Torsten Asmus

Summary Data and Analysis

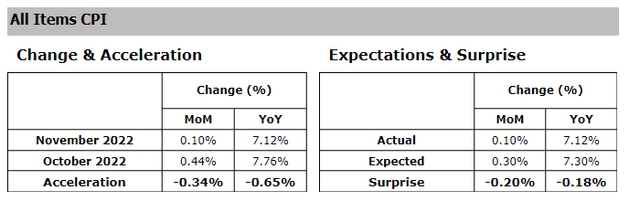

Figure 1 below highlights key summary data and analysis for this month’s All Items CPI.

Figure 1: All Items: Change, Acceleration, Expectations & Surprise

All Items CPI (BLS, Investor Acumen)

As can be seen above, All-Items CPI decelerated significantly and significantly surprised to the downside.

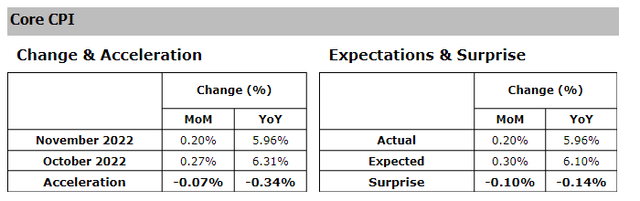

Figure 2 below highlights key summary data and analysis for this month’s Core CPI.

Figure 2: Core: Change, Acceleration, Expectations & Surprise

Core CPI (BLS, Investor Acumen)

As can be seen above, Core CPI also decelerated significantly, providing a significant downside surprise.

Analysis of Contributions of Key Aggregate Components of CPI

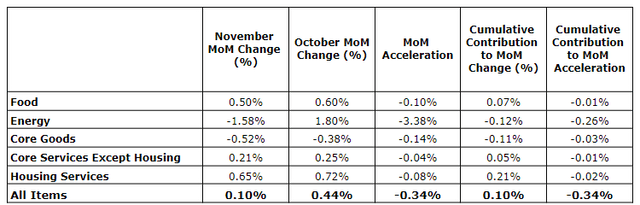

In Figure 3, we display the contributions to CPI inflation of five major aggregate components to the MoM (month-over-month) change in CPI and the MoM acceleration of CPI.

Figure 3: Analysis of Key Aggregate Components of CPI

Aggregate CPI Component Analysis (BLS, Investor Acumen)

We will briefly review how to interpret the table above (as well as other tables in this report), describing each column from left to right. The first column contains the MoM percent change for the current month. The second column contains the MoM percent change in the prior month. The third column contains the MoM acceleration – i.e., the difference between the percent change this month minus the percent change last month. The fourth column contains the Cumulative Contribution to the percent MoM change of CPI. This describes exactly how much each component contributed to the cumulative All Items MoM percent change in CPI. The sum of the values in this column will yield the MoM percent change of All Items CPI (with minor discrepancy due to rounding). Finally, the rightmost column contains the Cumulative Contribution to MoM Acceleration of All Items CPI. The sum of the contributions in this column adds up to the MoM Acceleration of All Items CPI. Although all five columns provide important information, we recommend that readers pay special attention to the rightmost column (Cumulative Contribution to Acceleration) as it reveals exactly what drove the MoM acceleration/deceleration in CPI during the current month compared to the prior month.

As can be seen in the table above, Energy decelerated very significantly, accounting for most of the overall deceleration in CPI. However, there was at least some deceleration in all major components. More details will be provided below.

Analysis of CPI Components that Contributed Most to Change & Acceleration of CPI

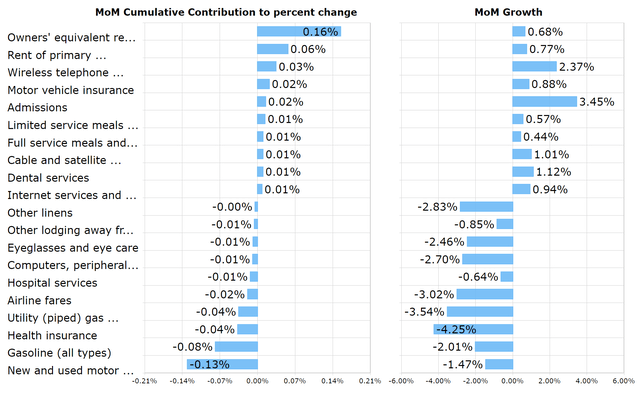

In the following section, we perform the same contribution analysis as above, but at a more granular level of detail. In Figure 4 below, we list the top 10 CPI components (most granular level) that contributed negatively and positively to the MoM percent change in All Items CPI. These contributions take into account both the magnitude of the MoM change in each component as well as the weight of each component in All Items CPI.

Figure 4: Top Contributors to MoM Percent Change

Top CPI Contributors (BLS, Investor Acumen)

One thing that emerges from this analysis is that a significant share of the deceleration of core CPI this month came from relatively volatile items, that might be considered “one-offs.” For example, the significant decline in new and used car prices, gasoline and health insurance may not be representative of core inflationary dynamics. Used cars, which is a highly volatile component, accounted for a very large share of the decline in core CPI.

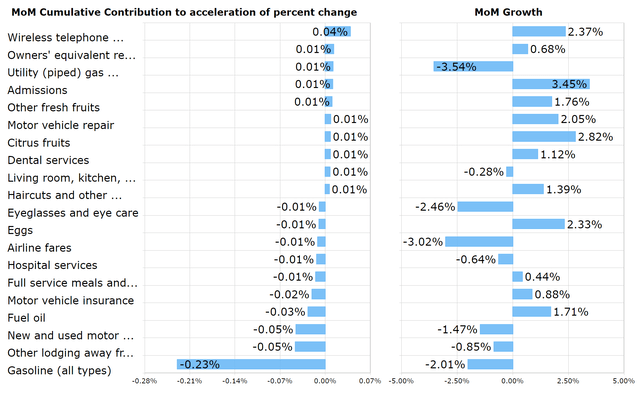

In Figure 5 below, we list the top 10 CPI components, at the most granular level, that contributed negatively and positively to the MoM acceleration (expressed in percent change) of All Items CPI. These contributions take into account both the magnitude of the MoM accelerations in the components as well as the weight of each component All Items CPI.

Figure 5: Top Contributors to MoM Acceleration

Top CPI Acceleration Contributors (BLS, Investor Acumen)

It is worthwhile to examine tables 4 and 5 above carefully as they are likely to include most or all of the items which surprised forecasters during the month.

As can be seen above, new and used cars and lodging away from home accounted for -0.1% of the deceleration, while gasoline provided -0.23 of deceleration. These items account for most of the deceleration and “surprise” for the month.

Some analysts had been hoping from some relief from primary rents and owner’s equivalent rent, but this did not occur.

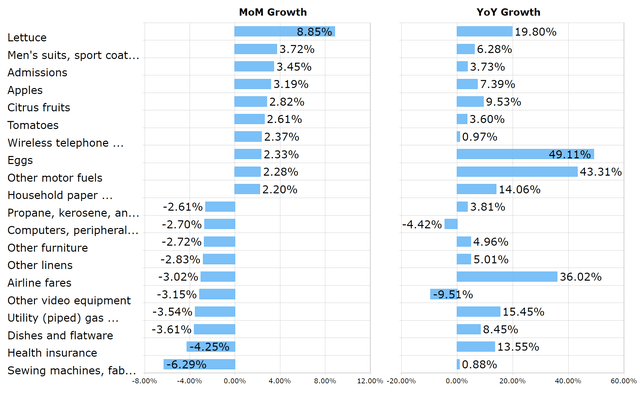

Top Movers

In Figure 6 below, for general interest purposes, we show the components with the largest positive and negative MoM change (%). The YoY change in these particular components is to the right.

Figure 6: Top Movers MoM Percent Change

Top CPI Movers (BLS, Investor Acumen)

Implications for Policy and Economic Performance

In this section, we review the potential implications of this month’s CPI report on policy (monetary & or fiscal) and the overall outlook for the US economy.

Impact on Policy. On the margin, this month’s deceleration of All-Items and Core CPI incrementally decreases pressure on the Fed to tighten overall financial conditions more than markets have expected. Indeed, today’s numbers may tend to lower market expectations regarding how much (“terminal rate”), how fast and for how long the Fed may increase the Federal Funds interest rate.

I needs to be noted that this the second consecutive month of significantly decelerating CPI figures, which is significant, from the point of view of Fed policy expectations.

Having said that, the initial reaction by markets may overestimate the Fed’s response to the November CPI. First, of decline in MoM core CPI, relative to expectations, was only 0.1%. Perhaps more importantly, most of the deceleration of inflation relative to expectations was quite narrow and concentrated in just a few volatile categories.

Indeed, if there were too much easing of financial conditions in bond and equity markets, I would not be surprised if the Fed “pushed back” a bit on any expectations of a significant change in the path of the Fed’s interest rate policy.

Impact on Economic Performance. On the margin, today’s numbers will further encourage the already widespread belief that inflation has peaked and is heading down in the intermediate term. This will take pressure off of interest rates across the economy such as mortgage interest rates. This could alleviate some of the headwinds that the economy has recently been experiencing, particularly in interest rate sensitive sectors.

Most importantly, the deceleration of inflation and the concomitant decline in interest rates, increase the odds of a potential “soft landing,” whereby the economy can avert a recession.

Potential Financial Markets’ Impact

Today’s CPI report, on the margin, will likely decrease risk perceptions regarding the probability of the Fed being forced to tighten monetary policy to a degree that would induce recession. In particular, market expectations of the Fed’s so-called “terminal rate” may decrease. This would cause the cost of financing across the economy to decrease and overall financial conditions to ease somewhat. This should provide a positive boost for both bond and equity markets.

However, I would caution that the internal details of this report, although generally positive, may not be quite as bullish as they appear on the surface. Much of the deceleration in both All-Items CPI and Core CPI was due to a few volatile components, which may not be representative of underlying inflationary trends.

The initial reaction of the equity market, which is up over 3% in pre-market trading, seems somewhat disproportionate to the actual data. This highly bullish reaction can be explained, in part, by the fact that the market appears to have come into this number leaning “bearish.”

First of all, there were widespread reports that the “whisper number” among traders was higher than consensus. Second, equity put/call ratios were extremely elevated, indicating a significant amount of “fear” about a hot number. Third, the VIX spiked on Monday by a large amount in anticipation of today’s CPI release, indicating that traders were paying very large premiums to either hedge their portfolios against feared risks and/or speculate on a hotter-than-expected number.

In sum, given that the market appears to have gone into this number leaning somewhat “fearful” and/or “bearish,” it is not surprising that the equity and bond markets are rallying significantly. However, the rally appears to be somewhat disproportionate relative to the actual data. It remains to be seen whether some of this rally may be at least partially “faded” by the end of today’s regular trading session and perhaps tomorrow’s session. If, to the contrary, the rally is not faded, it would be an indication of favorable technical conditions in the market.

Be the first to comment