energyy/iStock via Getty Images

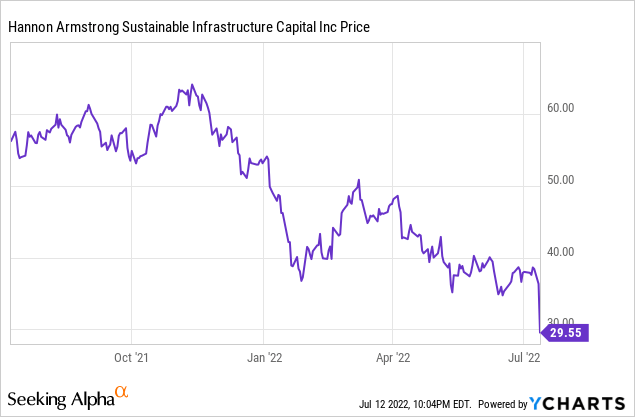

Shares of renewable energy investment REIT Hannon Armstrong Sustainable Infrastructure Capital (NYSE:HASI), which I’ll hereafter refer to as “HASI”, slumped 19% on Tuesday following a blistering short seller report. Tuesday’s losses were just the latest in what’s been a rather cloudy year for the renewable energy firm:

With shares down 50% off the recent highs, it’s probably tempting to buy the dip or double down if you already have a position. However, I’d strongly urge readers to consider the short seller report carefully and make an informed decision before committing any more capital to the business.

What Does HASI Do?

HASI has a great marketing pitch around providing capital to power the renewable energy revolution. With the rise in ESG investing over the past five years, this was already a winning marketing formula. Throw in the surge in fossil fuel prices this year following the invasion of Ukraine, and green energy might seem like a no-brainer.

However, there’s a difference between a reasonable investment theme and having the right actual investment to profit from said theme. And, when investors take a closer look at HASI, they might realize this is a more complicated investment that it first appears.

That’s because HASI, unlike many REITs, isn’t primarily out operating its buildings (or power plants in this case) itself. Rather, it invests in loans and equity of other renewable energy providers. This means it takes on a role like venture capital or being a junior creditor in many cases to green energy companies with sometimes thin balance sheets. To that point, HASI’s 10-K warns that:

- Our investments are subject to delinquency, foreclosure and loss, any or all of which could result in losses to us.

- Our mezzanine or subordinated loans are riskier, less protected against loss than, and generally less liquid than, other forms of debt with more senior preference.

- Our equity investments, many of which are illiquid with no readily available market, involve a substantial degree of risk.

- We generally do not control the projects in which we invest, which may result in the project owner making certain business decisions or taking risks with which we disagree.

To be clear, if you invest in HASI, you’re investing primarily in a group of equity and loan investments to other companies, rather than actually controlling windmills or solar farms yourself. And, as short seller Muddy Waters pointed out Tuesday, some of the accounting around renewable energy investing may be more complicated than the average investor realizes. Before getting into the meat of the short case, however, it’s worth reminding newer investors of Muddy Waters’ considerable track record as a short seller.

Muddy Waters Is A Top-Notch Short Seller

Muddy Waters has produced an excellent track record. Here’s an Institutional Investor profile from 2021, for example:

Carson Block, the founder of Muddy Waters Capital, likes to talk about what a screwed up year 2020 was — on many levels. But even as most short sellers gasped for life, Muddy Waters ended the year up a net 15 percent, according to an investor.

It was the fifth year Muddy Waters’ hedge fund posted a double-digit gain, which launched in 2016 and has managed such performance during one of the longest bull markets on record. The fund has produced an annualized return of roughly 19 percent — and that’s after a 2.5 management fee and a 30 percent performance fee.

Producing a 19% annualized return shorting stocks during a raging bull market is a rather impressive result.

Yes, Block is known for high-profile successes, such as exposing shenanigans at China Media Express, Luckin Coffee, and Sino-Forest, among many others. But it’s not just his greatest hits that stand out, either. His work is consistently of high-quality and merits great respect. I say that as a former analyst at another prominent short selling hedge fund. I’m familiar with a lot of people in the business. Some of them, I tend to ignore their reports. Others, I take very seriously. Muddy Waters is one you ignore at your own peril.

I’d also note that Grant’s Interest Rate Observer, another well-known and respected research outlet, published a negative report on HASI’s accounting back in May.

Muddy Waters Allegations

It’s important to note that Muddy Waters’ report doesn’t come out using words like “fraud” or “Enron”. This isn’t some bombastic short-seller report merely operating off overblown innuendo. Rather, Muddy Waters makes clear and detailed claims as to how HASI’s accounting allegedly presents a rosy view of the company compared to its actual operating results.

Muddy Waters’ main argument is that HASI’s reported results overstate its true economic earnings. It argues this is primarily through three avenues:

- Claiming income from tax credits given to third parties that may not ever turn into cash proceeds.

- Claiming an optimistic amount of income due to using aggressive discount rates on investments.

- Claims interest received in the form of “paid in kind” or “PIK” securities, which Muddy Waters states are effectively IOUs from distressed borrowers, rather than actual cash interest payments.

I’d encourage anyone with a position in HASI stock to read through the Muddy Waters report and judge the work for yourself. I recommend preparing to learn about some arcane accounting concepts such as Hypothetical Liquidation at Book Value “HLBV” if you plan to fully understand HASI’s finances.

It’s beyond this article’s scope to address all of Muddy Waters’ specific accounting claims. I’d note, however, the arguments are well-presented and logical. HASI, if it is in the clear, will need to present a lengthy and detailed rebuttal on a point by point basis because Muddy Waters’ work appears to be compelling.

I would note, however, that it appears what HASI is doing is above-board. There’s a difference between using what Muddy Waters describes as a “loophole” and engaging in over-the-line behavior. If investors want to invest in an ESG-friendly REIT and HASI presents an attractive marketing package to folks, caveat emptor. HASI’s SEC filings make it clear there is some complex financing arrangements going on here, and it’s up to investors to know what they’re purchasing.

More specifically, something like getting paid with PIK paper instead of cash isn’t illegal. Not even close — it’s a well-known and accepted practice. What HASI is doing here seems totally inside acceptable operating procedures, at least from my understanding.

However, if you invest in something like a business development company “BDC” that often receives PIK payments, they tend to yield far more than HASI stock does.

As I see it, the issue isn’t that the PIK payments are happening, but rather that people view HASI as a safe low-risk way to play the inevitable rise of green energy. Whereas the actual underlying business might be a lot less stable than its investors perceive.

My takeaway wasn’t that the company is a total house of cards, but rather that the market misunderstands the quality of the company’s earnings and is thus demanding way too low of a yield from the asset in return. It’s fine to take PIK payments and otherwise get non-cash earnings which may or may not ever actually prove out in reality. But you might well want to earn a higher than 5% dividend yield in return for that elevated business model risk.

Is Muddy Waters Correct?

HASI has released a statement saying Muddy Waters’ report is full of errors and that the company’s accounting complies with the law and is transparent. This is a usual sort of boilerplate response we see after short seller reports.

I’d like to see a more detailed press release addressing specific Muddy Waters concerns rather than just a blanket statement. Muddy Waters makes a detailed, specific, and seemingly compelling review of HASI’s finances, and we need a lot more than a terse response to restore confidence in the company.

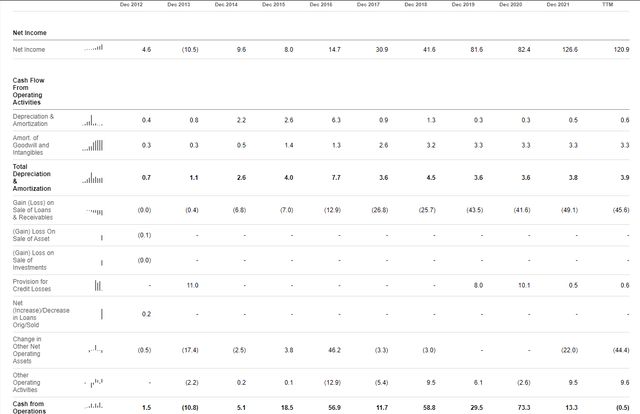

When in doubt, a good thing to look at is cash flow. And on this front, Muddy Waters appears to be standing on solid ground. HASI’s historical cash flow generation has been, in a word, uninspiring, even using the company’s reported financials, as shown below:

HASI Cash Flow Statement (Seeking Alpha)

The company hit a high point of $73 million in cash from operations in 2020. However, that dipped to $11 million in 2021 and has fallen into slightly negative territory over the past 12 months. When a company has strong reported earnings but can’t turn them into operating cash flow, that’s often a sign of poor earnings quality.

Dating back to 2013, HASI has issued at least $96 million of common stock each and every year. Additionally, in every single year, it has issued more stock than it has paid out in dividends. It’s not hard to see how an analyst would come to the conclusion that HASI could be funding its dividend from selling fresh equity to the public rather than generating recurring cash flows. As shown above, HASI’s operating cash flows would seem unlikely to support the dividend at current levels even if the company suspended new investments entirely.

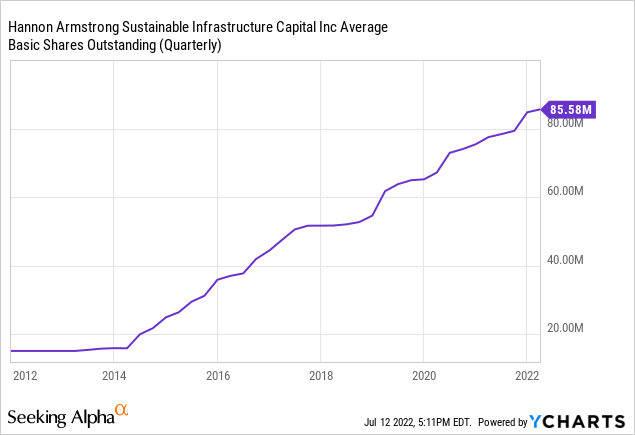

Speaking of all that dilution, since going public, HASI has now increased its outstanding share count fivefold, from less than 20 million shares to more than 85 million today:

It’d be one thing if this massive share issuance were turning to valuable properties throwing off tons of cold hard cash. Instead, however, the business continues to muddle along barely producing any cash flows while seemingly needing an endless supply of additional investor capital to keep its current trajectory going.

It’s worth asking when HASI will ever reach a sustainable level of operations. If it can’t generate enough cash flow to cover its dividend during a boom period for ESG investing and the renewable energy industry, then when will it happen?

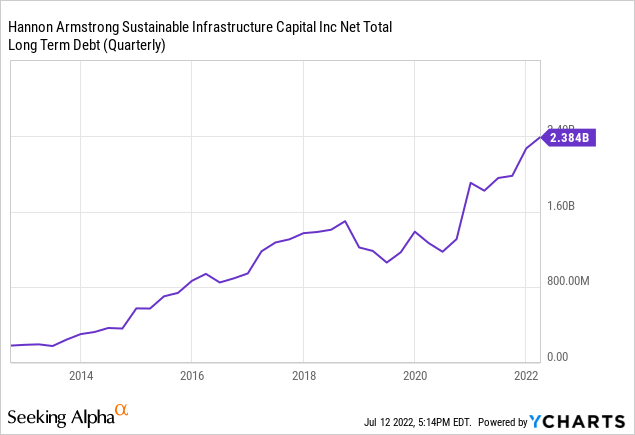

Speaking of sustainable, look at the company’s debtload as well:

Like the company’s share count, debt has ballooned from a very low starting point as of the IPO to $2.4 billion today.

A bull could reasonably argue that many REITs expand by issuing more debt and common stock. And that’s true. But most REITs (at least successful ones) generate more cash and funds from operations as they expand. HASI’s reliance on non-cash based income streams to produce accounting profits and so-called distributable earnings is less reassuring.

Will these accounting earnings eventually turn into cash and thus back a sustainable dividend payment? Time will tell. I’d be hesitant to bet against Muddy Waters, however. The firm has an excellent track record in going after companies such as timberlands owner Sino-Forest that operated in resource industries and had opaque cash flows.

I certainly don’t see HASI’s 5% dividend yield as being high enough to stomach this level of risk. There are countless fine REITs out there paying 5% today, and even some high-quality Dividend Aristocrats like 3M (MMM) are getting close to that mark as well.

In any case, when the business model is complicated and you don’t necessarily understand the accounting, it’s often better to stay away. Particularly in a bear market such as we face now, there’s no shortage of high-quality companies to buy with reasonable dividend yields. I’d need to see a much lower stock price to consider investing in HASI.

Be the first to comment