Luis Alvarez

Apple (NASDAQ:AAPL) has scheduled its next product launch event, originally titled “Far Out”, for September 7 at 10 AM, Pacific time. On that date, the tech company should unveil the iPhone 14, Apple’s third 5G-capable device, alongside the Apple Watch Series 8 – while other products, including the AirPods Pro 2 and a new iPad, could make the headlines as well.

Below, I review some of the most widely anticipated news that is likely to come out of Wednesday’s event. More importantly, I also discuss how the announcements could impact the investment thesis.

iPhone: the headliner

There is little doubt that the iPhone will be the main attraction. Apple’s smartphone experienced a renaissance that few expected to see in the last 24 months, propelled mostly by (1) pandemic and post-pandemic habits that increased the demand for smartphones and related services and (2) the launch of Apple’s first 5G device, in 2020, which seems to have sparked a wave of upgrades. Keep in mind that, in fiscal 2021, the iPhone segment accounted for 52.5% of Apple’s total revenues, up from 50.2% in the previous 12 months.

- Key developments: the iPhone 14 will be the star of the show. For starters, expect a no-frills refresh of the basic model; the retirement of the unsuccessful iPhone mini; and the introduction of a Plus trim whose screen should be the size of the current iPhone 13 Pro Max’s. More impactful will probably be the introduction of the iPhone 14 Pro family, which should be equipped with the A16 Bionic chip and feature what MacRumors is calling “one of the biggest camera updates we’ve seen on the iPhone line in years”.

- What matters to investors: when it comes to the new iPhone, the best-case scenario for investors would be more of the same. The chart above shows that the so-called super cycle has, indeed, materialized in the past couple of years. The next question is whether the iPhone 14 can provide the boost that Apple needs to deliver growth against very tough comps. The other meaningful item to pay attention to on Wednesday, in my view, is the starting price of the new Pro lineup. Should the suspected $100 increase come to fruition, not only would profitability improve – total company gross margin has expanded to 43.6% in 2022 YTD from 41.7% in the comparable period last year. Such a move would also support the idea that Apple may be an inflation-safe play, which I believe would bode well for the stock in the current market environment.

Apple Watch: a trick up the sleeve

If the iPhone has been a winner within Apple’s product portfolio as of late, the same cannot be said of the Watch. Once a key growth engine, the “wearables and others” segment saw revenues decrease YOY for the first time last quarter (see below), the result of (1) supply chain constraints and (2) unfavorable product launch timing. The Watch Series 8 will be Apple’s next attempt to breathe life into the business.

- Key developments: On the surface, and for both the 41 mm and 45 mm versions, the Series 8 will likely resemble its predecessor. Under the hood, the device will probably be equipped with an S8 chip and one interesting new feature: body temperature monitor. The accelerometer could now be used to add car crash alert capabilities, further expanding the role of the Watch as a health device – one of the product’s key selling points.

- What matters to investors: I find it unlikely that the Watch Series 8 will do much to spark demand within the wearable category and reverse the clearly negative growth trend witnessed since the start of the COVID-19 crisis. However, Apple could move the needle if the rumored Watch Pro sees the light of day this week. The higher-end device could sell for as much as $900, possibly exposing the Cupertino company to a new addressable market within this product category. Apple has been using (successfully, in most cases) the strategy of reaching out to both the lower- and higher-end of its target consumer base at the same time (think the iPhone SE and the Pro Max at a price range of $430 to as high as $1,600). Something like it could work for the Watch as well.

Key takeaways

I believe that (1) the iPhone Pro lineup, including a potential bump of $100 in starting prices, and (2) the possible launch of the Watch Pro would be the two most important topics of conversation during Apple’s event on September 7. The continuation of the 5G super cycle and a potential rebound in the wearables segment largely depend on these two items, in my opinion.

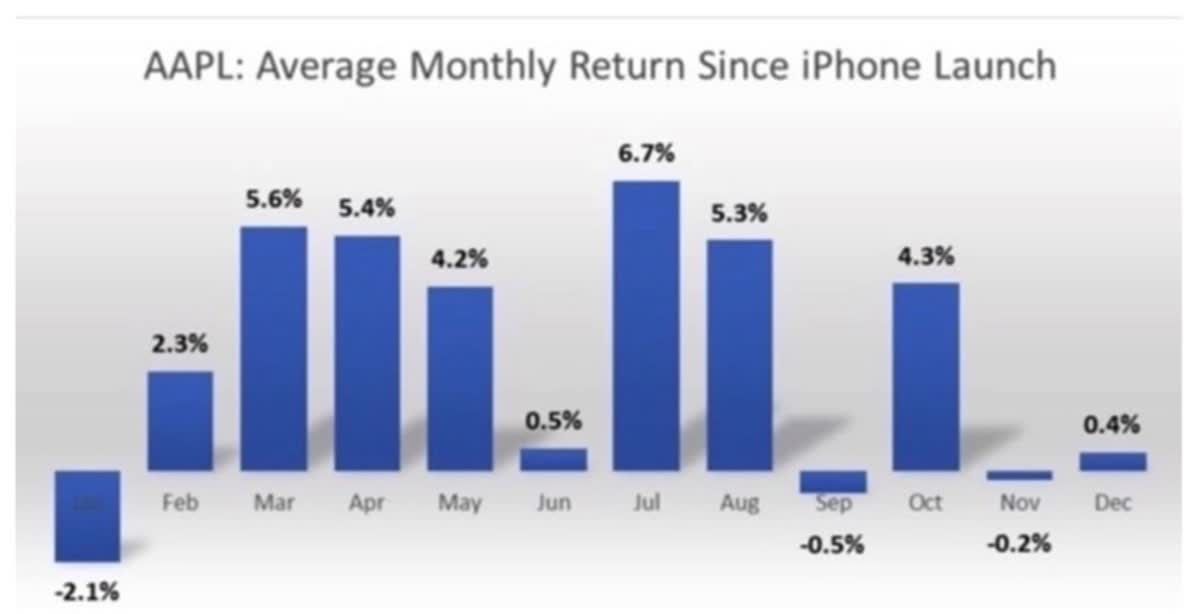

DM Martins Research, data from Yahoo Finance

Worth noting, Apple stock has notoriously behaved poorly following the launch of the company’s new iPhone models. The chart above shows how shares have historically underperformed in the September-to-January period since the launch of the original iPhone, in 2007, with October being the only exception. This is probably a classic case of “sell the news”, made worse by the uncertainty over the performance of the new iPhone through the end of January, when Apple officially reports fiscal Q1 numbers.

But to me, thinking of Apple within such a short timeframe misses the more important point. The Cupertino-based company has proven that it can execute very well regardless of the macroeconomic environment – COVID-19, recovery from the pandemic, rising interest rates, inflation, etc. In the current market landscape, quality probably matters more than usual, which is why I remain an Apple bull ahead of this week’s iPhone 14 launch and beyond.

Be the first to comment