de-nue-pic/iStock Editorial via Getty Images

Introduction

Match Group (NASDAQ:MTCH) has seen incredible growth across the company’s dating platforms. Tinder has led the way with an astonishing clip of 33% over the past five years. But this growth hasn’t translated into the same earnings growth for the company due to many one-off incidents. Even so, if EPS did grow at the same rate as operating income, the business would still trade at a 5.8x PEG despite a 30%+ drop in share price this year.

Historical Performance

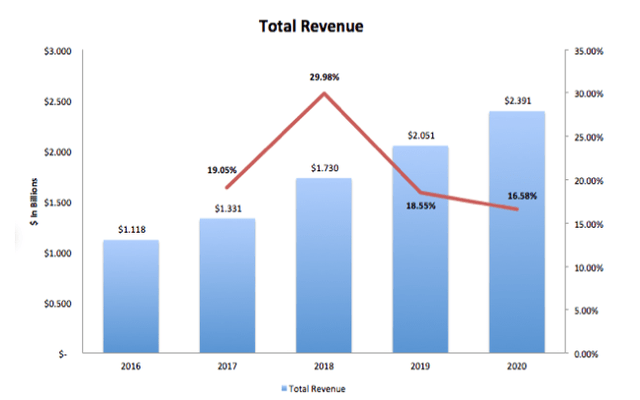

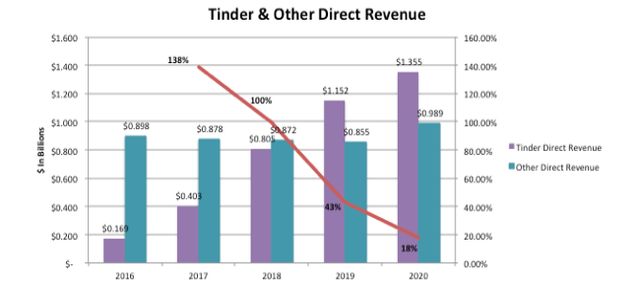

Match Group Revenue (SEC.gov) Match Group Revenue Breakdown (SEC.gov)

As can be seen above match group has seen spectacular growth over the last few years. Total revenue has seen a double-digit growth rate of 16.4% over the period above. This is largely due to the emergence of Tinder across the world. Tinder’s direct revenue grew at a clip of 51.6%. All other brands’ direct revenue saw low growth of 1.95% per year. Indirect revenue (revenue from advertising) has stayed very stable throughout the period, at around $50 million per year. Overall the demand for Match Group dating services has been through the roof, leading to double-digit growth each year.

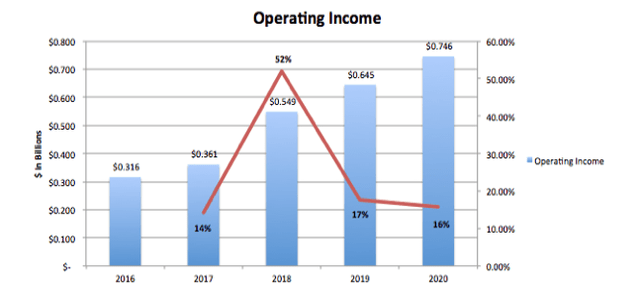

Match Group Operating Income (SEC.gov)

With this top-line growth, one expects similar results flowing through the income statement. Looking at operating income shows double-digit growth every year, and at a clip of 18.7%. Net income, on the other hand, has been growing, albeit in a rather inconsistent manner due to the IAC spinoff.

The Past Year

In 2021, the growth has been still prominent. Total revenue grew by double digits again at 25%. Direct revenue grew by the same percentage amount while direct revenue jumped by 30%. In 2021 Tinder’s revenue was outpaced by the other brands, with Tinder growing 22% and all other brands growing 29%. The biggest thing of importance to me is the fantastic APAC region growth of 41%, as it shows the products Match Group offers are successful in any culture or country.

Operating income grew by another 14% this year. The operating margin has stayed steady at around 30%. But net income for the year dived to just $277 million, a decline of 52.9% This decline was due to a $441 million charge from the settlement of the Tinder employee stock option litigation. Without this charge, net income would look much similar to last year. Altogether, Match Group’s growth rates are holding up very well, which is the bread and butter for investment in the company. While the litigation charge has caused poor results in 2021, without it shows a company finally seeing consistent bottom-line results.

Balance Sheet

The growth of Match Group has been powered by leverage. The company has negative stockholder equity and a debt load of over $5 Billion. But the company can stand this for some time if growth rates maintain. Match Group has good liquidity with a current ratio of 1.04x and a times’ interest earned ratio of 6.52x. This could be better, but paired with double-digit operating income growth is manageable.

Valuation

As of writing, Match Group trades around the $90 price level and has seen a 30%+ stock price decline this year. When last looking into this company, I found it to be way overvalued, but with a third of the market cap gone is it a fair value now? At the current price level, the company trades at a P/E of 96.8X using 2021’s EPS of $0.93. Assuming the EPS can grow at the rate of operating income at 18% per year, the PEG would be 5.4x. Overall, while Match Group has posted incredible growth rates for years and the stock price has dropped by a third, the company is still overvalued.

Conclusion

While the share price has declined by 30%+ and Match group continued to show incredible growth, the stock is still priced too high at 5.8x. This is even using the operating income CAGR as the assumed EPS growth rate, a feat that hasn’t been done year due to one-off events over the past five years. Overall, Match group has incredible operations, but even if consistent profit growth of 18% is realized the stock is still overvalued.

Be the first to comment