Olga Tsareva

Cronos Group Inc. (NASDAQ:CRON) has been crushed amidst a vicious crash in the cannabis sector. Hype for cannabis companies has faded, especially for those operating in Canada. Unlike its Canadian peers, CRON has maintained a somewhat more conservative cash burn profile and is the only one among the original “Big 4” Canadian operators that still has a strong balance sheet. $1 billion in net cash makes up around 63% of the current market cap. CRON offers potential tail-end upside from its synthetic biology program, making it a worthy addition to any cannabis portfolio.

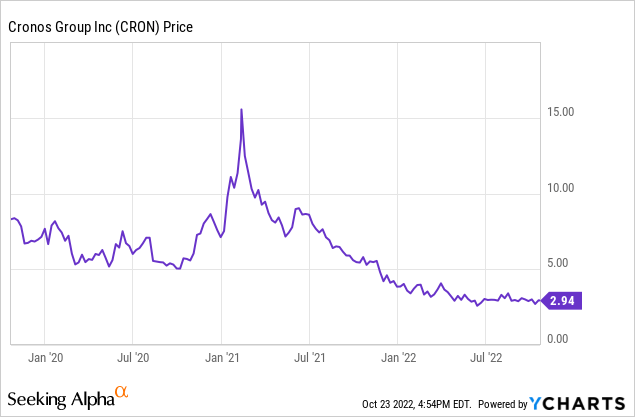

CRON Stock Price

CRON’s most recent peak was in early 2021, when it traded above $15 per share. The stock has since slid 80% to the present day.

I last covered the stock in March, where I rated the stock a hold on account of the weak fundamentals and better buying opportunities south of the border. While that assessment still stands, CRON remains one of the more compelling options in Canada.

CRON Stock Key Metrics

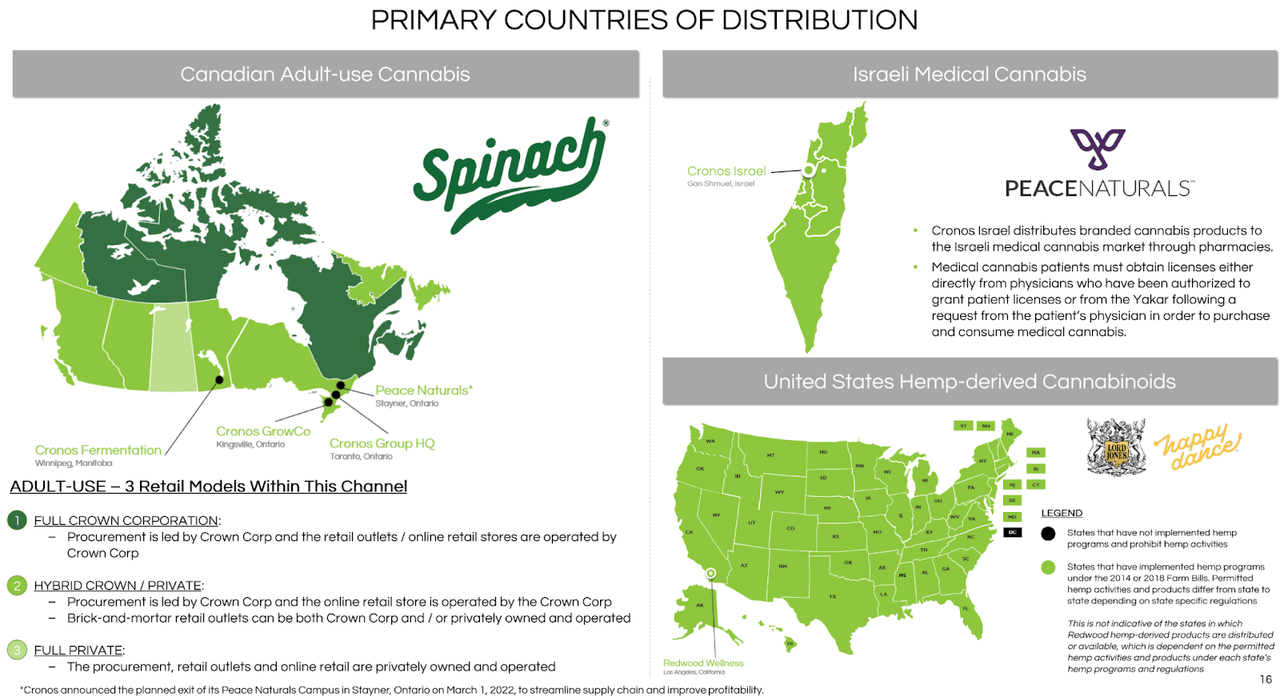

While CRON distributes medical cannabis products in Israel and CBD products in the United States, its primary base of operations is in Canada.

2022 Q2 Presentation

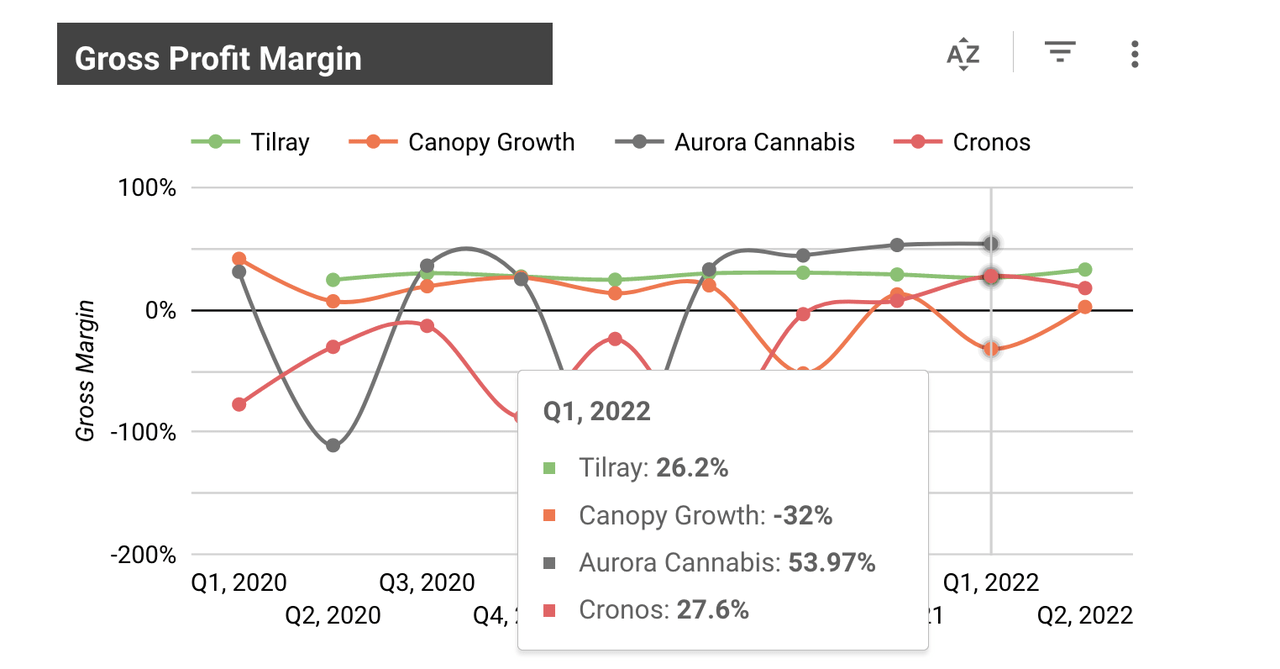

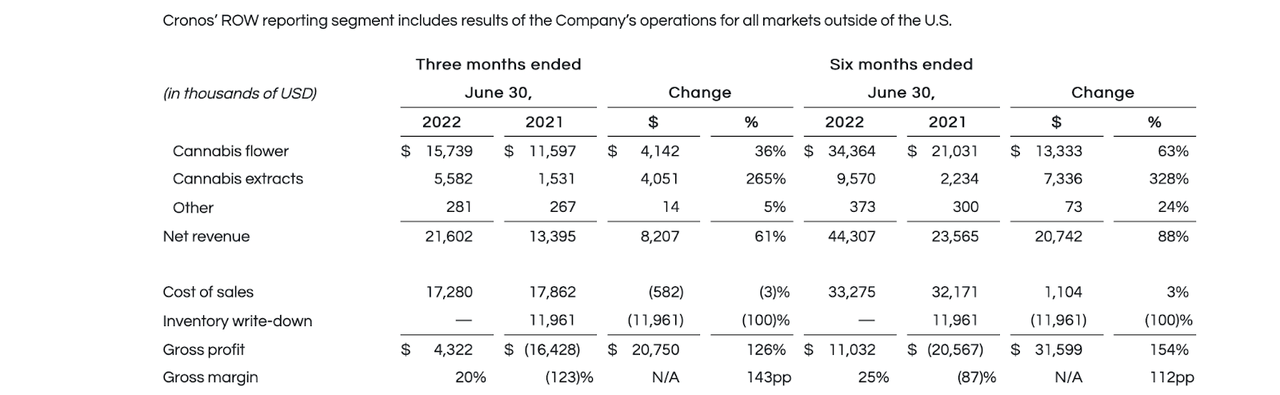

Unlike many Canadian peers like Canopy Growth (CGC) and Tilray (TLRY), which have diversified their cannabis business to include non-cannabis business segments like beverages, CRON has focused squarely on cannabis operations. CRON saw gross margins improve dramatically in the quarter, rising from negative 101% to positive 18%. That would place it neck to neck with well-known peers.

Cannabis Growth Portfolio

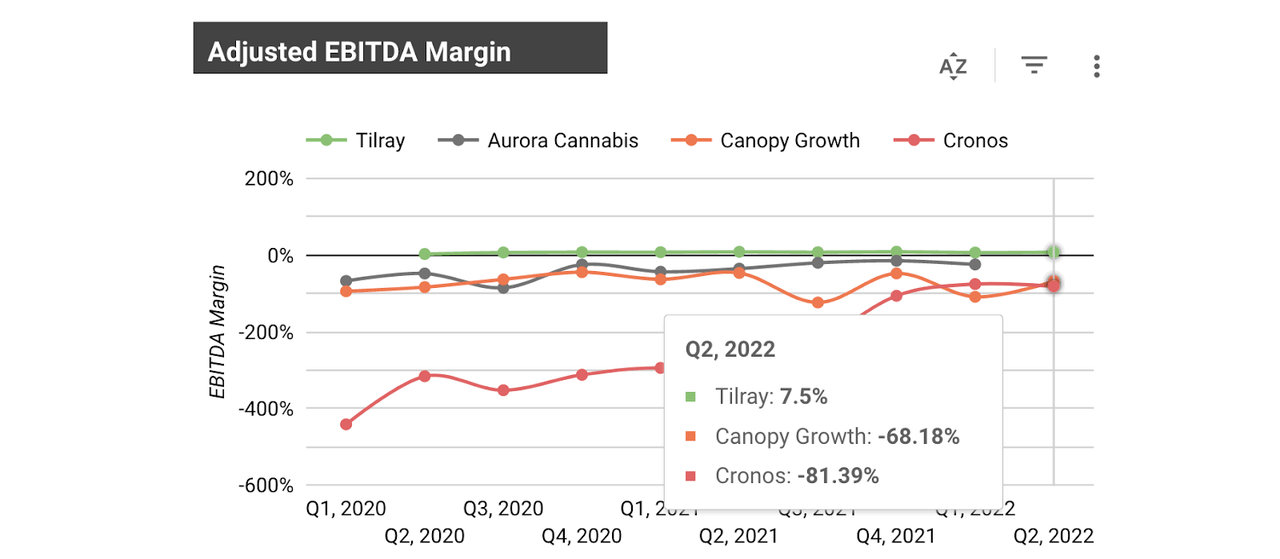

Adjusted EBITDA margin improved from negative 319% to negative 81.4% – reflecting significant improvement from admittedly low expectations.

Cannabis Growth Portfolio

Cannabis remains a pressured business in Canada as demand for legal products has not adequately matched the supply from licensed producers. That has led many LPs to shut down facilities and take inventory impairment charges. CRON had taken such steps in the prior year, which explains the improvement in gross margins this quarter, but it evidently is still not yet enough for the company to reach profitability. On the conference call, management also stated that the improvement in margins was due to “increased cannabis flower revenue, the introduction of additional cannabis extract categories that carry a higher gross profit and gross margin than other product categories.”

2022 Q2 Press Release

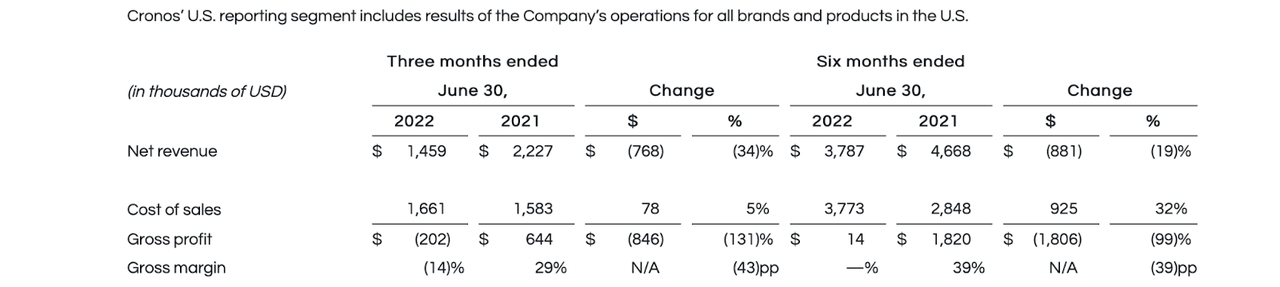

The company’s CBD business is even more challenged as gross margins swung negative in the quarter. CBD is federally legal in the United States but is a very commoditized product and demand remains questionable.

2022 Q2 Press Release

CRON ended the quarter with $945 million of cash and investments versus no debt.

Is CRON Stock A Buy, Sell, Or Hold?

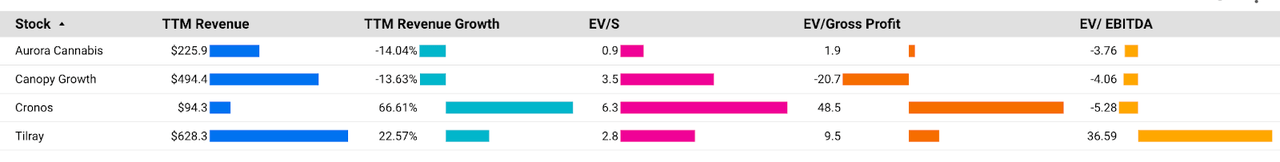

Inclusive of 125.2 million anti-dilutive shares, there are 495 million shares to account for. Adjusting for net cash, CRON still trades at a notable premium to Canadian peers on the basis of price to sales.

Cannabis Growth Portfolio

There are clear arguments for why a premium is warranted. CRON is showing significantly stronger growth than the larger peers, and it has a superior balance sheet that reduces financial risk. CRON’s cash burn profile has hovered around $140 million annually, meaning that its cash position should be able to buy it many years’ worth of time – the same cannot be said about the others. Further, Altria (MO) still has a 45% stake in the company, with a warrant that gives it the right to acquire an additional 10% stake for $1 billion (at current prices, it is unlikely for that warrant to be exercised).

2022 Q2 Presentation

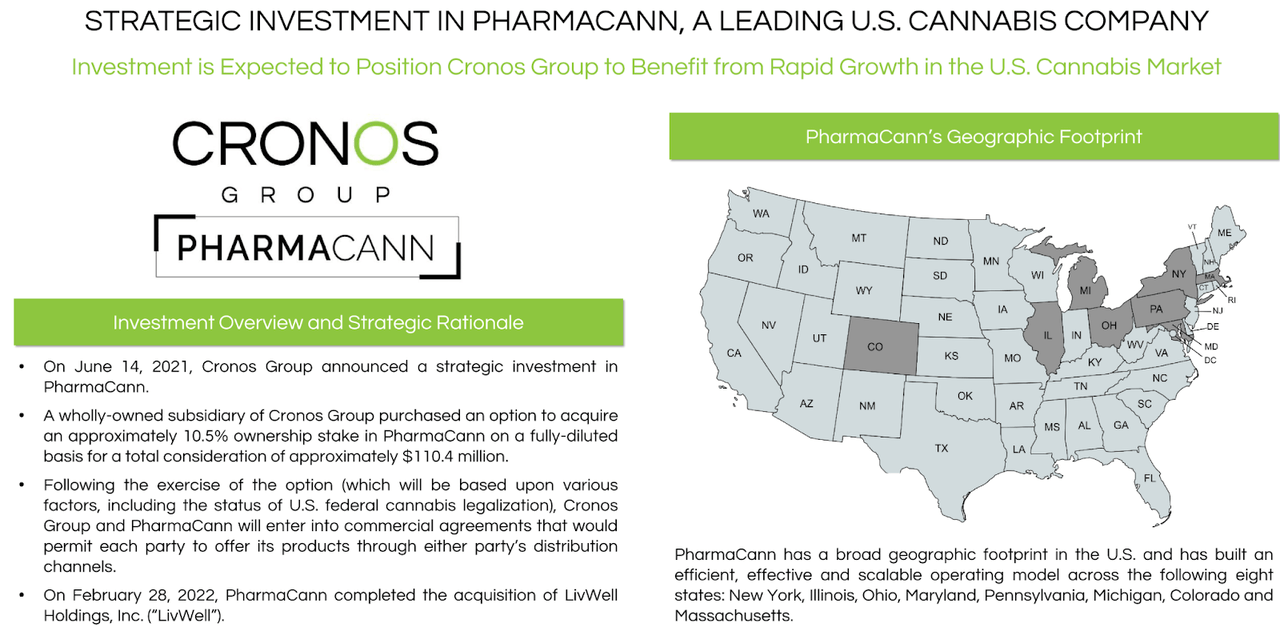

CRON also previously made a $110 million investment in the U.S. multi-state operator (“MSO”) PharmaCann, giving it some exposure to the growth of the U.S. cannabis sector.

2022 Q2 Presentation

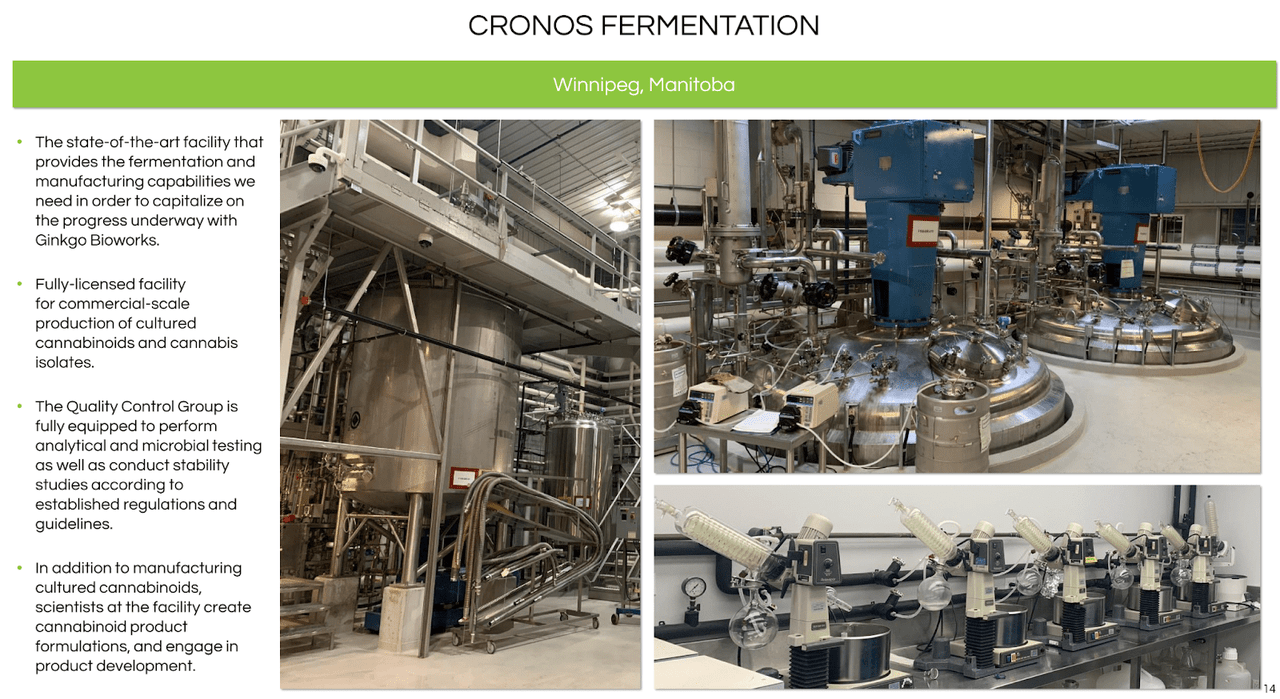

An underappreciated long-term story is the company’s unique R&D efforts in the cannabis space. Among other projects, CRON is closely working with the synthetic biology firm Ginkgo Bioworks (DNA) to produce cannabis compounds by reprogramming the DNA of yeast.

2022 Q2 Presentation

If CRON manages to discover a way to produce cannabis synthetically at a lower cost, then it may be able to achieve cost advantages over competitors. The stock is trading for roughly $500 million net of cash, though to be conservative one might want to avoid deducting the net cash due to the ongoing cash burn. While CRON is not as cheap as other cannabis operators in Canada, it offers potentially more optimistic long-term end results that may help it to achieve stronger multiples. While I remain neutral on CRON stock due to better alternatives in the U.S. MSOs, I consider CRON to be a core holding in any Canadian cannabis allocation, if one has one.

Be the first to comment