Oselote

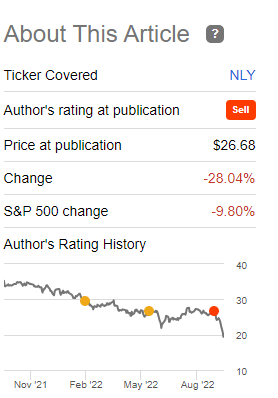

When we last covered Annaly Capital Management, Inc. (NYSE:NLY) we gave it a sell rating. The stock seemed detached from fundamentals and was trading above the last known tangible book value. We also expected tangible book value to erode further, and that made stamping a “sell” an easy choice. The stock has moved lower at a stunning pace, and so we update our thesis.

The Lost Decade Behind And The Challenges In 2023

What Explains The Move

There are three major changes happening right now that are impacting mortgage REITs, and unfortunately, all three went in the wrong direction over the last three weeks. The first was of course the mortgage rate. As a holder of 30-year mortgage-backed securities, NLY is impacted every time mortgage rates rise rapidly. Those have positively exploded.

Mortgage News-Twitter

Don’t just look at the rate, read the brief comments under that rate.

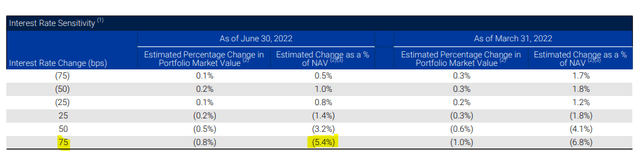

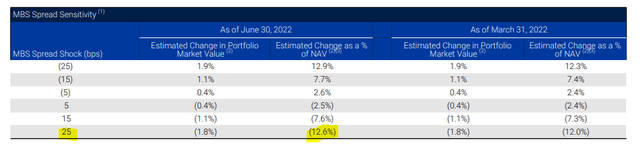

The company’s sensitivity to pure interest moves remains high based on the data provided on the Q2-2022 supplemental.

So that has not gone their way.

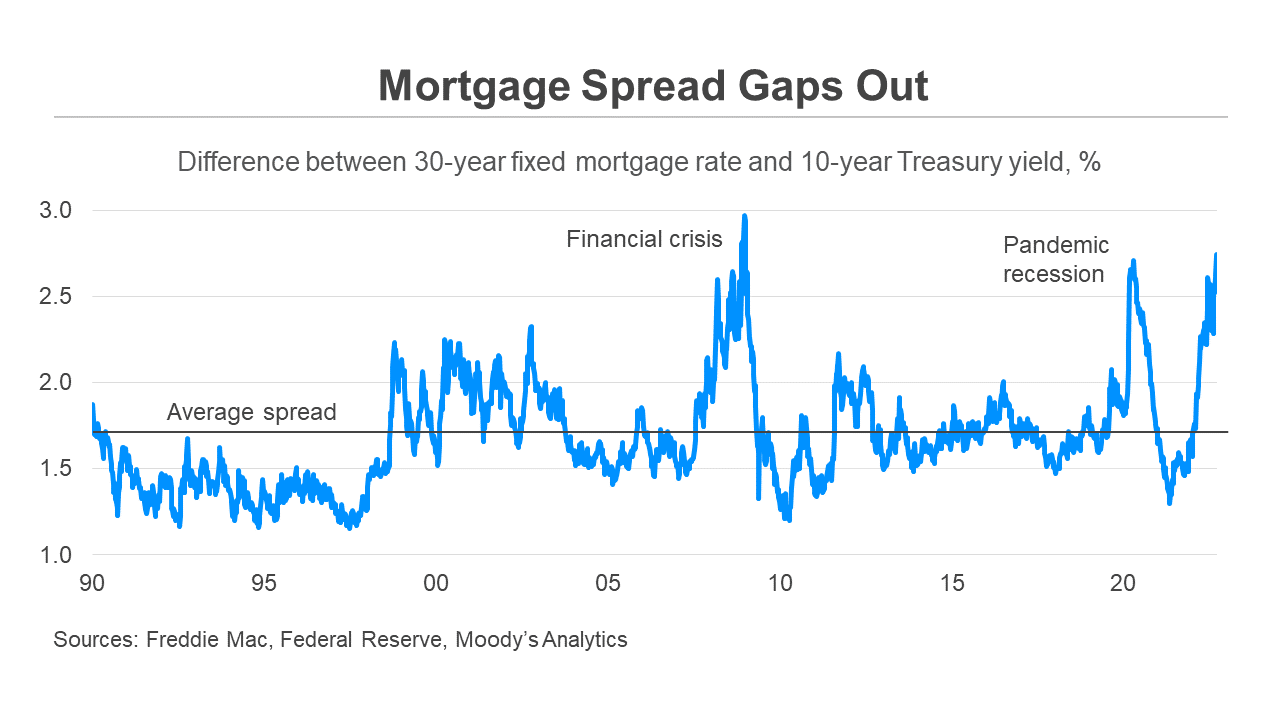

The second factor, spread sensitivity, was even worse. The difference between the 30-year fixed mortgage rate and the 10-year treasury rate moved up to global financial crisis levels.

Moody’s-Twitter

As a reminder, NLY hurts more on this movement than on the pure rate moves.

The reason for this is that NLY hedges mortgage rate sensitivity by having short positions on US Treasuries. When spreads widen, its hedges are less effective at mitigating damage to book value.

Finally, the biggest impact for mortgage REIT investors was the forward pricing for the Fed Funds rate. We saw an increase in peak pricing (we are looking at 4.6% now) and we also saw a complete wipeout of potential cuts in 2023. While these moves don’t impact book value as much, they are very important to earning income in 2023. We will get to that part next.

The Income Dilemma

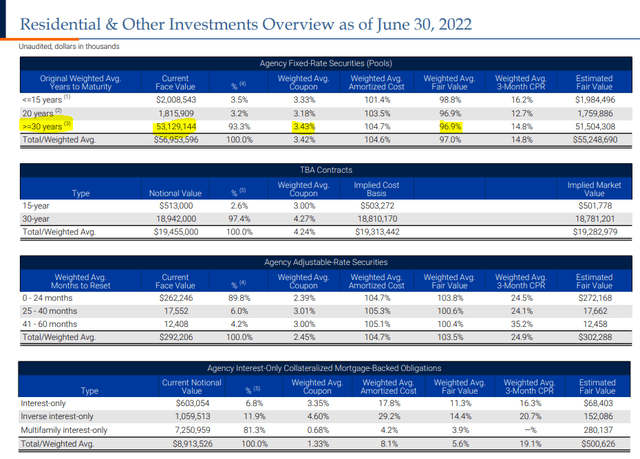

The bulk of NLY’s assets was 30-year mortgage-backed securities with a low yield and an even lower coupon.

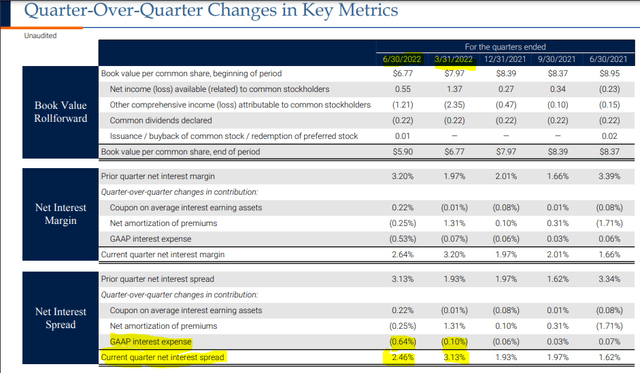

If you ignore the drubbing tangible book value took in the first half of 2022, things looked fine for the interest spread.

What we would note above is that the interest rate expense jumped from 0.10% to 0.64%. What we would also like investors to envision is what it will look like, if we hit a peak Fed Funds rate of 4.5% and NLY’s funding hedges run out. At present, the pricing is for Fed funds rate to be held at that high rate for a long time. Eurodollar futures are now pricing in rate cuts starting in 2024. This is what complete demolishment of hope looks like. All those coupon cutters that like the dividend and ignore the book value changes should realize that NLY’s income is probably drying up in the year ahead.

Prognosis

NLY is likely trading under tangible book value today, so that relative overvaluation has been fixed. Of course, if book value keeps falling, that does not help one bit. NLY will also face a massive increase in costs associated with Annaly Capital Management, Inc. 6.95% PFD SER F (NYSE:NLY.PF). This preferred share offering floats at the end of this month at 3-month LIBOR + 4.993%. What happens to this at peak Fed Funds rate? This issue would move to about 9.5%. This is an additional huge cost to the company. What makes it worse is that there are 28 million shares of this issue, and we are looking at an additional burn rate of about $4.5 million a quarter for NLY in 2023. NLY can pay this and watch its tight margins erode further. It can call the issue, but we don’t think the market will give very favorable pricing to a new preferred issue. In that case, redeeming $700 million plus of equity would require dumping assets 6 times as large to keep leverage levels constant. If these sound like bad choices, it is because they absolutely are.

Verdict

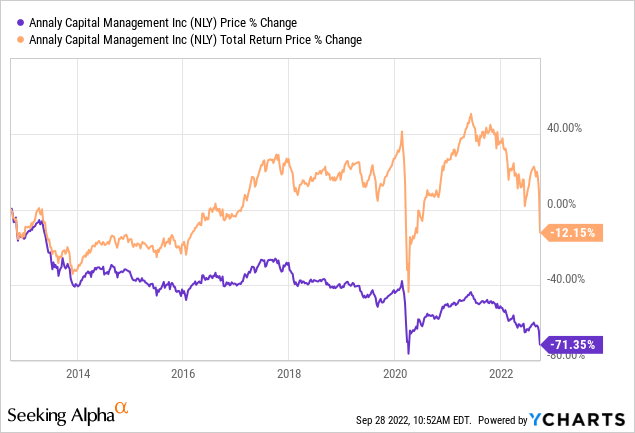

Total returns including reinvested dividends have been negative over the past 10 years.

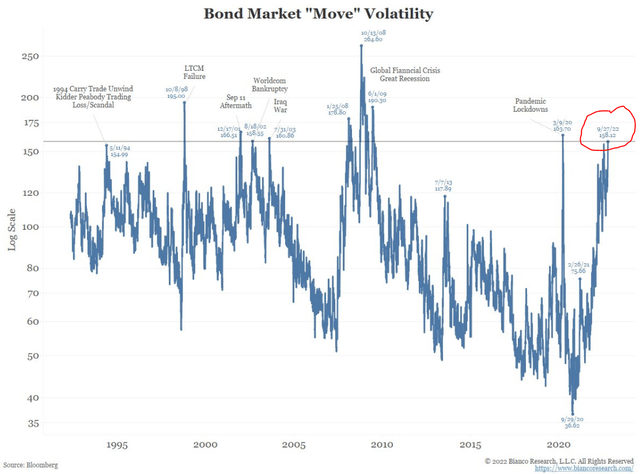

We are now going into a full-blown curve inversion and things likely get more complicated for the “borrow short, lend long” strategy. One can pin hopes that the Fed reverses course, and it is probable that with enough pain in the markets, they may dial down the hawkish talk. That won’t change a really flat yield curve. That won’t change the upcoming dividend cut within 1-3 quarters. That won’t change the pain of managing hedges for the next 12-18 months. Anyone thinking that NLY can hedge all these different directional interest rate risks without a huge cost, likely is a purchaser for the bridge we have to sell. Have a look at the bond market volatility index, aka the MOVE, below.

All that said, at about 5% under our estimate of tangible book value, we are upgrading this to a “hold” from a “sell”.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment