JHVEPhoto

Intro

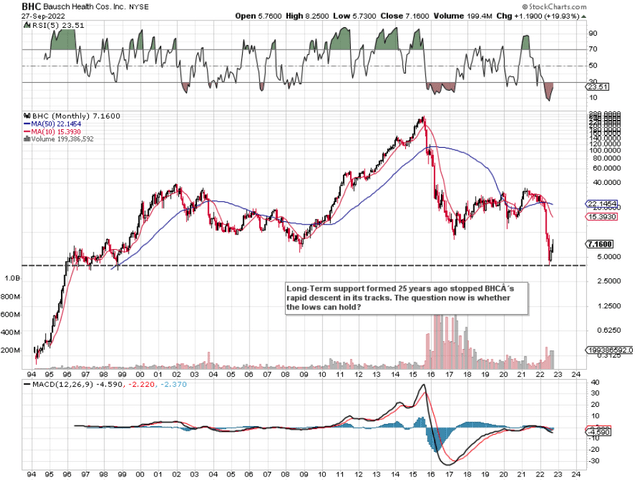

Investors who believe that stocks do not have a memory should digest the share price action of Bausch Health Companies Inc. (NYSE:BHC) in the long-term chart below. As we can see below, Bausch Health has had a very poor 2022 to date which most likely would have been much worse were it not for the stock’s long-term support which dates all the way back to 1996. The question now is whether shares can remain above this crucial support level over upcoming sessions because if they cannot, there is minimal downside support to keep the share price elevated. For this to happen, we need to see a reversal of the death cross (bearish cross-over of the 10-month moving average below the corresponding 50). This has to be a worry for the bulls no matter how bullish one may be in this stock.

BHC Long-Term Chart (Stockcharts.com)

There are many reasons to be either bullish or bearish in this play. This stands to reason given the extensive moving parts we have witnessed in Bausch in recent times. Will Ryaltris continue to gain traction? Will Xifaxan continue to come under more pressure from cheaper alternatives? The recent tentative approval for a Xifaxan generic by the FDA recently caught many by surprise and with good reason. Bausch has a standing patent in the US for this drug which is not set to expire until 2029.

Given Bausch’s leveraged balance sheet, this is something that the company did not need at this stage. Whereas stable companies with minimal debt can sustain volatile changes in their market caps, companies such as Bausch which are highly levered need to demonstrate solvency to ensure funding can be secured if needs be. In fact, we have seen some financial engineering of late regarding its debt which essentially buys Bausch more time to get its house in order.

From a shareholder or buyer’s perspective, the attraction here is the company’s excellent gross and operating margins (71% and 19% respectively) as well as the value of its non-GAAP earnings (forward multiple of 2.24) and sales (forward multiple of 0.32). GAAP earnings are pretty much non-existent due to significant interest expense but Bausch continues to generate free cash flow. Will this be enough though to keep more investors on the long side? We have our doubts for the following reasons.

Spike In Short-Interest

Recent activity in Bausch has short sellers out baying for blood. The short interest ratio has moved from 6.2% at the end of August to now come in at 9.73%. We use the 7% as a marker which basically makes up ultra wary of being long stocks above this level. Why? Short sellers are sophisticated investors which take far more risk than their long counterparts. Suffice it to say, when a short-interest ratio of a firm jumps sharply, it means short-sellers are fully aware of the upside risks but yet continue to trade from the short side. As we can see below on Bausch’s daily chart, the stock briefly this week won back its 10-day moving average ($7.32) before losing this support level once more. It is crucial, the stock both regains and remains above this level (Which in the process will turn up the average) to keep short sellers at bay.

BHC Daily Chart (Stockcharts.com)

Analysts Becoming More Bearish

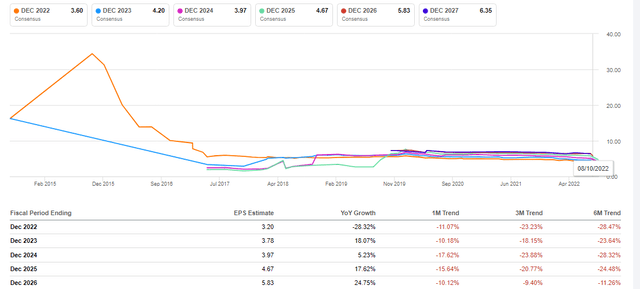

Although as mentioned, Bausch remains healthily profitable from a non-GAAP basis, earnings revisions have been sliding at a rate of knots over the past which is a worrying trend for the longs. In fact, if we look at the annual non-GAAP estimates below, we see that the dialing down of fiscal 2022 estimates is actually accelerating. Whereas the bottom-line estimate for fiscal 2022 has lost approximately 23% over the past three months (8% monthly average decline), the estimate is down more than 11% over the past 30 days alone. Suffice it to say, no matter how cheap shares of Bausch may appear at present, if the relentless dialing down of forward-looking earnings estimates continues for some time, then it is obvious that underside downside support will come under pressure once more.

BHC Earnings Revisions (Annual) (Seeking Alpha)

Conclusion

Given Bausch’s valuation, margin profile, and expected return to strong growth next year, the company’s debt, poor earnings revisions, and high short-interest all bring elevated risk to this play. We look forward to continued coverage.

Be the first to comment