filadendron/E+ via Getty Images

A Quick Take On a.k.a. Brands Holding

a.k.a. Brands Holding (NYSE:AKA) went public in September 2021, raising approximately $110 million in gross proceeds from an IPO that priced at $11.00 per share.

The firm operates a variety of direct-to-consumer apparel and fashion websites.

Given current trends of slower recovery in Australia combined with higher overall return rates, I’m not optimistic for a quick return to significant growth and operating profitability.

Therefore, I’m on Hold AKA for the near term.

AKA Overview

San Francisco, California-based a.k.a. Brands was founded to develop a portfolio of digitally-focused, DTC consumer apparel and fashion brands with a global reach.

Management is headed by Chief Executive Officer Jill Ramsey, who has been with the firm since May 2020 and was previously Chief Product and Digital Revenue Officer at Macy’s.

The company’s primary offerings include:

-

Princess Polly

-

Culture Kings

-

Petal & Pup

-

Rebdolls

The company focuses its marketing efforts on Millennials and Gen Z consumers who ‘seek fashion inspiration on social media and primarily shop online and via mobile devices.’

So, a.k.a. leverages its data to provide relevant social content and make other digital marketing strategy efforts to reach consumers directly online.

AKA’s Market & Competition

According to a market research report by BlueCart, the global market for DTC (direct-to-consumer) sales is expected to reach $20 billion globally in 2021.

This represents a forecast potential increase of 15% over results in 2020.

The main drivers for this expected growth are an increase in consumer openness to hearing directly from manufacturers via online channels.

Also, there is a growing desire by businesses to gain an edge through greater data-driven insights stemming from direct relationships with their customers rather than working through 3rd party distributors and retail outlets.

Major competitive or other industry participants by type include:

-

Ecommerce companies

-

In-person stores

AKA’s Recent Financial Performance

-

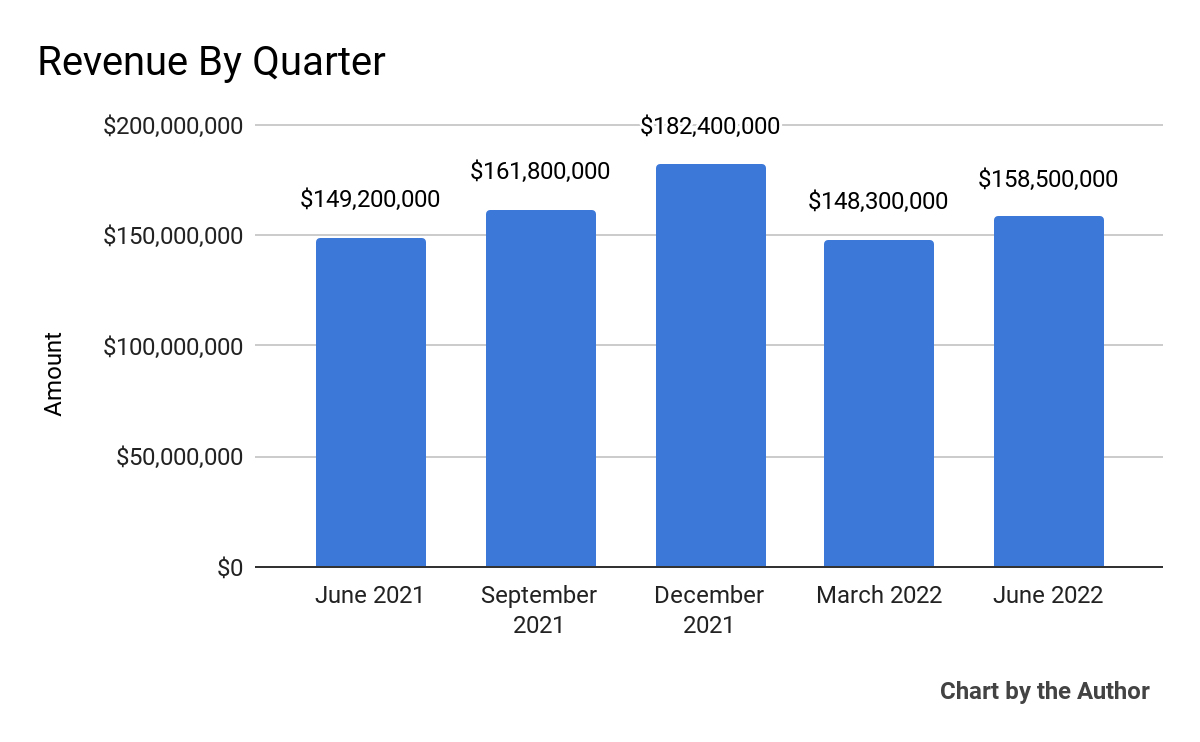

Total revenue by quarter has produced the following growth over the past 5 quarters:

5 Quarter Total Profit (Seeking Alpha)

-

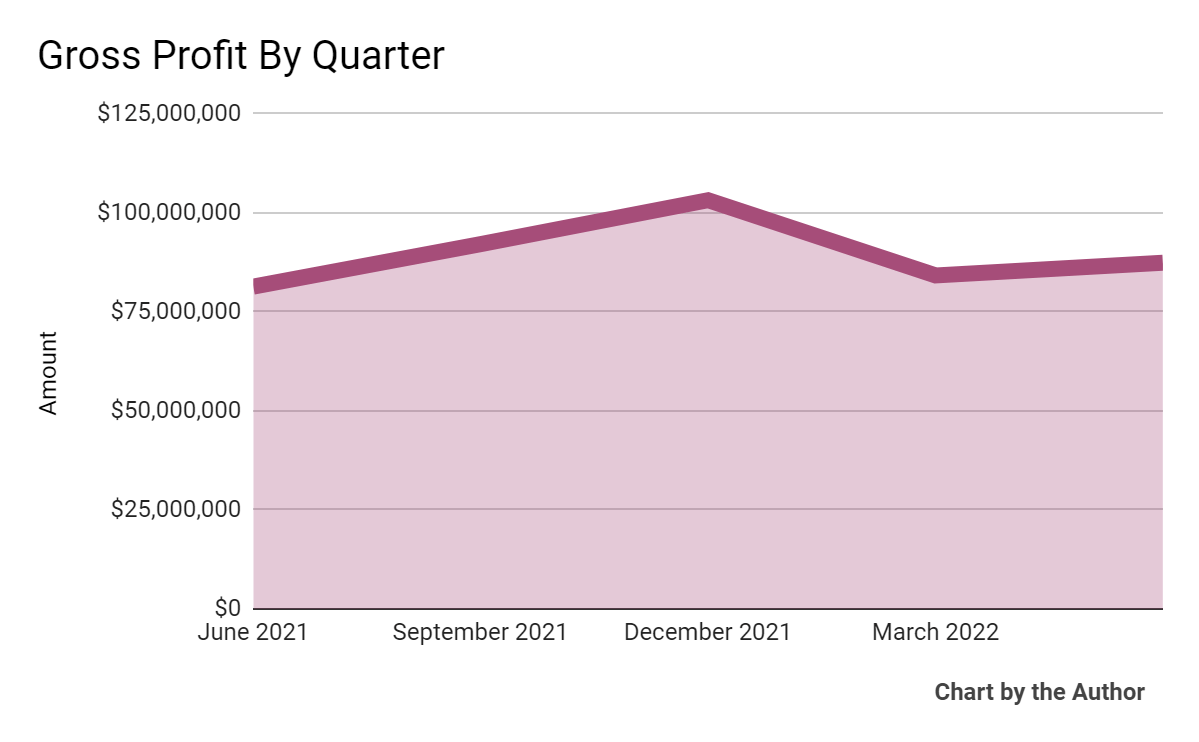

Gross profit by quarter has followed the same trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

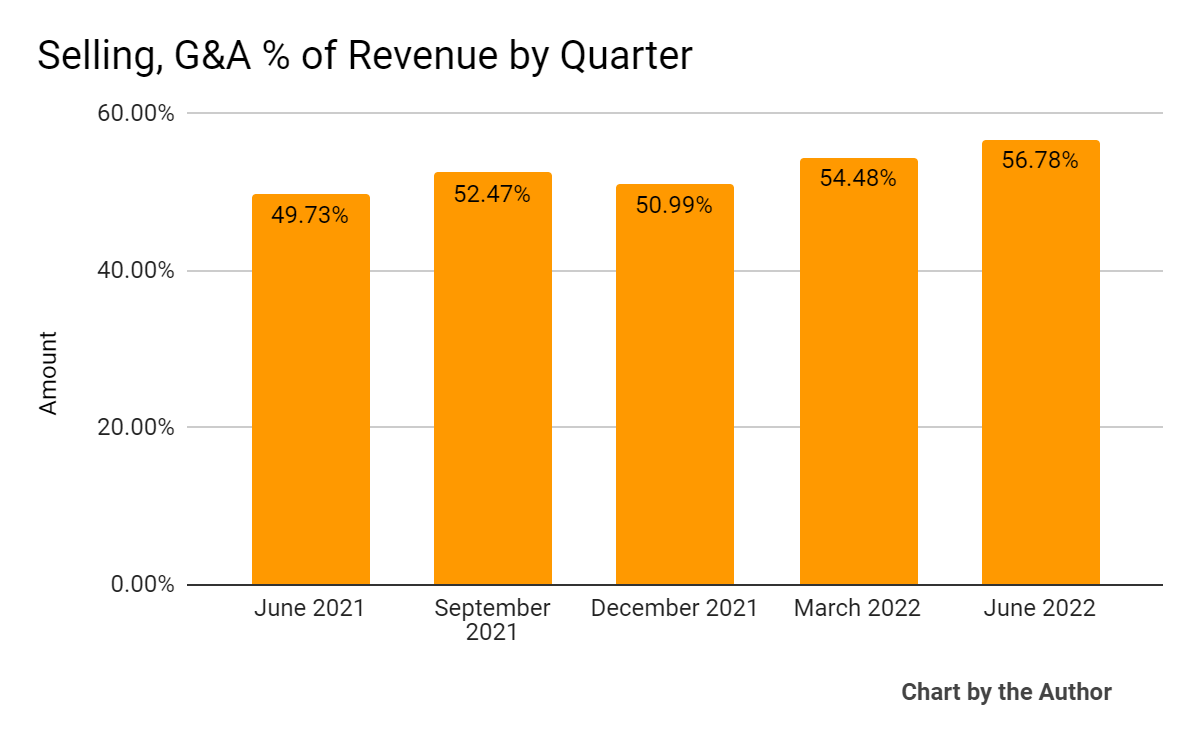

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher in recent quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

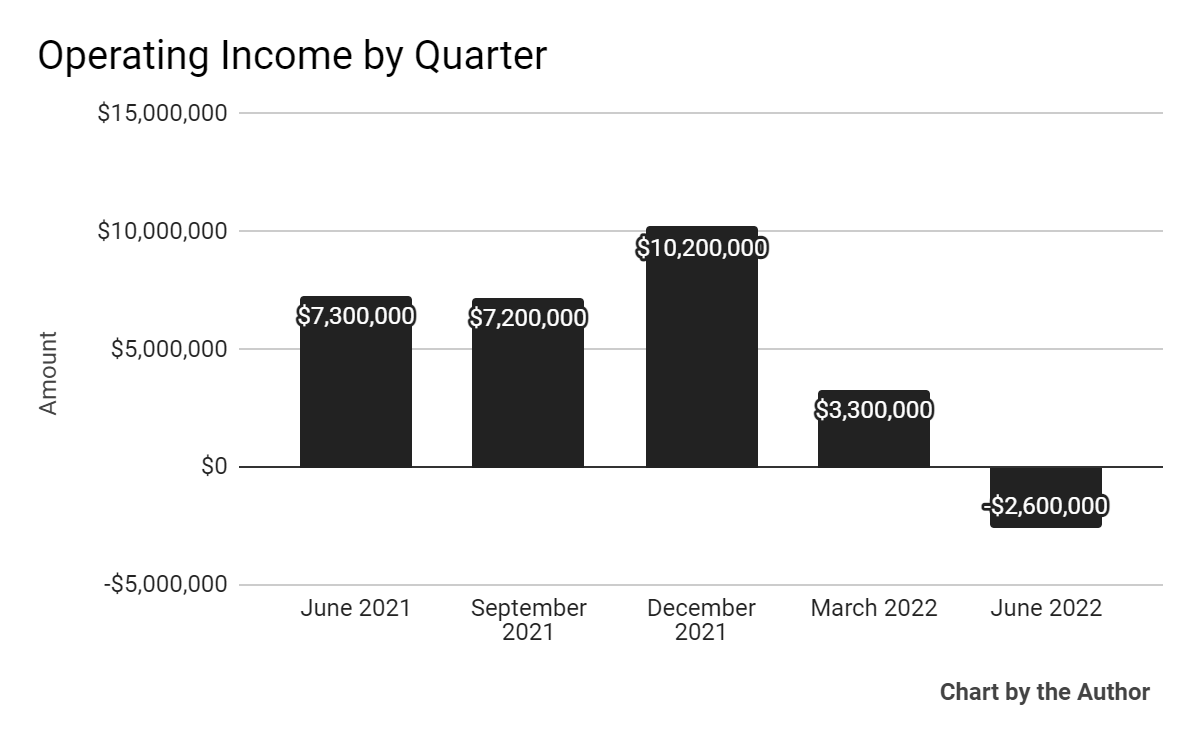

Operating income by quarter has turned into negative territory in the most recent quarter:

5 Quarter Operating Income (Seeking Alpha)

-

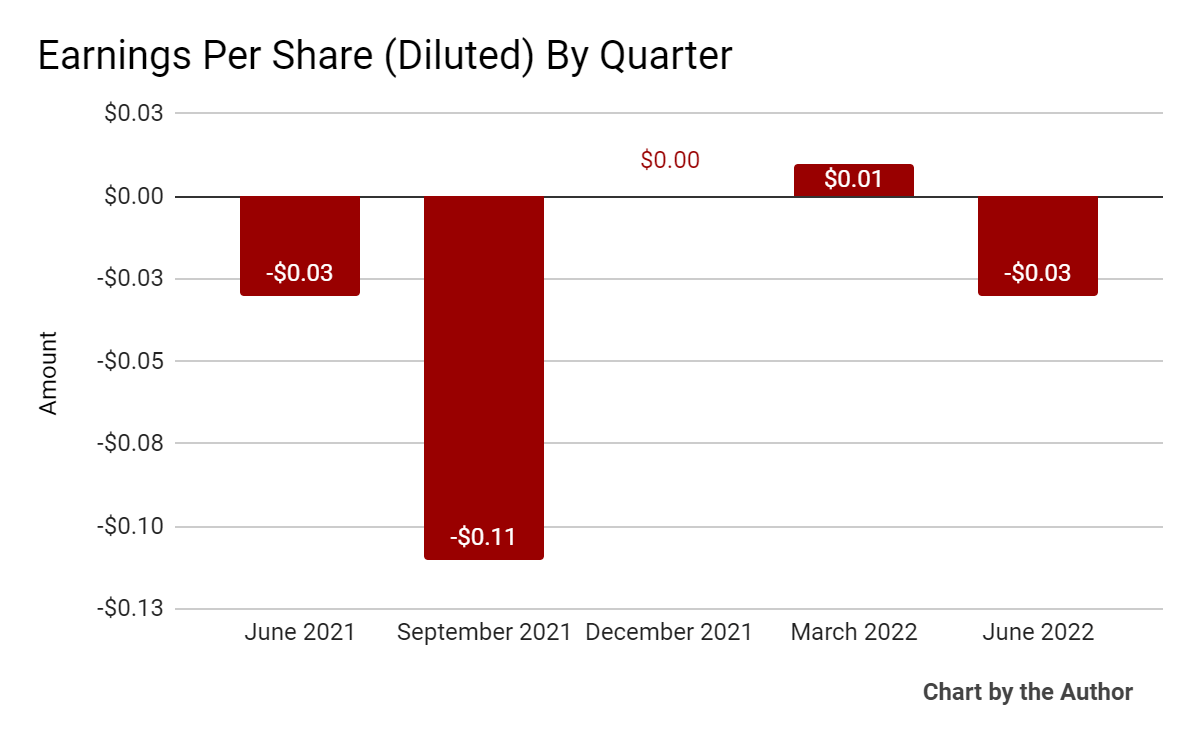

Earnings per share (Diluted) have also turned negative in Q2 2022:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

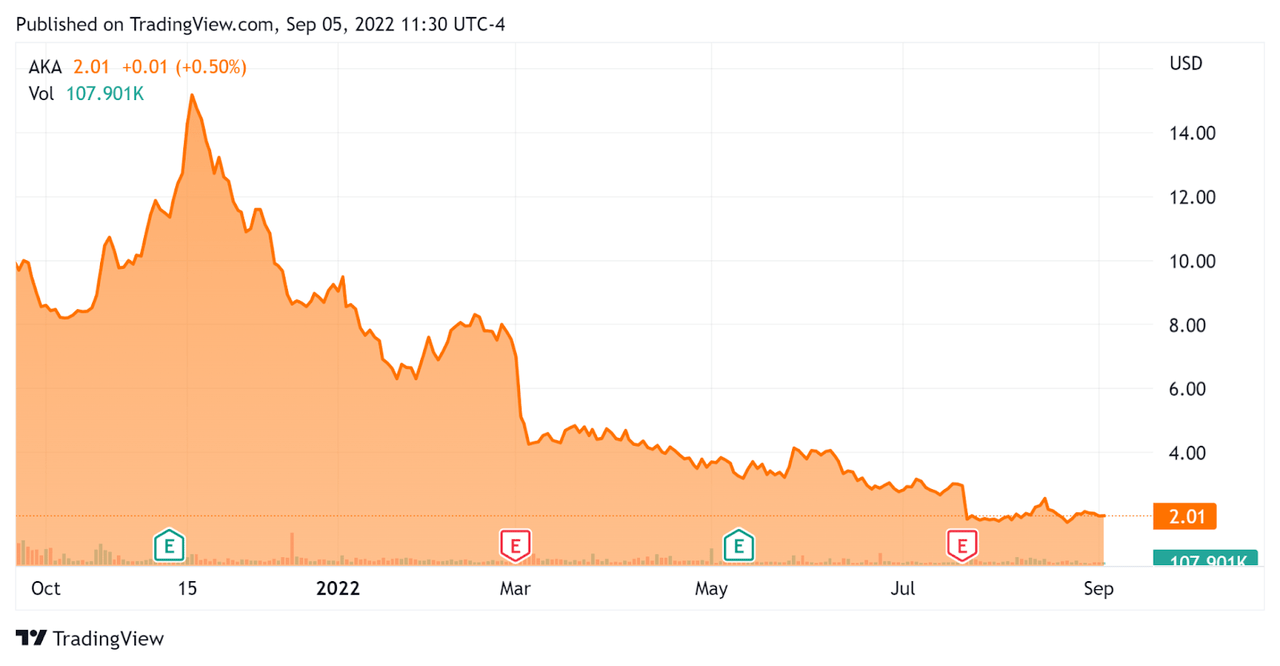

Since its IPO, AKA’s stock price has fallen 79.9% vs. the U.S. S&P 500 index’ drop of around 13.4%, as the chart below indicates:

Stock Price Since IPO (Seeking Alpha)

Valuation And Other Metrics For AKA

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.62 |

|

Revenue Growth Rate |

84.9% |

|

Net Income Margin |

-1.9% |

|

GAAP EBITDA % |

7.4% |

|

Market Capitalization |

$258,630,000 |

|

Enterprise Value |

$401,490,000 |

|

Operating Cash Flow |

-$7,100,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.13 |

(Source – Seeking Alpha)

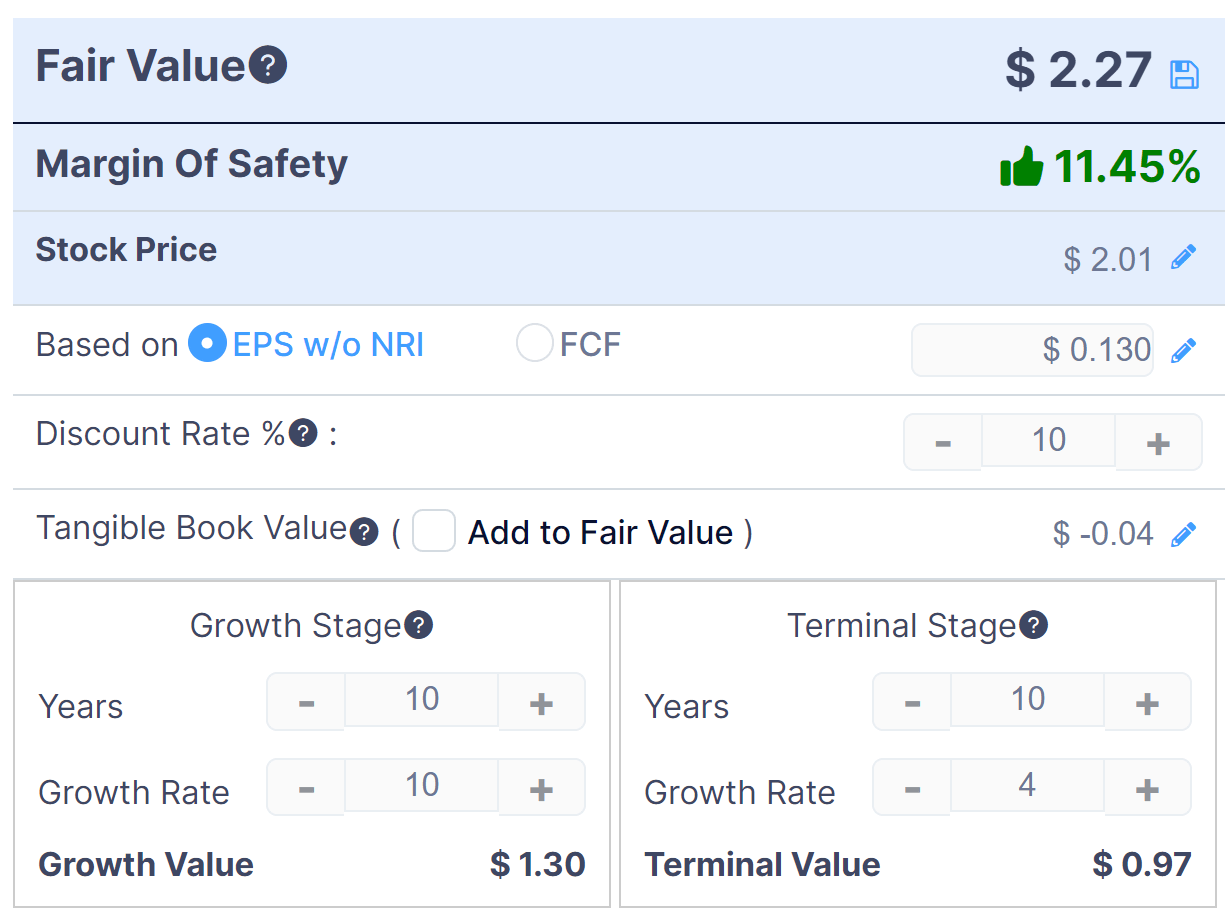

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

Discounted Cash Flow – AKA (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $2.27 versus the current price of $2.01, indicating they are potentially currently slightly undervalued, with the given earnings, growth and discount rate assumptions of the DCF.

Commentary On AKA

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management highlighted its U.S. sales growth, as its largest region grew by 16% year-over-year.

However, sales were negatively impacted by inflation-hit consumers and a ‘slower than anticipated recovery in Australia.’

Management has sought to protect margins by ‘maintaining discipline around inventory and promotions,’ among other areas of focus.

Notably, ‘active customers’ rose by 34% year-over-year as the firm now serves ‘3.9 million active customers globally.’

As to its financial results, net sales rose 6% year-over-year and the total orders increased 12% to 1.9 million, with the U.S. region being the main driver in these positive results.

Gross profit grew 7% year-over-year and gross margin was 55.2% versus 54.6% in Q2 2021, although product return rate rose significantly by 4.6% to 18.6%.

Selling, marketing and G&A expenses all increased, with marketing becoming less efficient as the quarter progresses and G&A expenses rising due to increasing headcount and likely wage inflation.

As a result, the firm generated an operating loss for the first time in the past five quarters.

For the balance sheet, the company ended the quarter with $29 million in cash and equivalents, additional credit line capacity of $25 million and $131 million in debt.

Looking ahead, management lowered its full year guidance to expected revenue of $630 million at the midpoint of the range and adjusted EBITDA of $39 million at the midpoint.

Regarding valuation, my discounted DCF indicates the stock may be undervalued given the assumptions.

However, the primary risk to the company’s outlook is a macroeconomic slowdown or recession along with continued elevated inflation, which may reduce its revenue prospects while increasing its costs.

A potential upside catalyst to the stock could include a ‘short and shallow’ downturn and lowered assumptions on the cost of capital as interest rates flatten.

But, given the current trends as described by management of slower recovery in Australia combined with higher return rates and elevated inflation, I’m not optimistic for a significant return to growth and operating profitability.

Therefore, I’m on Hold for AKA in the near term.

Be the first to comment