RHJ

Introduction

The last half-decade has been a volatile ride for Antero Resources (NYSE:AR) but following the events in Eastern Europe earlier in 2022, the outlook for their gas demand has never been stronger, which conveniently coincides with management making shareholder returns a focus. Despite still not paying any dividends to instead favor share buybacks, when digging deeper, they appear to be a diamond in the rough with massive potential for shareholder returns in future years.

Executive Summary & Ratings

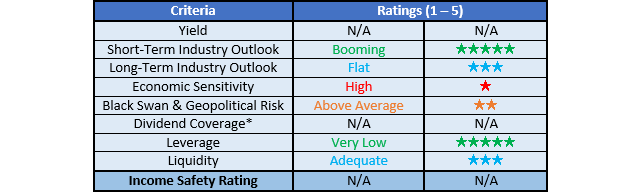

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

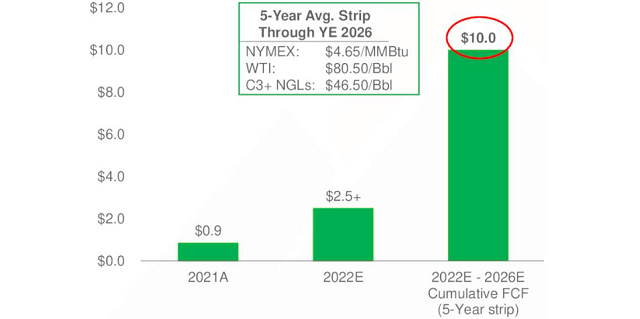

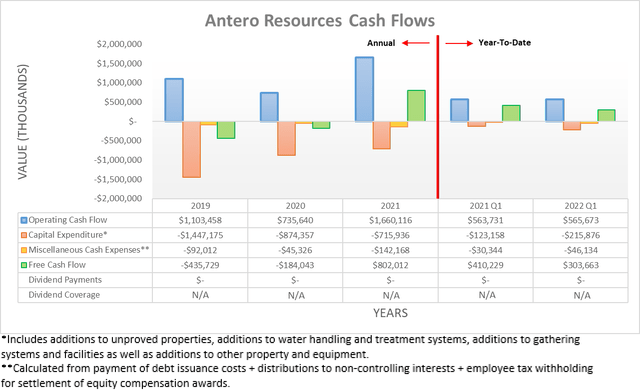

Quite unsurprisingly, as a gas producer, they have seen their cash flow performance fluctuate across the years with their operating cash flow ranging from a low of $735.6m during 2020 as the Covid-19 pandemic weighed down results, before recovering more than 100% higher year-on-year to $1.66b during 2021. Subsequently, the very strong gas prices thus far into 2022 have further improved their operating conditions, notwithstanding the otherwise tragic Russian invasion of Ukraine. Even though their surface-level operating cash flow of $565.7m during the first quarter of 2022 is effectively unchanged year-on-year versus their previous result of $563.7m during the first quarter of 2021, it was skewed by their temporary working capital movements. If removed, their underlying results were $701.7m and $503.2m respectively, thereby representing a very impressive increase of 39.45% year-on-year. Whilst this volatility is not necessarily ideal, it remains on par for the course for commodity producers, and thankfully when looking ahead, management forecasts years of ample free cash flow as they pass their days of high capital expenditure, as the graph included below displays.

Antero Resources May 2022 Company Presentation

Apart from their forecast to generate $2.5b of free cash flow during 2022 at these prevailing operating conditions, management expects this to continue well into the future until at least 2026 with accumulative free cash flow reaching a massive circa $10b. This is supported by their now lower capital expenditure, which is forecast to total $3.388b at the midpoint during 2022-2026 or $668m per annum, as per slide thirteen of their May 2022 company presentation. Back during 2019 and earlier years, they routinely spent $1b+ with even the $874.4m spent during the severe downturn of 2020 materially higher than forecast going forwards.

Very importantly, it can also be seen that their free cash flow estimation was based upon gas prices of only $4.65mmbtu and oil prices of circa $80 per barrel, both of which are far lower than their current levels of over $7mmbtu and $100 per barrel respectively. Following the events in Eastern Europe that have caused a global energy shortage, these price assumptions appear quite conservative, and thus if anything, their results are more likely to be higher than lower than estimated but even if they are only broadly in line, shareholders are still beginning to receive a tidal wave of cash, as per the commentary from management included below.

“…we expect to use approximately 25% of Free Cash Flow for share repurchases until the borrowings on our credit facility are repaid. Our current estimate forecasts the credit facility to be repaid later in the second quarter and we then intend to increase our return of capital to greater than 50% of Free Cash Flow.”

– Antero Resources First Quarter Of 2022 Results Announcement.

After years of providing no dividends nor any significant share buybacks, this is finally set to change during 2022 and beyond with management rolling out their new shareholder returns policy. Since we are now in the early weeks of the third quarter of 2022, they should have repaid their credit facility and thus now be returning half of their free cash flow via share buybacks, which amounts to $1.25b if their guidance for $2.5b of free cash flow comes to pass. At the moment, their current market capitalization is only approximately $10.5b and thus this equates to a very high circa 12% shareholder yield, which is especially impressive given that half of their free cash flow is still retained for deleveraging. Since this means they have a massive 20%+ free cash flow yield, it begs the question of whether dividends will one day become part of their shareholder returns policy, which was asked by an analyst recently, and thankfully the door remains open, as per the commentary from management included below.

“Well, I think anything with a 25% free cash flow yield qualifies is being undervalued, also sub four times EBITDA.”

“So we should be buying back shares as quickly as we can. And so, that’s what we’re doing. Once the $1 billion is done, of course, we’ll reassess, look at it in that time frame. Once that is exhausted and see what further return of capital strategies we have, but we’re firmly behind this first initial $1 billion share buyback program.”

– Antero Resources Q1 2022 Conference Call.

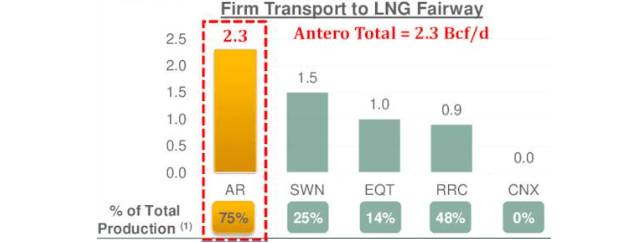

It can be seen that whilst management intends to complete their existing share buybacks as fast as possible due to the appeal of their massive 20%+ free cash flow yield, they have still left the door open to see dividends in the future. Obviously, no one knows exactly when this would come to fruition but it nevertheless keeps income investors such as myself hopeful and interested in their otherwise desirable characteristics. I would normally not be a fan of their complete weighting towards share buybacks as they are a commodity producer, due to the inherent volatility of gas prices and by extension, their free cash flow and share price because this tends to result in more share buybacks at the top of the cycle, thereby overpaying. Although I feel an exemption is warranted in this situation given their exposure to LNG, as the graph included below displays.

Antero Resources May 2022 Company Presentation

It can be seen that unlike their peers, 75% of their production has access to LNG transport and this places them in a poll position to help Europe transition away from Russian gas. Whilst this geopolitical situation is rapidly evolving month to month, when looking further ahead into the medium to long-term, it is now already widely known that Europe will transition away from Russian gas as soon as possible. This lifts the outlook for LNG demand from the United States and by extension, the free cash flow outlook for their domestic gas producers. Despite not necessarily removing the inherent volatility of the industry but nevertheless should help keep downturns less severe and shorter, thereby meaning that a weighting towards share buybacks is not as undesirable as for other commodity producers.

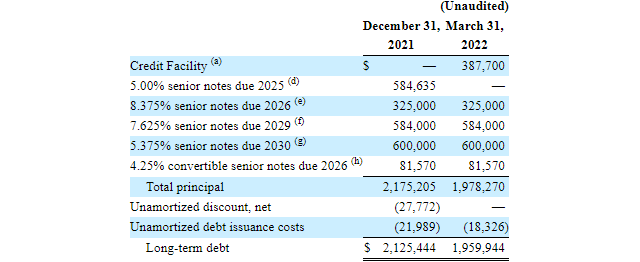

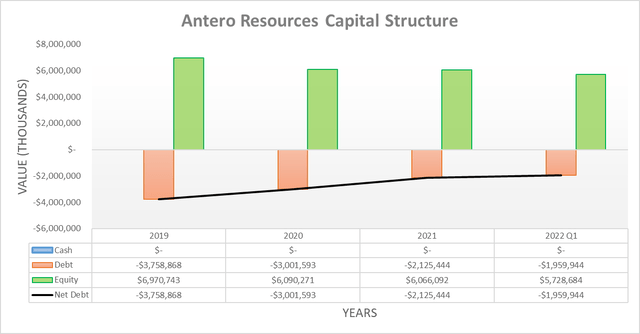

Even though shareholder returns are the name of the game in the medium to long-term, thankfully their absence was not without its benefits as their capital structure was significantly cleaned up. After once carrying $3.759b of net debt at the end of 2019, this was already reduced to $2.125b at the end of 2021 and following the first quarter of 2022, this dropped even lower to $1.96b.

When looking ahead, if they return half of their free cash flow via share buybacks their net debt will obviously continue its downwards march. If they achieve their 2022 guidance for free cash flow of circa $2.5b, this should translate into circa $1.25b for the full year and since they have already repaid $165.5m of net debt during the first quarter, this should see at least another $1b during the last nine months and thus see the year ending with net debt of only around $1b. Unless gas prices face a prolonged crash, which is not looking likely given the events in Europe, this trajectory sees them reaching zero net debt towards the end of 2023. Once reaching this point, it stands to reason that management will boost their shareholder returns even higher, quite possibly to 100% of their free cash flow given the lack of competing uses, which is a very desirable prospect given their massive 20%+ free cash flow yield.

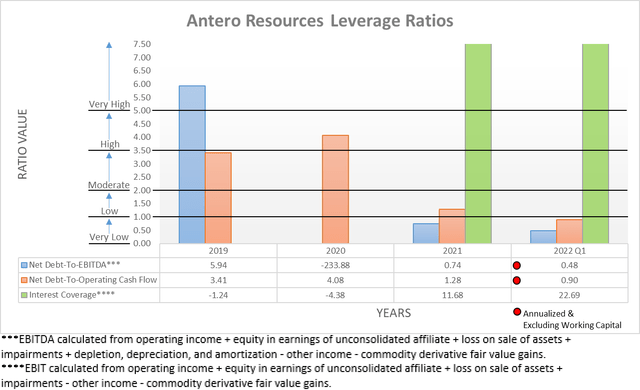

It was a given that their stronger financial performance and lower net debt would work together to push their leverage lower, thereby significantly strengthening their financial position and by extension, strengthening their prospects for shareholder return. When ending 2019, they faced the ensuing Covid-19 pandemic with very high leverage given their net debt-to-EBITDA of 5.94 sitting well above the applicable threshold of 5.01. Thankfully this is now an issue of the past with 2021 ending with a net debt-to-EBITDA of 0.74 and a net debt-to-operating cash flow of 1.28, which have both decreased further during the first quarter of 2022 to now sit at only 0.48 and 0.90 respectively. Whilst these are now already beneath the threshold for the very low territory of 1.00, they should obviously keep trending even lower during the remainder of 2022 and 2023 as their net debt decreases.

Once reaching net debt of approximately $1b at the end of 2022, even if their earnings were to hypothetically slide back to their level of 2019, their net debt-to-EBITDA would still only increase to 1.58 and thus remain firmly within the low territory of between 1.01 and 2.00. Even without any further deleveraging during 2023, this would significantly reduce the downside risk if weaker gas prices were to strike, thereby supporting the sustainability of their shareholder returns.

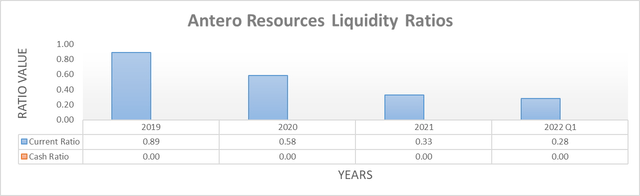

Despite their otherwise very healthy financial position, disappointingly, their liquidity leaves a blemish with their current ratio at a very low 0.28, which has steadily trended downwards each year since the end of 2019 when it was previously 0.89. This is normally associated with a liquidity crisis and thus financial distress, although in this case it primarily stems from their hedging commodity derivatives creating a $1.152b current liability as gas prices surge. Whilst not necessarily ideal, in theory, this is not as concerning as most similar cases with such low current ratios because this liability effectively offsets against the additional earnings they stand to receive from higher gas prices, which means that their liquidity still remains adequate. Thankfully they see no debt maturities until 2026 at the earliest once their credit facility is repaid even if they were to cease deleveraging, as the table included below displays.

Antero Resources Q1 2022 10-Q

Conclusion

Despite not offering anything to income investors in the form of dividends, they still sport many important characteristics of a desirable income investment. Most importantly, ample free cash flow as their capital expenditure winds down right as the outlook for gas demand simultaneously lifts, plus a financial position that is rapidly deleveraging and could reach zero net debt as soon as next year. In my eyes, these make them like a diamond in the rough for a patient income investor, and whilst I would have preferred to see dividends already within their shareholder returns, management left the door open for future years and thus I believe that their massive 20%+ free cash flow yield and rejuvenated financial position makes a buy rating appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Antero Resources’ SEC Filings, all calculated figures were performed by the author.

Be the first to comment