imaginima

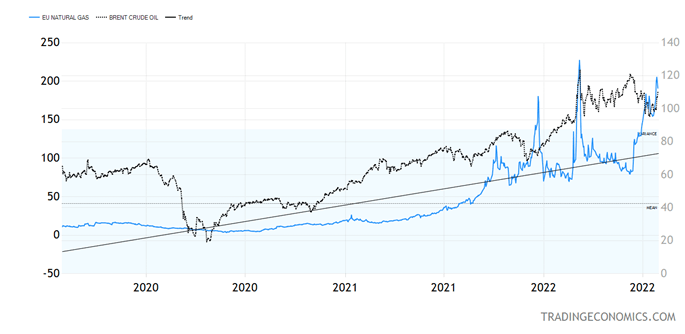

Last week saw some dramatic moves with TTF futures for European delivery of EU natural gas trading at a weekly high of EUR 228 per megawatt-hour before settling in about 15% off that high. More dramatic moves in natural gas futures for EU delivery are likely coming as volumes through the Nord Stream 1 pipeline are flowing at only 20% of previous levels.

There is no doubt that the Russians are using natural gas as a weapon to put pressure on the EU, using the explanation that sanctions prevent the maintenance of turbines that help gas flow through the pipeline, the implication being that if the EU removes sanctions, then natural gas will resume its flows.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

While the EU has not given any indication that it will remove its sanctions on the Russian Federation, the Russians have given every indication that natural gas flowing at 20% of capacity can stay that way for a long time, and I would not put it past them to reduce flows even further, sending natural gas futures for EU delivery to new all-time highs. The flow of gas alone can cause a bad recession in the EU in the middle of this crisis, and it would be up to the Russians to decide whether that helps their objectives.

I have my doubts if the ECB can proceed as aggressively as the Fed in the middle of this geopolitical situation. Mario Draghi, who recently resigned as Italy’s prime minister, famously noted as the head of the ECB a decade ago that he would do “whatever it takes” to save the euro. Italy is heading for a new election on September 25, which could have varying outcomes based on what happens with natural gas flows until then. Suffice it to say, it is not hard to see a repeat of the eurozone crisis from 2012 triggered by a eurozone-wide recession, under which scenario the euro can go deeply below parity with the dollar.

Natural gas is not as fungible as oil. It is true that there is an LNG market, but unfortunately, it is not big enough to replace Russian natural gas pipelines. I am not sure how many years it would take for LNG flows to ramp up to make up the difference, which means Europeans are in a very precarious situation.

The Fed is Inverting the Yield Curve

The 2-10 spread has been negative for a while, with the 10-year yield on Friday a tad over 2.65% while the 2-year was 2.89%. When flirting with this inversion previously, Powell pointed repeatedly to the fact that the 3-month vs. 10-year spread was not inverted (the 3-month settled at 2.38% on Friday), but I think by September that spread will invert, too, with another 50 basis point hike expected by Fed funds futures.

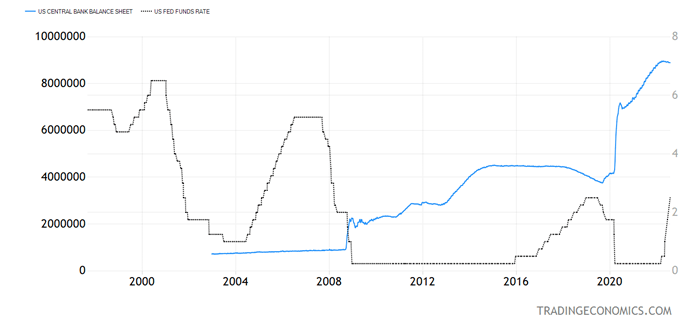

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Keep in mind that the Fed keeps hiking as the effects of previous 75 basis point hikes have not taken effect yet. I think the Fed is behind the curve and overzealous. That can cause an economic accident.

Furthermore, the Fed’s balance sheet is dropping at a little over $10 billion per month. Come September that shrinkage will double, from a monthly rate of $47.5 billion to $95 billion. I thought excess reserves were ample in December 2018 at less than half the present balance sheet, and we got a Taper Tantrum.

The Federal Reserve does not know ahead of time when the next Taper Tantrum will arrive, but suffice it to say that the doubling of the rate of shrinkage of the Fed’s balance sheet in September of this year to the highest in quantitative tightening history could be problematic.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment