Iryna Tolmachova

Introduction

This is the second and final article that was spurred by the recent earnings call of Costco (NASDAQ:COST). While I read the transcript, I was surprised that not only was I finding the usual (good) results and financials, but also I learned two valuable business lessons that I deem worthy of sharing with SA readers.

Summary of the first episode

In the first article, I focused on how Richard Galanti, Costco’s CEO, explained that Costco is a top-line company. This is of utmost importance in order to understand the company and assess it correctly. Otherwise, investors could fall into the trap of staying away from this stock because of its low margins. But, as we saw in the article, this is not the right way to think about the company and its profitability. In fact, Costco has become the retailer it is today because it chose to focus on top-line growth which enables the company to keep on returning as fast as possible onto its members the savings it achieves for them. But, if we have seen that margins are not Costco’s focus, how does Costco become profitable? Here is the well-known key: membership fees.

Always providing value

During the last earnings call, some analysts were worrying about the impact of a recession on Costco. Peter Benedict from Baird asked about Costco’s resilience during a recession. Let’s hear from the words of Mr. Galanti the answer which recalls what Costco had to do with barbecue grills and patio furniture which saw a slowdown.

I remember the ‘08, ‘09 one was that at the end of that year, which went from a recession to the Great Recession. It lasted for 4 or 5 years. And that — as we entered it, and it was pretty quick when it happened. We saw some, like, a slowdown in seasonal things, which were, like, barbecue grills and patio furniture and things like that. Big ticket — those kind of big-ticket items slowed. And if I go back to my notes, I’m sure we’ve talked about we had an extra — x million dollars of markdowns, just — to get through that stuff, so we didn’t have it lingering after the first of the calendar year. Other than that, generally speaking, one of the nice things about our model is, is we’ve done well in good times and bad times. And in good times, of course, people have money to spend. And in bad times, people want to save.

I think the good news is, even in bad times, we don’t view ourselves as having to be as conservative as perhaps others might be. We don’t take big reductions in buying — and open to buys or anything in that regard.

If I do remember back in ‘08, ‘09 with the barbecue grills and patio furniture, midway through the new year, and it was clear it was going to continue to be a recession, the reminder to the buyers was don’t bring down price points. We’ve driven value at greater value and greater price points, if we want to be a little conservative, fine, but don’t think it’s not going to do, go forward based on the assumption that we’re providing the best value out there.

I think the episode is highly significant. It outlines the confidence Costco has in the fact that it is providing its members with real deals that offer great value. This is why, even during the Great Recession, it didn’t focus as much on bargaining better prices from its suppliers in order to offer its members constantly lowered prices. On the contrary, Costco stayed true to the fact that it didn’t need further bargaining because it was already providing the best possible value in the market. In this way, Costco didn’t hurt its profitability and was actually able to clear its inventory once again.

Mr. Galanti also explained that Costco is aware that the value it offers to its members ignites sales growth, thus showing to us what lies behind a top-line company:

whenever we see any possibility of something weak, we figure out how to drive sales. And you usually drive sales by greater values, hot items. That’s the one thing I think we’re good at, is figuring out how to drive people into the door with hot items, and that’s helped us as well.

I think this is a valuable lesson: Costco is able to attract more and more customers not only because of low prices, but because at those low prices, customers are aware that they are getting very good products. Hence, we understand why Mr. Galanti speaks about offering value.

The membership program

We can now make one last step inside Costco’s business model. We have seen that the company is top-line focused and that, in order to drive its revenues up, it needs its comparable sales to grow. Growth is achieved by offering the best possible value to consumers who walk inside one of Costco’s warehouses.

But, here is something peculiar to Costco, in order to shop at Costco, people have to sing up for the membership program, paying a membership fee. So, along with comparable sales growth, when we look at Costco’s results, we have to look at the second major pillar of this company: membership fees and, most importantly, the renewal rate.

Once again, Costco hit all-time highs in terms of renewal rates. At the end of Q4, the U.S. and Canada renewal rate reached 92.6%, 0.3 percentage points higher compared to the prior quarter. Worldwide, the renewal rate reached 90.4%, 0.4 percentage points up from Q3. If we move from percentages to actual numbers, Costco reported at the end of Q4 65.8 million paid household members and 118.9 million cardholders, which equals to a 6.5% increase YoY. One could argue that the increase is due only to new openings. But Costco reported than the new warehouses had an impact that accounted for less than half of this growth, since it was just shy of 3%.

In addition, at the end of Q4, Costco reported 29.1 million paid executive memberships, which is a 1.2 million increase since Q3. This means that Costco was able to convince 74,000 members a week to upgrade their membership. Executive members now represent over 44% of Costco’s members and have a huge impact on Costco sales as they weigh for 72% of the company’s worldwide sales.

Why do people become members? Because they find at Costco the best deals. Keeping margins very low on goods sold enables the company to have lots of members who pay an annual fee that Costco offers with relatively no cost for the company. It may sound strange at first, but it actually is brilliant. By accepting very low margins, that is, by selling goods almost at cost, Costco manages to buy very good deals for its members, who pay to participate in Costco’s buying power. This is why Costco considers itself more of a buyer than a seller. Costco is thus able to build a win-win relationships with its members. The company, in fact, thinks itself more as a buyer on behalf of its members who, to reward the company for the bargains it offers, pay a membership fee in order to shop at Costco’s warehouses.

As Costco states in its annual report:

The membership format is an integral part of our business and has a significant effect on our profitability. This format is designed to reinforce member loyalty and provide continuing fee revenue. The extent to which we achieve growth in our membership base, increase the penetration of our Executive members, and sustain high renewal rates materially influences our profitability.

Now, membership fees are critical for Costco. In fact, they are a revenue that flows down to the bottom line except for taxes. If we think about it, it is money earned with almost no cost of goods sold. As I pointed out in my article “The Influence of Costco on Amazon Prime“, about 58% of Costco’s net income comes from membership fees. Therefore, if memberships were to go down, Costco would have a major problem to solve. So far, things have gone the other way around, with members increasing and upgrading their membership to executive level.

Costco During The Great Recession

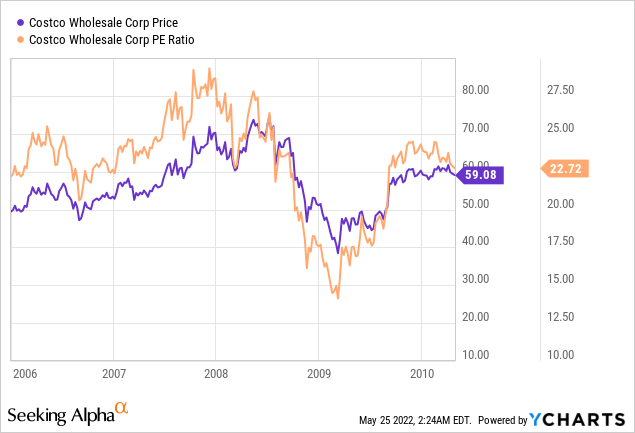

What happened to Costco during the Great Recession? Let’s begin with a chart that starts from January 1st, 2006 and extends to May 2010 in order to see what happened during the Great Recession. Costco, at that time, was way smaller of a company than today thus having a lot less scaling power. The stock price was cut almost in half down to $40 a share from its peak of $73. The PE ratio came down accordingly by 43% with a clear multiple contraction.

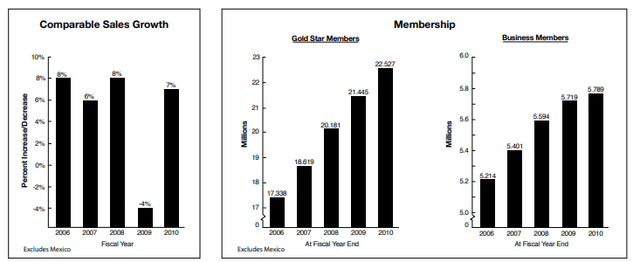

YCharts Costco 2010 Annual Report

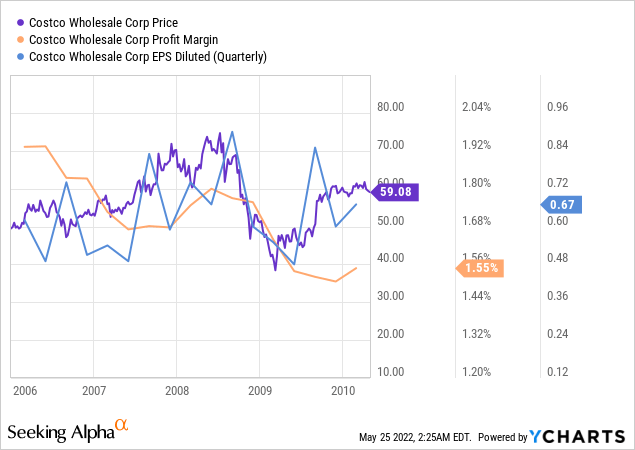

Let’s look at what happened to Costco’s profit margin: it came down from 1.92% to 1.56%, with only an 18% contraction. The EPS had a sharp drop in late 2008 till mid-2009 moving down from $0.87 to $0.48 to then recover immediately to $0.85. It seems like Costco may suffer at the late stage of a recession, but only temporarily.

YCharts

How and when to buy Costco

If we look at Costco with normal metrics such as PE or EV/EBITDA multiples we see that the company is trading at a 32 and 18.84, respectively. Its current price/cash flow is around 22, which may seem once again quite expensive. However, the real point every investor has to decide is what kind of premium to attribute to this company. In fact, it has a business model that can take advantage both from economic slowdowns and economic expansion. Furthermore, it is very reliable in growing its earnings and its free cash flow. In addition, we have to consider that many investors are very reluctant to sell the shares they already own and they actually look for any dip to pick up some more shares. I, too, bought a bit more Costco last week as I saw the stock coming down. I have to say that regarding Costco, I am more and more inclined to rely on experience rather than running different discounted cash flow models. So far, I have learned that every time Costco has a major dip, such as the one we are in right now, it offers an opportunity to buy some shares at good entry points. To me, the range between $450 and $480 is a first entry point. Below $450 I would buy more heavily. If the stock ever goes in the $300s then I will be deploying as much capital as I can to strengthen my position.

Conclusion

Sometimes I have heard people saying that consumers are divided into two: those who love shopping at Costco and those who can’t stand it. Investors too could be divided into two categories: those who are in love with the company and want to be long-term shareholders and those who keep away from the stock for various reasons, the most commonly reported being the high valuation.

As we have seen in these two articles, Costco is indeed a unique company with a very peculiar way of executing its business and many aspects that impress even a fine investor like Charlie Munger, who, not by chance, keeps on praising the virtues of this company.

Some people may actually grow tired of hearing over and over why Costco is a great company. So, in order to end our time together with some fun, I think we could enjoy and laugh a bit about little episode occurred at the 2011 Berkshire Annual Shareholder Meeting. Warren Buffet and Charlie Munger happened to talk once again about Costco. As Charlie Munger was repeating over and over how Costco is one of the best businesses in the world, Buffett decided it was time for one of his famous jokes:

Warren Buffett: Charlie and I were on a plane recently that was hijacked.

Charlie Munger: With what?

Warren Buffett: It was hijacked. I’m telling about our experience on that hijacked plane when the hijackers picked us out as the two dirty capitalists that they really had to execute.

But they were a little abashed about it. They didn’t really have anything against us, so they said that each of us would be given one request before they shot us, and they turned to Charlie and they said, “What would you like as your request?”

Charlie said, “I would like to give once more my speech on the virtues of Costco, with illustrations.”

The hijacker said, “Well, that sounds pretty reasonable to me.” He turned to me and said, “And what would you like, Mr. Buffett?”

And I said, “Shoot me first.”

Be the first to comment