Pgiam/iStock via Getty Images

Meta (NASDAQ:FB) stock has been on a bad run since September of 2021, with a drop of around 45%. The stock is setting up for a possible leg lower and a cratering in NFT demand may be a worrying sign.

NFT sales a worry after demand collapses

The arrival of Meta was a company plan to redirect focus from Facebook’s stale social media platform to embrace the metaverse. A key monetization feature of that move would depend on NFTs and digital collectibles sales. The market cheered when Meta was launched amidst a frothy NFT market, but demand has since cratered.

Sales on the market-leading OpenSea platform dropped by 67% over the past 30 days, according to DappRadar. Competition is heating up in the space with platforms offering rewards to lure users away from OpenSea.

Sales on OpenSea, approached $5bln in January 2022, which was a giant leap from only $8mln a year before, but sales halved to around $2.5bln in March 2022 and now the 67% into mid-April. This may be the sign that the ‘Tulip Mania’ bubble has popped for million-dollar JPEG files.

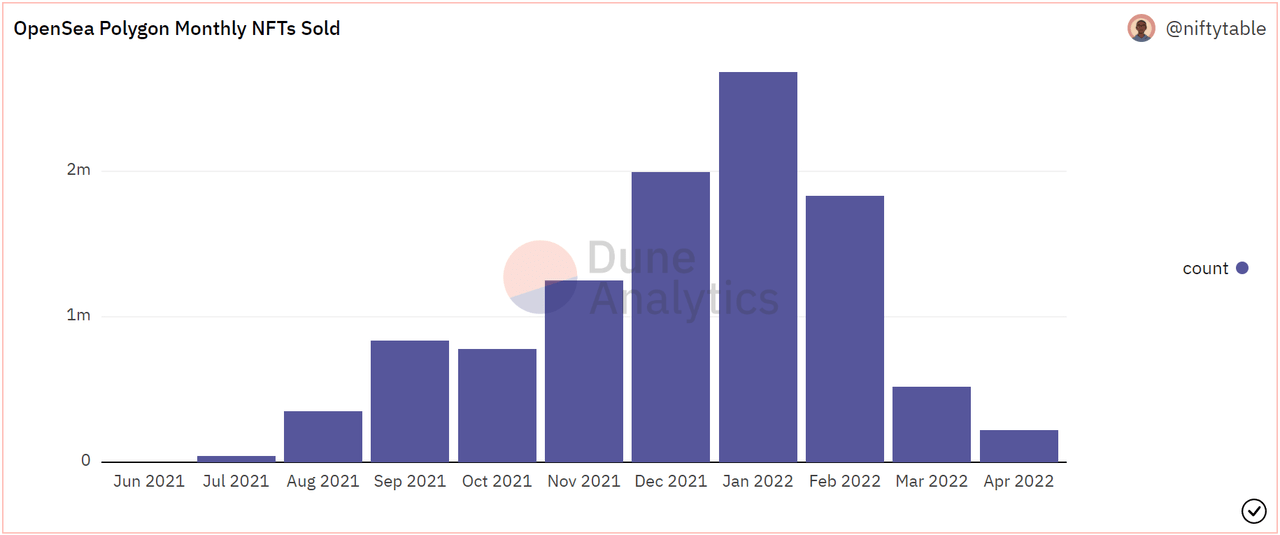

The chart of sales in the Polygon network, which is also a payment option for NFTs mirrored the ETH sales on OpenSea. Sales crossed 2.68 million NFTs in a month in January, but just a little over 500k NFTs were sold last month and sales are approaching June 2021 levels.

Polygon NFT Sales OpenSea (Dune Analytics)

Metaverse worlds have also been a victim of the drop with the Decentraland platform seeing a peak in sales back in November, where plots of land sold for millions of dollars. Notably, that peak came just after the late-October rebrand announcement by Facebook.

The excitement for metaverse projects saw a plot of digital land sell for a record $2.43 million in Decentraland. That purchase has since depreciated by 30%, which would be seen as a depression event in normal real estate markets.

Another investor just saw his investment crumble after purchasing an NFT of the first-ever Jack Dorsey Twitter tweet. The entrepreneur bought the piece for $2.9 million. He put the item up for auction this week and promised 50% to charity. The top bid so far is $6,200.

With competition becoming stiff in the NFT space that could require competitive pricing from Meta to attract users. But wait…

Meta wants a huge cut of content sales

The latest news this week is that Meta also wants to take a huge cut from the sale of NFTs in order to monetize its virtual world.

Its monetization plans were announced in a blog post on April 11th, stating that it is rolling out a test with a “handful of creators” which it will allow to sell virtual items on the platform.

However, the company did not state details of its content cut, however, a Meta spokesperson told CNBC that they are planning a 47.5% take from the sale of NFTs and digital assets on its “Horizon Worlds” virtual reality platform. This would be made up of a “hardware platform fee” of 30% in addition to its own fee of 17.5% for digital items sold through its Quest Store. This caused some outrage amongst the digital content community as the market leader OpenSea takes a 2.5% cut for each transaction, and LooksRare charges just 2%.

There are other platforms involved more in the provision of digital land and none of them are taking such eye-watering fees for content.

Meta’s VP of Horizon, strangely told The Verge, “We think it’s a pretty competitive rate in the market”.

As Facebook said, it is only working with a “handful” of willing creators that are probably just happy to have a foot in the door at the tech giant and the fee structure does not appeal to a wider audience.

Meta CEO Mark Zuckerberg previously criticised Apple for charging developers a 30% fee for in-app purchases in the App Store. He said in a Facebook post in November that Meta was making changes to help metaverse creators evade Apple’s App Store fee but seem to have backtracked.

“As we build for the metaverse, we’re focused on unlocking opportunities for creators to make money from their work. The 30% fees that Apple takes on transactions make it harder to do that, so we’re updating our subscriptions product so now creators can earn more,” he said.

Does the demographic support a metaverse move?

The obvious benefit that Meta has is scale; and that would attract content creators who want to sell small items, rather than one-off pieces of art.

But that will also rely on the demographic that Meta can attract to its platform. JPMorgan offered some hope with a report that said $1 trillion per year could be spent in the metaverse, “in the coming years”.

The Investment bank sees a huge amount of companies entering the Metaverse and said there is currently $54 billion spent on virtual goods every year, almost double the amount spent on music.

“The average price of a parcel of virtual land doubled in a six-month window in 2021 to $12,000,” JPMorgan added. However, that was part of the spike in digital collectibles that has since collapsed, so the jury is out on how much users Meta can attract.

The other thing we have to factor in with metaverse projects and NFTs is that, like most cryptocurrencies, many investors are holding items in the hope of flipping for riches. NFT Stats said there are 6,996 Decentraland owners, owning a total supply of 97,451 tokens. But, how many of those are actively immersed in the project?

Meta’s move to the digital world may just be Facebook in disguise. A project that sees a boom in users but relies on third-party advertisers to pick up the slack in revenues.

The other headwind for Meta’s grand plans are in user privacy and safety- again this is closely tied to its problems with the Facebook platform.

A whistleblower that leaked documents accusing Facebook of failing to protect its users last year lashed out at the company’s virtual world ambitions. Former Facebook product manager Frances Haugen told Politico that the company would need to install a lot of advanced hardware to hoover up data on its Metaverse users, adding:

According to Haugen, the company has made “very grandiose promises about how there’s safety-by-design in the metaverse. But if they don’t commit to transparency and access and other accountability measures, I can imagine just seeing a repeat of all the harms you currently see on Facebook.”

“When we do the metaverse, we have to put lots more microphones from Facebook; lots more other kinds of sensors into our homes”.

“You don’t really have a choice now on whether or not you want Facebook spying on you at home. We just have to trust the company to do the right thing,” she added.

Is the Meta rebrand just a new and advanced way to hoover up and monetize customer data and habits, with some gimmicky trinkets for sale on the side?

Metaverse is in its infancy and the company will have to give some clarity on how it intends to police things such as bullying and hate speech.

The company is obviously targeting a younger audience who wants to burn money and time in a virtual universe.

Zen Internet highlighted recently that 18 percent of 16-24 year olds are already using a virtual platform, and a quarter will spend at least an hour on it by 2026. This comes after Facebook lost half-a-million digital daily users according to its latest report, with teens declining 13 percent since 2019 – projected to drop by 45 percent in the next two years.

Meta could see another leg lower

The current state of play for Facebook is a market capitalization of $583bn and a price-to-earnings ratio of 15.2x.

The company has recently released a statement that it will release its Q1 results on April 27. So, what can we expect from the tech giant in 2022?

There is growing consensus on Wall Street that Meta Platforms is headed for another tough quarter. In the recent fourth quarter results, the company’s Q1 forecast was well short of previous analyst estimates.

The company warned that 2022 revenue would take around a $10 billion hit after Apple’s (AAPL) moves to tighten privacy for iPhone users, making it harder for Facebook to target phone users for consumer activity-based advertising. The company also warned that results could be affected by advertisers cutting their budgets in the face of rising inflation and supply chain issues. There was also talk of growing competition from the short-video giant TikTok.

RBC Capital and Oppenheimer have both cut their estimates for Meta’s first-quarter results.

It is clear on a macroeconomic front that any fourth quarter gloom that the company envisioned has materially worsened. At the time of writing their Q1 earnings forecasts, US inflation was around 7% but has worsened to 8.5% with a Federal Reserve that is projecting two 0.50% interest rate hikes in May and June. The Russia and Ukraine situation only emerged in late-February and that was also not accounted for. It has been said that up to 11 million Ukrainians have been displaced from their homes, from a country of 26 million Facebook users, which could put a dent in user growth for the platform.

It is clear that Meta has headwinds to user growth and ad revenue and the damage may not be seen until the second quarter results.

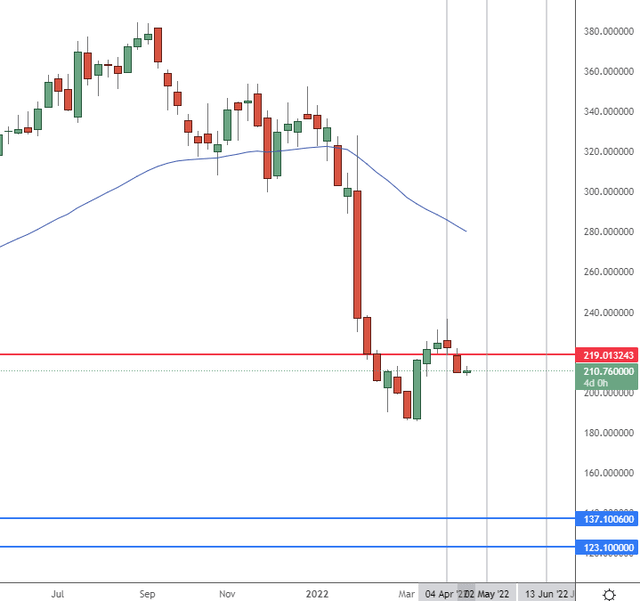

In my weekly newsletter, I use a proprietary algorithm which called for a potential turn in Meta around the 4th of April. The next targets are into mid-June for a low at the earliest. I see a potential leg down when analysts get the first, and possibly, also the second quarter results and support lies at the $123-137 level.

Meta W Chart (TradingView, Author)

Conclusion

Facebook’s grand rebrand to a metaverse world was announced at the ideal time with a booming investor appetite for NFTs and digital land. That appetite received a last spike in sentiment after the company’s announcement but sales of digital collectibles have since collapsed.

Meta will also face competition in a digital-based universe but wants to take a near 50% cut from content creators, which may drive many to decentralized spaces. That will mean Meta has to rely on the 18-24 age group, but the platform will face the same privacy criticisms as Facebook.

In the short term, the platform faces problems from the rise in inflation and coming interest rate rises that will put pressure on advertisers to tighten their belts as businesses react to the new hawkish central bank outlook.

Be the first to comment