Portra/E+ via Getty Images

PolyPid headquarter in Petach Tikva near Tel Aviv, Israel. (© Dr. Kai Blau / BiotechProfSchleuning GmbH, 2022)

Company background

PolyPid (NASDAQ:PYPD) is an Israeli company focusing on the development, manufacturing, and commercialization of novel, locally administered therapies to improve surgical outcomes. Basis of PolyPid’s product candidates is a unique technology platform that is anchored in the surgical site to provide controlled and continuous delivery of medications. Product candidates are designed to address diseases with high unmet medical needs by pairing PolyPid’s platform technology with drugs already approved by the FDA. Lead product candidate is D‑PLEX100, which is currently tested in Phase 3 clinical trials for the prevention of sternal and abdominal surgical site infections ((SSIs)). Interim results of the pivotal SHIELD I trial can be expected as early as May 2022 and topline data will follow at the end of Q3 2022.

This article was co-authored with Dr. Kai Blau, Equity Research Analyst at the German independent investment agency BiotechProfSchleuning. For this article, Kai particularly focused on PolyPid’s scientific approach and available clinical trial data. Kai personally visited PolyPid at its headquarters in Petach Tikvah, Israel, on March 27, 2022 on behalf of BiotechProfSchleuning and talked to Chief Financial Officer Dikla Czaczkes Akselbrad, Chief Commercial Officer Jean-Marc Hagai, and Operations Manager David Rothbard. During this on-site visit, Kai was able to gain a personal impression of the approximately 80-person company and its GMP manufacturing facility.

In the following, we would like to focus on the scientific aspects of PolyPid’s pipeline as well as on the financial situation of the company.

Scientific Approach and Product Pipeline

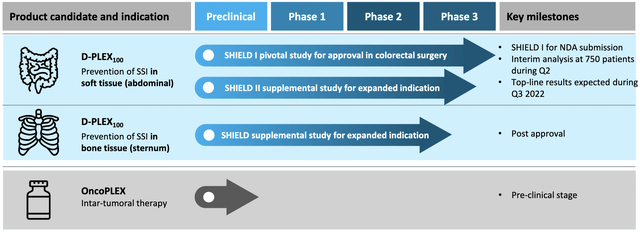

PolyPid develops two product candidates: lead product candidate D-PLEX100 is currently investigated in three Phase 3 trials for the treatment of surgical site infections ((SSIs)); OncoPLEX is investigated as intra-tumoral cancer therapy program targeting solid brain tumors with a Phase 1/2 clinical trial in Glioblastoma Multiforme ((GBM)) patients planned for end 2022. Both product candidates are discussed in more detail below.

PolyPid develops D-PLEX100 currently investigated in three Phase 3 trials for the treatment of surgical site infections (SSIs) and OncoPLEX as intra-tumoral cancer therapy program with a Phase 1/2 clinical trial planned for end 2022. (Source: Corporate presentation, March 2022, page 6)

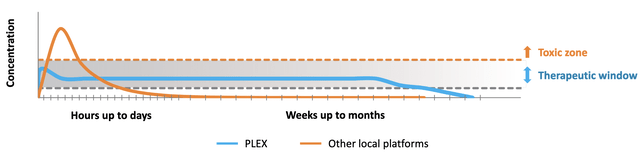

For its product pipeline, PolyPid makes use of the so-called PLEX technology (Polymer‐Lipid Encapsulation matriX). This is a platform technology that contains a matrix of alternating layers of polymers and lipids that entraps a specific drug. PLEX technology forms a protected reservoir that enables a prolonged delivery of drugs over periods of weeks to months. This enables the optimization of drug treatment regimens by predetermining both release rates and durations, which is usually challenging to achieve.

For D-PLEX100, PolyPid uses the PLEX technology to deliver the antibiotic doxycycline for the treatment of SSIs. D-PLEX100 enables an effective, constant, highly localized antibiotic concentration at the target site for 30 days, while maintaining low systemic antibiotic levels, and thus may potentially reduce toxicity and increase treatment safety. OncoPLEX aims to provide local prolonged and controlled exposures of the chemotherapeutic agent docetaxel in the interoperative tumor resection setting.

PolyPid uses the PLEX technology aiming a prolonged delivery of drugs over periods of weeks to months. (Source: Corporate Presentation, page 4)

The biophysical properties of the PLEX technology are described in detail in a 2012 scientific publication in the Journal of Controlled Release. At this time, the release compound was called BonyPid (BNP) and was described as novel approach that combines commercial osteoconductive ceramic tricalcium phosphate (TCP) bone filler granules with an antibiotic loaded into a fine combined polymer-and-lipid biodegradable coating:

By exploiting the exceptionally large surface area of the TCP granules which exceeds 50 m2/g, the fine coating of about 10–20 µm can accumulate into a significant overall mass of 10% of the bone filler, and only 1% antibiotics (100 mg Doxy per 11 g of BNP). This antibiotic dose is much lower than what is administered by other local delivery systems used for the treatment of bone infections.

The main lipid component of BNP formulation is DPPC (16:0 PC 1,2-dipalmitoyl-sn-glycero-3- phosphocholine), which accounts for 60% of the overall mass of the coating and more than 85% of the total lipids. DPPC in combination with PLGA (polylactic/polyglycolide) and cholesterol suggests a highly organized multilayer substructure. Polymer and lipids are organized in the form of multi-alternating layers. The study demonstrated that the antibiotic doxycycline in BNP retained its chemical and biological stability throughout prolonged (several weeks) release (the overall intact doxycycline in BNP at day 21 was 96% of the initial dose) and was also tested in an animal model. This exceptionally good long term in vivo chemical stability is explained by preserving most of the drug in an anhydrous state, protected from water by the alternating polymer/lipid multilayers.

Additionally, this study as well as a follow-up publication showed a dual release profile for BNP, being composed of a fast burst of about 25% of entrapped drug, followed by prolonged zero-order slow release over 3–4 weeks of the remaining intact drug with 3% release per day. Only a low drug dose (3 mg per animal) is given locally as BNP over a much larger dose (up to 10 mg per animal daily for 5 days) administered systemically demonstrating the advantage of BNP.

The exact formulation of the PLEX platform is adapted to the therapeutic agent in question. This means that the formulation between D-PLEX100 and OncoPLEX differs in detail to provide the best possible conditions for the active pharmaceutical ingredient.

D-PLEX100

D-PLEX100 uses the PLEX technology to deliver the antibiotic doxycycline over a long period and thus treat surgical site infections ((SSIs)), the second most prevalent type of healthcare acquired infections ((HAIs)). Currently, D-PLEX100 is tested in three Phase 3 clinical trials. While the SHIELD trial investigates the use of D-PLEX100 against SSIs in bone tissue (sternum) surgeries, the two trials SHIELD I and SHIELD II test D-PLEX100 in soft tissue (abdominal/colorectal) surgeries. SHIELD I is the pivotal trial which will be used as the basis for a New Drug Application (NDA) of D-PLEX100.

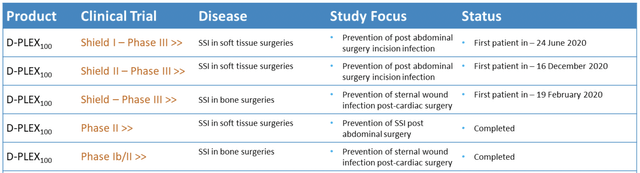

D-PLEX100 has investigated tested in one Phase 1b/2 and one Phase 2 clinical trial. Currently, three Phase 3 trials are ongoing studying D-PLEX100 against surgical site infections (SSIs). (Source: Company Website)

D-PLEX100 has been successfully tested in Phase 1 and 2 clinical trials. The results of a Phase 1b/2 trial (NCT02731573) have been published in October 2020 in the peer-reviewed Journal of Cardiac Surgery. In this trial, 81 patients were enrolled to prevent sternal wound infections ((SWIs)), a harmful postcardiac surgical complication. 60 patients were treated with both D‐PLEX100 and standard of care (SOC) and 21 with SOC alone. Both groups were followed 6 months for safety endpoints and SWI was assessed at 90 days. While the study found no SWI‐related serious adverse events in either group, the incidence of sternal‐related adverse events was significantly lower in the D‐PLEX100 group when compared with the control group (15.0% vs. 23.8% respectively, p < 0.01). There was one case of mortality on day 6 postoperative due to cardiogenic shock in the D‐PLEX100 group, which was not related to the treatment, as assessed by the investigator as well as by the independent ethical committee.

Additionally, the peak serum concentration of doxycycline in patients treated with D‐PLEX100 was about 10 times lower than the value detected following the oral administration of doxycycline hyclate with an equivalent overall dose and followed by a very low plasma concentration over the next 30 days. Doxycycline was detected in plasma for at least 1 month (720 hours) in patients treated with either 10 or 15 g doses of D‐PLEX100 applied to the surgical site.

Most importantly, there were no sternal infections in the D‐PLEX100 group (0/60) while there was one patient with a sternal infection in the control group (1/21, 4.8%). Based on literature, 3 to 5 patients with SSIs were expected in the D-PLEX100 treatment group and 1 to 2 patients in the SOC control group.

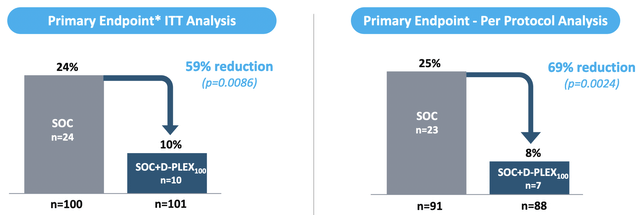

Positive topline data of a Phase 2 clinical trial (NCT03633123) investigating D-PLEX100 for the prevention of post abdominal surgery incisional infections have been announced in October 2019. The primary endpoint was the infection rate as measured by the proportion of subjects with an SSI event within 30 days post-surgery. Mortality within 30 days was considered as treatment failure.

In the Intent to Treat (ITT) population (D-PLEX100 + SOC (n=101) vs. SOC alone (n=100)), the local administration of D-PLEX100 resulted in a statistically significant decrease in SSIs of 59%, compared to SOC alone (p = 0.0086). In the Per Protocol population (D-PLEX100 + SOC (n=88) vs. SOC alone (n=91)), which includes all ITT subjects who completed the study without any major protocol deviations, patients treated with D-PLEX100 achieved a statistically significant decrease in SSIs of 69%, as compared to SOC alone (p = 0.0024).

In a Phase 2 clinical trial, D-PLEX100 achieved a statistically significant 69% reduction in infection rates in the patient population. (Source: Corporate Presentation, page 13)

Within the first 60 days post-surgery, there were five deaths in the SOC treatment arm, as compared to zero in the D-PLEX100 treatment arm (p = 0.029). Moreover, there were no D-PLEX100-related serious adverse events and no increase in wound healing impairment at the incision site as compared to control.

To date (April 2022), the study results have not been published in a scientific journal.

As stated above, D-PLEX100 is currently tested in three Phase 3 clinical trials:

D-PLEX100 is investigated in three big Phase 3 clinical trials to treat surgical site infections (SSIs). (Source: Corporate Presentation, page 15)

The SHIELD I trial (NCT04233424) investigates D-PLEX100 for the prevention of abdominal (soft tissue) SSIs and was initiated in June 2020 with enrollment of the first patient. SHIELD I will be the basis for a New Drug Application (NDA) for D-PLEX100. First, a total of 616 to 900 patients were planned to be enrolled with a blinded sample size re-estimation based on the overall infection rate following enrollment of 500 patients. However, the total number of patients was set to 950 in November 2021. Although the sample size re-estimation after enrollment of 500 patients therefore was unnecessary, at least it resulted in a recommendation to continue the trial by the data safety monitoring committee (DSMC). Moreover, PolyPid announced an unblinded interim analysis following enrollment of 750 patients. This goal was reached on March 2, 2022, resulting in expected interim results in May 2022. Based on the current speed of enrollment, complete enrollment of 950 patients can be expected by the end of May 2022. The company expects topline data for SHIELD I in Q3 2022. However, based on the results of the interim analysis, the DSMC can recommend early trial stopping due to efficacy, futility, or for sample size reassessment of up to 1,400 patients. Thus, final timelines for the trial will be determined following the interim analysis.

The SHIELD II trial (NCT04411199) investigates D-PLEX100 for the prevention of abdominal (soft tissue) SSIs and was initiated in December 2020 with enrollment of the first patient. The SHIELD II clinical trial has broader eligibility criteria than the SHIELD I trial, including minimally invasive surgical procedures. Study design and endpoints of the two trials are the same. In total, 900 to 1,400 patients are planned to be enrolled. In February 2022, PolyPid announced enrollment of 200 patients. Topline data are expected at the end of 2022.

The SHIELD trial (NCT03558984) to investigate D-PLEX100 for the prevention of sternal wound infections in open-heart surgery was initiated in December 2019. The first patient was enrolled in February 2020. Expected enrollment is between 1,284 and 1,600 patients. Enrollment was paused in April 2020 in part due to the prioritization of SHIELD I and SHIELD II trials and in part due to the COVID-19 pandemic. Trial investigators have been informed to continue monitoring currently enrolled patients per the trial protocol. An interim analysis is planned after a total of 850 patients have been assessed for the presence of at least one sternal wound infection or mortality for any reason within 90 days post-surgery. The current state of enrollment is unknown.

OncoPLEX

While clinical trial data demonstrating safety and efficacy are already available for D-PLEX100, OncoPLEX is currently still in the preclinical phase. OncoPLEX is an intratumoral chemotherapy product candidate initially targeting solid brain tumors, including those that are chemotherapeutic resistant. Here, PLEX technology is used to deliver the chemotherapeutic docetaxel in the interoperative tumor resection setting. In a planned Phase 1/2 clinical trial, OncoPLEX will be investigated in patients with Glioblastoma Multiforme (GBM). Usually, these patients receive chemotherapy a few weeks after surgery. Treatment of brain tumors with chemotherapy is limited primarily because of impediments to administration across the blood-brain barrier. In contrast, OncoPLEX will be applied during surgery making it part of the tumor removal process. Thus, the treatment with docetaxel starts immediately after surgery which gives the possibility to potentially delay or even eliminate reoccurrence of the tumor.

In September 2021, PolyPid announced positive preclinical data in two key GBM animal models. According to PolyPid, OncoPLEX induced strong inhibition of tumor growth and recurrence in a partially resected human glioblastoma subcutaneous mouse model. A single local OncoPLEX application induced 98% tumor growth inhibition (day 41 post operation) compared to the untreated control (p < 0.001), and 66% compared to animals that received multiple injections of systemic chemotherapy (p = 0.0165). Survival rate at day 41 was much higher in animals treated with OncoPLEX than in systemic treated mice, or untreated with 60%, 20%, and 10% survival, respectively.

Rat GBM model animals showed a 40% survival rate at day 23 following the beginning of treatment, as compared to a 0% survival rate in the standard systemic treatment arm (Temozolomide 33.5 mg/kg, 5 treatment days), the placebo arm (OncoPLEX without Docetaxel) and in the untreated control arm. Only OncoPLEX significantly enhanced the overall survival compared to both the placebo arm and to the untreated arm (p < 0.02). Importantly, local application of OncoPLEX in a rat brain model evidenced good safety profile at the different doses studied.

PolyPid had a pre-Investigational New Drug (IND) meeting with the FDA in late 2021 about the future development of OncoPLEX. The FDA supported a Phase 1/2 clinical trial of OncoPLEX as a potential part of first-line combination therapy for patients newly diagnosed with GBM. Currently, PolyPid is working on an IND application as well as on the design of the future trial, both of which are expected to be completed by the end of 2022.

Although OncoPLEX appears promising and has demonstrated efficacy and safety in animal models, it is too early at this time to predict success in clinical trials in GBM patients.

Timeline and Catalysts

PolyPid has major, large catalysts coming up in the next few months and additional catalysts can be estimated with relative certainty until mid-2023. For D-PLEX100 and the SHIELD I trial, however, the final timeline will not be determined until the interim results are announced and the DSMC’s recommendation is made, particularly with regard to the number of patients required.

- In May 2022, we can expect the results of the interim analysis of the SHIELD I trial. These results mean a direct preview of the trial’s topline data.

- In late May or early June 2022, complete enrollment of all 950 patients in the SHIELD I trial is expected.

- In Q3 2022, we expect topline data from the SHIELD I trial, likely in September.

- In late 2022, new details on OncoPLEX should follow, presumably with complete IND application and information on the Phase 1/2 study design.

- End of 2022, PolyPid will have a pre-NDA meeting with FDA regarding D-PLEX100

- In H1 2023, PolyPid will submit the NDA application if SHIELD I TLD are positive.

- In H1 2023, the OncoPLEX Phase 1/2 trial against GBM will start.

- In H1 2023, we can expect TLD from the SHIELD II trial. Positive results can be used for an indication extension of D-PLEX100.

In the Q2 2021 financial results and corporate update, PolyPid writes that the FDA agreed that a single pivotal Phase 3 study is sufficient for potential approval of D-PLEX100 for the prevention of SSIs in colorectal surgery:

Received written responses from the U.S. Food and Drug Administration (FDA) to a Type B meeting request submitted following receipt of Breakthrough Therapy Designation for D-PLEX100, regarding the development plan for the Company’s lead product candidate, D-PLEX100. The FDA indicated that PolyPid’s proposal for a single Phase 3 pivotal study, SHIELD I, provided the study results are adequate, would provide sufficient evidence of clinical efficacy and safety to support approval of D-PLEX100 for the prevention of SSIs in colorectal surgery.

From this, it can be inferred that PolyPid will apply to the FDA for marketing approval upon receipt of successful topline data. A New Drug Application (NDA) will presumably be submitted in H1 2023 dependent on positive interim results, a maximum number of 950 patients required as well as on positive TLD. Positive data from the SHIELD II and SHIELD clinical trials would expand the market size of D‑PLEX100 after successful approval, but the study data are not necessary for initial approval.

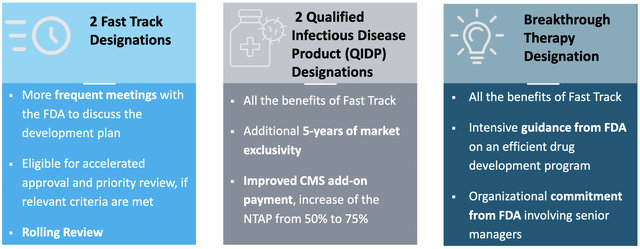

It can be assumed that the FDA review process for D-PLEX100 will be conducted as a 6-month priority review. PolyPid has received several designations from the FDA for D-PLEX100 that qualify the product for priority review:

PolyPid has received several designations from the FDA for D-PLEX100 that qualify the product for priority review. (Source: Corporate Presentation, page 16)

Thus, a PDUFA date in H2 2023 would be quite likely. However, the exact date of the submission of the NDA by PolyPid remains to be defined, as well as the decision of the FDA to accept it and to review it as a priority review.

Market size and Competition

Hospital acquired infections ((HAIs)) are infections that patients acquire when receiving medical treatment in a healthcare facility. According to a 2014 CDC report, about 4% of hospitalized patients in the U.S. suffered from at least one HAI. The report states that 2011, an estimated 648,000 hospitalized patients suffered from 721,800 infections. 21.8% of these patients suffered from SSIs.

SSIs prolong patient recovery and thus cause longer hospital stays. Therefore, according to the WHO SSIs account for an estimated $10 billion of incremental hospital costs per year in the United States and €11 billion per year in the European Union. Directly attributable costs of SSIs range from approximately $11,000 to $26,000 per infection.

SSIs occur in approximately 5% to 30% of soft tissue surgeries, including approximately 10% to 15% of open abdominal surgeries, approximately 15% to 30% of colorectal surgeries and up to 4% of hysterectomies. PolyPid estimates the size of the soft tissue surgery market in the United States at more than 7 million surgeries. Another 4.1 million surgeries are estimated in the EU-5 countries, including France, Germany, Italy, Spain, and the UK. This market size would be covered by the SHIELD I and SHIELD II clinical trials.

PolyPid’s SHIELD trial investigates D-PLEX100 for the Prevention of post-cardiac sternal (bone) SSIs. In the context of cardiac surgeries, SSIs can occur in 5% to 8% of procedures but carry a mortality rate of up to 40% for deep sternal wound infections, which are more difficult to treat than superficial infections. Additionally, in the context of orthopedic surgeries, SSIs can occur in 0.5% to 4.0% of primary hip, knee, and spine surgery and in 10% to 15% of general trauma and open fracture surgery. Orthopedic SSIs are difficult to treat, are associated with lifelong infection recurrence risk of 10% to 20% and increase healthcare costs by more than 300% compared to infection-free patients. PolyPid estimates the bone surgery addressable market opportunity in open heart surgeries and selected orthopedic surgeries at over 6.2 million surgeries in the United States and at over 4.5 million surgeries in the EU-5 countries.

Each SSI episode costs $10,000 to $25,000 but can be up to $90,000. Therefore, the total cost for a hospital could be around $3-10 billion per year. This is roughly translated to an average SSI cost per surgery of $200 to $600.

In PolyPid’s Phase 2 trial, D-PLEX100 achieved ~60% reduction in SSIs. Hence, the break-even price of D-PLEX100 at which hospitals are indifferent between using D-PLEX100 and not using it from an economic standpoint, is around $120 to $420 per surgery. A range of $50 to $200 per surgery or less than half of the break-even price can be assumed, which would make hospitals see a clear economic benefit of D-PLEX100 in addition to other clinical benefits to patients. However, this is a very conservative range. There could be a scenario in which D-PLEX100 is reimbursed by insurance. In such a case, it is more reasonable to assume a pricing closer to the break-event point.

The current standard of care (SOC) for preventing SSIs involves the implementation of a range of treatment and prevention measures before, during and after surgery, including prophylactic antibiotic administration, antiseptic measures, and wound care. There are other approved treatments that can be applied locally during surgery for the prevention of SSIs, including triclosan-coated antiseptic sutures, negative wound pressure therapy, the CleanCision wound retraction and protection system and a resorbable gentamicin-collagen sponge, which is approved in the EU and Canada. Moreover, in orthopedic surgeries approved treatments for localized SSI prevention pair bone cement or bone graft substitutes premixed with an antibiotic.

Other companies probably competing with PolyPid have approved and are developing localized extended-release delivery systems, such as DepoFoam by Pacira Pharmaceuticals, Inc., ZYNRELEF by Heron Therapeutics, Inc., JELMYTO by Urogen Pharma Ltd., and ZILRETTA by Flexion Therapeutics, Inc. However, not all these products compete directly with D-PLEX100.

PolyPid anticipates that D-PLEX100 could be used as a complementary part of many surgical protocols, rather than competitive, in addition to the current standard of care for the prevention of SSIs. This is also reflected in the study design of the Phase 1/2, Phase 2, and Phase 3 trials, in which D-PLEX100 was always tested together with SOC versus SOC alone. The fact that D-PLEX100 is not directly compared against these products in a clinical trial is not a disadvantage for subsequent approval by the FDA, as D-PLEX100 is to be used in addition to SOC, not as a monotherapy.

Financials

PolyPid closed its IPO on the Nasdaq on June 30, 2020. This was the company’s third effort to go public. Its last attempt was in February 2018. However, the company later abandoned its plans citing market conditions as the reason. PolyPid sold 4.3 million shares and gathered $69 million by pricing shares at about $16.

Following this initial offering, price has been going down, marking a market lack of interest. The first public financial announcement (for Q4 2020) since IPO was made on February 10, 2021. There was probably lots of expectations regarding this announcement, but expectations were disappointed by the slow pace of recruitment (100 people in 2 arms) and price per share went down ever since.

Market cap is currently less than half the value it had at IPO ($323 million on June 30, 2020 vs. $92 million on April 18, 2022), which must be a disappointment to the initial investors but what we consider an opportunity at this point in time.

As previously described, the currently ongoing Phase 3 trials investigating D-PLEX100 are based on solid data from Phase 1 and 2 studies. At the same time, key catalysts are just around the corner. Thanks to a recently secured loan facility, PolyPid is able to get by with its current cash reserves until beyond the next major catalysts.

As of December 31, 2021, PolyPid had cash and cash equivalents and deposits in the amount of $32.2 million, down from $66.6 million on December 31, 2020. PolyPid expects that this cash balance will be sufficient to fund operations through the end of 2022, meaning new funding won’t be needed until after the SHIELD I topline data is announced.

However, 2021 PolyPid had averaged operating expenses of $8.6 million per quarter with a cash burn of $5.2 million in Q1, $8.5 million in Q2, $10.9 million in Q3, and $9.7 million in Q4 2021, respectively.

Based on the ongoing clinical trials plus the beginning preparation for NDA application at the end of this year, 2022 expenses can be expected to be around $10 million per quarter. Assuming these facts, PolyPid would have needed new funding before the end of the year. More precisely, PolyPid would have run out of money already in October 2022. Fortunately, PolyPid announced on April 6, 2022, that the company has entered into a secured loan agreement for up to $15 million with Kreos Capital VI (Expert Fund) LP. The loan facility is comprised of three tranches in the amount of $10.0 million, $2.5 million, and $2.5 million, respectively, with a drawdown of the first tranche available upon the execution of the agreement. The second tranche of $2.5 million will be available subject to obtaining positive results from the planned unblinded interim analysis of the SHIELD I trial expected in May 2022. Drawdown of the third and final tranche of $2.5 million will be available subject to obtaining positive topline results from the SHIELD I trial or if other conditions are met. Drawdowns of the second and third tranches can be made by December 31, 2022. CEO Amir Weisberg states that the loan facility extends PolyPid’s cash runway into Q2 2023. Based on the above calculations, it should rather be expected that the funding will now last until the end of Q1 2023 at the most. The decisive factor here is whether the interim results and topline data are positive, as the payout of a total of $5 million is tied to this.

Notably, PolyPid entered a Controlled Equity Offering Sales Agreement with Cantor Fitzgerald & Co. in July 2021.

Within this agreement, PolyPid may offer and sell, from time to time, Ordinary Shares in an at the market (ATM) offering for an aggregate offering price of up to $45.0 million. In its latest annual report PolyPid states that as of February 28, 2022, they have not sold any Ordinary Shares pursuant to the ATM offering. In an interview given in February 2022, Dikla Czaczkes Akselbrad, Executive Vice President and Chief Financial Officer at PolyPid, stated:

We are also evaluating future financial opportunities. We have also filed an ATM program that will allow us to issue shares when the time is right.

Financial situation, while tight, shall allow to fund the company till SHIELD I completion. If results mimic Phase 2 results as we expect, PolyPid should be able to supply the cash required for further funding its operations while the price per share should greatly appreciate as investors measure the potential it has.

- Anticipated market and sales

As shown above, in the U.S. alone around 13 million surgeries are target markets for D-PLEX100.

In a PolyPid market research dated March 2021 done with medical personal (surgeons and non-surgeons) anticipated a wide adoption rate (50%) of D-PLEX100 in Abdominal, Cardiac and Orthopedic surgeries if Phase 3 mimics Phase 2 results.

Therefore, a conservative estimate of the D-PLEX100 unit price would be at least around $200 which would allow hospitals to save at least the same amount in cost of SSI. That would make the U.S. market for D-PLEX100 of around $2.6 billion and $1.7 billion in Europe, so a $4 billion at least worldwide. If 50% of hospital adopt D-PLEX100, a conservative $2 billion yearly sales are expected when the product is widely produced and sold at full capacity of manufacturing.

As of today, market cap is below $100 million and price per share around $5, nearly the third of the IPO price ($323 million). Market has not been very rewarding so far for this stock, despite the fact that recruitment is finally going at a good pace. We can state that this Biotech has been going mostly unnoticed, despite its huge upside potential.

In case of positive SHIELD I interim or final results, we anticipate that this Biotech will not stay anymore unnoticed, be it by the market or by a big Pharma. We anticipate that price per share will greatly appreciate and the volume as well allowing a better liquidity of the stock and a multiple of current market capitalization. Only with current production facility in Israel, PolyPid can produce up to 300,000 vials of D-PLEX100 annually, generating in a very short time frame after D-PLEX100 is approved at least $60 million of annualized sales starting in 2024. But manufacturing facility capacity ramp-up can be obtained as soon as D-PLEX100 proves successful and allows to fund itself decently (through stock offering or partnership with a Big Pharma).

Therefore, we expect an extremely quick ramp-up of sales, if approved, due to the fact that SSIs are clearly a heavy burden with the current SOC and costing hospitals and insurers billions of dollars. Hospitals are also penalized for high infection rates and will see their Medicare and Medicaid reimbursement dollars negatively affected. With alternative payment models incentivizing reduced total cost of care, key CMS Programs are Strong Drivers for D-PLEX100 to be widely adopted.

Currently the seven analysts covering PolyPid have set a target price between $14 and $30 average $22.

Assume a multiple 4x sales for market capitalization, which is conservative. This puts that potential short term market capitalization with existing capacity at about $240 million, and price per share of $13. This is still minimal compared with its potential at full capacity of production when it addresses its whole market which should reach several billions capitalization.

Therefore, in a conservative approach, we expect price per share to reach at least $15 this year 2022 if SHIELD I results are positive (Q3 latest) and from there-on only to increase till further results are issued until the company reaches and exceeds the billion market cap or a $50 per share as middle term target (2024).

Risks

As with any Biotech, there are some high risks associated with this stock.

- First of all, the risk of trial failure, which would probably condemn the company. If SHIELD I trial fails, the company will probably not be able to fund further research and will probably need to close its doors.

- Risk of lacking cash: we have seen that the company is in good position to be able to fund itself till the initial results fall. We do not anticipate cash to be an issue if SHIELD I trial reaches significance.

- Risk of lack of interest/ attention from the market: This promising company has been vastly unnoticed so far by the investment community and daily volumes are sometimes ridiculous and do not allow proper trading. We do expect this situation to change as soon as its full potential is known and recognized. The Ticker is followed by reputed Analysts from well known investment banks, so there is a strong expectation for this state of fact to change.

Conclusion

With D-PLEX100, PolyPid is developing a product for the prevention of surgical site infections (SSIs) that is important from a clinical point of view and effective from a scientific point of view. The available Phase 1 and 2 trial results are highly favorable and there is no reason to doubt that the good results will not be replicated in the ongoing Phase 3 SHIELD I trial. With Phase 3 interim results in May and topline data presumably coming in September, two major catalysts are imminent. Financially, PolyPid is in relatively good shape and has sufficient funding until after topline data. However, PolyPid will need new money for the NDA of D-PLEX100 no later than the beginning of 2023.

The potential market for D-PLEX100 is large and PolyPid’s underlying PLEX technology is a promising basis for further products. Not only OncoPLEX against Glioblastoma Multiforme (GBM) should be considered, but also other possible future products in collaboration with third parties. At a current market cap of roughly $100 million with three Phase 3 trials ongoing and half the IPO price, in our view PolyPid seems clearly undervalued given its potential.

No risk, no reward and we believe the tenfold potential upside reward is worth the risk.

Be the first to comment