visualspace/E+ via Getty Images

American Outdoor Brands (NASDAQ:AOUT) has had a disappointing run as a standalone public company. After spinning off from Smith and Wesson brands (SWBI) as the accessories and outdoor part of the company, it was immediately faced with the peak of the consumer area in 2021. However, long term the company has made great progress with its portfolio of acquired and internally developed brands, with strong growth in the past 3 years in the latter. The company has 21 brands overall, with half in the growing outdoor lifestyle market of camping, fishing and hunting. Combined with a firearm industry at trough lows, the company is at a compelling valuation with little debt and ability to buy back significant shares over time. The key to their strategy as noted by CFO Andy Fulmer, “Our Dock & Unlock formula serves as the foundation for long term cash flow generation. That cash in turn funds further organic growth as well as the ability to capture attractive M&A opportunities when they arise.” This growth proposition plus a stock trading far under book value give potential buy and hold investor to make significant gains over the coming years. A company with strong long term growth prospects, trading far under book value and no debt is a rare thing in today’s market.

AOUT IR Presentation Q2 (AOUT IR )

Fiscal Q2 results have lots to like

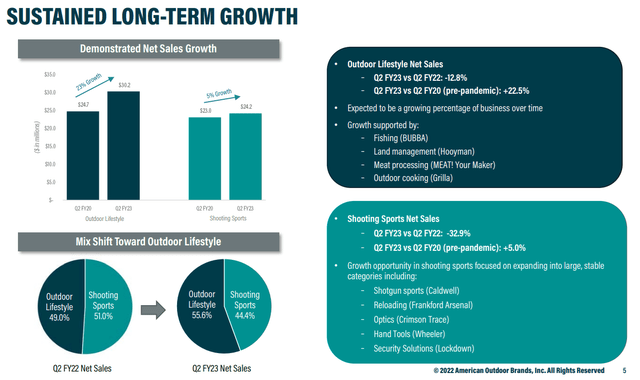

The recent Fiscal Q2 2023 (Fall 2022) results have a lot to like from a longer term perspective. While the firearm accessory business is bottoming out, the outdoor lifestyle brands continue to do well. After the pandemic bump, you need to look at a more normalized growth trajectory over the coming years. Revenues were $54.4 million down 23.1% over the prior year which is mostly explained by the very weak results in the firearm business. The company has guided the full Fiscal year 2023 guidance is for 25% growth from F2020 which would be around $209m – or 15% below last year’s mark. This suggests an improvement in growth rate in the coming quarters and a completed normalization by mid next year. Smith and Wesson has seen sales begin to bottom out in a similar area after past boom cycles. Firearm sales tend to move higher during political periods, in particular leading up to elections, which gives the stock potential upside leading into the 2024 election.

Fiscal Q2 margins continue to be strong, with a significant 10% and growing of AOUT revenue direct to consumer only, which is leading to stronger margins over time. Sales for Q3 were down 12.8% year over year in the outdoor lifestyle segment but up 22.5% over pre pandemic levels for 7.5% CAGR. Shooting sports were only up 5% over pre-pandemic levels but keep in mind pre-pandemic 2020 was a very high level of sales and should normalize above 1-2% growth. The company is going to continue to focus on its acquired brands like BUBBA, Grilla grills and in house brands like MEAT! These brands combined have 10-15m yearly sales at the moment but are just a few years old with significant growth runway and strong distribution from AOUT. The fact much is sold direct to consumer allowed for a strong gross margin % of 47.7% in Fiscal Q2. This was actually up 1% over the prior year, impressive considering the reduced sales of 23.1%. This is due to a larger % of direct to consumer and high margin products with growth in the DTC space 119% over last year. Look for that to continue to be the focus, acquiring small popular brands and scaling them with their expertise and distribution skills. The company has up to $72m in available capital, allowing for a significant acquisition in the coming year if the right fit is available.

Inventories under control

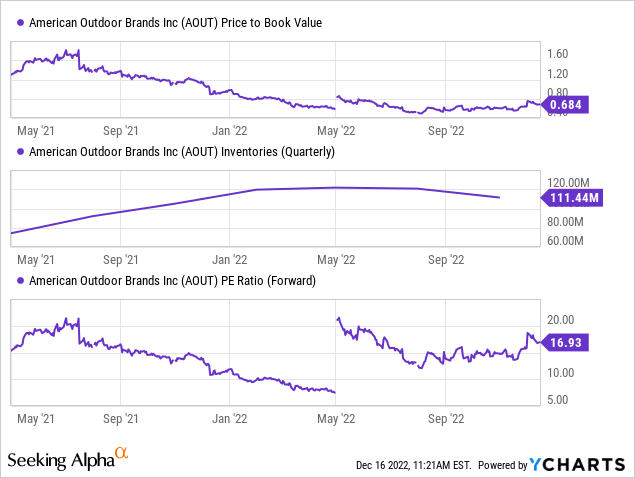

The company also has taken some of these small brands like Grilla and moved the facilities to the same location as their other brands, allowing greater manufacturing efficiencies. This is going to save the company $1.5 million per year showing commitment to profitability. Small improvements like this has the company aiming for a long term EBITDA margin in the high teens, significantly better than both the 16.5% last year and 11.8% this quarter. The company has also done a good job reducing inventory which is a big fear of Wall Street going into 2023. As you can see above, the company has $111.4 million in inventory which is down over $10 million from 2 quarters ago. This is a welcome reduction in inventory with margins actually improving showing little discounting was needed to move product. They did mention they will have slightly lower gross margin in the winter, as they have promotions around the holidays. The company will continue to hold more inventory as the portfolio of brands and SKU grows, but they look to reduce it and increase cash in the coming year. Commentary on the Q2 call suggested the inventory level will come down to the $85-100 million range in the coming year where they feel most comfortable. New products are about 30% of sales right now showing that desire to innovate and build upon the portfolio of offerings in fishing, hunting and outdoors products.

Stock searching for bottom

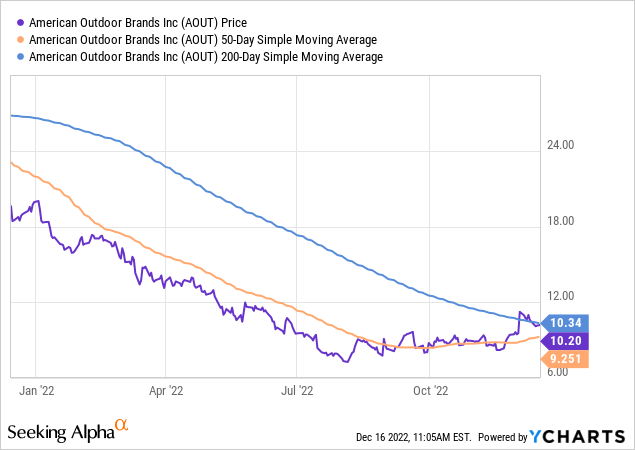

The stock is above its 50 day moving average and right at its 200 day. It got a significant pop from its Q2 earnings report as the results were above expectation. The stock has formed what looks like a bottom with significant buying volume in August, September and after the early December earnings. This follows other consumer stocks that have been beaten down holding up well throughout the fall, not surprising when the stock trades at just 0.68x Book Value less than half of the peak. Much of that value is in inventories but the company has proven recently to be able to move inventory at a strong margin and generate cashflow. This makes the $10 million dollar buyback extremely enticing as well, with the current market cap at just $140 million US. For a company at GAAP profitability even during a downswing, the potential is there for a significant move higher over the coming few years.

Conclusion

AOUT is an interesting company with no significant debt and high structural margins. While the company deals with the post pandemic and stimulus hangover, they continue to make great progress with its portfolio of brands. The buyback is providing a floor in valuation at this level allowing for some strong upside in the next 2 years as we head into another election cycle. This is the best time for long term investors to buy AOUT even with a weakening consumer going into 2023.

Be the first to comment