Eric Francis

Daily Journal is trading below its working-capital value

Daily Journal Corporation (NASDAQ:DJCO) is a business and legal news and advertising editorial in California. Until his recent step-down as chairman of the board in April, the marketable securities investment side of the business was run by Charlie Munger for the last 45 years. While the company likes to say that they are not a smaller version of Berkshire Hathaway (BRK.A, BRK.B), the operations have a resemblance. The company operates several small newspaper circulations throughout California, most focused on the legal and business communities. While the company does generate about $50 million a year in the news business, overhead and salaries amount to roughly $48 million of that, generating a net income of $2.15 million FY 2021.

What the company has in common with the original Berkshire Hathaway is that it has built up a holding in marketable securities that makes up the vast majority of its assets, to the tune of $347 million worth for a company with a $326 million market cap. Over the years, whilst the news and advertising business had been dwindling, Charlie Munger as Chairman of the Board was overseeing the investment of retained earnings into stock holdings. At this point, dividends alone make up more net income than what is provided by the media part of the business, with unrealized gains of $244 million.

Being that this is a business that is nearly self-sustainable at this point, the company also carries very little debt. It has put the company in a rare situation where they are now trading below net current asset value, with $372 million in total current assets and only $33.5 million in debt. We will further examine one of the original Benjamin Graham value metrics in this article, the net-net, or as Warren Buffett termed it, the cigar butt valuation. My thesis is this is a buy, especially in an economic downturn where the margin of safety is becoming ever more important. In this case, I like to call the Daily Journal a Cohiba butt, because it is certainly an elite version of a discounted dollar.

What is a net-net ?

This is a term you may have heard uttered by value investment gurus. Many value funds from the 1950s even up until now hunt for companies that are trading below liquidation value. Buffett and Graham were obsessed with these because, in poor economic times, they provide the highest margin of safety. Nick Sleep, who ran Nomad Partnership in the early 2000s, also started by looking for dollars selling for .50 cents. Nomad was so determined to find cigar butts at first that they even bought net-nets in Zimbabwe. You find these deals more often than not in smaller cap companies that don’t require a lot of debt to sustain the business. Daily Journal Corporation is certainly in this category.

The exercise in finding a net-net is both simple and unique. It is the only valuation metric I am aware of that solely relies on the balance sheet and disregards the income and cash flow statement. Many of you out there have a copy of Benjamin Graham’s The Intelligent Investor. If you are so inclined, you can open your copy and flip to pages 390-391, where you will see a succinct description of how to perform the exercise:

Technically, the working-capital value of a stock is the current assets per share, minus the current liabilities per share, divided by the number of shares outstanding.

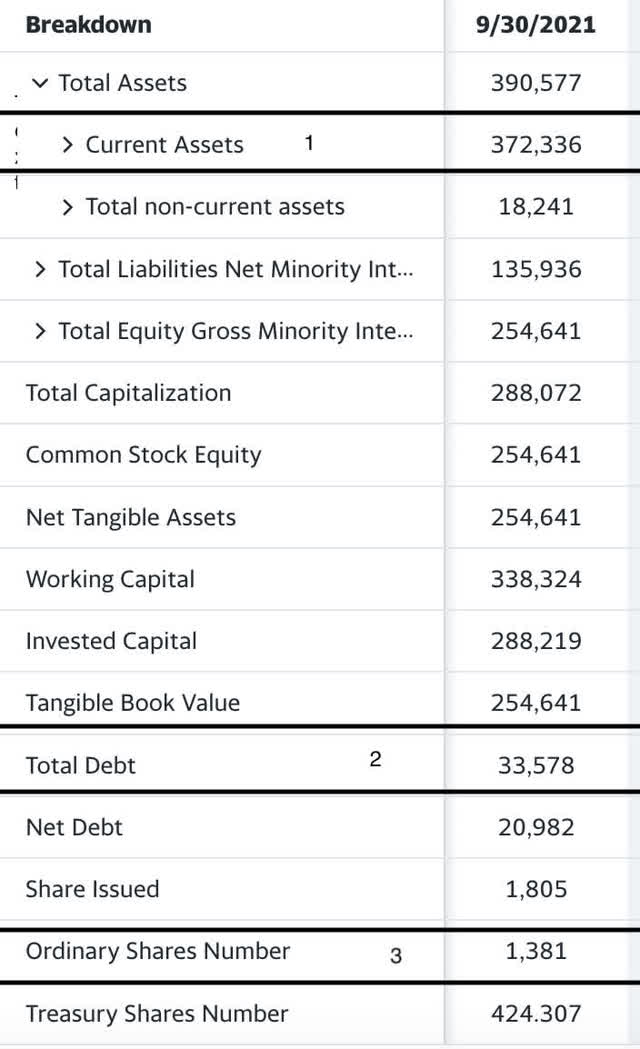

All three of these items are lined up right on the balance sheet. Let’s examine the balance sheet of the Daily Journal and go through the exercise:

Daily Journal Balance Sheet (yahoo finance)

1. Here we can see total current assets are $372 million FY 2021.

2. Subtracting out the total debt of $33 million, we get net current assets of $338 million.

3. Ordinary shares, (shares issued minus those in treasury from buybacks not yet retired), are only 1.38 million. Taking the net current assets of $338 million and dividing it by 1.38 million shares outstanding gets us $245 a share in net current assets.

As the majority of these are marketable securities, with a tad over $12 million being held in just cash, let’s take a look at their holdings next.

Daily Journal Corporation 13 F

DJCO holdings mrq (whalewisdom.com)

Heavy focus on banks

With large holdings in Bank of America (BAC), Wells Fargo (WFC), and U.S. Bancorp (USB), Buffett, Munger, and Graham have always been big proponents of bank stocks. Buffett likes them because they always trade at fair valuations to assets and earnings, but are also a great hedge against inflation. As the dollar value of homes, cars, and all other goods requiring consumer debt goes up, it doesn’t take a larger workforce to generate higher dollar loans against those goods. All you have to do is move commas and decimal points. Banks are unique in that their revenue and income will grow with the economy without adding costs. The biggest costs to banks are normally defaults and bad loans.

One of the larger holdings that was recently halved is Alibaba (BABA, OTCPK:BABAF). The Daily Journal took significant losses on this holding, as have other elite hedge funds that got too enthusiastic about the “Amazon of China” moniker. Rounding out the bottom of the list is POSCO (PKX), a Korean steel company that is trading at .32 price-to-book and 4.5 X forward earnings. The banks and POSCO are all trading well under their Graham number value (22.5 × (Earnings Per Share) × (Book Value Per Share), while Alibaba was a stock that discounted free cash flow practitioners had high hopes for, but continued to revise down. From the majority of the selections on the list, we can see that Munger’s thought process is at least 80% centered around the original theses of The Intelligent Investor.

Additionally, the company does not pay a dividend. This holds true to the Berkshire Hathaway model that tax efficiency and compounding are the main tenets of its business model.

Daily Journal’s other operations

This is, in a nutshell, Charlie Munger’s deferred tax vehicle brainchild, but let’s see what else they do outside of the part Munger managed:

Daily Journal Corporation (the “Company”) publishes newspapers and websites reporting California and Arizona news and produces several specialized information services. It also serves as a newspaper representative specializing in public notice advertising. This is sometimes referred to as the Company’s “Traditional Business.”

Journal Technologies, Inc. (“Journal Technologies”), a wholly-owned subsidiary of the Company, supplies case management software systems and related products to courts, prosecutor and public defender offices, probation departments and other justice agencies, including administrative law organizations, city and county governments and bar associations. These organizations use the Journal Technologies family of products to help manage cases and information electronically, to interface with other critical justice partners and to extend electronic services to the public, including e-filing and a website to pay traffic citations and fees online. These products are licensed in 42 states and internationally.

Essentially all of the Company’s U.S. operations are based in California, Arizona and Utah. The Company also has a presence in Australia where Journal Technologies is working on three software installation projects. Financial information of the Company, including information about each of the Company’s reportable segments, is set forth in Item 8 (“Financial Statements and Supplementary Data”).-Daily Journal 2021 10K

Furthermore, they state:

The Company is not a smaller version of Berkshire Hathaway Inc. Instead, it hopes to be a significant software company while it also operates its Traditional Business. -Daily Journal 2021 10-K

As an added bonus, the newspaper side of the business is not irrelevant. They do point out that they intend to expand this business, especially in the field of advertising technology, where they make acquisitions from time to time. The 10-K further points out that when it makes an acquisition to expand its media software business, the company usually finances the acquisition by borrowing at favorable interest rates, using its marketable securities as collateral.

This is a similar tax sheltering strategy that elite CEOs like Elon Musk or Jeff Bezos use. They bottle their net worth up in appreciating securities and then borrow against those to fund their lifestyles rather than sell shares. This way they avoid capital gains tax and maximize compounding. All they pay is interest at favorable rates with excellent collateral.

Catalysts

In essence, this is a bank-centric, closed-end fund-like vehicle trading at a discount to NAV, while being traded like a normal corporation with all the added tax benefits. The underlying holdings could be winners if the net interest margins of banks continue to rise and the U.S. consumer base stays away from massive defaults and foreclosures. When prolonged recessions occur, value funds will turn over every stone to find net-net opportunities to protect their calculated downside. With the stock currently trading at $237 with net current assets at $245, it’s akin to buying a dollar for .97 cents. As the price goes lower with the rest of the market, the margin of safety grows.

Conclusion

I like to call this a Cohiba Cigar Butt because it is certainly a prosperous company rather than one in liquidation that happens to be below its current asset value. The discount to current asset value just started to get revved up with Daily Journal’s drop below $240. This is also a small-cap stock with a valuation of $326 million, and only a few hundred shareholders.

Volume is not huge, and an order might not be fulfilled the same day on the buy or sell side. However, if hedge funds start to smell significant danger and become very defensive, these types of plays and cash positions will be popular. While Charlie Munger is not in charge any longer, hopefully, his younger cohort that will be managing the funds will be as disciplined. Accumulate at $245 and below. A strong buy if it dips below $200.

Be the first to comment