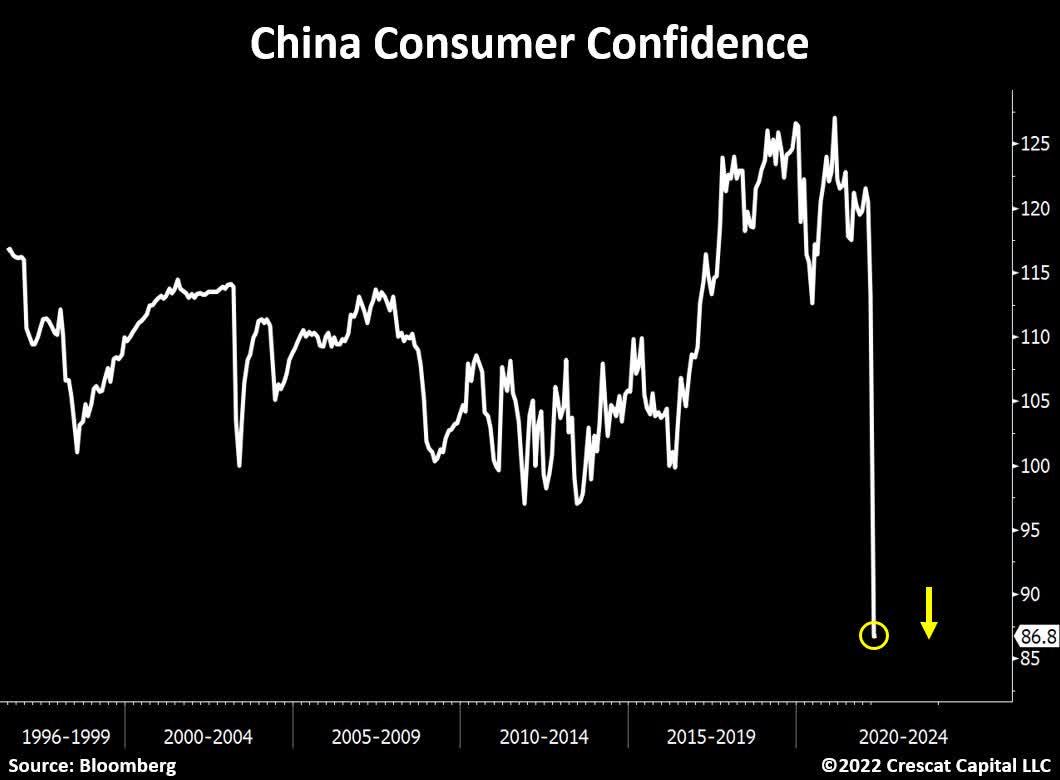

Despite Wall Street’s most recent bullish calls, I believe it’s still too early to assume a strong rebound in the Chinese economy. While the economy and the stock market are two different things, the forward-looking nature of equity markets makes them extremely sensible to new data and uncertainty. In my opinion, the data coming out of China at the moment isn’t as bullish as some analysts believe. For instance, consumer confidence has recently reached a multi-decade low despite interest rate cuts, prompting several Chinese watchers to wonder if the country’s economy will be able to expand at a high single-digit rate going forward.

Bloomberg

Despite the government’s efforts to provide stimulus through lower interest rates, the Chinese investors’ risk appetite has been muted over the last 12 months compared to the previous decade and doesn’t show any sign of a significant rebound for now. This is reflected in sluggish YoY domestic loans growth, which has also hit a multi-decade low this year.

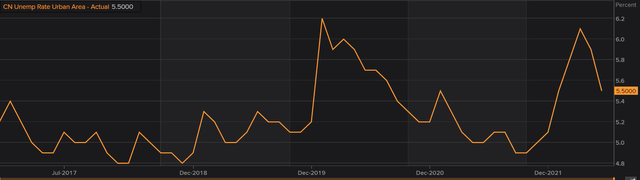

On top of that, the urban unemployment rate reached a record high of 6% in May 2022 before gradually declining. Nonetheless, urban unemployment remains significantly higher than the historical average of 4.8%. The situation is worse if you filter the data by age category. Chinese youth unemployment rate has reached nearly 20% in June 2022, much higher than in the Euro Area (~13%) or the US (~8%).

For the abovementioned reasons, I believe that the economic recovery in China will take longer than expected and will probably be measured in years rather than months. In this article, I will review the iShares MSCI China ETF (NASDAQ:MCHI) which provides exposure to the different sectors of the Chinese economy.

Strategy Details

The iShares MSCI China ETF tracks the investment results of a broadly diversified index composed of Chinese equities that are available to international investors.

If you want to learn more about the strategy, please click here.

Portfolio Composition

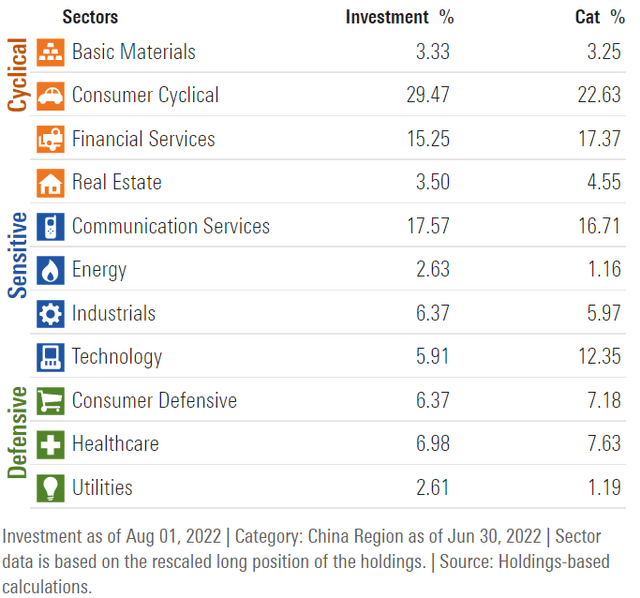

MCHI invests ~29% of total assets in Consumer Cyclical stocks, followed by the Communication Services sector (18%) and Financials (~15%). The largest three sectors have a combined allocation of approximately 62%. Over 51% of the equity exposure is invested in cyclical industries, which is likely to make the strategy more volatile during economic downturns. In terms of geographical allocation, Mainland China represents 98% of the portfolio, with the remaining amount invested in Hong Kong-listed shares.

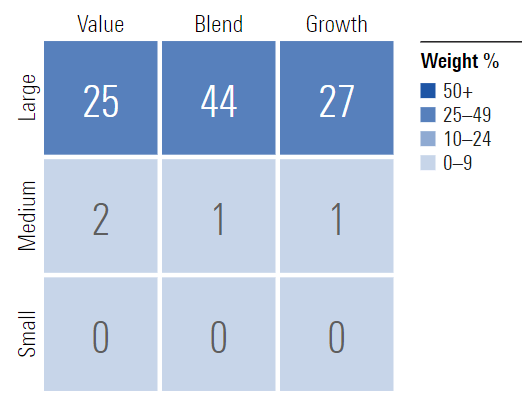

~44% of the portfolio is invested in large-cap “blend” equities, characterized as large-sized companies where neither growth nor value characteristics predominate. Large-cap issuers are generally defined as companies with a market capitalization above $8 billion. The second-largest allocation is large-cap growth stocks, which account for 27% of the portfolio.

Morningstar

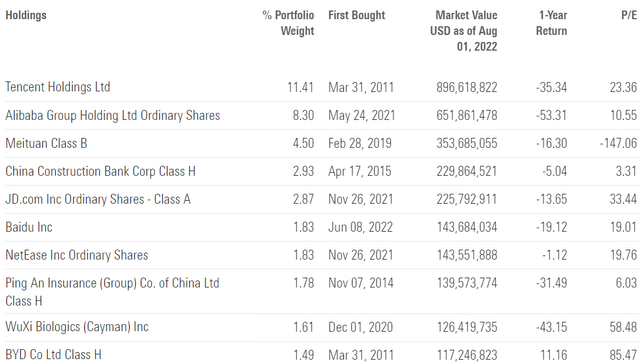

MCHI is currently invested in 613 different stocks. The top 10 holdings account for ~39% of the portfolio, with no single stock weighting more than 12%. The fund manages a concentrated portfolio and for this reason, I think it’s very important for investors to feel comfortable with the top ten names. Given the way the portfolio is structured, potential buyers should also be ready for a higher level of volatility compared to a more diversified strategy.

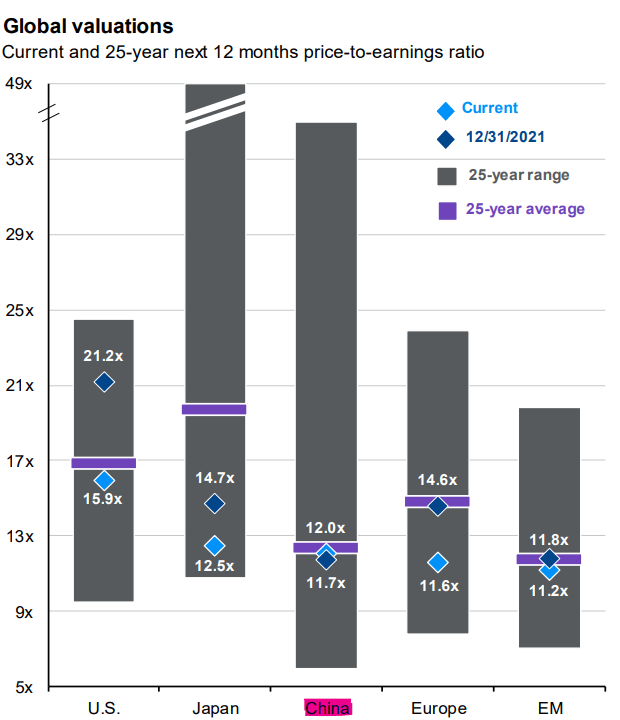

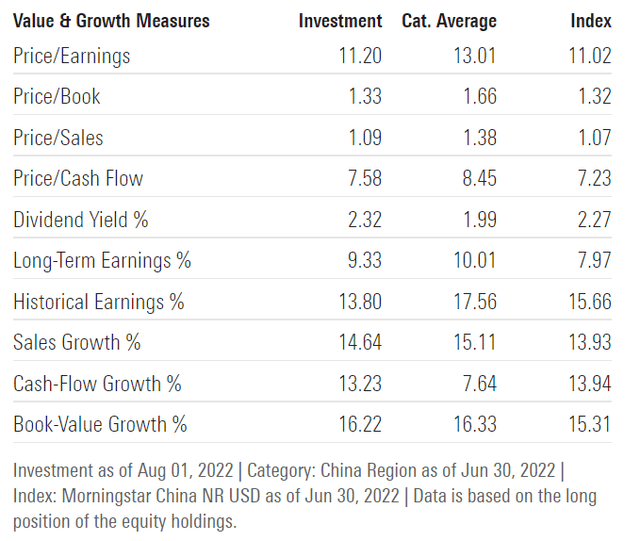

Since we are dealing with equities, one important characteristic is the portfolio’s valuation. According to data from Morningstar, MCHI trades at ~1.3x book value and ~11x earnings.

It’s relatively well known by now for a large number of investors that China is cheap based on fundamental multiples. However, I think the main challenge is to identify how the country compares with peers and to differentiate between value and price. For comparison, China trades at similar multiples to other emerging markets, but it’s cheaper than most developed markets despite a higher expected growth rate. The unique challenges associated with an emerging market economy and the geopolitical risks are pushing market participants to require a premium over developed market equities, thus lowering valuation multiples.

JPM

Is This ETF Right for Me?

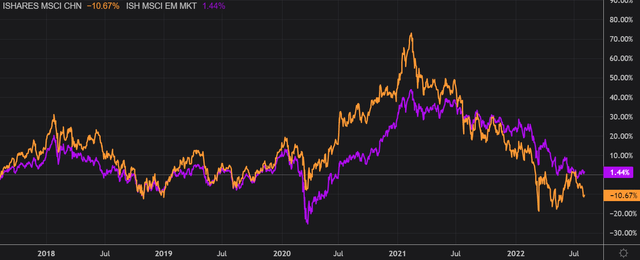

I have decided to compare MCHI’s returns against the iShares MSCI Emerging Markets ETF (EEM) over the last 5 years to assess which was a better investment. Over that period, EEM outperformed MCHI by ~12 percentage points. It’s interesting to note that Chinese stocks were doing better until the government’s crackdown on tech stocks that started at the end of 2020. The subsequent real estate crash aggravated the situation for many Chinese equities, and the index seems to have a hard time rebounding ever since.

To put MCHI’s returns into perspective, a $100 investment in this fund 5 years ago would now be worth $89.3. This represents a compound annual growth rate of ~2.24%, which is a terrible absolute and relative return.

However, if we take a step back and look at the 10-year returns, MCHI outperformed other emerging markets over that period. Sentiment toward Chinese stocks remains negative for now in my opinion, which is one of the indicators suggesting a bottom in this market might be near. That said, I continue to believe that the Chinese economy is unlikely to show signs of a rapid recovery in the near future. If we add geopolitical tensions between Western countries and China, we have a very uncertain picture and as a result, the main goal of every investor should be to minimize risk. The best way to do that while at the same time betting on a rebound is through long-dated call options, where the upside is unlimited and the amount at risk is limited to the premium paid for that option.

Key Takeaways

MCHI provides exposure to a basket of Chinese stocks. This ETF runs a concentrated portfolio, where the top 10 holdings account for over 39% of total assets. Despite Wall Street’s recent positive comments on the Chinese economy, I believe it is still too early to expect a major recovery. While the economy and the stock market are separate things, equities are very sensitive to new data due to their forward-looking nature. Chinese consumer sentiment, loan growth, and employment data all remain weak and below trend for now despite government intervention. As a result, I believe the best way for investors who want to get some long exposure to Chinese stocks is through long-term options, where the downside risk is limited, and the upside potential is uncapped.

Be the first to comment