Jae Young Ju/iStock via Getty Images

Introduction

Because there have been no analyses about Valens published on Seeking Alpha, the purpose of this article is to provide a full, comprehensive overview of the company and what I feel its potential is.

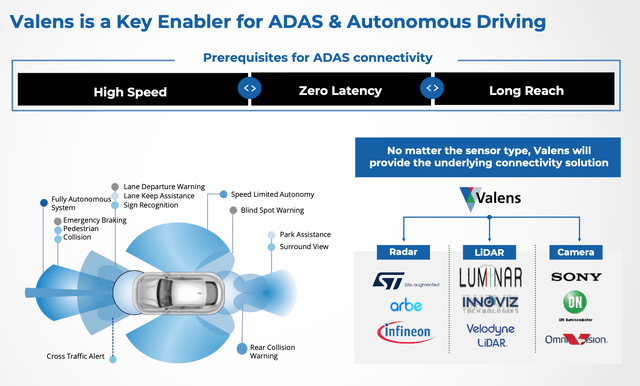

Valens Semiconductor (NYSE:VLN) is a prominent provider of semiconductor products for the professional audio-video and automotive industries. The company’s solutions enable long reach, no latency, rapid video and data transmission. Valens’ HDBaseT technology is the dominant standard in the professional audio-video market. Valens’s technology provides chipsets that support Advanced Driver Assistance Systems (“ADAS”), Automated Driving Systems (“ADS”) and is a vital enabler of the growth of autonomous driving. More specifically, when it comes to self-driving cars, Valens’ high speed connectivity solutions are unique in that they are unaffected by the types of sensors, cameras, LiDAR, or radars used in cars, allowing automotive OEMs to link their ADAS systems better and faster.

The MIPI Alliance has chosen Valens’ underlying technology as the foundation for a new high-speed vehicle video communication standard.

Valens became a publicly traded corporation in late 2021 after completing a SPAC merger with PTK. The deal was priced at an EV of ~$900M and the PIPE was subscribed at $10/share.

Valens is based in Hod Hasharon, Israel and has a headcount of around 270.

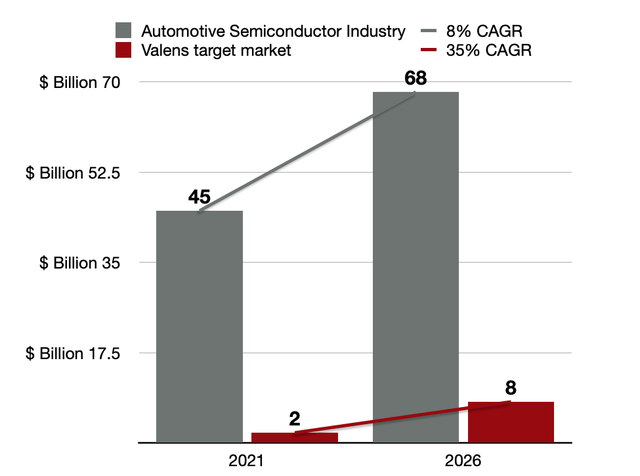

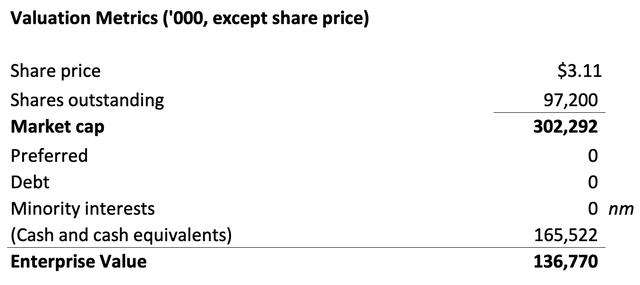

Valens is currently trading a $3.11/share.

A long investment horizon (3-5 years) is best suited for this investment idea.

Target Market

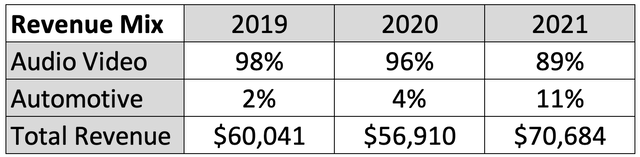

As we have just seen, the two main markets in which Valens operates are the Audio-Video and the Automotive market.

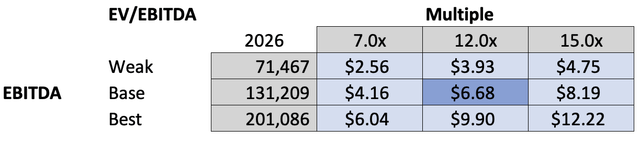

The worldwide automotive semiconductor industry is predicted to rise from $45 billion in 2021 to an estimated $68 billion by 2026, with connectivity solutions serving as the primary driver. Over the same time period, the target market for Valens’ vehicle connection devices is projected to grow even faster. Valens’ target markets are predicted to expand from around $2 billion in 2021 to approximately $8 billion in 2026.

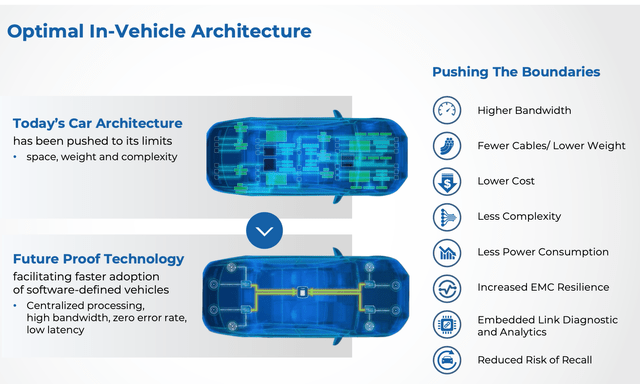

Without getting too technical, the expansion of the aforementioned markets will be buoyed by the requirement that a vehicle be capable of processing increasing amounts of data. The current automotive architecture, on the other hand, has reached a tipping point, and traditional solutions are no longer able to meet current and future needs. In terms of bandwidth and performance, those solutions are limited.

In addition, as the number of electronic devices and wires placed in cars grows, so does the amount of electromagnetic interference that vehicle systems must deal with. Valens’ technology is the only one that can provide error-free connectivity in these extreme conditions.

Also, as electric vehicles become more common, the demand for the technologies such as those that Valens produces will increase exponentially.

Just recently, members of the European Parliament voted in favour of a complete ban on the sale of internal combustion engines in new cars by 2035. The company has not provided any additional information on this, but we do know that management is actively collaborating with a few electric vehicle manufacturers in Europe, the United States, and China.

Car Architecture Evolution (Valens)

Operations and Business Relationships

So far, Valens has sold more than 25 million chips to some of the world’s most demanding customers.

On the automotive side, Valens’ most high-profile relationship in the sector right now is with Daimler (Mercedes), specifically with Tier 1s that supply Daimler.

Currently, every Mercedes vehicle is equipped with three to four Valens chips. It translates to nearly $20 in revenue per car (RVP), and Valens expects to make over $30 million in annual revenue from this partnership alone. (It’s worth noting that management initially indicated an RVP of 18-20$, then changing it to “north of 20$” in Q3 2021 and finally “north of 25$” in Q4 2021.) I believe that this growth has been fuelled, at least in part, by Valens’ capacity to pass on price hikes to its customers.

Additionally, Mercedes just unveiled the EQS, their first all-electric premium automobile, which features numerous Valens chips in its infotainment system. Working with Mercedes provides Valens significant exposure as Mercedes exclusively works with the top firms and accepts only the highest quality.

While management has not revealed the extent of the cost savings Mercedes benefits from by employing Valens’ chips, management has stated that they are “…significant”. This is crucial to manufacturer as competition will increase and cost savings will be of vital importance to them.

There are many more business collaborations Valens has entered into. In fact, VLN has recently partnered with Stoneridge and is in discussions with other truck manufacturers about incorporating VLN technology into their vehicles. Importantly, this market has a substantially higher average selling price (ASP) and much greater margins.

For what concerns the audio-video segment of the company, Valens’ chipsets have a wide range of applications in the sector. They enable users to distribute content from a source to big high-resolution screens, projectors, and video walls with sharp quality, despite the massive amount of data they handle. These chipsets are used in a wide range of applications, including video/audio distribution, remote healthcare and high-resolution medical imaging, transportation, education, and remote operation, such as KVM (Keyboard, Video, Mouse) extension, which is very popular in data centers and allows a remote operator to control a control PC/machine.

Valens’s Revenue Mix (Author, Valens)

The audio video segment is profitable on an operating basis already. The automotive side of the business is not as it is currently being dragged by high R&D expenses, which, as management indicated should start begin to decline after 2024. Management expects the automotive segment to significantly start contributing to revenues starting from 2023.

Valens’s Technology

Valens pioneered the HDBaseT connectivity technology and co-founded the HDBaseT Alliance, a standards organization pushing HDBaseT technology, alongside LG, Samsung, and Sony Pictures. HDBaseT is the best optimal solution for a wide range of verticals and applications, meeting market connection requirements for long-distance transmission, convergence, low-cost, and simplicity. HDBaseT is the global standard for combining and distributing ultra-high-definition video and audio, Ethernet, control signals, USB, and up to 100W of power via a single, low-cost frequently used cable for up to 328 feet/100 meters. HDBaseT minimizes cable clutter while maintaining great performance and quality. The alliance presently has over 200 members that are working on HDBaseT-enabled devices.

Valens technology was created with the goal of delivering high-speed video and data in EMC challenged situations (Electromagnetic Compatibility, the word “EMC” refers to a system’s or device’s ability to operate in an electromagnetic environment without causing interference with the operation of other electrical items in the environment.)

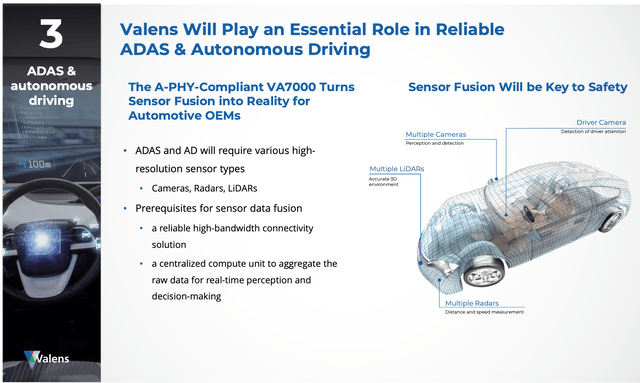

The technology was developed to meet the needs of the automotive market with the development of the Automotive business unit, and was later chosen as the baseline of the MIPI Alliance’s most recent standard for high-speed video connectivity in cars.

Valens is the first vendor to bring solutions to market that comply with the new MIPI A-PHY standard, and it is poised to become the de facto standard for high-speed video connectivity in vehicles. In 2024-2025, the first automobiles with A-PHY components are projected to be on the road.

For reference, MIPI A-PHY is the first standardized, asymmetric, long-reach serializer-deserializer (SerDes) physical layer specification for advanced driver assistance systems (ADAS), autonomous driving systems (ADS), in-vehicle infotainment (IVI) displays, and other surround-sensor applications, according to MIPI (e.g., cameras, lidar, radar).

The major goal of A-PHY is to transport high-speed data between cameras, displays, and the ECUs that control them.

Valens recently shipped the newly designed VA7000 chip to approximately 30 customers and received positive feedback on their engineering sample from potential customers and partners who have already begun evaluating the VA7000 samples.

The VA7000 belongs to the ADAS family of products. The number of chips utilized in a car is predicted to expand considerably in the near future (beginning in 2025), particularly for video-data communications. Based on an average number of chips per vehicle of 8 to 10, Valens management estimates revenue per car to reach $75, and revenue per car in cars with the company’s infotainment solution paired with Valens’ ADAS distribution can easily exceed $100. The VA8000 series of chips is currently being developed by the company, and will offer not just sensor to ECU connectivity, but also ECU to display connectivity.

In 2030, almost 100 million new cars are expected to be sold (Deloitte research). Each automobile will have approximately ten speed links, resulting in 1 billion links and 2 billion chips required for production, implying that the VLN target market should be around $10 billion.

Management intends to capture 10-15% of that market share, hence projecting to be a >$1 billion company after 2030. According to McKinsey, up to 50% of newly sold cars in 2030 will be electric.

One crucial (and I believe highly valuable aspect) of Valens’s technology is that Valens is able to easily tweak existing chips so that they can be used in a variety of sectors. As a result, you have an efficient, high-margin transversal usage of the same technology. Valens has repurposed the VA6000 chip, which was originally designed for the automotive sector, to work in the audio video market, “that has been a huge success” management has stated. This will work in both directions, with audio video technology being applied to automobiles and vice versa. Similarly, healthy growth should be aided by expanding into new markets (such as medical imaging and remote surgery) and benefiting from scale.

Valens currently has 117 granted patents and 9 pending patents applications.

How Does Valens’ Technology Compare to its Competitors’?

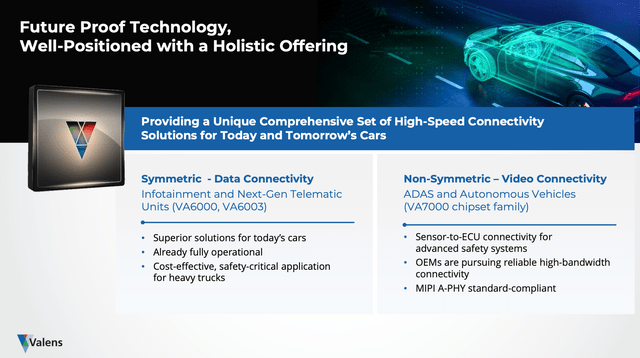

Let me begin by describing the two basic types of data-transfer links found in vehicles. I’ll try to avoid getting too technical and keep things simple. You usually have symmetric solutions or asymmetric ones. A brief overview of symmetric and asymmetric solutions:

Ethernet is a symmetric connectivity technology that has been used to link ECUs together. However, Ethernet is unable to address the need of offering a high-bandwidth, zero-latency, error-free link. This is where A-PHY comes into play especially when you are dealing with asymmetric link radars, ECU cameras, ECU LIDARs, and ECU.

Interestingly, Valens’ executives have declared that they welcome competition in the A-PHY business since it will increase acceptance of the new technology and expand the market. They basically assert that their market share would likely decrease, but that they will be operating in a smaller slice of a larger pie. Valens benefit from a significant first mover advantage.

Symmetric/Asymmetric solutions (Valens)

Remember that Valens was the first to develop an asymmetrical A-PHY compatible solution.

More standardised solutions such as Ethernet, while not the primary growth engine for VLN, are nonetheless significant and worth investigating. Symmetric (Ethernet) and asymmetric (A-PHY) solutions not always compete with each other, they can often coexist. Valens, in fact, now also offers both the VA6003 symmetric solution (which is especially valuable for the trucking industry) and the VA7000 asymmetric one allowing them to work in tandem, with the goal of becoming a one-stop, quick and reliable solution for businesses.

We can see two key competitors if we focus on Valens’ key development area, which is asymmetric links, where they are deploying the A-PHY technology. Texas Instrument is one of them, and Maxim is the other.

There are some substantial differences among the type of technologies these two competitors offer: First and foremost, on the technological front, Valens’ primary technology is digital. It’s based on a digital signal processor (DSP). In comparison to Valens, each of these competitors have a more broad revenue mix. And Valens’ capacity to scale up its technology is far more than those of its competitors who use analog technology.

When it comes to high-speed links, which connect sensors to ECUs, the industry demands high bandwidth, zero latency, and error-free links. The bandwidth scalability is much more possible with VLN digital technology deployed today of 8-Gb (moving to 16-Gb and then 32-Gb in the future), whereas its competitors are struggling to scale up the bandwidth from an electromagnetic interference immunity standpoint. Valens enjoys a significant advantage. One of the major challenges facing the automobile industry in the future is electromagnetic interference. To ensure that the ADAS systems are immune to internal and external noise, you’ll need high-reliability high-speed connectivity.

Valens’ competitive advantage is based on their chip’s DSP-managed physical layer, known as the PHY.

Financial Results

Valens’ top line increased by 33 percent annually from 2010 to 2021, rising from $3 million to $67 million.

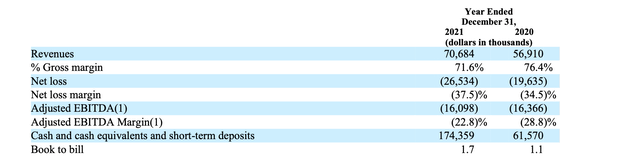

Here is a snapshot of the company’s key financial metrics, as per its 20F 2021 SEC file.

Valens’ Financial Metrics (Valens SEC file)

Q1 2022 revenues came at $21.6 million up 61.8%% YoY, net loss was $5.05 million compared to a loss of $6.4 million in Q1 2021.

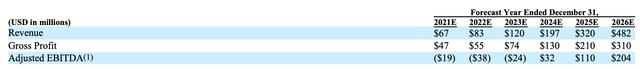

It is worth mentioning that management has beaten projections a couple of times and also raised guidance for 2022. Here below is a snapshot from the company’s F4 SEC document in which the company initially presented its revenue, gross profit and EBITDA.

Management Estimates and Projections (Valens)

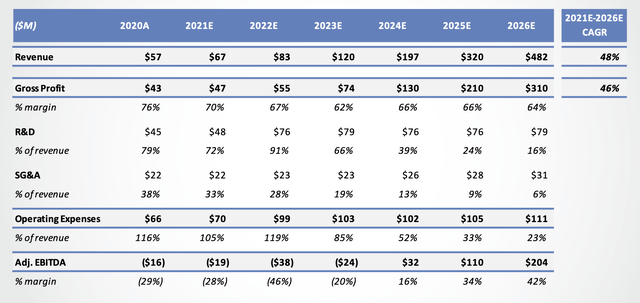

Estimates for 2021 were exceeded as the company recorded $70.7 million in revenues, $50.6 million in gross profit. Valens recently increased its 2022 revenue and gross profit estimate to more than $87 million and $58 million, respectively. Management expects a 48% revenue CAGR from 2021 to 2026.

One critical item to note is that all predicted revenues between now and the end of 2023 are based on existing contracts and goods, as per management indication. As a result, revenue is not contingent on the success of new product development and market introduction.

This leads me to believe that the revenue predictions in the table above do not take into account the opportunity to penetrate new markets or identify further applications for Valens’ chips, something that however is already happening (e.g medical imaging). As I stated at the outset, you will be able to use Valens’ chips whenever you need to transfer massive amounts of data with zero or near-zero latency at a very low cost.

On the balance sheet side, the company has strong liquidity and no debt. Cash stands at more than $165 million.

Inventory has increased for two primary reasons.

- The company kept a steady flow of orders to its supply chain partners in order to keep pricing stable;

- The company stocked up on raw materials in anticipation of an enhanced order flow.

In fact, inventory totaled $9.3 million in FY2021, with “work in process” inventory accounting for half of the total, signalling management expectations in increased demand for VLN products.

The company currently burns cash, in 2021, it burned roughly $21 million.

Valens’ Book to Bill ratio has been strong and improving in recent years. The company’s book to bill ratio was 0.94 in 2019, 1.1 in 2020, and 1.7 in 2021.

Management has declared that it does not expect any dilution until at least 2024, or until it can generate cash which I expect to happen after 2024, as R&D expenses will start to decline by then.

Why Did the Stock Go Down?

Aside from the general market downturn, I believe there are two key idiosyncratic explanations for VLN stock’s steep decline (about 60% YTD):

- The lock-up period ended in April, and I am confident that huge blocks of stock were sold into the market by large shareholders, putting downward pressure on the stock price. While a significant shareholder selling stock is not a positive sign, we must consider these sales in the context of the broader market downturn; the profits of those sales may have been channeled to other uses, including meeting margin calls on other positions or similar.

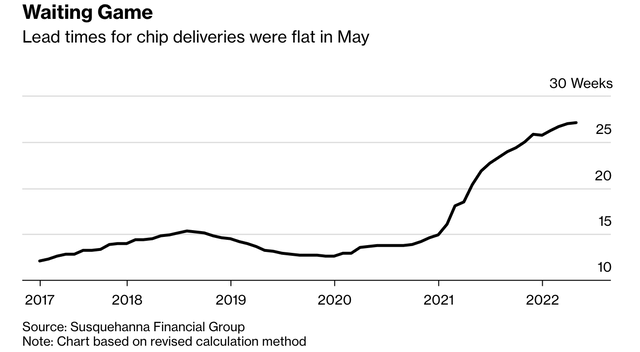

- In 2021 and 2022, chip delivery lead times increased considerably, putting more pressure on the stock price.

The graph below is from a Bloomberg article in which Mercedes’ head of production and supply chain management, Joerg Burzer, stated, among other things, that the supply chain situation was stabilizing and looking better than last year.

Lead times for chips (Bloomberg)

Management has been aggressive in providing positive news releases to counteract the stock price fall. Additionally, in May 2022, Valens’ CEO Gideon Ben Zvi and a member of the Board of Directors, Moshe Lichtman, each bought $100,000.00 worth of stock.

Valuation

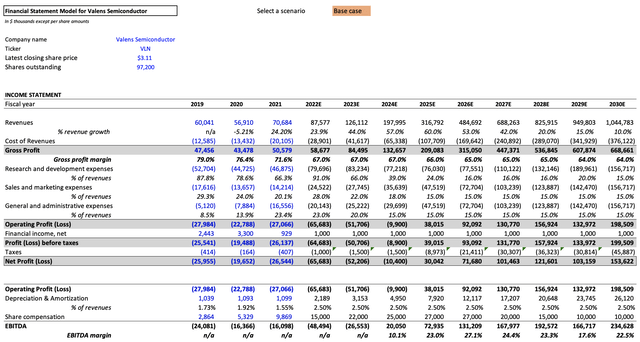

A few things are worth mentioning before getting into the valuation part of the article. I have partially based my projections on management’s statements and F4 filings. The base scenario of my excel model roughly reflects management’s assumptions. I have then tweaked some variables to derive a best case and a weak case. It should be mentioned that management has exceeded its own projections so far. Please keep in mind that management has disclosed sales, OpEx, EBITDA and gross profit predictions until 2026, and just claimed that they plan to be a $1 billion firm by 2030. Everything after 2026, including SG&A, R&D, General Expenses, and diluted stock amounts, is based on my own assumptions.

Management Projections (Valens)

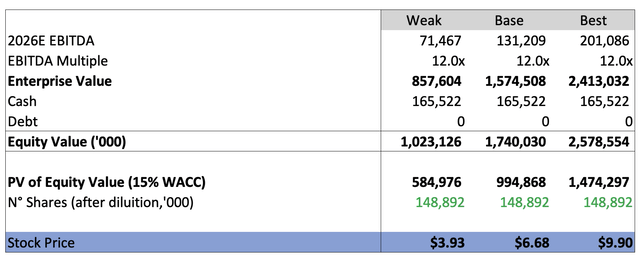

The compressed multiples I’ve used all reflect the semiconductor sector’s lesser attractiveness and the macro issues we are currently confronting. This is also reflected in the WACC used to calculate PV, which is relatively high.

Valens has around $32 million in deferred tax assets against which they have recorded a 100% allowance, while this would become valuable once (and if) the company turns profitable, I have not included their positive effects in my model, in order to increase the margin of safety of my valuation. Israel’s tax rate currently stands at 23%.

Here below are my 3 scenarios (Base, Best, Weak) for Valens’ income statement:

Base scenario,

VLN valuation model, base case (Author)

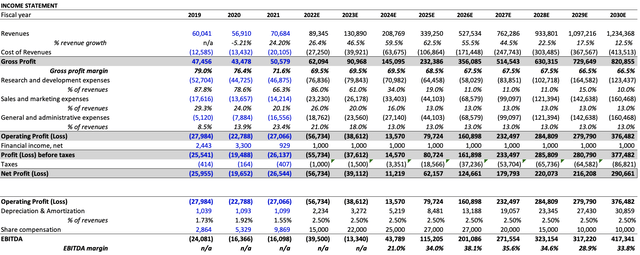

Best scenario,

VLN Income statement, best case (Author)

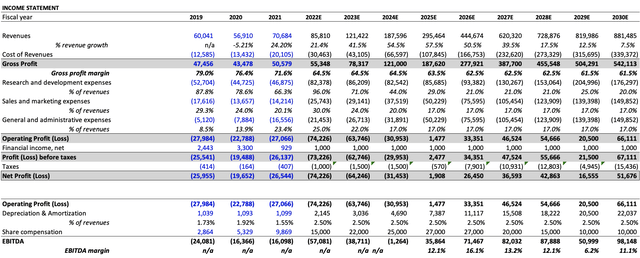

and finally, weak scenario.

VLN Income statement, weak case (Author)

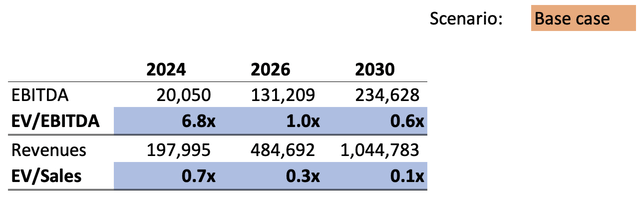

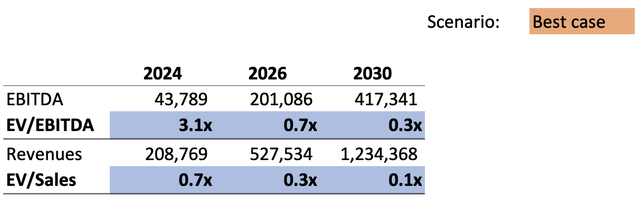

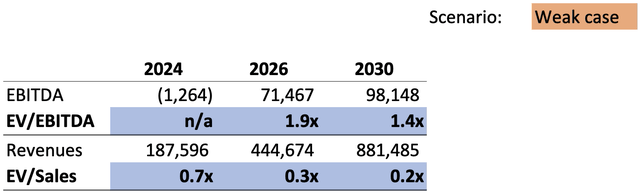

We now turn to some valuation metrics, the company’s current Enterprise Value is:

This represents a serious discount from the $900M valuation at which the company became public.

These are the EV/EBITDA and EV/Sales multiples compared to the 2024, 2026, and 2030 projections, respectively. Based on these multiples, the company is selling at a discount to the industry’s five-year average multiples for those ratios: 4x EV/Sales – 13.2x EV/EBITDA

Base case,

Best case,

Weak case,

As a reference, in February 2022, Intel Corporation (INTC) announced the all-cash acquisition of the Israeli company Tower Semiconductor Ltd. (TSEM). Tower Semiconductor Ltd. develops and sells analog-intensive mixed-signal semiconductors. The entire consideration was $5.4 billion, representing a 12.2x EV/EBITDA multiple and a 3.6x EV/Sales multiple.

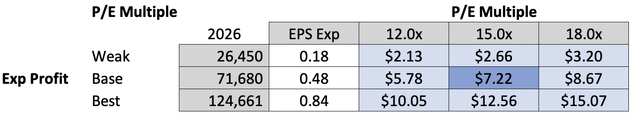

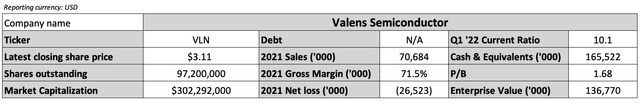

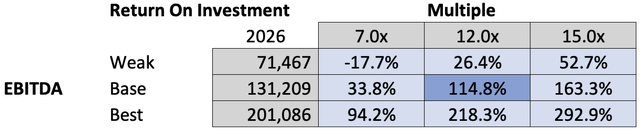

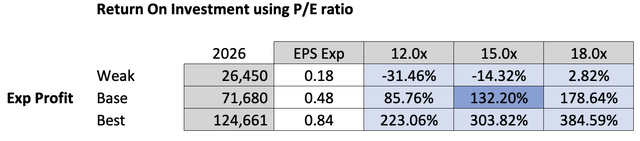

To come up with a target price for Valens’ stock, I used two methods. A discounted EV multiple (using alternative multiples of 7x, 12x, and 15x) and a more plain P/E multiple (using different P/E ratios of 12x, 15x, and 18x) were calculated based on the expected EBITDA and Net Profit in 2026.

Given the compression in those multiples that I expect to occur as a result of higher rates, the multiples utilized are relatively conservative.

Discounted equity value. The number of shares is projected to increase as a result of stock based compensation (Author)

The following table summarizes different theoretical stock values for different EBITDA multiples,

Stock prices for different EBITDAs and multiples (Author)

Presented below are the returns for the relevant stock prices shown above,

We now turn to a P/E multiple valuation method. Given the expected net incomes for 2026, the theoretical stock values for a given P/E ratio are:

Theoretical stock prices, P/E valuation multiple (Author)

And the relevant returns are:

Based on everything presented thus far, I believe a PT of $6.7 is reasonable, representing a potential return of ~115%. Buying at the current valuation provides investors with an attractive risk/reward profile.

Competitors

These are Valens’ primary competitors. I’ve already discussed how and why Valens’ technology is superior than those of its competitors. Their respective valuation measures are shown below. Some of these firms have a significantly higher market capitalization and a more diverse revenue mix; some even have debt. Valens is debt-free.

Data is from Bloomberg.

VLN: P/B 1.7 – P/S 3.5 – Market Cap $302.3M

ADI: P/B 2.01 – P/S 7.03 – Market Cap $74.6B (1.94% dividend yield)

TXM: P/B 9.98 – P/S 7.37 – Market Cap $139.6B (2.9% dividend yield)

TSEM: P/B 3.06 – P/S 3.2 – Market Cap $5.07B

SKYT: P/B 4.3 – P/S 1.3 – Market Cap $265.2M

Risks

- Market downturn continues

- Higher rates cause a compression in valuation multiples

- Inflation

- Supply chain disruption caused by Chinese lockdowns

- Competition

- Europe low auto sales

- Large shareholders may continue to sell, putting additional downward pressure on the share price

- The Fed and other central banks fail to structure a soft landing, causing economies to enter recession.

Conclusion

Valens Semiconductor operates in a rapidly developing market that is now being hampered by chip shortages, inflation, and macroeconomic instability. This, I feel, is reflected in the stock price, which has recently plummeted. This could be an intriguing investment to explore if you have a long investing horizon and a reasonable risk tolerance. In the previous three months, the company’s valuation has dropped dramatically, to the point where I believe it has become excessive. This was exacerbated by the end of the lock-up period and the NASDAQ’s poor performance. The latter has created a climate of indiscriminate selling, which I believe is creating opportunities to buy companies with great potential at a reasonable price.

Be the first to comment