simarik

We were previously sell-rated on Netflix (NASDAQ:NFLX), and after the recent 3Q22 earnings, our rating has not changed. Netflix is nothing short of a household name, but we now expect it to transition into a neutral-no-growth media company.

Netflix outperformed expectations by adding 2.4M net paid subscriptions in its latest quarter. We attribute the boost in subscriptions to have resulted from Netflix’s release of its new crime series, Monster: The Jeffrey Dahmer Story. We believe Netflix now relies on customer loyalty to a few high-hit shows rather than to Netflix. Under current macroeconomic headwinds, we believe the company’s reliance on hits like The Jeffrey Dahmer Story leaves it vulnerable to churn from users with lower disposable income. We believe these users are prone to only resubscribing before major releases. We expect Netflix will remain a major streaming company but believe it will be reliant on a few high-hit series and will not enjoy the hype it received during the pandemic and before.

We also believe the stock is too expensive for the growth-risks present. After 3Q22, Netflix stock has become more richly valued despite persisting macroeconomic and spending headwinds that have yet to wash out. We recommend investors sell the stock at current levels.

Exposed to the risk of user resubscription pre-major releases

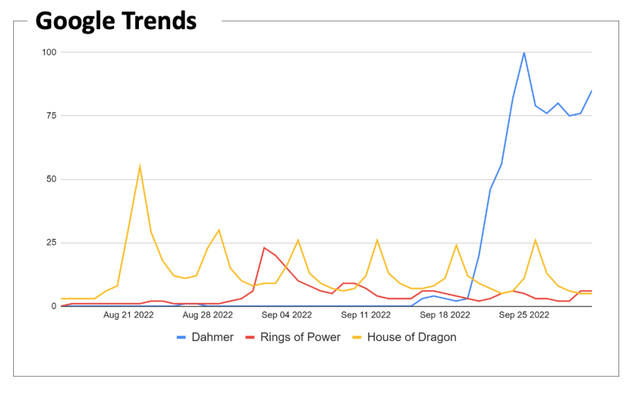

In its 3Q22, Netflix performed ahead of expectations in its net add subscriptions as the company added 2.4M compared to the 1M guidance. We believe subscribers are the most important KPI for a streaming media company like Netflix. While the increased subscriptions are encouraging at face value, we believe the net added subscribers are highly dependent on a few high-impact series, i.e., Stranger Things, Squid Game, The Sandman, and most recently, Monster: The Jeffrey Dahmer Story. We continue to believe that Netflix subscriptions are now reliant on loyalty to specific series rather than the platform. The following graph outlines the views for the Dahmer series compared to other streamers.

Again, at face value, this graph looks outstanding for Netflix. However, we argue that users’ loyalty to specific series makes Netflix vulnerable to users with lower disposable income resubscribing in advance of major releases. With inflation hitting an all-time high and interest rates spiking, we believe fewer and fewer individuals have disposable income to direct toward subscriptions and entertainment.

Ad-tier plans will likely be a positive

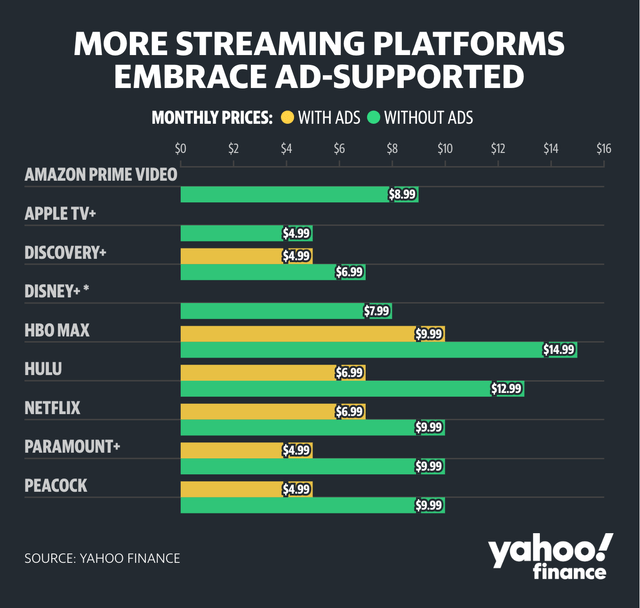

Netflix announced it would be rolling out its ad-supported subscription in November for 12 different countries. The ad tier is priced at around $6.99. We expect the ad-tier plan will likely receive solid demand within the current macroeconomic environment as users opt for cheaper alternative streaming platforms. While we’re excited to see how the ad-tier plays out, we still maintain our concerns around Netflix being part of the streaming cattle and no longer leading them. Competition, including Disney’s (DIS) Disney+ and HBO, AppleTV (AAPL), and Amazon Prime (AMZN), are also introducing ad-supported subscriptions, each with different pricing.

The following graph outlines the different ad-supported subscriptions available in the market.

F/X headwinds are cutting deep

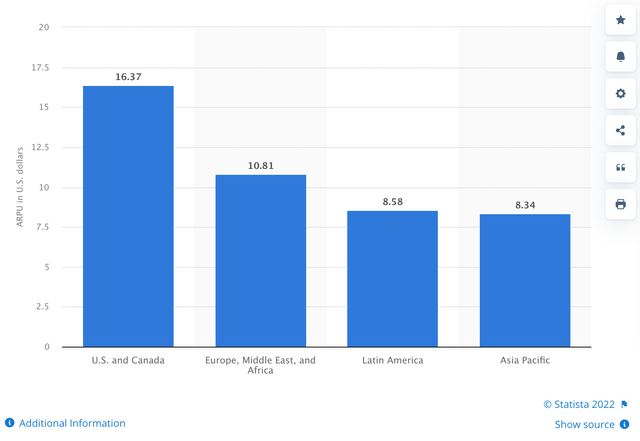

We believe Netflix will face churn due to F/X headwinds. In the 3Q22 shareholder letter, Netflix stated that the “sequential decline in revenue was entirely due to F/X.” We expect the stronger value of the US dollar will harm the top and bottom line growth for Netflix towards the end of the year. Netflix’s global customer base makes it increasingly vulnerable to currency fluctuations. The following graph shows Netflix’s quarterly average monthly revenue per streaming customer for 3Q22.

Netflix CFO Spence Neumann recognized the issue of foreign exchange affecting U.S.-based international companies and expects the bad exchange rates would cost the company around $1B in revenues.

Valuation is at the core of our bearish thesis

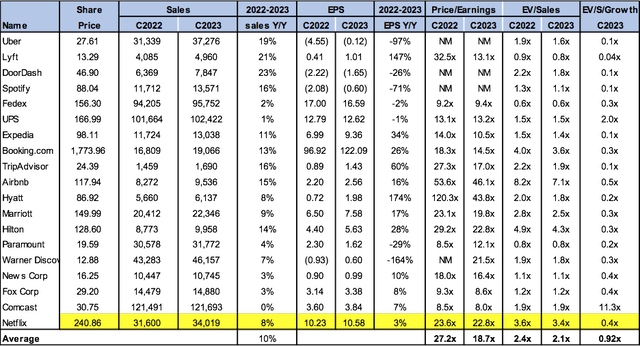

We believe Netflix is overvalued, trading at 22.8x EPS $10.58 C2023 on the P/E basis compared to its peer group average at 18.7x. On the EV/Sales metric, the stock is trading at 3.4x C2023 compared to the group average at 2.1x. We believe Netflix is unreasonably priced as its growth is not without major risks.

The following chart illustrates Netflix’s peer group valuation.

Word on Wall Street

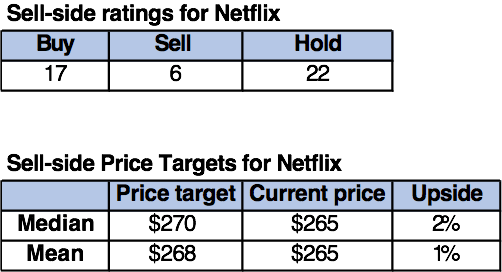

Wall Street is divided on Netflix stock. Of the 45 analysts covering the stock, 17 are buy-rated, 22 are hold-rated, and the remaining are sell-rated. The stock is currently trading at $265. The median and mean price targets are set at $270 and $268, respectively, with an upside of 1-2%.

The following chart indicates Netflix stock’s sell-side ratings and price targets:

TechStockPros

What to do with the stock

While Netflix initially boomed because it had the first-mover advantage, we believe the industry has changed. Netflix is competing with giants (Disney+ and HBO, Amazon Prime, and AppleTV, among others) that have multiple revenue streams and can outspend the company on marketing and content. We don’t expect Netflix to disappear, but we believe it is increasingly becoming reliant on hit series to boost subscriptions. We expect this will create churn from low-income users as they might resubscribe only before major releases. We recommend selling the stock at current levels.

Be the first to comment