jittawit.21

Price Action Thesis

W. P. Carey (NYSE:WPC) has been a massive winner for REIT investors since its March 2020 COVID bear trap (significant rejection of buying momentum). Therefore, investors who held on firmly have been well-rewarded. It also has a robust long-term uptrend and has outperformed the SPDR Real Estate ETF (XLRE) in 2022, thanks to its built-in escalators on its leases, mainly linked to inflation. Therefore, it has benefited tremendously from the current high-inflation environment, lending tremendous visibility to its earnings.

Our price action analysis indicates a slow and steady accumulation along its long-term trend. However, a bull trap (significant rejection of buying momentum) in June led to considerable selling pressure. However, buyers have entered consistently to support the dips, lending further credence to its bullish momentum.

We think its valuation is relatively well-balanced, with a bias to the downside. The Street consensus suggests that its AFFO per share growth could slow markedly through FY23. Coupled with its recent bull trap, we believe caution is warranted.

Therefore, we rate WPC as a Hold and urge investors to wait for a more reasonable entry level before adding exposure.

W. P. Carey – Robust Long-Term Uptrend

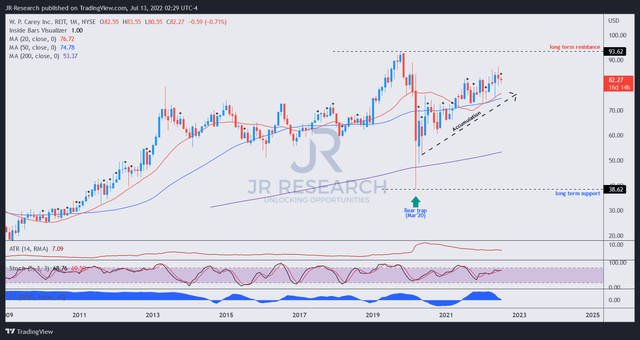

WPC price chart (monthly) (TradingView)

The recovery from its March 2020 COVID bottom has been remarkable. But, more importantly, it has shown no signs of rapid flush-up price action on its long-term charts (akin to the pre-COVID flush-up price action). Therefore, it has been a slow and steady accumulation phase often linked to robust upward momentum.

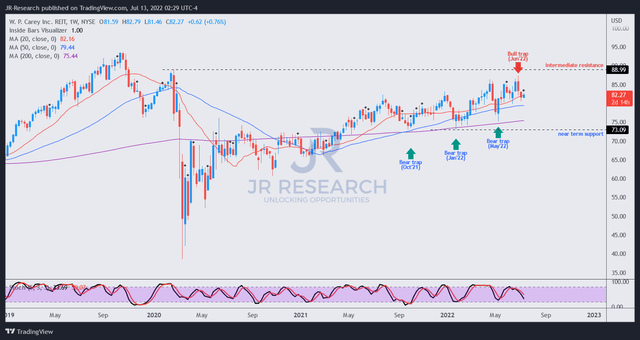

WPC price chart (weekly) (TradingView)

We also observed similar price structures in its medium-term trend. A series of bear traps in 2021 and 2022 helped sustain its bullish bias, indicating the market was supportive of buying the dips on WPC. Therefore, we urge investors to use such price structures to consider adding exposure, reflecting the market’s intention to reject further selling downside. Consequently, they offer solid dip-buying opportunities with a reasonable risk/reward profile.

Notwithstanding, we noticed a bull trap price structure formed in June 2022, as the market rejected further buying upside. The price action has attempted to consolidate over the last two to three weeks at its mid-June lows. However, we don’t consider the current levels attractive, as there are no signs of bear trap price action.

Moreover, the bull trap formed close to its intermediate resistance ($89), which suggests that the selling pressure could be robust at that level. Given the limited potential upside of 8.2% to its intermediate resistance, we believe the risk/reward profile from the price action perspective is not attractive.

Buying Momentum Could Be Hampered by Slowing AFFO/Share Growth

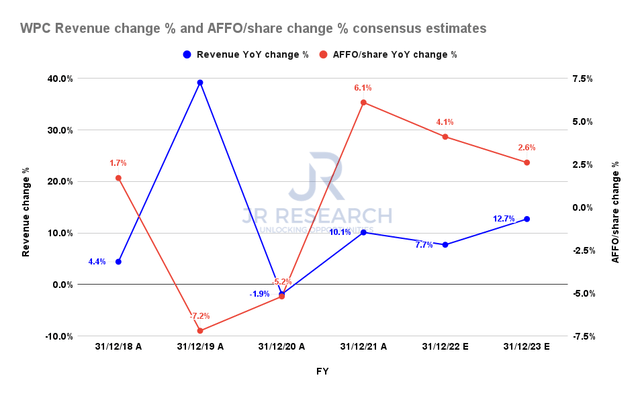

WPC revenue change % and AFFO/share change % consensus estimates (S&P Cap IQ)

Furthermore, the consensus estimates (bullish) suggest W. P. Carey’s AFFO per share growth could decelerate through FY23. Therefore, we believe investors need to consider that further buying upside could be limited unless its valuation is attractive.

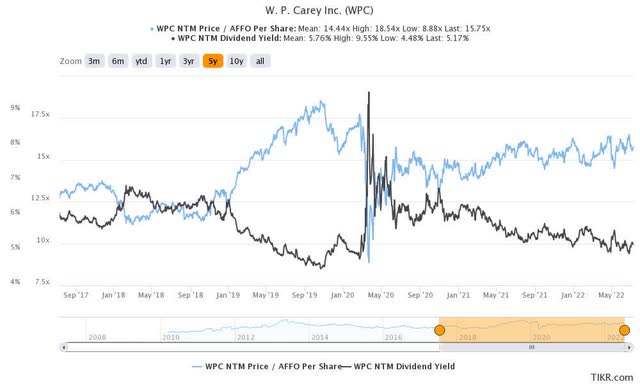

But, WPC traded at an NTM P/AFFO per share of 15.75x (Vs. 5Y mean of 14.44x). Moreover, its NTM dividend yield of 5.17% is also lower than its 5Y mean of 5.76%. Therefore, the market has added a discernible premium to WPC, given the robustness of its underlying model in the current environment. CEO Jason Fox accentuated in a recent June conference (edited):

99% of our leases have bumps built into leases. In fact, it’s above 99%. Of that, 58% of our leases are linked to inflation. And within that category, 38% of the 58% is tied to uncapped CPI. Inflation in Europe has been as high and in many countries higher than what we’ve seen in the US. So there’s a real tailwind that we have flowing through to our portfolio. (Nareit REITweek 2022 Investor Conference)

But, given slowing growth estimates ahead, we are not convinced that the current premium is justified. Furthermore, its price action remains close to its intermediate resistance and has yet to demonstrate constructive price structures seen in January and May. Therefore, we are not convinced that the current levels represent an attractive level to add exposure.

Is WPC Stock A Buy, Sell, Or Hold?

We rate WPC as a Hold for now.

There’s little doubt that WPC is supported by a robust long-term uptrend, undergirded by a series of bear traps. However, its June bull trap could continue to deny WPC further buying upside.

Furthermore, our analysis suggests that the premium asked for WPC now may not be justified in the face of slowing AFFO per share growth.

Therefore, investors are urged to consider adding exposure at more attractive price levels.

Be the first to comment