AutumnSkyPhotography

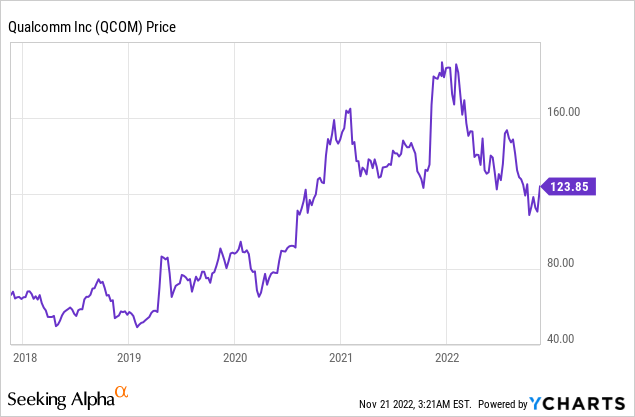

Qualcomm (NASDAQ:QCOM) is a leading semiconductor chip designer which powers the Samsung Galaxy Smartphone series and Meta’s Quest VR headset. The company recently generated solid financial results for the fourth quarter, which given the cyclical decline in semiconductors is a huge feat. Despite this, the company’s stock price is down 34% from its all-time high in January 2022. Qualcomm is poised to benefit from the growth across multiple industries from 5G to IoT and even the Metaverse. Thus in this post, I’m going to break down the company’s most recent earnings report in granular detail, before revealing the stock’s valuation, let’s dive in.

Fourth Quarter Earnings

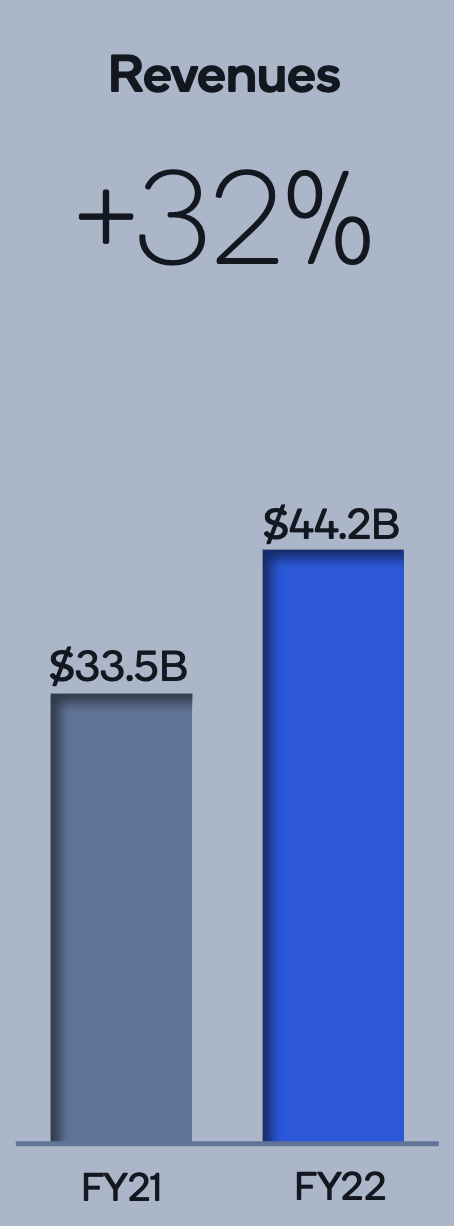

Qualcomm generated solid financial results for the fourth quarter of fiscal year 2022. Revenue was $11.39 billion, which beat analyst expectations by $19.96 million and increased by a rapid 22% year over year. For the full fiscal year 2022, revenue was $44.2 billion which increased by 32% year over year.

Revenue Qualcomm (Q4,22)

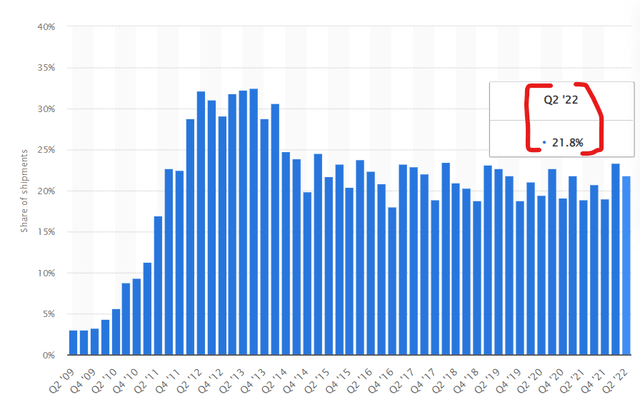

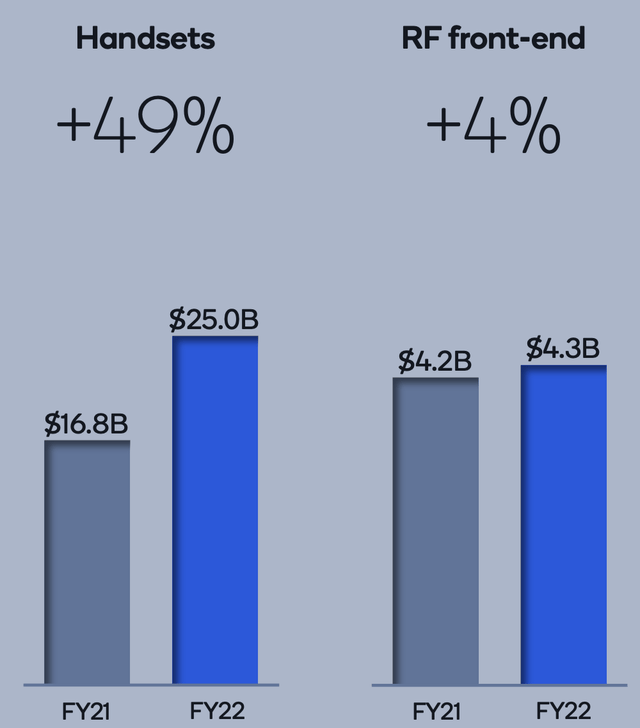

Top-line Q4 revenue growth was driven by solid Handset revenue of $6.1 billion which increased by a rapid 59% year over year. For the full fiscal year of 2022, revenue was $25 billion which increased by 49% year over year. Qualcomm announced an extended agreement (up until 2030) with Samsung to power its 5G and even 6 G-enabled devices, with its Snapdragon platform. This also includes other Samsung devices such as tablets, PCs, and extended reality devices. This is significant for a couple of reasons, firstly the agreement locks in potential cash flow until at least 2030, which is great for revenue stability. Secondly, most smartphone users have the choice between two major providers, Apple with the iPhone (~50% market share) and Samsung devices which make up 21.8% of the global smartphone market. Therefore a bet on Qualcomm is really a bet on the future of Smartphones and Samsung as a whole.

Samsung market share (Statista)

In Q4,22 RF Front end revenue was $922 million, which increased by just 9% year over year. For the full fiscal year RF front-end revenue was $4.3 billion which increased by 4% year over year. The main headwind against this segment was channel inventory issues.

Full Year 2022 Revenue by segment (Q4,22 report)

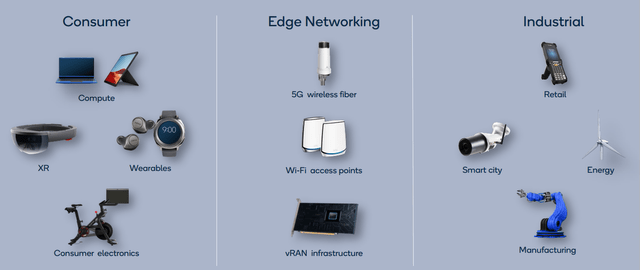

A criticism for Qualcomm in the past has been its large concentration of revenue from handsets which made up ~54% of sales in Q4, FY22. The good news is management has made it a strategic priority to grow its Internet of Things [IoT] segment and Automotive segment to diversify its revenue. Management has been executing well so far with IoT revenue increasing by 24% year over year to $1.9 billion. IoT devices consist of portable devices such as wearables to 5G wireless access points and even smart security cameras. These devices usually require high performance, with lower power consumption, and thus are perfect for Qualcomm’s Snapdragon platform. The IoT industry is forecasted to grow at a rapid 22% compounded annual growth rate (CAGR) and be worth over half a trillion dollars by 2027.

Virtual Reality headsets are also a key type of IoT device and the perfect application for Qualcomm’s custom Snapdragon XR platform. Qualcomm powers “virtually all” commercially available extended reality devices. In addition, the company recently announced a multiyear agreement with Meta Platforms (META) to develop next-generation virtual reality headsets. Zuckerberg even appeared via video at the Qualcomm Snapdragon tech summit.

Snapdragon platform (Qualcomm)

Meta has bold plans to invest up to $100 billion ($10B/year) over the next 10 years into the Metaverse. Whether this investment will pay off financially is unknown, however as Qualcomm will be providing the “brains” of many virtual reality devices it can benefit from this investment either way. This reminds me of one of my favorite quotes of all time, “when there is a gold rush, sell shovels”. During the California gold rush, most “speculators” lost money trying to find and mine gold themselves. However, those that made money were the people selling shovels and pickaxes. I imagine the same will be true for the Metaverse, most companies/products will not generate returns. Therefore if a company sells the “shovels” or processor hardware they will make money either way. The “metaverse” industry was worth $22.79 billion in 2021 and is forecasted to be worth nearly $1 trillion by 2030, growing at a rapid 39.8% compounded annual growth rate.

Automotive is another strong growth segment for Qualcomm, as its revenue grew by 58% year over year to $427 million. This was driven by Qualcomm’s “Digital Chassis” platform which offers connectivity to the next generation of vehicles. Qualcomm has $30 billion design pipeline from 26 global car manufacturers such as BMW, GM, Honda, Volvo, Renault, and even Ferrari.

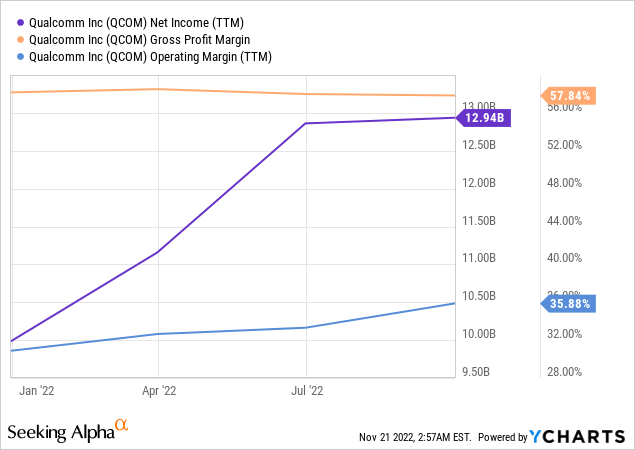

Profitability and Balance Sheet

In Q4, FY22 Qualcomm generated earnings per share of $2.54, which missed analyst expectations by negative $0.24. However, on a “normalized” basis Earnings per share was $3.13 which was in-line with analyst expectations. The company has achieved 500 basis points of EBIT margin expansion from 29% in the fiscal year 2021, to 34% by the fiscal year 2022.

Qualcomm has a solid balance sheet with $6.4 billion in cash and short-term investments. The company does have a fairly large amount of debt ($15.5 billion) but only ~$1.9 billion of this is current debt (due within the next 2 years). Management returned $1.3 billion to shareholders, in the form of $800 million in dividends and $500 million in share buybacks.

Advanced Valuation

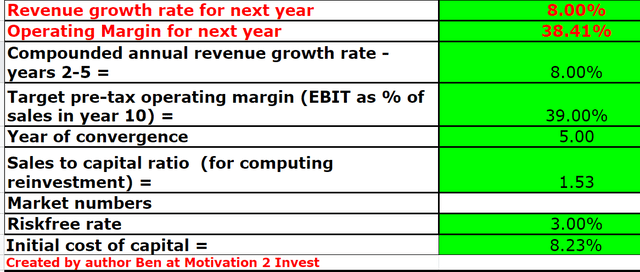

In order to value Qualcomm I have plugged its latest financials into my valuation model which uses the discounted cash flow method of valuation. I have forecasted a conservative 8% revenue growth per year over the 1 to 5 years. These estimates are fairly prudent given the company grew its revenue by 37% in the prior year and IoT revenue is gaining traction.

Qualcomm stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted the company’s operating margin to stay at ~38/39%, but do note this includes an uplift from R&D expenses which I have capitalized.

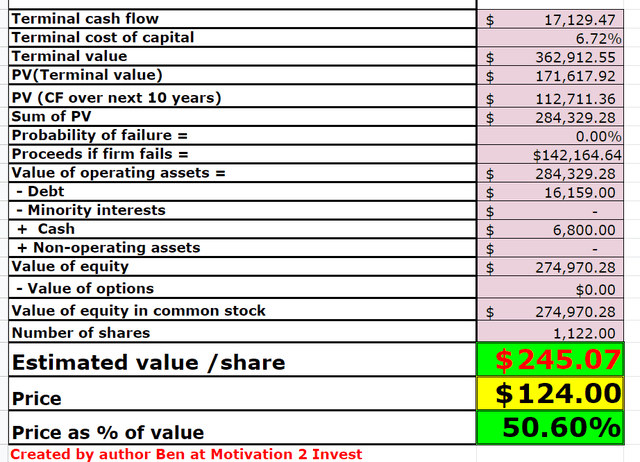

Qualcomm stock valuation 2 (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $245 per share, the stock is trading at $124 per share at the time of writing and thus is ~49% undervalued.

Risks

Recession/Smartphone Demand

Qualcomm still has the majority of its revenue derived from its handset segment and one major customer which is Samsung. Now although the company is diversifying its revenue with its rapidly growing IoT and Automotive segments this is still a short-term risk. There is also a looming recession on the horizon given the high inflation and rising interest rate environment.

Final Thoughts

Qualcomm is a tremendous company that is truly spearheading many technological advances with its Snapdragon chip. Management is executing on its strategy well and the company generated strong revenue growth in the most recent quarter. Its stock price is also undervalued at the time of writing and thus could be a great long term investment.

Be the first to comment