onurdongel/iStock via Getty Images

Investment Thesis

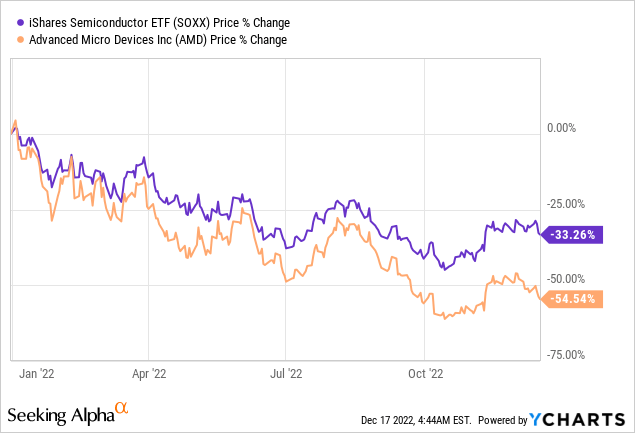

Advanced Micro Devices, Inc. (NASDAQ:AMD) has substantially underperformed the iShares Semiconductor ETF (SOXX) index. However, its improving growth prospects, revenue mix, growing Data-Center market share, and attractive valuation make AMD a buy amidst the global Chip Wars and for the long term.

Improved Positioning In The Data-Center Market

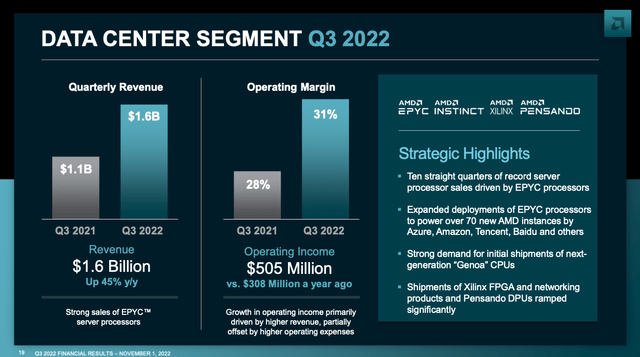

AMD’s technology portfolio and focus on increasingly modular and interconnected chips have aided its positioning in the data-center market. As a result, AMD’s data center continues to post strong growth, with revenue up 45% YoY in Q3 2022 to $1.6 billion from $1.1 billion in Q3 2021.

Performance superiority is a consistent theme across AMD’s data-center products. This makes it among the top hyperscale cloud providers, significantly contributing to its revenue. This segment is also lucrative from a gross margin perspective. Moreover, AMD’s extension of its portfolio across single and dual-socket CPUs to address a variety of server workloads will help expand its reach and lift pricing.

AMD is well-positioned to keep expanding data-center share as it widens the range of workloads, particularly for artificial intelligence training and inference. AMD’s chiplet architecture for connecting different computing units enables it to configure chips in a highly tailored manner, especially for high-end customized workloads. As a result, even with a likely slowdown in hyperscalers’ capital spending, AMD could sustain data-center growth of more than 25-30% due to its architecture lead over Intel Corporation (INTC), reflected in superior chip performance and higher average selling prices.

The company has also announced that it will infuse its CPU portfolio with Xilinx’s FPGA-powered AI inference engine, with the first products slated to arrive in 2023. As a result, AMD could nearly double its market share in data centers to around 40% through 2025, driven by its lead in chiplet and performance improvement for custom workloads due to the addition of Xilinx and Pensando accelerators.

Data Center Segment (static.seekingalpha.com/uploads/sa_presentations/406/88406/original.pdf)

Client CPU Share Can Remain Steady Despite Weakening PC TAM

Client (desktop/notebook CPU) sales saw a significant reset in Q3 2022, declining 53% QoQ, driven by a weaker-than-expected PC market compounded by ongoing inventory burn across the PC supply chain. The management expects PC industry units to be down high-teens to 20% this year compared to its prior expectation for a mid-teens % decrease followed by a ~10% decline in 2023 as the supply chain continues to adjust inventories down for at least the next 2-3 quarters. The team is significantly under-shipping to PC consumption to help flush channel inventories, which should support Client revenues to inflect to the upside in 2H23.

Revenue Mix Shift & Chip Performance Improvements Lift Margins

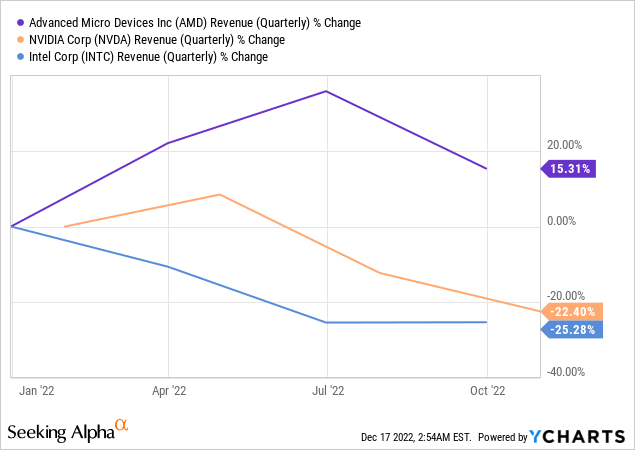

AMD’s rising chip performance per watt, driven by the use of leading-edge process nodes from Taiwan Semiconductor Manufacturing Company Limited (TSM), and the infusion of accelerators with its chiplet architecture, may support the firm to sustain top-line growth faster than the overall market.

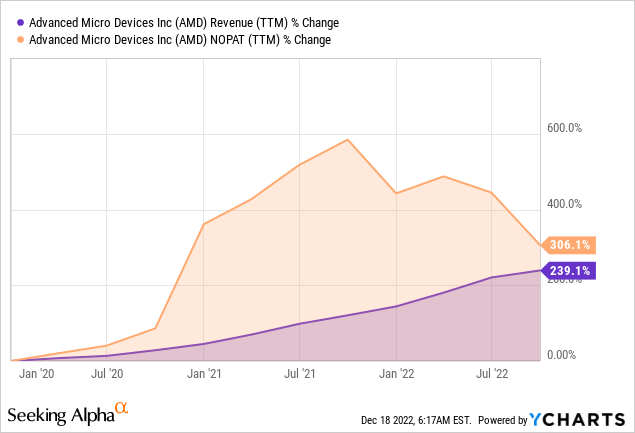

AMD’s sales growth is fueled by high-performance products and continuous increases in chip performance per watt ahead of rivals, notably Intel. As a result, AMD could exceed its long-term 20% sales-growth target rate, with estimates have come down sharply for 2023 following its inventory correction tied to the Client segment.

The company’s strong road map for custom workloads in data centers and diversification into other markets, such as networking, should support the company in sustaining top-line gains faster than the semiconductor market. Thus, the company’s shifting mix toward higher-margin Data centers and Embedded segments will boost operating profit growth faster than the top line.

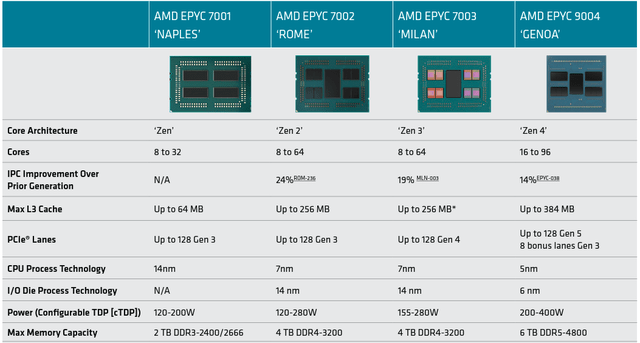

Genoa: EPYC 4th Gen Is A Game Changer

AMD delivered yet another impressive family of server CPU products, helping to extend and solidify its server CPU product leadership compared to INTC, which continues to recover from past missteps. In addition, AMD’s 4th gen server processors (codenamed Genoa) offer significant improvements compared to both AMD’s prior Gen of products and INTC’s existing Ice Lake products.

Though AMD could not compare performance with INTC’s Sapphire Rapids (which still needs to ramp in volume), Genoa rumors to be superior. Notably, at up to 96 cores, AMD broadened its suite of offerings in this generation to meet a more diverse set of customer needs, with different SKUs optimizing for density, cache, frequency, cost, etc. In addition, the launch included endorsements from key data center ecosystem players in both Cloud (Google, Microsoft Azure, Oracle) and Enterprise/HPC (Dell, HPE, Lenovo, Supermicro, VMware).

From a performance standpoint, AMD’s Genoa is estimated to generate a gen-to-gen ~2.6x efficiency improvement for Cloud workloads, a ~2.5x improvement in floating point ops performance for HPC, and a ~2.9x improvement in performance for Enterprise workloads, with improvement on a performance-per-watt basis across all three segments as well. AMD also highlighted the EPYC family of processors has now achieved over 300 world records, up from 200 since the launch of Milan.

Finally, Intel may begin shipping its 7-nm chips after production delays in 2023. AMD’s EPYC server CPUs, now on third-generation 7-nm chips, are set to shift to 5-nm, maintaining an advantage over Intel. In addition, the 5-nm chips aid performance, shrink price premiums and reduce costs. Thus, Amazon, Google, and Microsoft could move more workloads to AMD servers through 2023.

www.amd.com

New GPU Launch Could Stimulate Demand

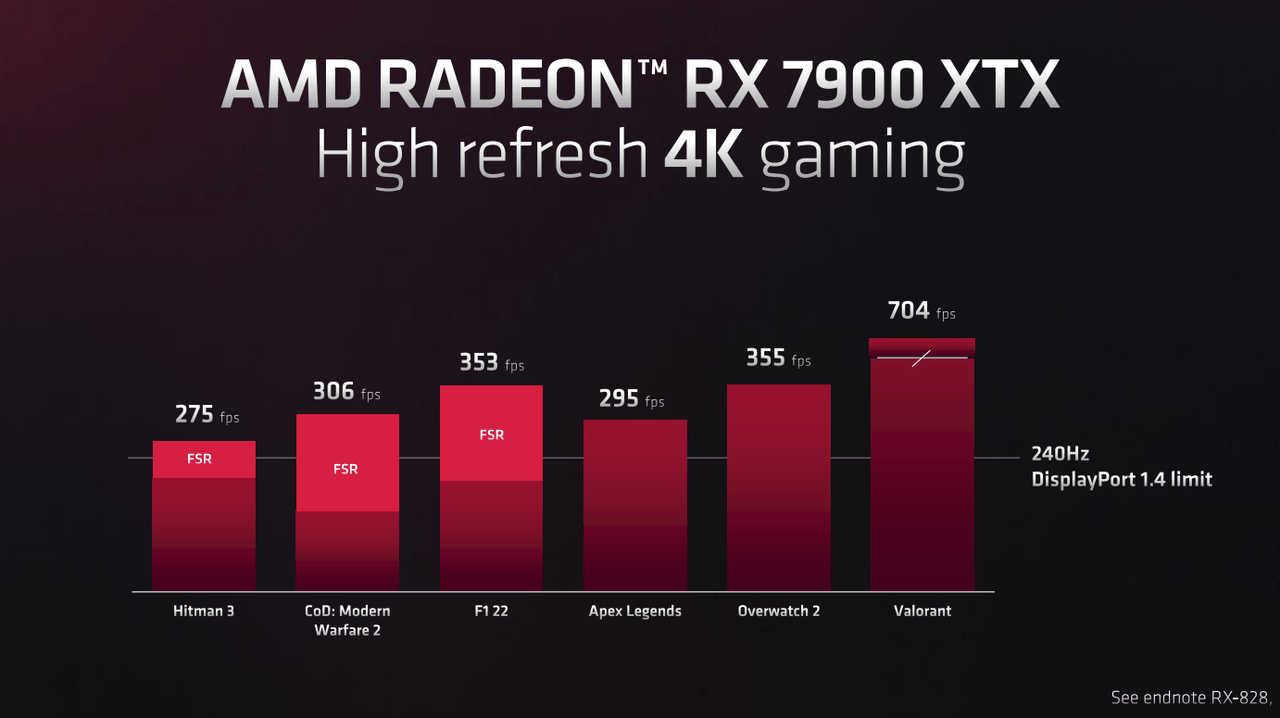

AMD’s 7900 XTX/XT RDNA3 was launched on December 13 at $999/$899 and is competing with the more expensive NVIDIA Corporation (NVDA)’s RTX 4080 (~$1200 MSRP), while the RTX 4070 Ti, the rebranded RTX 4080 12GB (originally $899), could release in January as both NVIDIA and AMD look to expand their mass-market in GPUs into 2023.

AMD’s RX 7900 XTX delivers a comparable gaming performance to the NVDIA’s RTX 4080. Still, the $200 difference in pricing would be the key differentiating factor for AMD’s newly launched GPU as gamers make a purchase decision in an economy where discretionary spending is dwindling. In addition, other mass-market versions at lower prices in 2023 could help drive demand in the next few quarters.

www.pcgamer.com/amd-radeon-rx-7900-xtx-xt-price-release-date-specs/

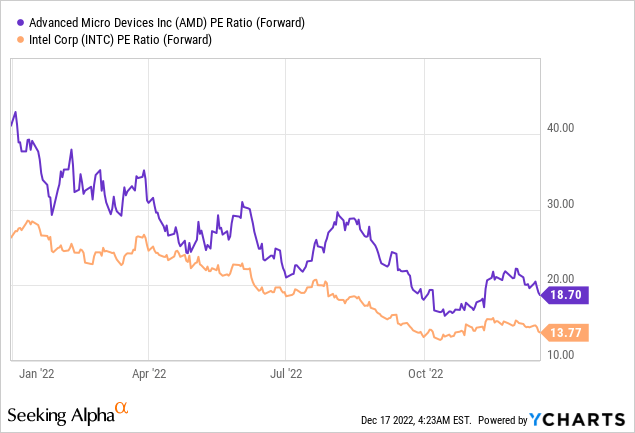

Client Weakness Favors Valuation

AMD’s price/earnings multiple has come down sharply after the estimates’ slowdown for sales and profit growth amid an inventory correction in its client segment. Yet, the market could be under-assessing resilience in the Data Center business and overstating the possibilities for expansion by Intel. In addition, AMD’s server growth can aid sales mix and margins, as Intel’s server-share loss and foundry expansion hurt the chipmaker’s margins.

In addition, AMD’s transition to the 5-nm process aids its cost profile, and its chip-performance advantage is helping close the gap with Intel on pricing. As AMD builds its Data Center portfolio with the recent acquisitions of Xilinx and Pensando, Intel risks losing market share across multiple workloads.

Conclusion

Despite growing macro headwinds buffeting the PC market compounded by continued inventory work-downs across the PC supply chain, AMD’s Data center and Embedded businesses remain relatively strong heading into 2023 on a resilient North American cloud environment and continued strength in military, aero, industrial and communications sectors.

Be the first to comment