anilakkus/iStock via Getty Images

Company Snapshot

Mativ Holdings, Inc. (NYSE:MATV), previously known as Schweitzer-Mauduit International, Inc., is a global specialty materials company, with a presence in over 100 countries. Over a decade ago, MATV was noted for its expertise in the manufacturing of tobacco-centric paper, but these days the company is a lot more diversified.

MATV currently reports under two segments:

- Advanced Technical Materials (“ATM”) – this division accounts for 63% of group revenue and the focus here is on resin-based products used in the end-markets of healthcare, transportation, industrial, construction, and filtration.

- Fiber-Based Solutions (“FBS”) – the rest of the group revenue comes from this division, which focuses on papers and fiber-oriented materials for the tobacco industry.

Here are a few reasons why MATV may be pursued by investors.

Q4 2022 Could Diverge From Historical Trends

I suspect some investors may be reluctant to engage with MATV at this juncture as it didn’t have the greatest of quarters in Q3, and traditionally, Q4 has been seasonally weak. This year it could be different. The management thinks the EBITDA in Q4 will likely be on par with Q3 in absolute terms (another quarter of $93m EBITDA, followed by a push towards $100m in the quarters ahead) and better in YoY growth terms (25% in Q3). What are some of the potential drivers?

Firstly, do consider that in Q3, the company will be able to make up for some of the lost business that was triggered by some cyber-attacks which impacted their manufacturing sites. This had impacted EBITDA by $5m, plus there was some additional expenditure of $6m, linked to third-party assistance to resolve the issue. These items will not weigh on Q4.

Then I’d highlight the currency dynamics. For much of this year, MATV has been hampered by a weakening euro, but this is unlikely to be a lingering headache in Q4. Since the company published its Q3 results last month, the EUR/USD pair has appreciated by close to 5%, and this should reflect favorably on reported numbers.

In recent periods, both of MATV’s divisions have been benefitting from ample pricing strength, and management expects a continuation of the same. Just for some perspective, in Q3, the differential of pricing over its input costs was closer to $23m (in the ATM division alone, price over input costs came in at $76m).

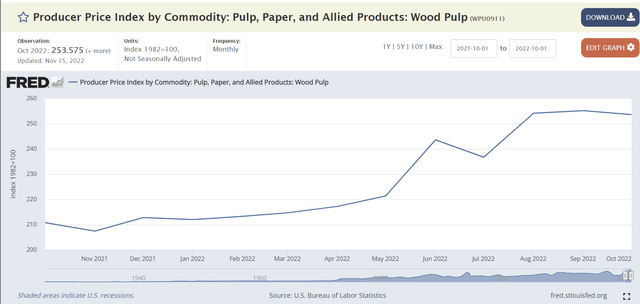

On the other hand, it’s also been encouraging to note the dynamics with some of MATV’s notable raw materials. After rising for multiple months, wood pulp prices appear to have flattened out and dipped in recent months.

Meanwhile, consider another important ingredient like Polypropylene (PP), whose prices continued to drop for yet another month in November. I don’t believe the situation will improve any time soon, as additional supply is due to come on board whilst demand will be lower than the 2021 levels (in 2021, demand was up by 8%).

Finally, I’d point to the ample $65m cost synergy-related savings plan, much of this related to SG&A control; earlier, the company was targeting a figure of $20m, but this could be exceeded, with some of H1-23’s budgeted savings now due to be front-loaded in Q4.

MATV Offers A Useful Defensive Edge, Supplemented By The Yield

I’d like to think that MATV Holdings and its stock could offer investors some useful defensive qualities that could come in handy in the current environment.

A large chunk of the FBS business comes from supplies to small and major cigarette and cigar manufacturers around the world; demand from these guys will likely stay resilient even during a recession. Then you also have other areas of the business that could be deemed to be somewhat recession-resilient such as filtration and protective solutions. When it comes to the filtration business, demand for cleaner air and water is unlikely to be tempered by recessionary pressures. Then, in protective solutions, you have steady demand on account of paint protection.

Then there’s the stupendous forward dividend yield of 7.7%, which could serve as solid insurance if we witness further drawdowns in the stock. Also note that MATV has a long history of paying dividends now (26 years, as against a median figure of just 7 years for the materials sector). Some of the long-standing MATV shareholders may be disappointed by the company’s decision to cut its dividends by 9% in August this year, but even at that lower DPS, the yield is still almost 250bps greater than the stock’s 5-year forward dividend yield of 5.2%!

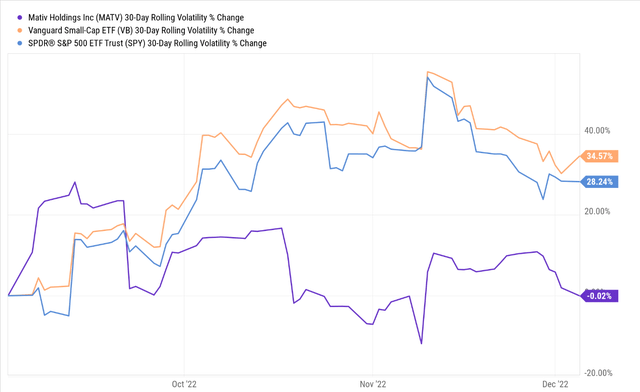

Interestingly enough, MATV is part of the top-10 stocks of the S&P SmallCap High Dividend Low Volatility Index that was rebalanced in July and focuses on high-yielding small-cap stocks that exhibit low volatility.

It’s worth noting that over the last three months, the MATV stock’s rolling volatility has been substantially lower than its small-cap peers and the S&P 500 (SP500). This could prove to be very useful when risk aversion perks up in the markets.

Even if the dividend was curtailed, investors shouldn’t fret as precedence will go towards reducing the company’s net debt, which currently stands at 4.2x EBITDA. I believe the company is well-poised to ameliorate the leverage on account of enhanced working capital management in Q4, and they intend to finish the year at 3.75x. Even though MATV may have substantial debt on its books, what I also find quite encouraging is that this is all largely fixed-rate debt (weighted average rate of 5.25%) on account of the execution of various interest rate swaps in Q3. Crucially, the company also does not have any major debt maturity due until 2026 (the 6.875% unsecured notes).

Improved Operating Leverage Next Year Reflects Well On The Forward Valuations

Even without a potentially better Q4 factored in, the numbers for next year look quite promising. According to YCharts estimates, MATV is poised to witness decent operating leverage for FY23, where EBITDA growth (32.9%) will exceed revenue growth (32.4%). Much of this could be driven by the ongoing sustainable pricing strength in various categories, and the SG&A synergies they hope to extract from the Neenah merger. In effect, you’re staring at an EBITDA figure of $398m for FY23. This would translate to a forward EV/EBITDA multiple of only 7.24x.

Considering the operating leverage on offer, I believe the valuation multiple is quite reasonable, more so when you consider that the multiple is closer to the lower end of the stock’s 5-year forward EV/EBITDA range of 6.5-9.1x.

Good Risk-Reward Dynamics On The Charts

To conclude, we focus on the technical landscape. The chart below shows the price imprints of the MATV stock over the last 26 years or so. There are two important things to note here.

Since peaking in October 2013, MATV has been trending in the shape of a descending channel. If you’re looking to go long at current levels, the risk-reward looks quite attractive as the price is not too far away from the lower boundary of the channel.

Secondly, also note that the price has now hit a price zone that had served as a notable pivot point back in 1997, and we could see another pivot at these levels, albeit towards the upside.

The favorable risk-reward on the standalone monthly chart is augmented by dynamics on a relative strength chart measuring the performance of MATV and other small-cap stocks that make up the Vanguard Small-Cap ETF (VB). Note that this ratio is currently almost 3x lower than the mid-point of its long-term range and has also now dropped to levels last seen in mid-2008 from where it bounced, implying promising prospects for MATV.

Be the first to comment