Tim Allen/iStock via Getty Images

The Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE), better known as XLRE, is a real estate ETF that investors might be considering as the economic regime and direction become a greater concern. Cries of recession are certainly mounting, so quality should be at the top of all our agendas. XLRE has that across its four main exposures and should be able to maintain value when down could be the direction for all assets in what might become a scary time of rate hikes and still persistent inflation. Let’s discuss the picture.

Note on the Economic Environment

We aren’t sure exactly what is going to happen. But we maintain that the current inflation is a lot to do with the supply chain, and would be gone if shortages weren’t present. Consider that with irregular lead times, in addition to scarcity, a premium is also paid for the certainty of inventory all of which gets baked into prices and affects inflation. The issue with inflation is that even if it is supply side and fundamentally transitory, an expectations cycle could drive inflation in a persistent manner even once supply side issues pass, so the central banks are beginning to take action.

Markets are expecting only modest increases of inflation. 4% rates are being discussed, but we think that higher rates at perhaps 6% are going to be needed to quell the pent-up demand and reduce goods consumption which is where this inflation is coming from. With inflation creating a lot of uncertainty and rate increases hurting equity values, quality is paramount.

A Look at XLRE

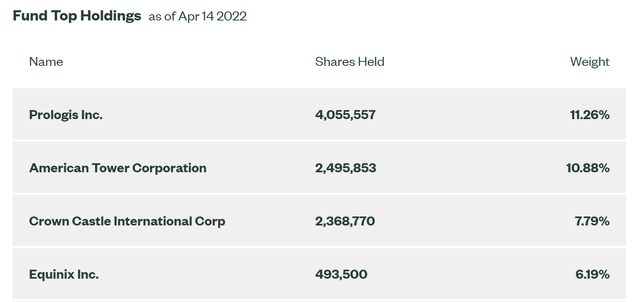

XLRE has that quality. Have a look at its major exposures.

How does XLRE protect your cash?

- Prologis (PLD) – Even if supply chain issues start becoming more controlled with consumption velocity falling with rate hikes, the economy should still be operating at high capacity with employment levels providing a margin of safety. That means that Prologis’ logistic properties like warehouses should continue to have value as the digital economy and e-commerce continue to keep them relevant along the decline of retail, as well as the strategic and political onshoring trend keeping inventory levels held by companies higher than normal.

- American Tower Corporation (AMT) – AMT, much like Crown Castle International (CCI), are companies that own telecom infrastructure. They lease this infrastructure to tenants like Verizon (VZ) and AT&T (T). High-quality tenants for infrastructure that play a key role in delivering mobile services is a very safe market as connectivity demands grow and with rate increases being absorbable by these companies. Moreover, the lease agreements do respond to inflation, so value won’t be destroyed in their lease assets if inflation were to continue.

- Equinix (EQIX) – This is another REIT within the XLRE portfolio that gives you exposure to trends in connectivity. The company builds colocation centers that allow for tenants to peer with each other on mutually beneficial bases in order to save IP transit costs that would otherwise be incurred when getting a peer’s data through the internet backbone. While the company is pretty fairly valued given the current status quo, it would also be fairly valued in more dire circumstances thanks to its great utility, self-financing model, and excellent value proposition.

Conclusions

XLRE is trading just at NAV and has a really low gross expense ratio at just 0.1%. The yield isn’t too bad from the underlying assets either at 2.53%, which is respectable given the quality of the XLRE assets. While XLRE trades at a PE above 45x, this merely reflects the quality in the assets. It is not a bargain, but if you don’t want to speculate by raising cash, quality is king and XLRE has that, albeit recognised by the markets. A modest yield will keep cash flows coming from a REIT-based portfolio that will unlikely fail to make payments, with inflation tailwinds in Prologis if it persists, and plenty of defense in higher rates due to the important industrial value of telco infrastructure and other connectivity and internet infrastructure. If you want to play it safe, XLRE is a buy.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment