MikeMareen

Investment Summary

At HBI we continue to trawl the broad healthcare spectrum in search of selective opportunities and/or to revise ratings within our coverage universe. Since our last report on Repligen Corporation (NASDAQ:RGEN) we’ve observed several factors of confluence emerge that lead us to reaffirm our position on the stock as a hold. In this report I’ll discuss our latest examination findings on RGEN.

As a reminder, our previous hold call on RGEN was predicated on the balance of several factors, in a list ranging market to idiosyncratic headwinds [you can read it by clicking here]. These included:

- Shares were trading at a sizeable 88x trailing P/E at the time of the last publication. Back then we were seeking names positioned in the low-beta/high quality pocket of the market, hence RGEN didn’t align with these investment principles.

- A reasonable trailing return on equity (“ROE”) for the company of c.8.80% was clamped with RGEN stock trading at 6.2x book value, reducing the investor ROE to just 1.41% if paying that multiple.

- Annualized return on invested capital of 9.95% comfortably outpacing the WACC hurdle of ~8.3%, backed by strengths in other profitability measures, noting “ROE and [return on assets] ROA have recovered from FY18 lows…[b]oth of these have each pushed substantially north to a combined value of ~16% last quarter [Q1 FY22].”

- Price target of $200 [RGEN priced at $202 on publication] and thus unsupportive valuations to place a bid.

Turning to the present day, we’ve noted similar trends, and, despite management’s revisions to FY22 guidance on the last earnings call, we are cautiously neutral on RGEN at this stage. Reaffirm hold.

RGEN Q3 financials corroborate hold rating

Switching to the company’s latest numbers, we’d note it was a mixed period of growth, with COVID-19 revenues diminishing at pace.

It printed quarterly revenue of $201mm, a 12.7% YoY growth schedule. We’d also note this result includes an $11mm headwind from foreign exchange (“FX”) impacts from the USD strength in FY22. It pulled this down to adjusted EPS of $0.77 on a fully diluted basis, down from $0.78 a year ago.

It’s also worth advising that COVID-19 revenues – or the lack thereof – continue to be a headwind to RGEN’s top-line growth in our estimation.

To illustrate, COVID-19 revenue, thinned by $19mm signifying a 40% YoY decline. Moreover, YTD revenues totaled $615mm, representing an organic YoY growth of 28% – however, note that a 900bps decline in COVID-19 revenue was also recognized across this period as well.

Looking at the segment highlights, we saw the core business perform well, with a 29% increase in revenue for the quarter. In particular, we noted the filtration and chromatography sectors were the primary growth levers within the portfolio.

Upsides here were underscored by strength in the hollow fibre and ATF portfolios for the company. Meanwhile, another standout in our estimation was the gene therapy segment. RGEN clipped 50% growth in this division for the 9 months to September 30.

Furthermore, the number of accounts under RGEN’s wings with annual revenue exceeding $1mm increased by more than 70% from the previous year. We’d note this totals over 20 accounts.

We’d also note that CapEx for the YTD was $67mm, with capital allocated primarily to the fluid management segment and build out of its assembly plants in the U.S. and Ireland.

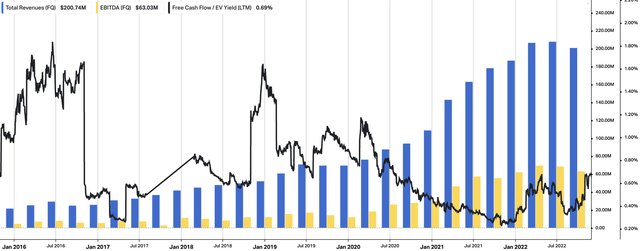

You can see the impact of diminishing COVID-19 sales to the company’s top line in Exhibit 1. Management’s revision of FY22 guidance [discussed later] offers some confidence looking ahead. However, there’s still a risk to revenue, EPS upside looking ahead in our estimation. What’s more is that investors would be buying RGEN at a 69bps trailing FCF yield, well off previous highs seen before the pandemic.

Exhibit 1. RGEN quarterly operating performance, FY16–date

Data: HBI, Refinitiv Eikon, Koyfin

Guidance revision also worthwhile of mention, balance downside case

We’d also point out that management more or less reaffirmed its forecasts for FY22 from the top to bottom lines. It now expects FY22 revenue of $795–$805mm, down from $790–$810mm at the upper end.

Interestingly, this calls for YoY growth of 19–20% at the top line, whereas it estimated an 18–21% growth previously. A major headwind RGEN identifies looking ahead is FX headwinds and the reduced contribution from COVID-revenue. However, it does also project a 33% YoY growth in its core franchises for the year.

Management noted its growth assumptions are built on the increasing demand in its core business. To this point, it raised guidance in its base business to $645mm at the upper end of range.

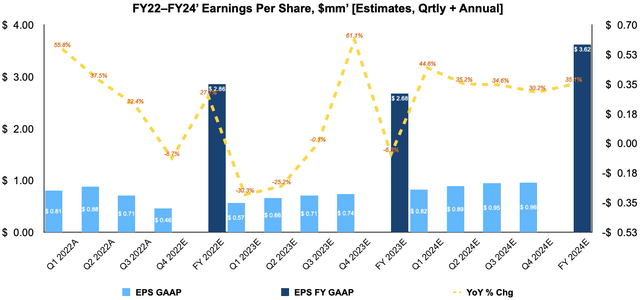

On this is projects adjusted EPS of $3.15–$3.20, and we feel this is a reasonable number to work by. We’d also note that RGEN’s FY22 forecasts are above consensus estimates, which must be factored into the investment debate.

You can see our EPS growth assumptions for the company below, which are also built on performance of RGEN’s base business in FY23 and FY24.

Exhibit 2. RGEN FY22–24 EPS growth assumptions [internal estimates].

Data: HBI, Refinitiv Eikon, Koyfin

Valuation and conclusion

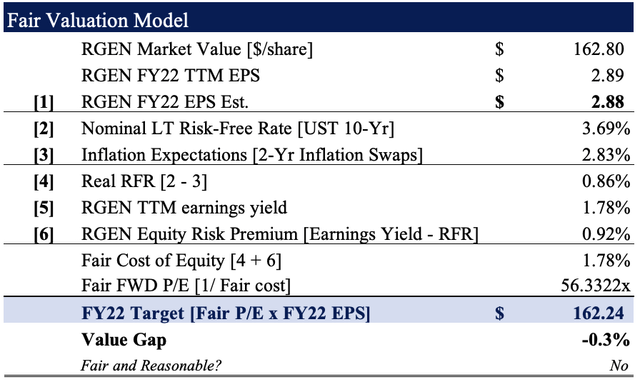

It’s also worth highlighting that consensus has priced RGEN quite richly at 58.4x forward earnings. We believe this is too much of a premium and given our GAAP EPS for FY22 for the company, value it at 56.3x forward P/E [Exhibit 3].

When rolling the FY22 EPS estimates forward to the 56.3x multiple it derives a price objective of $162. Note, this is below our previous target of $200. As such, this also supports our neutral view.

Exhibit 3. Fair forward P/E of 56.3x FY22 EPS Est. $2.88 = $162.

Note: Fair forward price-earnings multiple calculated as 1/fair cost of equity. This is known as the ‘steady state’ P/E. For more and literature see: [M. Mauboussin, D. Callahan, (2014): What Does a Price-Earnings Multiple Mean?; An Analytical Bridge between P/Es and Solid Economics, Credit Suisse Global Financial Strategies, January 29 2014]. (Data: HBI Estimates)

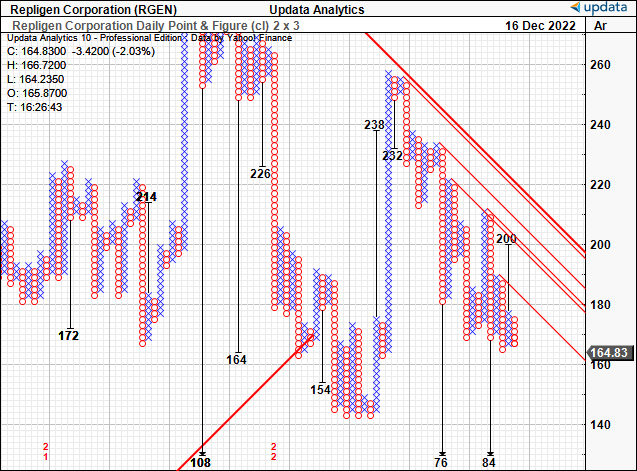

Finally, you’ll observe below we have downside targets as far as $76, $84, which is a key downside risk in our opinion. RGEN also has a number of inner and outer resistance lines to punch through in order to reverse the thesis.

Exhibit 4. Downside targets to $84, $76

Data: Updata

Net-net, we continue to rate RGEN a hold and foresee more selective opportunities elsewhere in the space. Valuations, slow EPS upside and a choppy broad market are all factors that must be considered in RGEN’s investment debate. Rate hold, $162 price target.

Be the first to comment