Pgiam/iStock via Getty Images

Holding company, Valhi, Inc. (NYSE:VHI) has been shellacked in the last five years. However, in the last year, the company’s profitability has risen, allowing the company to perform better than the Russell 2000 and S&P 500. Nevertheless, the company remains deeply undervalued, with 60% of its enterprise value in the form of free cash flows.

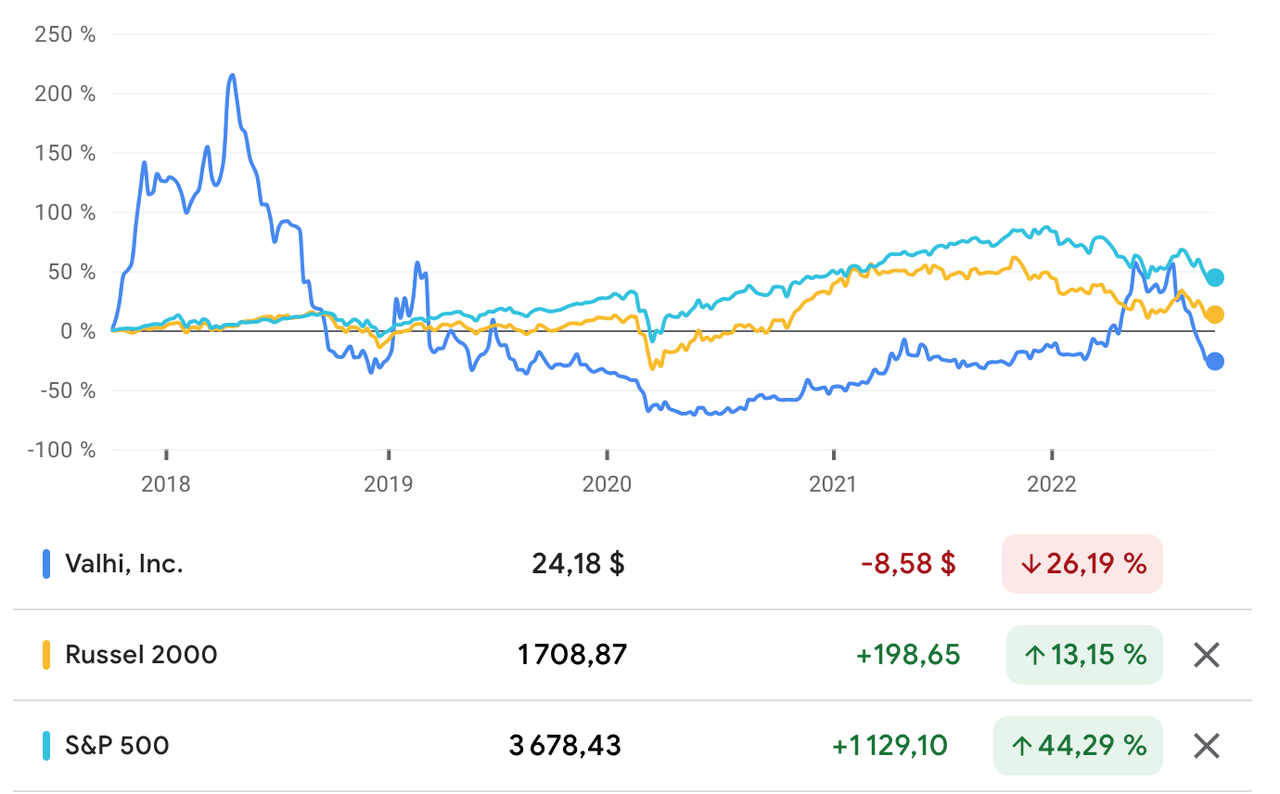

Stock Performance

At the time of writing, in the last five years, Valhi has declined 26.19%, compared to a 13.15% rise for the Russell 2000 and a 44.29% increase for the S&P 500.

Source: Google Finance

Year-to-date, Valhi, the Russell 2000, and the S&P 500 are all down. Valhi is down 16.91%, the Russell 2000 is down 24.8%, and the S&P 500 is down 23.31%. Although this suggests that Valhi is doing “better” than these indices, it still points to the long-term difficulties the stock has had since the 2006-2015 period of wild price swings. The company’s stock market performance reflects the company’s financial performance throughout the last five years. That is a story of declining profitability which has started to turn in the last year.

A History of Profitable Growth

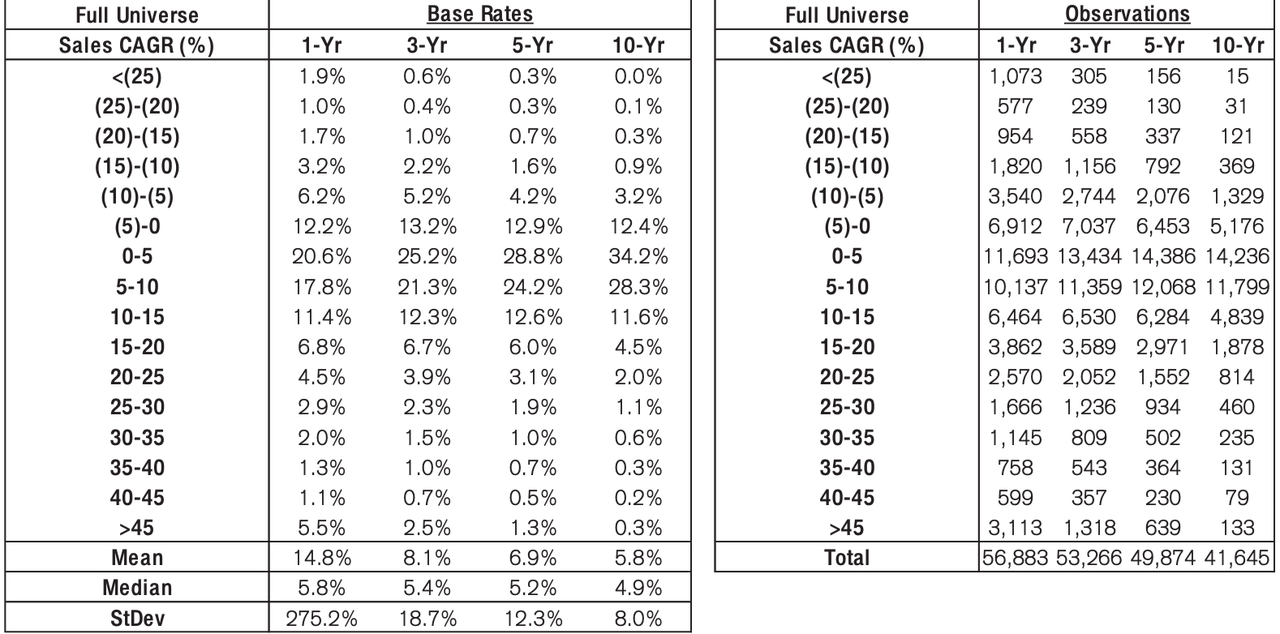

Valhi has grown revenues from nearly $1,88 billion in 2017, to nearly $2.3 billion in 2021, at a 5-year revenue compound annual growth rate (CAGR) of 4.09%. According to Credit Suisse’s The Base Rate Book, 28.8% of firms between 1950 and 2015, had similar levels of growth. While not sensational, this does suggest that the numbers are normal and sustainable.

Source: Credit Suisse

In the trailing twelve months (or TTM), Valhi has had $2,53 billion in revenue.

Gross profitability has declined from nearly 0.22 in 2017, to nearly 0.21 in 2021. This is below the 0.33 threshold that Robert Novy-Marx says makes a firm attractive. In the TTM period, gross profitability has risen to just over 0.24. This reflects some increase in the ability of the company to make money in the TTM period, which has contributed to its superior performance against the broad market.

Valhi’s operating profit margin has declined from 18.8% in 2017 to 12.4% in 2021. This again hints at declining profitability in the last five years. However, in the TTM period, Valhi’s operating profit margin has risen to 13.8%, which reflects the improving profitability in the TTM period.

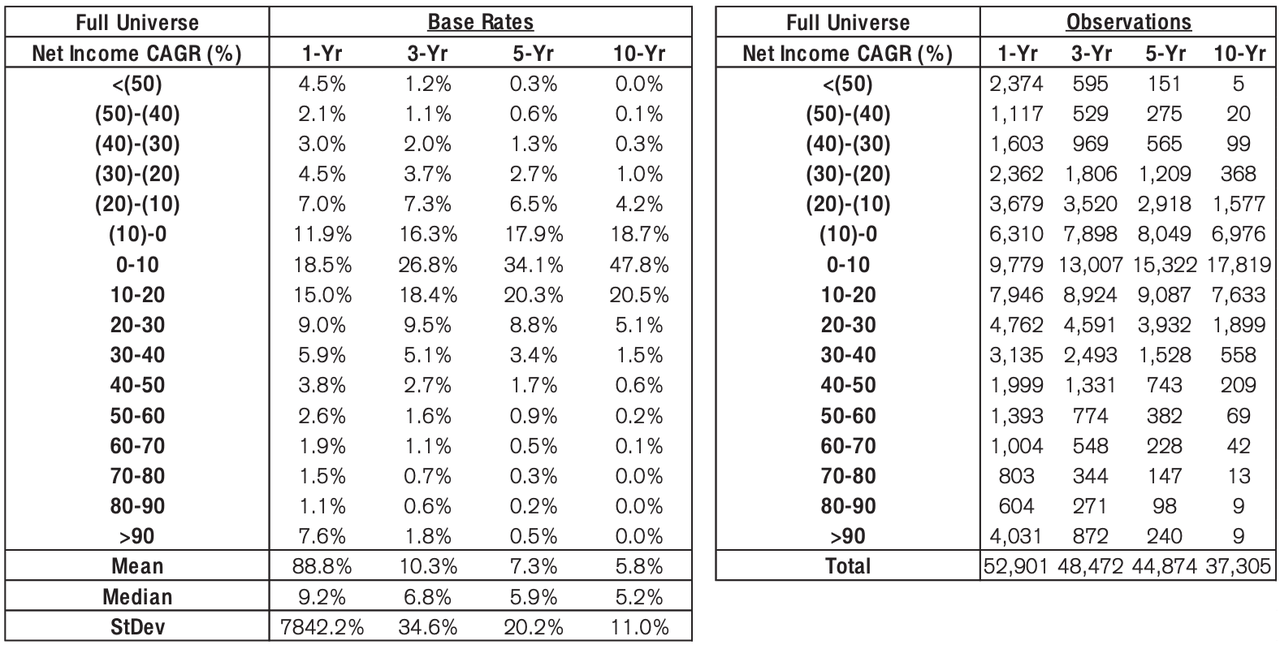

Net income has plunged from $207.5 million in 2017, to $127.2 million in 2021, for a 5-year net income CAGR of -9.32%. Those results are shared by 17.9% of companies. In the TTM period, net income has risen to $164.4 million. Once again, we can see that in the TTM period, the company’s fortunes have turned.

Source: Credit Suisse

Free cash flow (FCF) has risen markedly from $188 million in 2017 to $419 million in 2021, at a 5-year FCF CAGR of 17.38%. In the TTM period, FCF has declined to $359 million. This is perhaps the only thing that has not improved in the TTM period.

The company’s return on invested capital (or ROIC) has risen from 5.4% in 2017, to 9.7% in 2021. The company has a 5-year average ROIC of 7.2%. In the TTM period, ROIC has risen to 12.7%. Once again, we can see improving profitability in the TTM period.

Operating Segments

Valhi completely owns or majority-owns a range of subsidiaries, such as 50% of Kronos Worldwide (KRO), 87% of CompX International Inc (CIX), and 83% of NL Industries (NL) which owns 30% of Kronos), 63% of Basic Management, Inc. and 77% of The LandWell Company.

Kronos Worldwide

The company’s Chemicals Segment operates through Kronos Worldwide. The company produces value-added titanium dioxide pigments (TiO2). TiO2, when used as a pigment, is found in a number of products, such as paint, coatings, plastics, paper, inks, foods, and cosmetics. It is used in two-thirds of all pigments, and in 2018, the value of pigments made from it were valued at $13.2 billion.

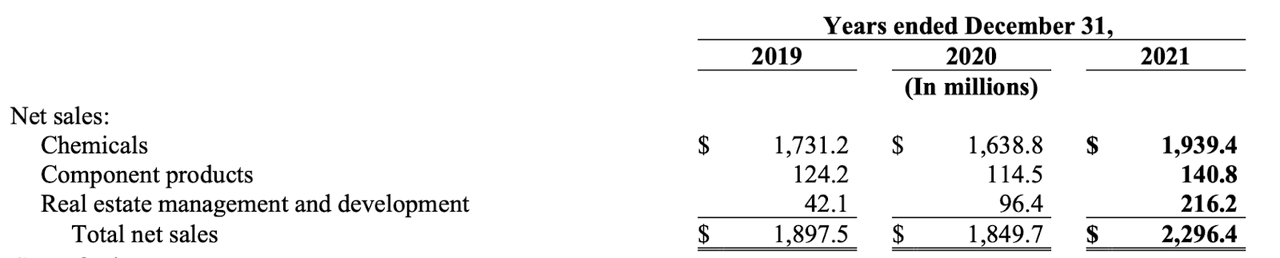

The Chemicals Segment is by far the most important segment in the company, with 84% of the company’s revenue in 2021.

Source: 2021 Annual Report

CompX

The company’s Component Products Segment operates through CompX. CompX manufactures security products, stainless steel exhaust systems, gauges, throttle controls, wake enhancement systems, trim tabs and related hardware and accessories for the recreational marine industry.

Basic Management, Inc. and The LandWell Company

The company’s real estate management and development segment operates through Basic Management and LandWell. Basic Management is a utility service provider and owns real estate in Henderson, Nevada. Landwell is developing land holdings in Henderson, Nevada.

Demand for TiO2 Is Growing

North America is the biggest market for Valhi’s products, with Europe a close second.

Source: 2021 Annual Report

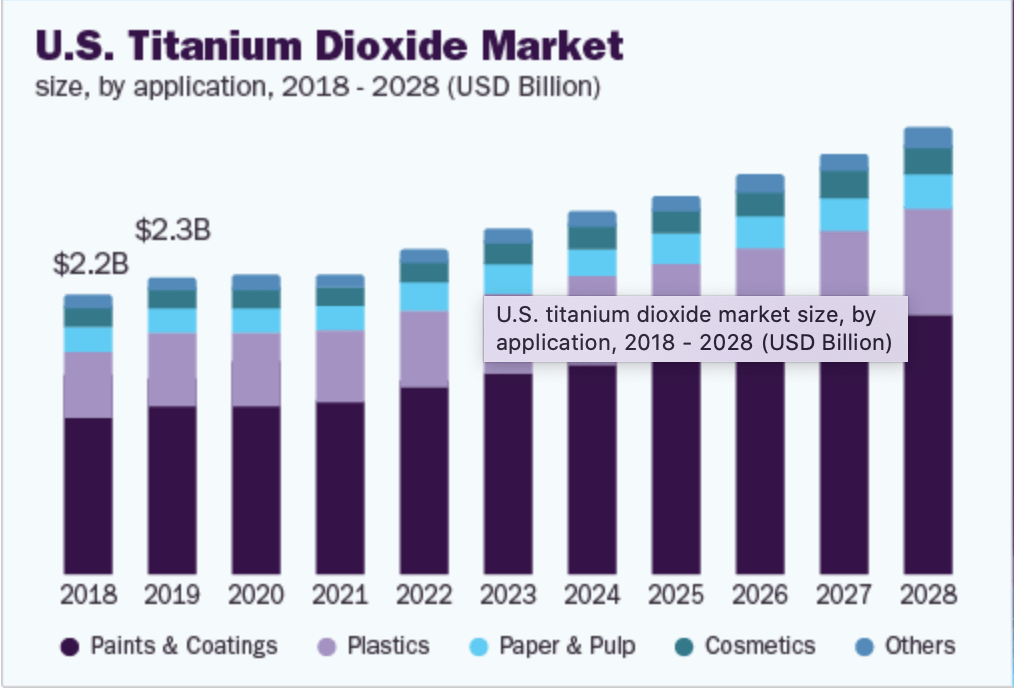

According to Grand View Research, the US market is expected to grow 5.9% CAGR between 2021 and 2028.

Source: Grand View Research

This growth is a reflection of the growth in end-user industries, especially in paints and coatings. In addition growth is expected to come from the developing world, thanks to the growing demand for light automobiles. The recovery of the automotive market is expected to extend to Western Europe as well. The recovery of the global automotive industry is seen as another contributor toward growth. Global Market Insights predicts a CAGR of 7.5% between 2020 and 2026.

While inflation and the threat of a recession in Western Europe, and a deepening economic crisis in the United States, may lead to a decline in demand, so far, the company’s results suggest that the company has been able to deal with this, and grow revenues and profitability.

Alignment With Shareholder Interests

Contran Corp. owns a 92% stake in Valhi. Contran Corp. itself is majority owned, either directly or indirectly, by Lisa K. Simmons, Thomas C. Connelly, her late sister’s husband, and their children. Simmons and Connelly are trustees of the trusts held for the children. Connelly is obligated to vote in line with Simmons. The rest of the corporation’s stock is owned by the Family Trust, whose beneficiaries are Simmons and her late sister’s children. So, the corporation reflects the will of one person: Lisa K. Simmons.

The advantage for shareholders of the company is that Valhi’s management will take a long-term view of their business and their investments.

Is Valhi a Buy?

With a FCF of $352 million in the TTM period and an enterprise value of $583.2 million, Valhi has an FCF yield of just over 60%. This is an incredibly high FCF yield to have. More than half the company’s value for a prospective buyer is in the form of FCF. Compare this with the 1.5% FCF yield that the 2000 largest businesses in the United States have, as calculated by New Constructs LLC.

Conclusion

Although the company has struggled in the last five years, in the TTM period, the company’s profitability has risen, without a corresponding increase in the value of the company. The share of the enterprise value that Valhi has is so large that there is arguably little if any risk for an investor.

Be the first to comment