sefa ozel/E+ via Getty Images

More often than not, it takes time for an investment thesis to play out. But this is not always the case. Sometimes, a company can move the direction you were expecting in a relatively short period of time. A great example of this can be seen by looking at View (NASDAQ:VIEW), an enterprise that produces ‘smart glass’ that utilizes artificial intelligence to automatically adjust in response to the sun. There are also other uses to this technology that are rather exciting, such as creating immersive displays to enable video conferencing. In recent months, however, shares of the company have taken quite a tumble, driven by fears of potential bankruptcy and a broader economic slowdown. Although revenue continues to climb at a nice pace, the company is hemorrhaging cash and recently had to resort to a sizable financing transaction that could lead to significant dilution in the future. Based on all of these factors and the absence of any meaningful improvement in its bottom line, I do believe that the stock still has further to fall from here. And as such, I’ve decided to keep the ‘sell’ rating I assigned to the company previously.

A bad view

My first foray into View was back in the middle of August when I wrote a rather bearish article on the enterprise. I found myself impressed by the company’s continued top line growth. But beyond that, I found little for investors to be optimistic about. Yes, revenue was climbing at a nice pace. At the same time, however, the company was incurring significant net losses and hemorrhaging cash. Due to no end of this pain insight, I felt bearish enough about the company to rate it a solid ‘sell’ to reflect my view that shares should meaningfully underperform the broader market for the foreseeable future. Fast forward to today, and it seems I wasn’t bearish enough. While the S&P 500 is down 8.4%, shares of View have tumbled 37.3%.

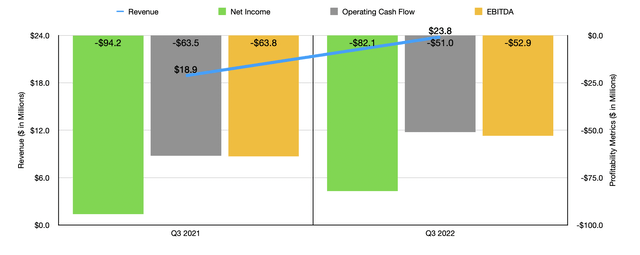

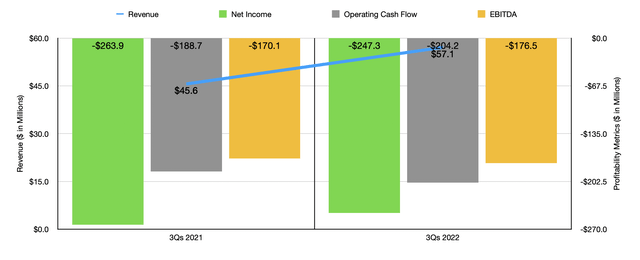

At first glance, growth-oriented investors might seem perplexed by this movement. But after you dig deeper, you can see precisely the problem. To see what I mean, I would like to point to results achieved during the third quarter of its 2022 fiscal year. This is the first quarter for which new data is available that was not available when I last wrote about the enterprise. During that time, sales came in at $23.8 million. That’s up nicely from the $18.9 million reported the same time last year. That third quarter was instrumental in keeping sales growth up nice year over year. For the first nine months of 2022, for instance, the company generated sales of $57.1 million. That’s up from the $45.6 million reported in the first nine months of 2021.

In addition to seeing revenue continue to climb, some investors who are bullish on the company may point to the fact that profitability is improving. But to me, making that argument would be the same as saying that removing a bucket full of water from the Titanic would mean that the picture was getting better for the passengers. In the third quarter of this year, the firm generated a net loss of $82.1 million. Yes, that is an improvement compared to the $94.2 million reported the same time last year. But at the same time, is a sizable amount of money that easily surpasses revenue. Other profitability metrics followed suit. Operating cash flow, for instance, went from negative $63.5 million to negative $51 million. And over that same window of time, EBITDA for the company went from negative $63.8 million to negative $52.9 million. As was the case in the third quarter alone, the picture for the company has been bad for the entire year from a profitability perspective. Yes, the net loss for the firm has narrowed from $263.9 million to $247.3 million. But operating cash flow has worsened from negative $188.7 million to negative $204.2 million, while EBITDA has gone from a negative $170.1 million to negative $176.5 million.

I don’t think it would be an overstatement to say that the company is, at best, in a precarious state. In fact, with cash exceeding debt of only $48.5 million on its books as of the end of the latest quarter, it looks as though the company can’t last very much longer without a capital infusion. Thankfully for the shareholders of the firm, this cash infusion did come. But it was not cheap. On October 27th, the company completed the issuance of $200 million worth of convertible senior notes. These notes come due in 2027, which gives the company plenty of time to pay the debt back. The actual cash interest on the notes is not all that bad, coming in at 6%. Furthermore, the company has the option to pay the interest with additional notes instead of cash, but that raises the rate of interest to 9%. What’s way painful though is that these notes are convertible, with the number of common shares that they are convertible into totaling as many as 186.92 million. To put this in perspective, as of the end of the latest quarter, the company had 221.51 million common shares outstanding. So even without the paid-in-kind aspect of the notes, Investors could see dilution of as much as 45.8% from this deal.

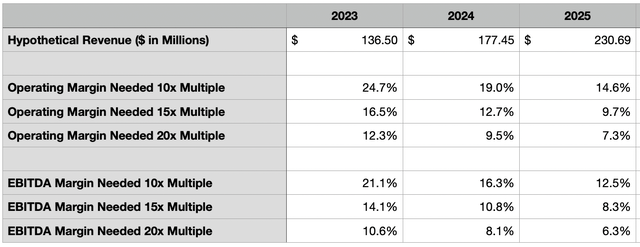

If this were a one-time transaction, things might not be so bad. But as I mentioned already, cash flow is so awful for the enterprise that the company will burn through this capital rather quickly. In theory, the company could go on to represent a decent investment opportunity. But this, to me, is highly unlikely. In one hypothetical scenario, I asked the question of how much cash flow the company would need to generate in a given year if revenue were to continue climbing at a rate of 30% per annum for the next three fiscal years. In the table below, you can see the implied operating cash flow and EBITDA margins for the enterprise in those cases. These are not terribly large numbers in the grand scheme of things, particularly if we assume that the company would warrant trading multiples that are near the higher end of the scale. But compared to where the financial picture is today, the leap looks nigh insurmountable.

Takeaway

Based on all the data provided, I will say that I still find the business model used by View to be interesting. I’m a huge fan of this type of technology, but that doesn’t mean that it makes for a good investment opportunity. The fact of the matter is that the company is losing capital much more rapidly than it is bringing in. It would be different if growth were significantly greater than it is today. If that were the case, it might be able to race to profitability faster. But seeing as how that is not the case and seeing as how the company has already had to resort to a highly dilutive transaction, with that only doing so little as bidding time for the enterprise, I can’t help but to remain bearish moving forward.

Be the first to comment