hallojulie

The Buy Thesis

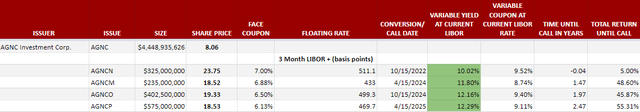

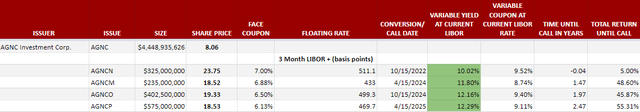

AGNC Investment Corp. (NASDAQ:AGNC) preferreds are trading at discounts to par greater than 20% and dividend yields upon conversion to floating that exceed 12%. That is a yield and upside to par commensurate of a fixed income security with a very high level of risk.

I posit that the actual fundamental risk is significantly lower and these securities would more appropriately be priced at par or a variable yield around 9%. This suggests 30% appreciation upside to AGNC Preferred E (AGNCO) along with a big dividend while we wait.

Let me begin by discussing the difference between perceived risk and what I view as significantly lower actual risk. I will then move on to show how the variable rate conversion presents both a huge dividend and protection against rate movements. Unlike other fixed income instruments this can generate a strong return to shareholders whether interest rates rise, sink or stabilize.

The discrepancy between perceived risk and fundamental risk

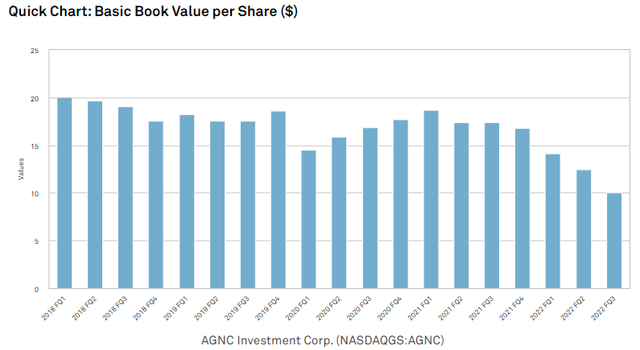

I don’t know if it is unique to this cycle or a long-standing tendency of which I am only recently becoming aware, but the market seems to really like extrapolating recent data. If there is a series of a data points that seem to be in a certain direction the market starts trading the stock as if that will become a secular trend. In the case of AGNC, there is quite a string of book value erosion.

S&P Global Market Intelligence

Tangible book value is even lower at $9.08 per share as of 9/30/22. It fell again after the quarter and now sits about 15% below the $9.08 number as per Peter Federico on the conference call

“As of last week, our book value at this end of last week was down about 15%”

That is quite the streak of book vale erosion, so it is understandable that the market is pricing AGNC as a highly risky security and that pricing has been absorbed into the preferreds which now trade at big discounts to par and have huge dividend yields.

Portfolio Income Solutions

I believe it was a mistaken extrapolation of book value erosion that created this level of discount and in the following sections I intend to demonstrate why I believe the actual risk level is much lower.

Low risk relative to level of yield

12%+ is a level of yield typically reserved for really junky bonds that have high default risk. A preferred is not a bond, but its default works in the same way in that the common gets wiped out before the preferred loses liquidation value.

I think the risk of AGNC defaulting or failing to pay its preferred dividends is quite low for the following reasons:

- Current coverage of both liquidation preference and preferred dividends is ample.

- Absolute book value is enhanced by share issuance

- RMBS securities have high yields resulting in healthy Net Income Margin (NIM).

- Book Value per share is stabilizing and likely rising slightly

With a market capitalization of $4.4B, AGNC has quite a bit of equity underneath its preferreds. Since AGNC trades at a discount to book, the amount of equity under the preferreds is actually north of $5B. That is a nice cushion.

On the income side of things, AGNC had third Quarter net spread and dollar roll income per common share of $0.84. The loss to net income was a result of mark to market on marketable securities.

Preferred dividends were only $26 million compared to $177 million in Net Interest Income for the quarter.

Run rate income covers preferred dividends with a good margin for error.

Share issuance – dilutive to common but cushion enhancing for preferred

One of my favorite aspects of looking at the entire capital stack is how certain events affect different tranches in different ways. In the quarter, AGNC had a rather significant common issuance per Bernice Bell, CFO:

“We opportunistically issued approximately $290 million of common equity through our at-the-market offering program at an average price of $10.10 per share and issued $150 million of fixed rate reset preferred equity.”

The common share issuance, since it occurred at a discount to book value was quite clearly dilutive to common shareholders. However, it is simultaneously an obvious benefit to preferred shareholders as it adds to the cushion underneath the preferreds and enhances the absolute amount of income that funds the preferred dividends. As a preferred shareholder, I do not care about earnings per share. I merely care about absolute earnings going up.

RMBS have high yields

The zero interest rate environment was quite unhealthy for agency mortgage REITs. With interest rates as low as they were, RMBS coupons were extremely low and spreads of mortgages over treasuries were fairly low as well. As such, net interest margin was pinched and the premium to par at which vintage RMBS traded meant prepayment ate up a large portion of interest income.

Today, nearly all RMBSs trade at a discount to par and at wide spreads to treasuries of similar duration. This gives the securities inherently much higher returns. In addition to the higher base coupon, prepayment and default are now positive events since they both result in recovery of par value.

So rather than having prepayment or default be a loss of somewhere around 3%-5% it is now an immediate gain. The magnitude of gain will depend on how discounted the security is which is a function of coupon relative to yield to maturity and the duration of the security. Most vintages of issuance, however, are now at favorable discounts.

Partially detracting from the much higher yields is the fact that cost of financing has risen sharply. However, the overall profitability of such investments is still enhanced because spreads have widened so NIM is in a better place. The now higher level of income contributes to the security of sustained preferred dividend payments.

Book value stabilizing

In looking at the long series of book value declines it is tempting to think that is the new normal, but if we examine the etiology, I think it is clear that it will not continue indefinitely.

There were two primary causes of book value declines:

- Rapidly rising rates

- Blown out spreads

When rates rise, treasuries and other similar instruments (like RMBS) rise in yield. In order to rise in yield, the prices must fall. Therefore, in owning a large portfolio of RMBS, AGNC suffered significant mark to market losses. Such losses can often be hedged against and indeed AGNC has moderate success in hedging the losses of rising rates, but fully hedging proved difficult because it was not a clean linear shift of the yield curve. The move was rapid and involved flattening and even inversion. Hedges did not match up perfectly and book value was lost.

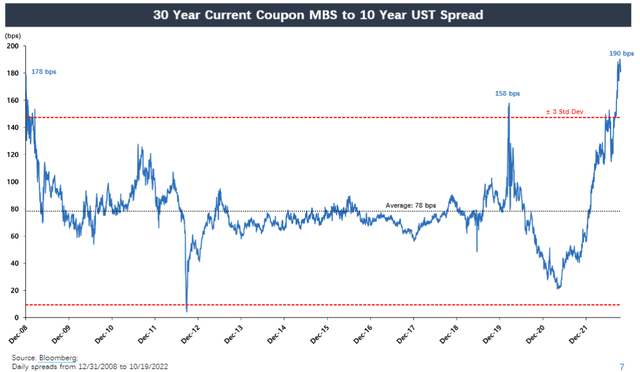

Even with the twisting, the bigger source of book value erosion was spreads blowing out. Rather than treasury yields going up and RMBS yields going up together, RMBS yields went up substantially more. Spreads now sit near a historic high at about 190 basis points.

Bloomberg

That is a Z score of more than 3.

Consider for a bit how absurd this is. An RMBS, much like Treasuries, is essentially guaranteed its par value by the U.S. government or related agencies. There is a bit more volatility in RMBSs than in treasuries so it makes sense that there would be a non-zero spread, but the risk level between the two instruments is quite close.

It is a phenomenon of fund flows that has caused government backed securities to have yields 190 basis points higher than other government backed securities. Certain fixed income ETFs have large holdings in RMBSs and as rates rose these ETFs had big outflows. In turn, these outflows caused indiscriminate selling which has crescendoed into this atypically wide spread.

The government backed agencies that guarantee the RMBS are financially quite healthy right now. The fundamental risk has not increased. In fact, fundamental risk has probably decreased because prepayments are low and delinquencies are low.

In my opinion, this spread with a Z score of 3 in an environment in which risk is normal or slightly lower than normal is clear and massive mispricing.

Put simply, spreads are blown out and there is no fundamental reason that spreads should be blown out.

As such, I think it is almost inevitable that spreads will come back in. New mortgage origination has fallen off a cliff as potential homeowners are hesitant to take on 7%+ mortgages when so recently they were available in the 3s.

With minimal new origination any entity that normally invests in RMBS will not be able to buy fresh issues and will instead have to turn to the already issued market. This will naturally tighten spreads back up.

So why does all of this portend stabilized book value?

High interest rates do not hurt book value. It was the movement of interest rates. For book value to go down further it would require some combination of treasury yields going up further and further spread widening.

I don’t see a clear path to Treasury yields. A lot of it will depend on whether the Fed is more dovish or hawkish than what is already priced in. Your guess here is as good as mine.

What is clear, however, is that there is tremendous gravity to have spreads tighten. The average spread between RMBS and treasuries over the past 14 years has been 78 basis points. That is over 100 basis points of spread tightening and AGNC’s book value rises dramatically when spreads tighten.

Just as spreads blowing out caused brutal mark to market, spreads tightening back up causes a favorable mark to market. Book value will rise.

Catalyst – V shaped recovery in book value

Will book value recover all the way to where it was? Absolutely not

AGNC was forced to sell some of its portfolio at unfavorable prices to maintain leverage ratios. The losses from that are permanent. However, the large securities portfolio that remains is on the cusp of a significant mark-to-market gain simply from normalization of spreads.

This does not require any significant event, merely the cessation of the ETF outflows that have caused the dislocation.

Q4 will likely still be a down quarter for book value. I think it will be up from the 10/25/22 number presented on the call, but down from the 9/30/22 book value number.

1Q23, however, will likely feature a rise in book value which will go a long way to changing the market narrative.

AGNCO will no longer be the preferred of a terminally eroding company, but rather the preferred of a stable company that invests in assets backed by the U.S. government.

That kind of preferred does not trade at a 12% dividend yield. It would trade closer to 8%-9%.

Variable rate conversion enhances dividend payouts and nullifies interest rate risk

AGNCO presently pays a 6.5% coupon which in its discounted state represents a current yield of 8.5%. On 10/15/24, the coupon converts to floating at a rate of 3-month LIBOR plus 499.3 basis points. At current LIBOR of 4.41% that is a yield against par of 9.4% but at the discounted price that is a yield of 12.2%.

Portfolio Income Solutions

The beauty of the variable rate is that it nullifies interest rate risk. If interest rates go up more, the dividend an investor receives goes up linearly. If interest rates go down, the level of yield demanded by the market would be lower so the price would tend to rise.

Due to this variable rate feature, I think AGNCO can return to approximately par whether interest rates are higher, lower or flat to today’s rate. The 30% capital gain in a return to par is predicated on the idea that actual risk is much lower than the extreme level of risk currently priced into the security.

Agency RMBS is an inherently low risk asset class. The leverage AGNC uses does introduce some level of risk, but with a roughly $5B equity cushion and ample hedging activity, I see it as extremely unlikely that the risk impacts the preferreds.

I am happy to take an 8.5% current yield, soon to be a 12.2% yield while I wait for the market to calm down and price this thing at a yield more commensurate to its risk level.

Be the first to comment