courtneyk/E+ via Getty Images

Co-produced with Treading Softly

Have you ever had house envy?

Your friend, or an acquaintance, buys a new house with all the fancy bells and whistles. It’s rocking the massive tub, big screen tv, and a 7 burner stovetop (apparently, that’s a big deal, according to my wife). You’re led to drool over their new place even if you’d never use the features.

Those who have read my work before likely know that I love to generate income from as many aspects of my life as possible. I make money whenever someone visits the gas pump. I make money when someone goes to the doctor or visits a hospital. Do you have power on your home, pay for a cellphone plan, or buy groceries? You’re paying me pennies every moment.

I do this because I see the essentials of life and know that if I can generate income from them, my income stream will be secure and growing.

For many, their mortgage is their largest recurring monthly expense. So let’s talk about how I take your largest bill and get double-digit yields from it.

You can do it too.

Let’s dive in.

Pick #1: AGNC – Yield 12.7%

When you take out a mortgage on your house, the company you applied with likely told you whether you could apply for a “qualified” mortgage or whether you needed to apply for an “unqualified” mortgage. Likely, you didn’t pay much attention to the details, you were simply concerned about getting approved for the house you wanted at the lowest possible mortgage rate. To the investors who later bought the mortgage, the distinction is everything.

Qualified mortgages are guaranteed by the “agencies,” Fannie Mae or Freddie Mac. These are government-sponsored enterprises that are tasked with making home ownership available to the maximum number of people. The agency guarantee ensures that there is always ample capital available from investors to buy mortgages. Investors get to collect the interest and principal payments, and in the event that a borrower defaults for over 90 days, the agency buys back the mortgage at par. In other words, there is no scenario where the investor receives less than 100% of the principal. As a result, the mortgage-backed securities that carry the agency guarantee, AKA “agency MBS,” are among the lowest risk investments in the world. They enjoy high liquidity, second only to U.S. Treasuries, and their yields tend to trade at a relatively low premium to U.S. Treasuries.

AGNC Investment Corp (AGNC) is a mortgage REIT that takes advantage of these unique features in MBS. Agency MBS is, for all practical purposes, as safe as U.S. Treasuries. However, since agency MBS typically trades at a premium to U.S. Treasuries, AGNC can profit from that difference.

AGNC profits from borrowing shorter-term debt and then buying agency MBS, which typically is expected to last 7-10 years. While mortgages usually have 30-year terms, very few borrowers actually keep the same mortgage for 30 years. People move and sell their houses, they refinance to take advantage of lower interest rates, they refinance to take out cash as their property value increases, some might make oversized payments, and others will refinance to extend their term and lower their payments (even if interest rates are higher).

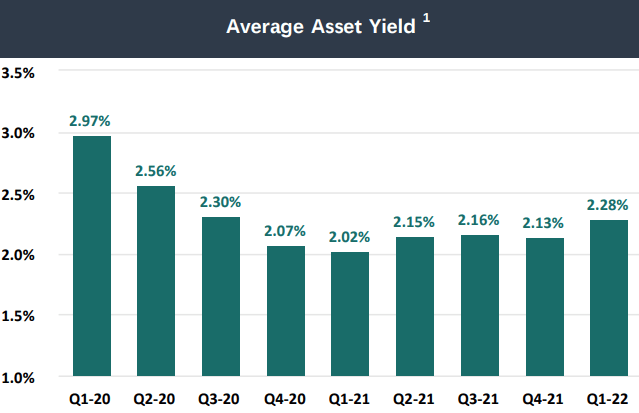

AGNC finances its acquisition of MBS with short-term repurchase agreements. These are non-recourse borrowings that are secured by the MBS they are buying, these repos typically have terms of 3-6 months. AGNC profits on the difference between the yield it receives and the yield it pays. (Source: Q1 2022 Stockholder Presentation).

Q1 2022 Stockholder Presentation

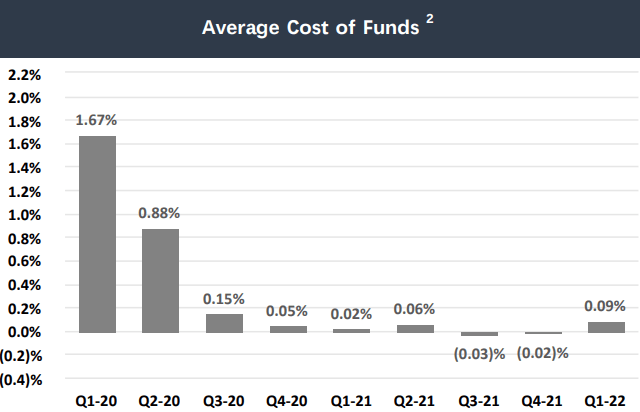

You can see the yield that AGNC receives on the chart above, and the yield it pays on the chart below.

Q1 2022 Stockholder Presentation

This is as of Q1 2022, obviously, both of these numbers have changed a lot. When these are changing, the key question for AGNC is always which is changing faster? AGNC profits from the difference between yield and cost of funds. So when rates are going up, it is positive if AGNC’s yield received goes up faster than its cost of funds. It is negative if the cost of funds is going up faster than the yield received.

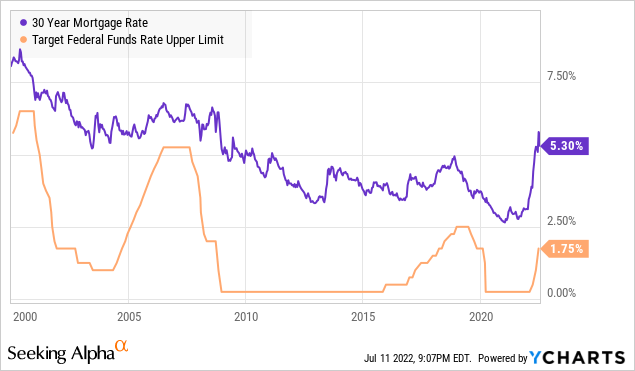

If we look at the big picture, we can see that mortgage rates have moved a lot faster than the Federal Reserve has hiked its target rate. These numbers are not exactly what AGNC will receive in yield or exactly what it will pay, but the 30-year mortgage rate is determined by MBS prices, and the Federal Funds Rate heavily influences the repo rate that AGNC borrows at.

Note that the last time mortgages were over 5%, the Fed’s target rate was also over 5%! I wouldn’t say it is impossible for the Fed to get to 5%, but it would be really stupid for them to try.

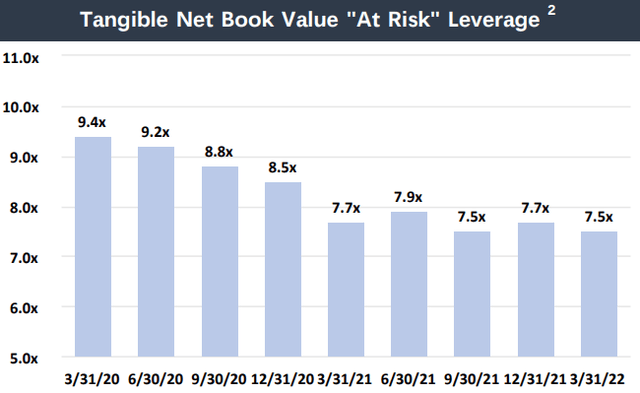

This spread is very wide and indicates that AGNC will get more money on new investments/reinvestments than they have in about a decade. Of course, to benefit from this, AGNC has to have the ability to invest more. Fortunately, it came into 2022 with very low leverage relative to its history.

Q1 2022 Stockholder Presentation

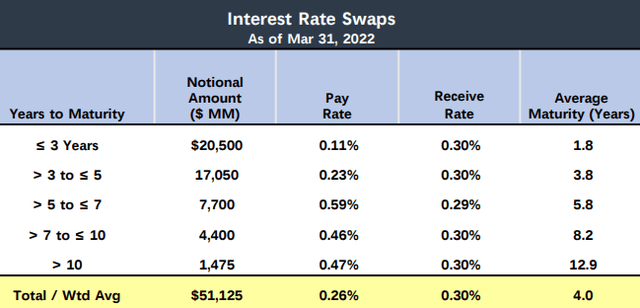

AGNC is in a position to leverage up and buy tens of billions in MBS and benefit from these higher spreads. But what about AGNC’s older MBS? This is why AGNC hedges. They use “interest rate swaps,” where they pay a fixed rate and receive a floating rate. AGNC has spent the past two years acquiring swaps with very low pay rates.

Q1 2022 Stockholder Presentation

Yes, that is $51 billion, which AGNC is paying only 0.26% on and is receiving a floating rate, which as of today is closer to 1.6%. Since AGNC is likely to borrow over $51 billion, this serves to effectively fix its interest rate. This provides AGNC a long runway to leverage up at its convenience without the profitability of its legacy MBS materially decreasing.

So why is AGNC’s price down so much? The answer is book value. AGNC is long agency MBS, and hedges its position by shorting U.S. Treasuries. This is a tactic that works great when mortgages and Treasury prices move together. However, they don’t always move together.

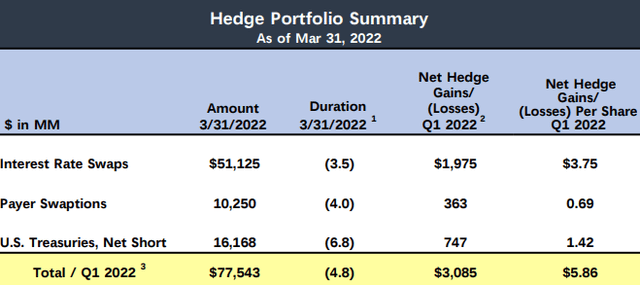

AGNC has benefited from its hedges to the tune of over $3 billion ($5.86/share).

Q1 2022 Stockholder Presentation

However, that change in hedges was unable to completely offset the headwind of declining MBS prices. Book value has gone down because the value of AGNC’s hedges has not gone up as quickly as the value of its assets went down. This happens when mortgage rates go up quickly (prices come down), while Treasury rates, AGNC’s primary hedge, have gone up more slowly.

We can panic over this, or we can realize that MBS underperforming Treasuries has increased future returns for AGNC. Like any other debt asset, lower prices reduce current values but increase the total return of future investments. In the case of MBS, since the principal is guaranteed, the fall in price has nothing to do with default risk. If these were corporate bonds, we might worry about what portion of the change in price is due to bankruptcy risk for the borrowers. In this case, the change in price is purely one of valuation. The MBS, whether priced at $105, $95, or $85 will always pay $100.

Since I’m in AGNC for the income, the prospect of getting much larger returns in the future as AGNC leverages up is far more important to me than the temporary decline in book value. Book value will recover either when MBS prices rise, or when Treasury prices fall. In the meantime, the earning potential for AGNC is much higher and that is what I am buying.

Pick #2: PMT-B – Yield 8.4%

Part of High Dividend Opportunities’ strategy towards interest rates has been to be “agnostic.” We want our portfolio positioned in a way that whatever the Fed does, we win. Rates go up? We win. Rates go down? We win. Rates stay the same? We win.

How do we balance our portfolio to do that? We have exposure to some fixed-rate debt, like PIMCO CEFs and numerous high-yielding preferred shares. These investments go up in price when interest rates are low. At the same time, we diversify into investments that have exposure to floating rates, so if rates go up, our income goes up too!

PennyMac Mortgage Investment Trust, 8.00% Series B Fixed-to-Float Cumulative Redeemable Preferred Shares (PMT.PB) is an investment that does both. It pays a high fixed yield today, yielding over 8%. The dividend will remain fixed for the next two years. Then if PMT chooses not to call it, PMT-B will start paying a floating rate at 3-month LIBOR + 5.99%. If PMT-B were floating today, that means the dividend would be raised and PMT-B would pay $0.521/quarter instead of $0.50/quarter.

PennyMac Mortgage Investment Trust (PMT) is related to PennyMac Financial Services, Inc. (PFSI), the largest correspondent producer in the country. This means that PennyMac originates the mortgages and provides its own money, as opposed to many mortgage originators that sign the agreement with a borrower and then sell it to investors.

PMT plays the role of investor, providing capital, while PFSI is the company that holds all the infrastructure. This provides tax benefits as PMT is structured as a REIT and it also provides shareholders the opportunity to get a much higher yield investing directly in PMT.

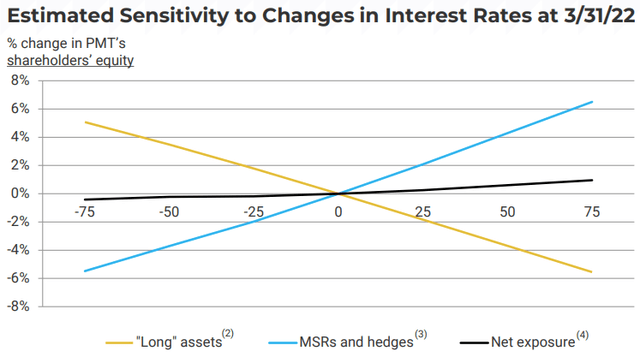

PMT has a variety of strategies including Credit Risk Transfers (or CRTs), Mortgages Servicing Rights (or MSRs), and Agency Mortgage-Backed-Securities (or MBS). PMT’s diversified strategies help ensure that it always has some business that is doing well. For example, as rates rise, Agency MBS go down in value, but MSRs go up in value. As a result, PMT’s book value only declined 6% in Q1 2022. A quarter that was exceptionally volatile and difficult for mortgage REITs.

Going forward, PMT is positioned for book value to climb with rising rates.

PennyMac Mortgage Investment Trust

This provides a great level of security for the preferred shares.

PMT-B is now trading at a significant discount to par. As 2024 approaches, there are a few possibilities:

- PMT decides to call PMT-B immediately in June 2024. As a result, PMT-B investors would receive an effective YTC (yield-to-call) of approximately 11%. I can live with 11%/year for two years!

- PMT leaves PMT-B outstanding and interest rates are as high or higher than they are today. Investors will receive $0.50/quarter in dividends, then will receive a raise based on LIBOR. I like raises!

- PMT leaves PMT-B outstanding and interest rates are lower than they are now. In that case, investors will receive $0.50/quarter, and the dividend will be reduced. If LIBOR were near zero, it could go as low as $0.375/share. Which at current prices would be a yield of 6.3% on your capital. If interest rates are back to 0%, 6.3% doesn’t look too unattractive.

This is what I mean by a win/win situation. Buying at current prices, we get a good return regardless of what rates do, and if they remain higher, we could get a really great return. This plays a very important role in balancing our portfolio to benefit if rates stay high, something that is a negative for most preferred is a benefit for PMT-B.

Shutterstock

Conclusion

With AGNC and PMT-B, investors all of risk tolerance levels can enjoy large sums of recurring income from the largest investment many make – their homes. I get a cut from thousands of mortgages paid by everyday folks like you and me. All because I own companies that provide the capital necessary to support the American Dream.

Retirement comes with its own set of expenses and spending. We need income to meet those expenses head-on and to overcome them so we can enjoy the freedom to live as we please. Long ago, I crafted my Income Method to enable my portfolio to generate the income I will need in retirement. Over the years, I have seen my portfolio grow rapidly. Every year my income is higher than the year before.

You can also achieve this by using income investments to get paid for your ownership. Own the businesses that get paid from everyday expenses and turn them into everyday income generators.

Don’t know where to start? You’ve got two great ideas right here!

Be the first to comment