nattul

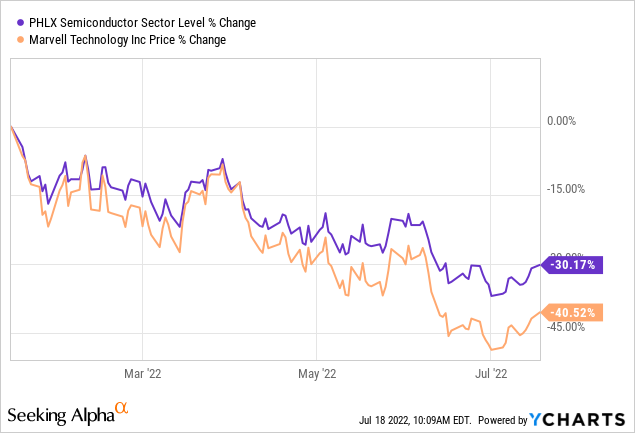

We have a buy rating on Marvel Technologies (NASDAQ:MRVL). MRVL is a specialized semiconductor company focused on data center infrastructure and operates in computing, networking, security, and storage markets. The stock is down about 41% YTD, below the semiconductor index (SOX). We believe the semiconductor sector is suffering from weakened consumer spending, and IT spending cuts that are underway. Despite this, we are bullish on MRVL. We believe the possible upcoming spending cuts in MRVL’s business (enterprise and data centers) are priced into its stock. We believe the stock is down more than it should be, providing a good entry point to invest in the company. Marvell is well-positioned to beat the semiconductor peer group within enterprise and data center markets in the long run.

Ycharts

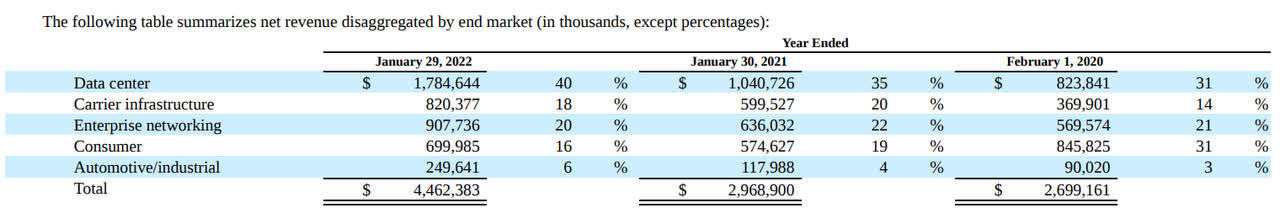

MRVL is primarily a data center company

MRVL targets five markets, the biggest of which is data centers making up 40% of revenues. The other markets are carrier infrastructure, enterprise networking, consumer, and automotive/industrial. The following table outlines the revenue each market brings in. We believe the company is well-positioned because of its high exposure to data centers and enterprise networking markets.

Marvell 10-K

Data centers are at the core of MRVL’s revenue and are a primary expanding market. Datacenter markets are growing due to the global shift from enterprises and businesses toward cloud environments and the rising adoption of advanced technologies. There is an increased need to store data. Research firm BlueWave estimated the data center market to have been worth $206B at the end of 2021 and is predicted to grow at a 10.2% CAGR between 2018-2028. We expect data center market growth to continue and believe MRVL is well positioned to benefit from that growth.

Well-positioned in the data center, enterprise, and automotive/industrial markets

MRVL is increasingly exposing itself to enterprise and automotive/industrial markets. Enterprise is estimated to grow at a CAGR of 4.4% over the next five years. Automotive/industrial is projected to grow at a CAGR of 4.5%. We believe MRVL is well-positioned to take advantage of growth within these markets in the long run.

All semiconductors tie back to consumer spending

MRVL’s primary business is not directly exposed to consumer markets. Yet, we believe it is not immune to the negative impacts of weakened consumer spending. We expect weakened consumer spending to lead to IT cuts, ultimately leading to cuts in data center and enterprise spending. Consumer spending is declining, evident in demand headwinds in PC and smartphone markets. Spending on smartphones has already begun falling; according to IDC’s worldwide quarterly mobile phone tracker, shipments of smartphones will decline 3.5% to 1.3B units in 2022. IDC’s Worldwide mobility and consumer device trackers reported, “the smartphone industry is facing increasing headwinds from many fronts – weakening demand, inflation, continued geopolitical tensions, and ongoing supply chain constraints.” We believe the declines in consumer electronics spending will cause cloud CAPEX to be cut. We believe data center and enterprise CAPEX will also be cut. Nevertheless, we believe MRVL stock has already priced in the negatives for the most part.

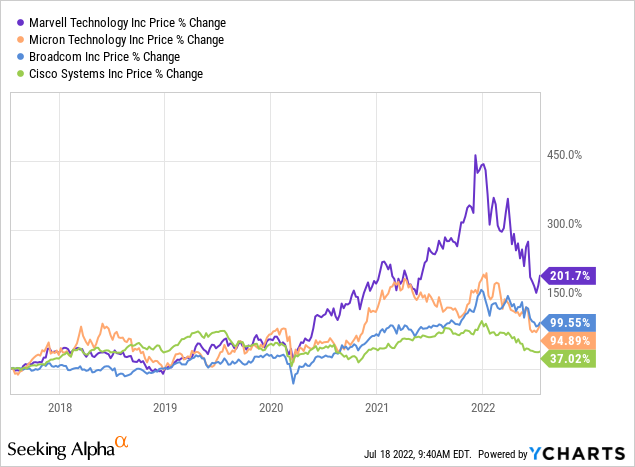

Stock Performance

MRVL stock has appreciated about 202% over the past five years. The majority of that growth is attributed to the pandemic-induced increase in demand. The stock grew 121% from March 2020 until the present. MRVL matches competition growth during the same period with Broadcom (AVGO) +97%, Cisco (CSCO) +35%, and Micron (MU) +91%. The stock has been down 10% over the past year. YTD is also down 45%. We believe MRVL is dropping due to the demand headwinds within the semiconductor sector and the possibility that weakened consumer spending will cause cuts in data center spending. We believe MRVL provides an attractive risk-reward situation when demand speeds up because of its position within the data center and enterprise markets.

The following chart illustrates MRVL’s stock performance.

Ycharts

Valuation

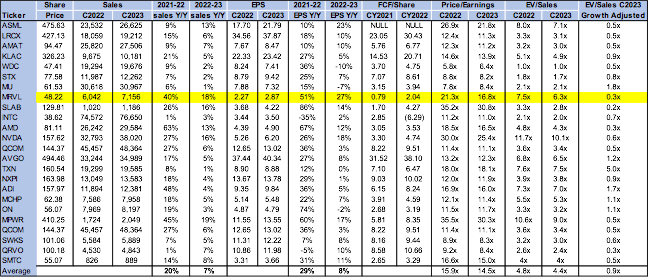

MRVL is trading around $48. The stock is slightly expensive relative to its peer group. On a P/E basis, the stock is trading at 16.8x C2023 EPS $2.87 compared to the group average of 14.5x. The stock has pulled back almost 44% from its 52-week high of $94. On an EV/sales basis, the stock is trading around 6.3x C2023 compared to the group average of 4.4x. On a growth-adjusted basis, MRVL is trading at 0.3x compared to the group average of 0.9 x. We believe MRVL stock dropped as part of the downward draft facing the entire semiconductor sector. We believe the stock is a growth pick and recommend investors buy based on its current weakness.

The following chart illustrates MRVL’s peer group valuation.

Refinitiv & Techstockpros

Word on Wall Street

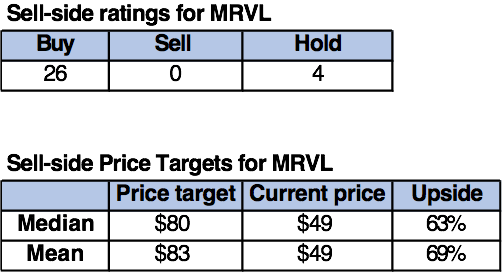

The consensus on MRVL stock is a buy. Of the 30 analysts, 26 are buy-rated, four are hold-rated, and none are sell-rated. MRVL is trading around $49. The median price target is $80, and the mean price target is $83, with a potential 63%- 69% upside.

Refinitiv & Techstockpros

What to do with the stock

Our bullish call on the stock is because we believe the company is well-positioned to benefit from the global shift to the data center, enterprise, and automotive/industrial markets in the long term. We believe the stock provides a favorable risk-reward at current levels and recommend long-term oriented investors to buy in.

Be the first to comment