JHVEPhoto/iStock Editorial via Getty Images

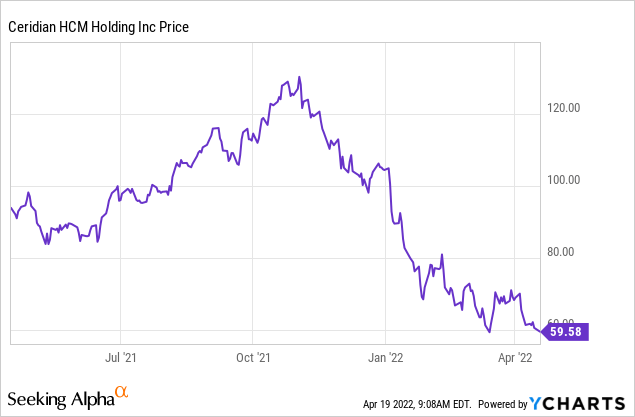

Since November, the market has done a really good job “flushing out” some low-quality growth stocks and returning them closer to their true worth. Such is the case with Ceridian (NYSE:CDAY), an HCM competitor to Workday (WDAY) that has continuously lagged behind its cloud peers. Ceridian, a company that is best known for its Dayforce product that comprises enterprise HR, payroll, benefits management, and other key HR modules, is a relatively less-heard of software stock that had historically somehow managed to command a premium valuation.

One of the few software companies to be based in Minneapolis, Minnesota, Ceridian has always lagged its peers in one key metric: gross margins. While most software companies tout margins in the 70-80% range, Ceridian’s margin profile has always been at roughly half that. With the ~40% year to date decline in Ceridian’s stock, it seems investors have finally caught on to the fact of Ceridian’s disadvantages versus its peers.

I last wrote on Ceridian in November, when the stock was trading at $124 per share. At the time, I had issued a bearish rating on the company, citing a number of fundamental weaknesses plus an extravagant ~13x forward revenue multiple – completely unjustifiable for Ceridian’s growth profile and its margins.

Since then, the stock has shed more than 50% of its value from that peak, so I’m adjusting my rating to neutral as the over-valuation argument is no longer quite as strong.

This being said, I still see a lot of the same fundamental weaknesses in Ceridian, including:

- Weak profile vis-a-vis cloud competitors. HCM is a very crowded space, dominated by the likes of Workday and Oracle (ORCL), and Dayforce is barely a distant laggard.

- Margin lags cloud peers. While Ceridian’s cloud revenue carries a low-70s gross margin like peers, the weighting of Ceridian’s revenue toward float and other lower-margin products puts Ceridian’s overall GAAP gross margin at just 37% in its most recent quarter, far below most SaaS peers and justifying a significant discount in its valuation multiple.

- Weakening adjusted EBITDA margins, and insufficient bottom-line profits to justify valuation anytime soon.

- Confusing leadership structure, with Ceridian just having elevated its COO to co-CEO status, while still reporting to the original CEO (seems like a catalyst for boosted compensation to me). Recent examples like Salesforce (CRM) indicate a dual-CEO structure doesn’t often last or work out well.

And even after the stock’s recent collapse, it’s still too soon to call Ceridian “cheap”. At current share prices near $60, Ceridian trades at a market cap of $9.06 billion. After netting off the $367.5 million of cash and $1.13 billion of debt on Ceridian’s most recent balance sheet, the company’s resulting enterprise value is $9.82 billion.

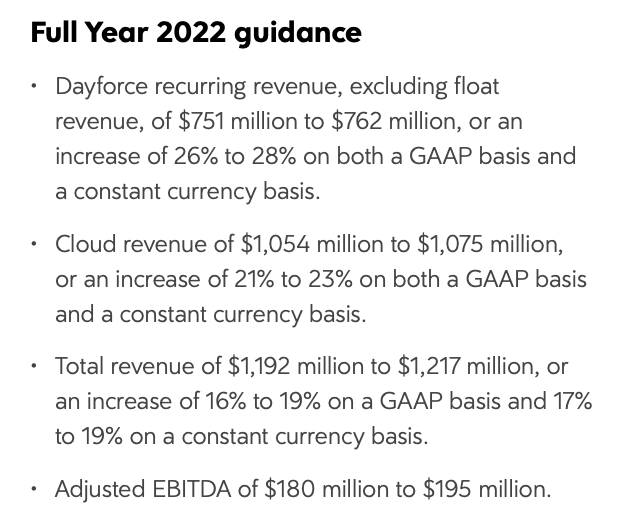

Meanwhile, for the upcoming fiscal year FY22, Ceridian has guided to revenue of $1.19-$1.22 billion, or 16-19% y/y growth:

Ceridian FY22 outlook (Ceridian Q4 shareholder letter)

Against the midpoint of this revenue outlook, Ceridian trades at 8.1x EV/FY22 revenue – which I think is still quite rich for the combination of a high-teens grower with a ~40% gross margin profile. There are SaaS stocks with a similar or better growth profile in the market that are trading at similar or cheaper valuations, that don’t have the margin problem that Ceridian has (Zendesk (ZEN), Avalara (AVLR), Zoom (ZM) and Smartsheet (SMAR) are all examples of stocks that are strictly superior to Ceridian, from a valuation/growth/margin standpoint).

The bottom line here: the sidelines remain the best option for Ceridian. In my view, despite a swift correction since November, Ceridian’s share price still has fat that can be trimmed.

Q4 download

Let’s now go through Ceridian’s latest Q4 results in greater detail. It’s worth noting that this earnings release was a big disappointment; after the release in early February the stock has been in a consistent downtrend and has lost ~27% since then.

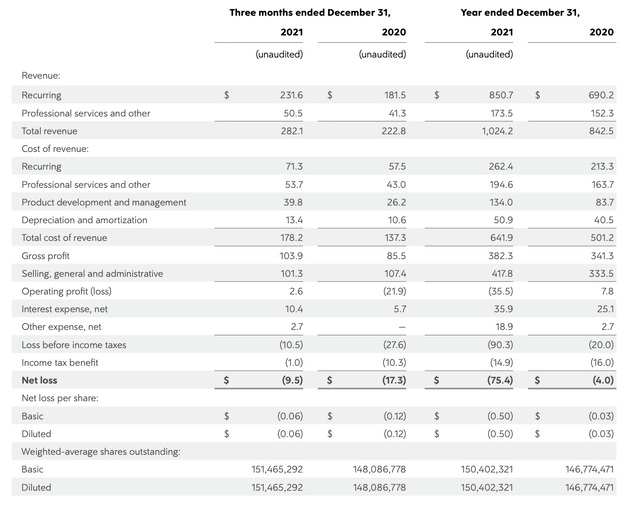

The Q4 earnings summary is shown below:

Ceridian Q4 results (Ceridian Q4 shareholder letter)

Ceridian’s revenue grew 27% y/y in the quarter to $282.1 million, slightly outpacing Wall Street’s expectations of $275.0 million (+23% y/y) and keeping pace with Q3’s 26% y/y growth rate.

Revenue drivers from the prior few quarters held true in Q4. Dayforce, Ceridian’s flagship cloud HCM product, exhibited strong 30% y/y growth in the quarter, while PowerPay, the company’s payroll solution, indexed far below the company’s overall growth rate at just 8% y/y growth. Between these two cloud products, total cloud recurring revenue grew 27% y/y.

Float revenue, however, continued to be in negative territory. The good news here is that Ceridian is expecting slight improvement in float in FY22, driven by higher employment levels in its clients. Rising interest rates don’t help here, as Ceridian noted the majority of its float investments are in longer-term fixed income securities that don’t immediately reprice when interest rates are rising.

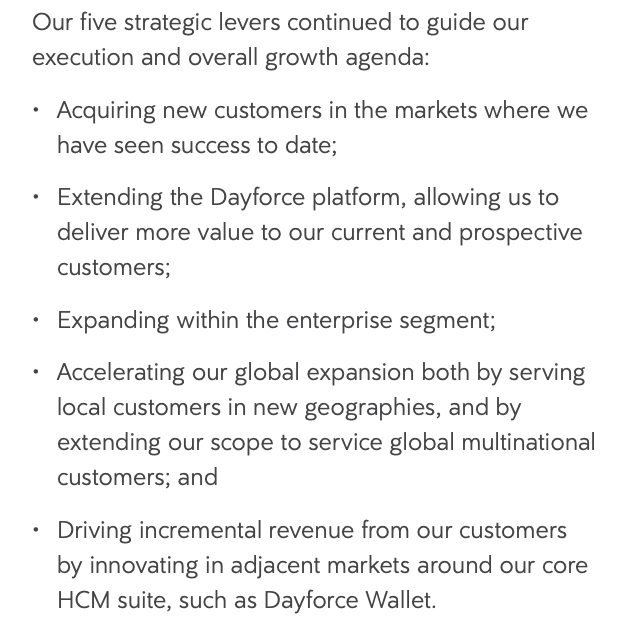

The below snapshot showcases what Ceridian’s five key growth and execution priorities are for FY22:

Ceridian FY22 priorities (Ceridian Q4 shareholder letter)

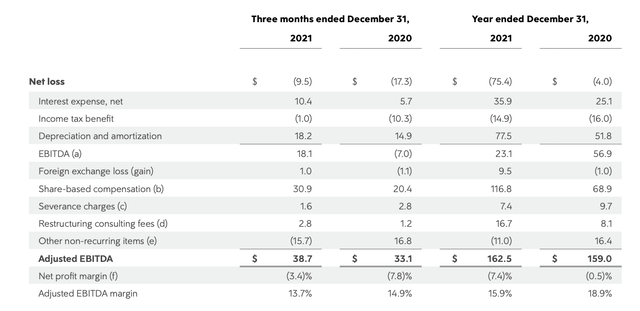

Unfortunately, margins saw a bit of retrenchment in the quarter, which the company attributed to continued investments in sales and product development. Adjusted EBITDA in Q4 still grew 17% y/y to $38.7 million from an absolute dollars standpoint, but margins of 13.7% were 120bps weaker than the year-ago Q4.

Ceridian adjusted EBITDA (Ceridian Q4 shareholder letter)

And for the entirety of FY21, Ceridian’s 15.9% adjusted EBITDA margin was 300bps weaker than the 18.9% in FY20. It’s worth noting as well that Ceridian’s guidance is calling for a continued deterioration in adjusted EBITDA margins: its $180-$195 million outlook represents slight growth in EBITDA dollars, but margins compress closer to ~15% as well. Ceridian, too, will be subject to the wage inflation pressures that are eating up all industries – and given the competitiveness of its HCM space, it won’t find much room to increase its subscription pricing for fear of losing customers to the likes of Workday and Oracle.

Key takeaways

My view of Ceridian as a third-rate competitor in the HCM space is largely unchanged. Though Ceridian has shed a lot of value since hitting peaks above $120 last November, I think the company’s weaker growth and margin profile versus most SaaS peers still leaves its ~8x forward revenue multiple unjustified. Steer clear here.

Be the first to comment