onurdongel/E+ via Getty Images

(Note: This article appeared in the newsletter on May 1, 2022 and has been updated with current information.)

Antero Resources (NYSE:AR) management has been around this industry for a long time. It was not too long ago when comments were firmly on the side of excess transportation capacity being a huge liability. Some of the comments were that the excess transportation commitments were going to cost his company as much as $500 million over the next few years. Well, those next few years are here, and costing is not exactly what is happening.

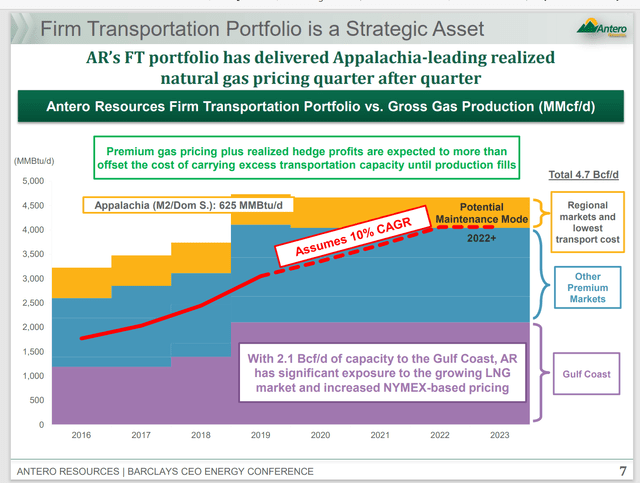

Antero Resources History Of Transportation Commitments As Presented in 2019. (Antero Resources Presentation At Barclays CEO Energy Conference September 3, 2019)

This was a presentation back when the comments to my articles firmly were on the side of big losses from too much capacity. After all, it is not like the industry was going to be cyclical (in the eyes of the comments) in that a demand recovery would occur that would result in more growth. Therefore, big losses from that excess capacity, not to mention any new projects that got underway were going to cost dearly. Antero did slow the growth in response to market conditions that occurred not long after this presentation.

I tried to mention, at the time, that management in cyclical companies just does not put up with those kinds of losses. Whenever contracts are made by management, they try to take into account the industry cycle and unforeseen events. The first event was winter storm URI which allowed for a cash flow bonanza about a year or so ago. Now that long-delayed industry pricing recovery has occurred along with transportation bottlenecks “all over the place”.

This management is now in the catbird seat with excess capacity (that they claim they will release as strategy indicates). They can also retain the excess capacity and sell it for a profit as Occidental Petroleum (OXY) did a few years back before they sold the whole pipeline near the top of the market for a huge profit.

So many times, the market claims to want good management. Yet when that management looks ahead, it comes under attack for being farsighted because Mr. Market usually assumes “more of the same” in the short term and assumes it really loudly. Obviously, thanks to a severe winter storm, and now a short supply in transportation capacity, the imagined worst case of $500 million in losses to pay for transportation capacity that would not be used is just not going to happen.

Anyone investing in a cyclical industry needs to realize that sometimes immediate losses have to be taken to be sure that the business runs smoothly in the current situation. Management is paid to make those evaluations, and many times they have a far better view of the industry than does the market. All one has to do is read the headlines to determine a lot of managements were not so farsighted (or as some put it did not luck out).

Transportation constraints happen every single time there has been a cyclical recovery somewhere. The companies that have commitments to future Mountain Valley Pipeline operations face considerable uncertainty as to when it will start up. That is not all that unusual for interstate pipelines which face a myriad of regulations and other obstacles. That means this business is not only run with low visibility, but it is also run with a fair amount of supply unpredictability. Very few managements can navigate that much “juggling” successfully. This one has (one way or the other) and they deserve credit for that.

The latest quarterly report shows production that is about three-quarters of the firm capacity shown above. Since the slide above, management has undoubtedly released some capacity since that slide was presented and likely at least expressed interest in some projects. So, the situation has likely changed a little since that slide was presented. An investor can also bet that management will be managing the transportation business exactly like they have in the past. That means keeping some reserves around “just in case”.

Now sometimes, like now, they can sell the excess capacity for an easy profit one way or another. Other times, like back in 2019, there will be some cost for idle capacity that would raise overall transportation expenses. Of course, an occasional storm Uri that sent natural gas prices through the roof enabled this management to make a one-time bonanza in the first quarter of 2021. That bonanza likely paid for several years of idle capacity.

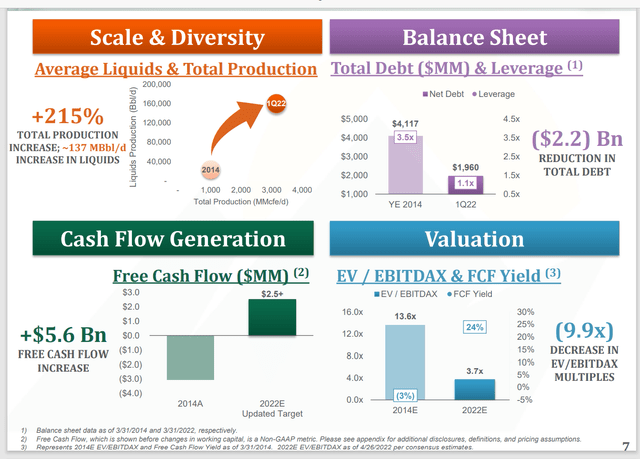

Antero Resources Key Growth Measures Of The Business (Antero Resources First Quarter 2022, Earnings Call Presentation)

As a result of several strategies adopted by management, the company has clearly successfully navigated a very rough time for the natural gas industry (and made it to the other side).

Total debt will likely follow a far more traditional strategy with conservative leverage ratios going forward. Management created a lot of value along the way with the initial debt load. The primary example of this would be Antero Midstream (AM) as well as the far larger natural gas business.

The free cash flow yield is going to be tremendous going forward. The main growth vehicle will likely be the increasing sales of ethane production as management has mentioned that nearly three-quarters of ethane remains in the natural gas stream for lack of customers. Since ethane is the main ingredient for plastic, the future prospects of more sales appear to be excellent.

More importantly, when the company went public back around 2014, the graph above about valuation demonstrates that management did its job for the shareholders by getting those initial shareholders great value for the common stock when initially selling to the public. The onus is on the new shareholders to demonstrate where they thought the value was when management clearly thought they got a good price. So, it is no surprise that the stock price has yet to revisit the high prices of those days.

The company is now far larger and will be priced as a large company in a cyclical industry going forward. Nonetheless, the increase in exporting capacity of both natural gas and natural gas liquids has made the cycle far more favorable for the company than was the case when the unconventional business grew rapidly to oversupply the natural gas markets. The growth of ethane needs by the plastics markets is another favorable environment that will last into the future.

As far as value goes, of the companies I follow, insiders in the oil and gas industry have, up until recently, been getting into the industry or acquiring either companies or property. Therefore, I likely will not consider selling unless they do. The exception would be some wildly favorable stock price that is unlikely to happen. Management has done a good job with this company. Some would say they were just lucky. Either way, this management will likely treat shareholders well in the future.

A key retirement or company sale would likely change my mind. But until then, I intend to stick with management.

Be the first to comment