Herbert Pictures/iStock Unreleased via Getty Images

The market for wide body aircraft is currently soft, and it will likely take some years before strength is regained. One of the programs that seems to be suffering significantly is the Airbus A330neo, as I will show in this report.

Major customer downsizes Airbus A330neo order

AirAsia X Airbus A330neo (Airbus)

AirAsia X has been one of the biggest customers for the Airbus A330neo of Airbus SE (OTCPK:EADSY) since its launch in 2014. In December 2014, the Malaysian low-cost carrier ordered 55 aircraft, and a year later, it added another 11 orders to the books, bringing its share in the backlog to nearly 40%. In July 2018, Airbus and AirAsia X agreed to add another 34 units to the order book bringing the orders to 100 units. However, by September 2012, after a review, only 12 units were added, bringing the total number of A330neos that AirAsia X had on order to 78 instead of 100. By that time the share of AirAsia X in the A330neo backlog had already declined to 33%. This, of course, is still significant, as one out of every three orders was destined for AirAsia X.

In 2017, I reported that the AirAsia X order for the Airbus A330neo was at risk. Back then, the main considerations for a review of the order were potential difficulties for sale-and-lease-back transactions for the aircraft because lessors had started accumulating orders for the jet, and possible limitations on the routes to Europe, as AirAsia X eyeballed a very dense configuration pushing the aircraft close to its limits. Less than three years later, the pandemic would start, and AirAsia X had already been charmed by the newly launched Airbus A321XLR, which provides a vehicle that allows for incremental capacity additions.

When the pandemic started affecting the airline industry, I highlighted the order from AirAsia X for the Airbus A330neo to be one of the first that could be prone to cancellation. At the time, I expected that 40 orders could be cancelled. More than 1.5 years later, in November 2021, AirAsia X and Airbus agreed to reduce the Airbus A330neo order to just 15 units and 20 Airbus A320XLRs, implying the cancellation of 63 Airbus A330neos and 10 Airbus A321XLRs. The cancellations, we are now seeing, reflect exactly that.

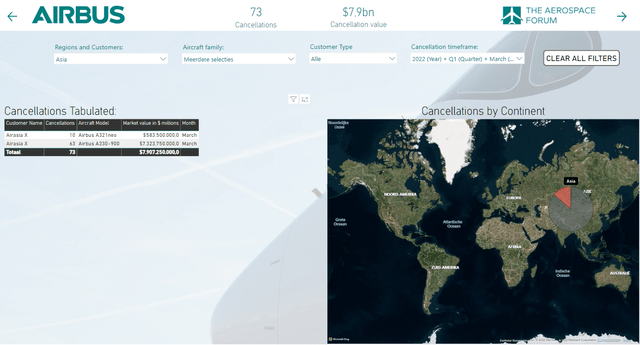

AirAsia X cancellations (The Aerospace Forum)

AirAsia X has reduced its orders for the Airbus A330neo by 63 A330neo aircraft valued at $7.3 billion, according to the TAF Airbus Cancellation Monitors data analytics tool and 10 Airbus A321XLRs valued at nearly $600 million. Interesting to note is that the reduction in cancellations is higher than the minimum of 40 aircraft that I expected to be prone to cancellation. The reason why the number of cancellations is higher is because when I projected 40 cancellations, leaving 38 Airbus A330neo orders on the books, AirAsia X had 38 Airbus A330-300 aircraft in its fleet. Leaving 38 orders on the books would leave the Malaysian carrier with enough orders to replace its previous generation aircraft with more fuel-efficient ones. However, as part of the restructuring of the airline, its A330ceo fleet has now been reduced to just 13 aircraft. The 15 aircraft that are left on order can be used for replacement of those 13 aircraft and account for modest growth in the future. As a result of the cancellation, Airbus has lost 27% of its backlog for the Airbus A330neo.

Obviously, this is a significant loss for Airbus. It is also a blow for Airbus, but the reality is that Airbus has already brought the production rates for the program in line with the new reality for the Airbus A330neo program. The writing has been on the wall for this cancellation for the past 5 years, I would say, and the pandemic really provided the final push.

Conclusion

AirAsia X has always been a big customer of the Airbus A330neo program until now, but there also has always been doubts on the carrier eventually taking delivery of the aircraft it ordered. For some years, I have considered that a significant part of the order would be cancelled, and we are now seeing an agreement between Airbus and AirAsia X about an order reduction reflected in the books. Valued $7.3 billion, the reduction is a blow for Airbus, but one that they did already anticipate as well and, as a result, no changes to the production rates are required.

While cancellations are considered a negative, the cancellations do mean that the quality of the backlog has improved. The future success of the Airbus A330neo is largely going to depend on how Asian carriers, which have been major customers for the Airbus A330ceo, are replacing their fleet.

Be the first to comment