master1305

Introduction

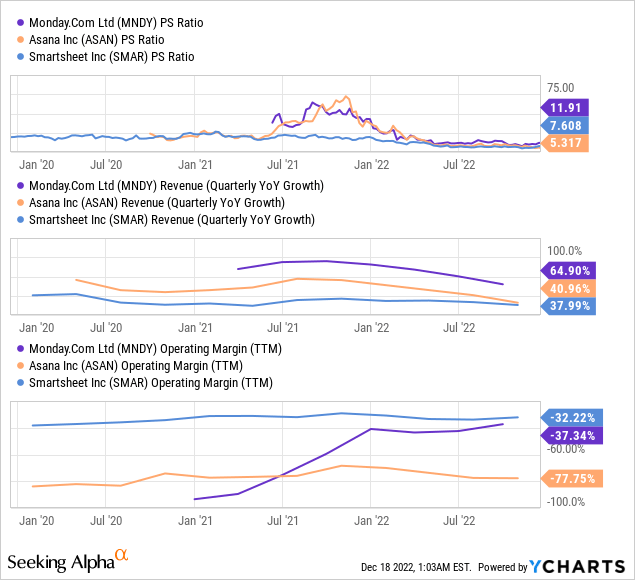

Work management software tools have been around for decades, but legacy players are being disrupted by modern, rapidly-growing, cloud-based platforms like the ones we own at TQI, namely, monday (NASDAQ:MNDY), Asana (ASAN), and Smartsheet (SMAR). Mind you, this is a very crowded space, and competitive pressures are evidently visible on the bottom lines of companies operating in this space.

YCharts

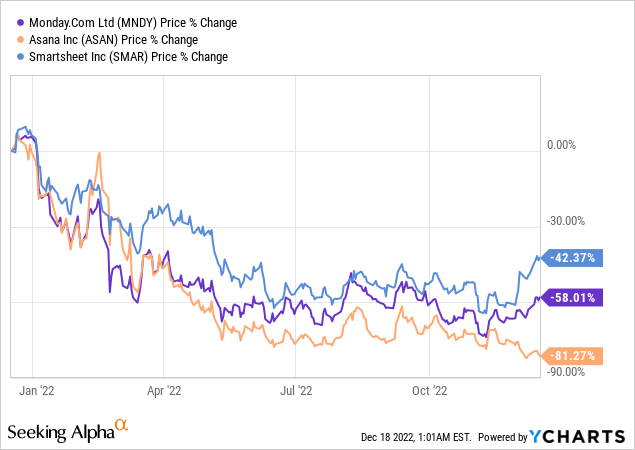

All three businesses in our basket are also operating with negative to breakeven cash flows (unprofitable on GAAP basis). In 2022, rising interest rates have led to a sharp correction in valuation multiples across high-growth tech universe, and our work management software basket hasn’t been spared the blushes.

YCharts

In the last twelve months, Smartsheet, monday, and Asana are down ~40%, ~60%, and ~80%, respectively. In this note, we will focus only on monday.com, but if you’re interested in my earnings analysis for the other stocks mentioned above, please refer to this note:

Without further ado, let’s jump straight into monday’s Q3 numbers.

Reviewing monday.com’s Q3 Earnings Report

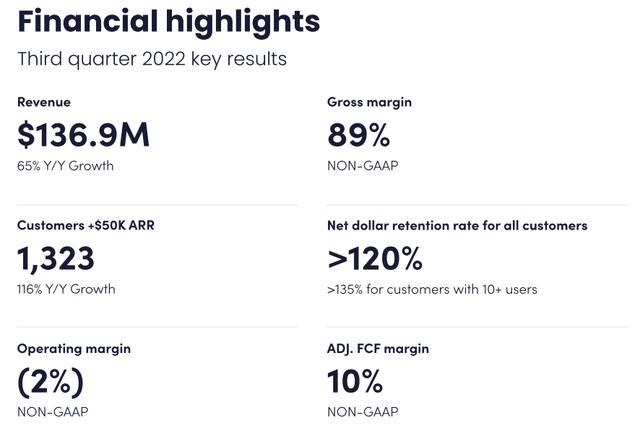

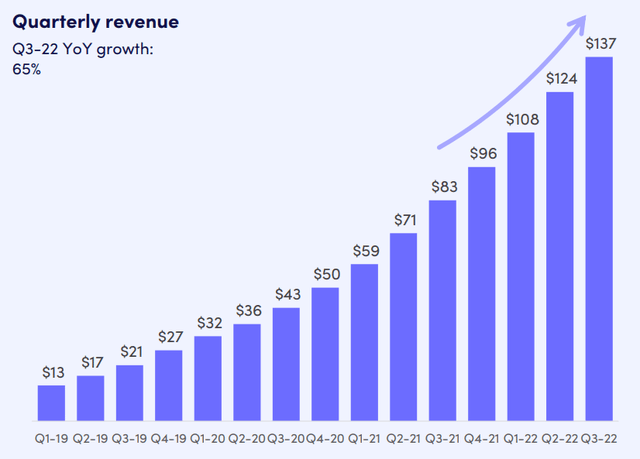

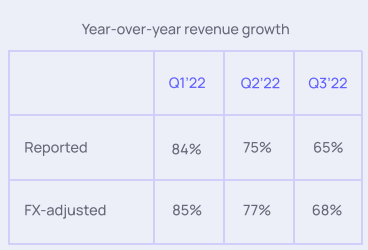

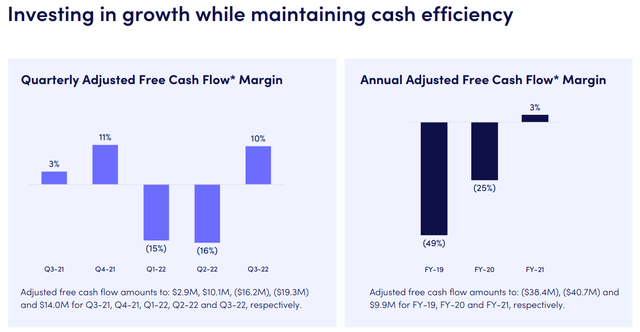

monday reported stronger-than-expected numbers for its Q3 earnings, with quarterly revenues growing by 65% y/y to $136.9M. More importantly, monday returned to positive adj. free cash flows. In Q3, monday’s adj. FCF margin reached +10%, resulting in adj. FCF of $14M. Furthermore, monday’s NRR stayed above 120%, showing robust demand from existing customers.

Monday.com Q3 2022 Investor Presentation

Management commentary on Q3:

The strength of our Work OS platform and continued execution in the quarter resulted in strong top line growth, with revenue growing 65%. This quarter once again demonstrated our ability to drive growth from both new and existing customers, particularly at the enterprise level where we expanded our base to over 1,300 customers.

– Roy Mann (Founder and co-CEO of monday.com)

In the Q3 earnings call, monday’s management alluded to strength in US dollar and weak demand in Europe as major drags on the business. Despite facing these macro headwinds, monday is delivering exceptional growth and margin improvements.

Monday.com Q3 2022 Investor Presentation

Yes, monday’s growth rates are decelerating and sales cycles are getting longer. However, monday’s platform expansion, declining customer acquisition costs, and rising retention rates are ample reasons to invest in monday.

Monday.com Q3 2022 Investor Presentation

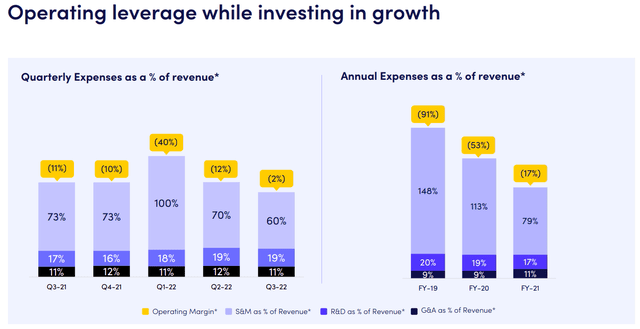

As revenues scale up, monday is delivering robust operating leverage. In Q3, monday’s operating margin improved to -2%, with a significant drop in Sales & Marketing expense. The beautiful thing about monday’s Q3 report was that management cut back on S&M expenses and still revenue growth continued to remain robust.

Monday.com Q3 2022 Investor Presentation Monday.com Q3 2022 Investor Presentation

Here’s some more commentary from monday’s management:

We made strong progress against our financial and operating plans, which drove improving margins and positive adjusted free cash flow in the third quarter. While uncertainties in the macroeconomic environment remain, these results give us confidence to increase our outlook for the balance of the year, as we remain focused on improving efficiency and profitability while investing responsibly to grow the business.

Monday.com Q3 2022 Investor Presentation

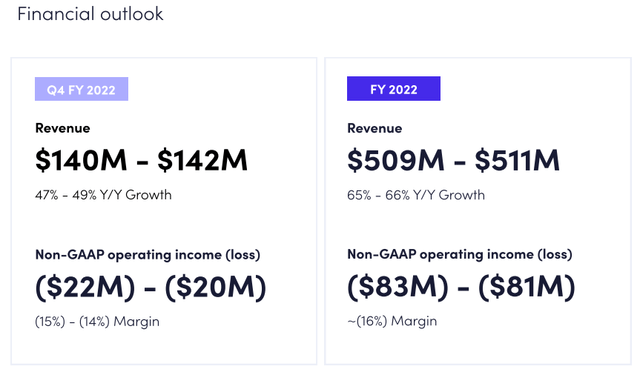

For Q4, monday is projected to deliver revenues of $140-142M (growth of 47-49% y/y), and non-GAAP operating loss of -$22-20M. Now, monday is far from being a consistently profitable business. However, with a cash position of $852.5M and no debt, monday’s balance sheet is in great shape, and I see no liquidity problems brewing at the company.

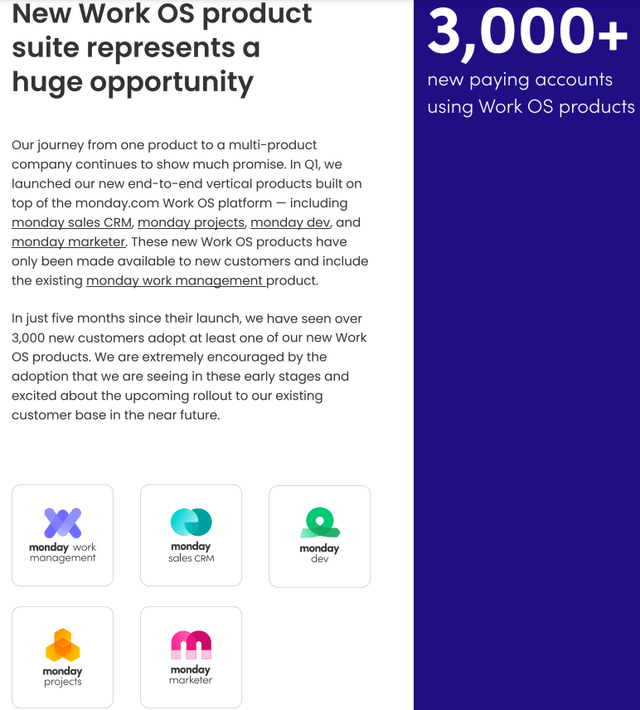

In Q1, monday launched several products atop its work management platform, including monday sales CRM, monday projects, monday dev, and monday marketer. So far, monday has only been selling these products to new consumers; however, as announced on the Q3 call, monday is gearing up to cross-sell these products across its vast customer base sometime in 2023.

Monday.com Q3 2022 Investor Presentation

Going into a potential recession, this platform expansion from monday looks very promising as organizations are likely to look for bundled offerings to preserve capital.

Additional commentary from monday’s management:

Our new Work OS products continue to see great traction, and we are very encouraged by the adoption and positive feedback we have received from early customers. We remain confident in the long-term opportunity ahead as we continue to provide products and solutions that are core to our customers’ business success across an expanding breadth of use cases.

– Eran Zinman, Founder and co-CEO of monday.com

Despite facing macro headwinds, monday continues growing like a weed, and it is doing so whilst improving margins. monday is not yet profitable; however, it is operating close to FCF breakeven. Having a cash cushion of ~$850M and no debt should allow management to remain aggressive during the impending downturn, i.e., capture more market share. Overall, I am impressed with monday’s financial performance in Q3, and I am already looking forward to next quarter.

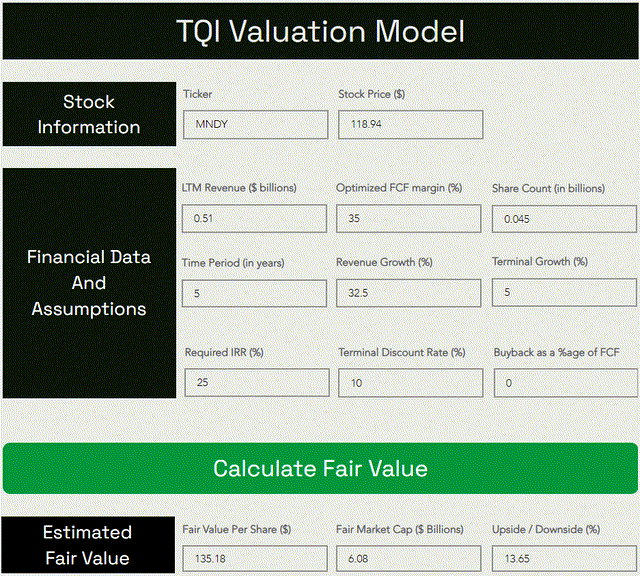

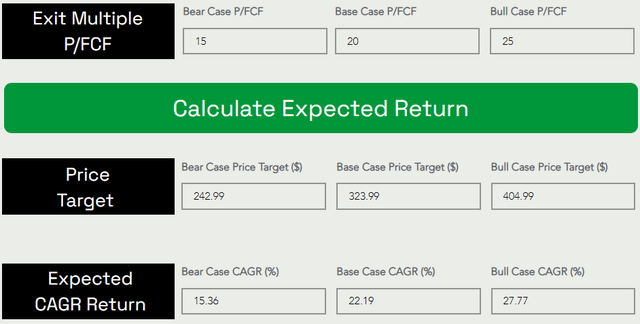

Here’s my updated valuation for monday.com

TQI Valuation Model (Author’s Website: TQIG.org) TQI Valuation Model (Author’s Website: TQIG.org)

A significant update here:

- Old FV estimate: $118.60, New FV estimate: $135.18

- Old Base case PT (5-yr): $285.98, New Base case PT (5-yr): $323.99

This upgrade is driven by stronger-than-expected top and bottom line performance from monday in Q3.

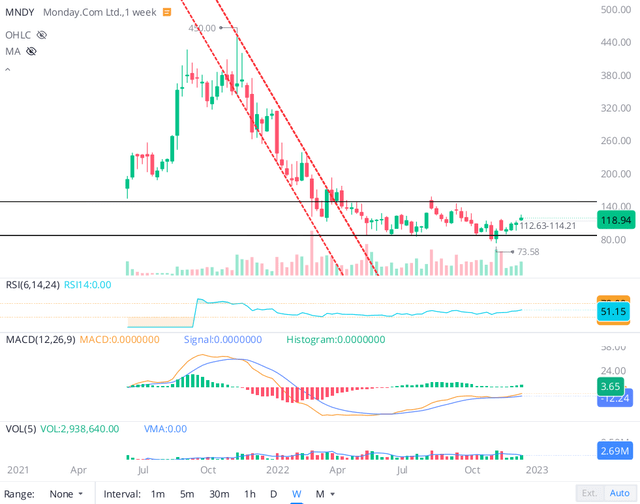

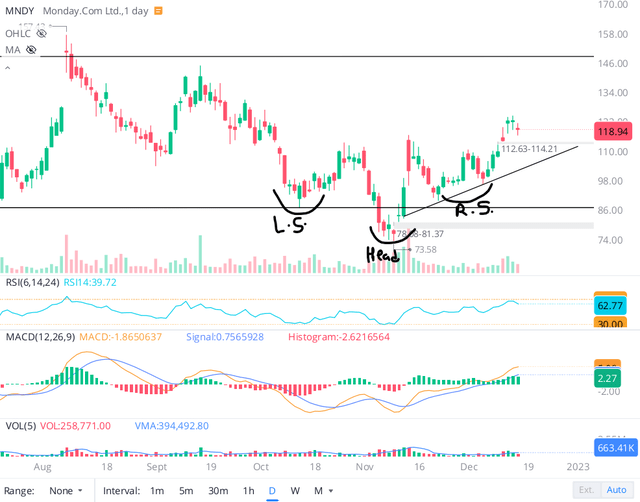

A look at MNDY’s technical chart

monday’s relatively-short history as a publicly-traded company has been quite volatile, with the stock climbing from an IPO price of $155 to $450 in a matter of months during mid to late 2021, only to suffer a significant drawdown in 2022. From a technical perspective, monday’s stock finds itself in a Stage-1 base formation.

After hitting a new 52-week low of $73.58 per share in mid-October, MNDY has been rallying higher. On the technical chart, I see an inverse head and shoulders pattern, which could result in a move up to $150 in the near to medium term.

However, given the current macroeconomic backdrop, equities could come under pressure in the first half of next year. monday’s stock is unlikely to be immune to the broad market conditions, and hence, we could very well see a move back down to the lower end of this base at the $80-85 range.

From a technical perspective, monday’s stock is in a no trade zone. However, a long-term investment makes sense here due to strong fundamentals and a reasonable valuation. Hence, I like the idea of accumulating shares in this counter for the long run via DCA plans.

Key Takeaway: I rate monday.com a buy in the low $100s, with a preference for staggered accumulation.

Thanks for reading, and happy investing. Please share your thoughts, questions, or concerns in the comments section below.

Be the first to comment