slobo

Introduction

I first purchased AutoZone, Inc. (NYSE:AZO) stock near the bottom of the pandemic crash on March 20th, 2020. I bought 30 stocks total during the March 2020 crash and I wrote publicly about 20 of those stocks in a series on Seeking Alpha called “Stocks I Bought On The Dip,”, including one covering AutoZone. (The other 10 ideas were reserved for my marketplace service, The Cyclical Investor’s Club.) Of the 20 stocks I wrote public articles about, I only still hold three of them, and AutoZone is one of those three. The vast majority of the rest I took triple-digit profits in over the course of the last 2 years, and I wrote articles detailing my sales for pretty much all of those stocks. As I wrote about taking profits, it was not uncommon to encounter readers who couldn’t understand why I would sell these stocks after they had performed so well. I did my best to explain to readers that often if the price of the stock rises at a faster rate than earnings do, the forward returns of the stock are diminished. When those expected future returns get low enough, I sell, and then invest in something else with better prospects.

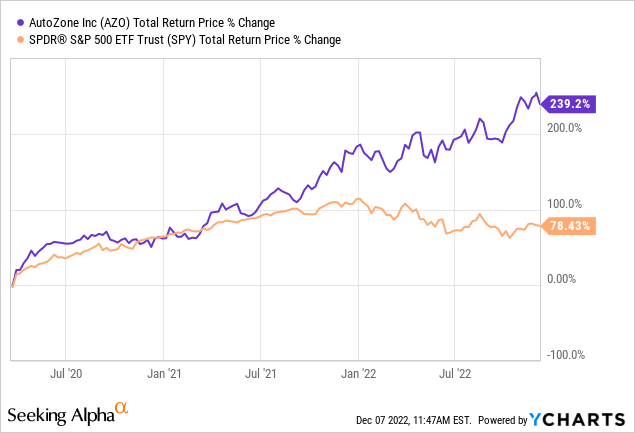

AutoZone has performed very well since I bought it:

Of the stocks I still hold in my portfolio, it has been the strongest performer along with Tractor Supply (TSCO), tripling the performance of the S&P 500 over the same time period. (These actually weren’t the best returns of the group, I took profits in Ameriprise Financial (AMP) in 2021 with a +260% return, and it still holds the top spot.)

So, AutoZone has performed extremely well, yet I’m still holding it even while I sold 17 of other the other 20 stocks I bought during the March 2020 dip and later wrote about publicly. Why? The simple answer was that AutoZone’s valuation remained reasonable during this time because earnings grew fast enough to keep up with the rising stock price. In this article, I will examine that valuation after the recent earnings report in which AutoZone surpassed analysts’ expectations again. And I will also cover some of the potential dangers AutoZone stock might face over the next year or two.

My Valuation Method For AutoZone

This will be the same valuation method I used to determine the price to buy AutoZone when it was really cheap back in March 2020. The valuation method first checks to see how cyclical earnings have been historically. Once it is determined that earnings aren’t too cyclical, then I use a combination of earnings, earnings growth, and P/E mean reversion to estimate future returns based on previous earnings growth and sentiment patterns. I take those expectations and apply them 10 years into the future, and then convert the results into an expected CAGR percentage. If the expected return is really good, I will buy the stock, and if it’s really low, I will often sell the stock. In this article, I will take readers through each step of this process.

Importantly, once it is established that a business has a long history of relatively stable and predictable earnings growth, it doesn’t really matter to me what the business does. If it consistently makes more money over the course of each economic cycle, that’s what I care about.

AutoZone is a very rare publicly traded business that has a perfect record of long-term EPS growth with no years of EPS decline. Part of that is due to their aggressive buyback policy, which helps boost EPS (I will control for that later in the analysis). Having no EPS drawdowns to account for at all makes AZO a fairly easy stock to analyze on an earnings basis, which is what I will do in this article.

AutoZone Stock – Market Sentiment Return Expectations

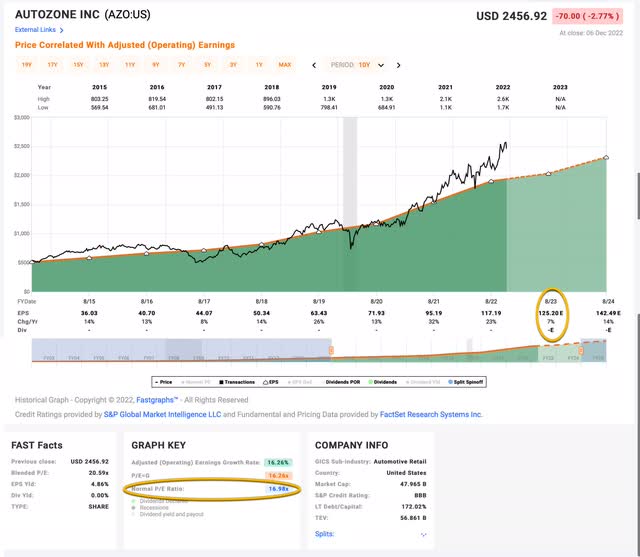

In order to estimate what sort of returns we might expect over the next 10 years, let’s begin by examining what return we could expect 10 years from now if the P/E multiple were to revert to its mean from the previous economic cycle. For this, I’m using a period that runs from 2015-2023.

AutoZone’s average P/E from 2015 to the present has been about 16.98 (the blue number circled in gold near the bottom of the FAST Graph). After the most recent earnings report, EPS estimates for 2023 have risen from $125.20. This creates a forward P/E of about 19.66 for AZO. If that 19.66 P/E were to revert to the average P/E of 16.98 over the course of the next 10 years and everything else was held the same, AZO’s price would fall and it would produce a 10-Year CAGR of -1.45%. That’s the annual return we can expect from sentiment mean reversion if it takes 10 years to revert. If it takes less time to revert, the return would be lower.

Business Earnings Expectations

We previously examined what would happen if market sentiment reverted to the mean. This is entirely determined by the mood of the market and is quite often disconnected, or only loosely connected, to the performance of the actual business. In this section, I will examine the actual earnings of the business. The goal here is simple: we want to know how much money we would earn (expressed in the form of a CAGR %) over the course of 10 years if we bought the business at today’s prices and kept all of the earnings for ourselves.

There are two main components of this: the first is the earnings yield, and the second is the rate at which the earnings can be expected to grow. Let’s start with the earnings yield (which is an inverted P/E ratio, so, the Earnings/Price ratio). The current earnings yield is about +5.09%. The way I like to think about this is, if I bought the company’s whole business right now for $100, I would earn $5.09 per year on my investment if earnings remained the same for the next 10 years.

The next step is to estimate the company’s earnings growth during this time period. I do that by figuring out at what rate earnings grew during the last cycle and applying that rate to the next 10 years. This involves calculating the historical EPS growth rate, taking into account each year’s EPS growth or decline, and then backing out any share buybacks that occurred over that time period (because reducing shares will increase the EPS due to fewer shares).

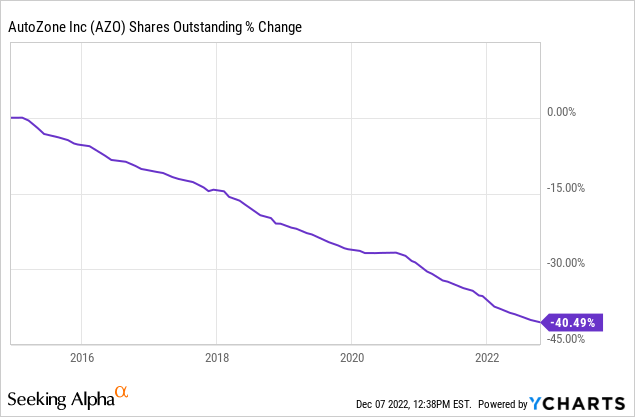

Instead of paying a dividend, AutoZone spends most of its earnings on share buybacks. This helps to create that smooth EPS growth trend we saw earlier, and inflates the EPS growth rate because shares are being reduced. I want to know what the earnings growth rate would roughly have been without these buybacks, which have been massive, with AZO buying back 40% of the business since 2015. After I control for those buybacks, I get an earnings growth rate of about +10.47%, which is much more conservative than the FAST Graphs calculation of +16.26% earnings growth.

Next, I’ll apply that growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR estimate. The way I think about this is, if I bought AZO’s whole business for $100, it would pay me back $5.09 plus +10.47% growth the first year, and that amount would grow at +10.47% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I calculate to be about $191.60 (including the original $100). When I plug that growth into a CAGR calculator, that translates to a +6.72% 10-year CAGR estimate for the expected business earnings returns.

10-Year, Full-Cycle CAGR Estimate

Potential future returns can come from two main places: market sentiment returns or business earnings returns. If we assume that market sentiment reverts to the mean from the last cycle over the next 10 years for AZO, it will produce a -1.45% CAGR. If the earnings yield and growth are similar to the last cycle, the company should produce somewhere around a +6.72% 10-year CAGR. If we put the two together, we get an expected 10-year, full-cycle CAGR of +5.27% at today’s price.

My Buy/Sell/Hold range for this category of stocks is: above a 12% CAGR is a Buy, below a 4% expected CAGR is a Sell, and in between 4% and 12% is a Hold. A +5.27% CAGR expectation makes AutoZone stock a “Hold” at today’s price.

In order for AutoZone stock to cross my basic “buy” threshold, the price would need to drop below $1,607.00 per share. In order to cross my “sell” threshold, the price would need to rise above $2,681.00 per share. If it did rise above that price, I would review the stock closely and determine whether to sell.

Additional Considerations

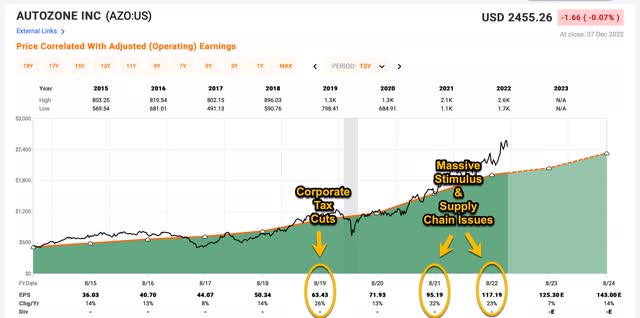

AutoZone has been the beneficiary of several tailwinds since 2015.

In the FAST Graph above, I have highlighted three years out of the past 8 years where AutoZone experienced outsized EPS growth. In 2018, the U.S. federal government lowered the corporate tax rate, and that likely explains the boost that year, and then 2021 and 2022’s earnings were likely helped by massive government stimulus and supply chain issues slowed the production of new cars, meaning people are driving older cars that need more repairs. Currently, the average car on the road in the U.S. is at a record, over 12 years old.

This was a recipe for success for AutoZone, and I think without these benefits, perhaps we would only have experienced 8% average earnings growth instead of 10.47% over this period. That means, going forward my earnings growth assumptions might still be a little on the optimistic side. So far, though, AZO has shown no signs of negative earnings growth. In their most recent earnings report this week, not only did beat expectations, but sales increased Y/Y by +8.7% and same store sales increased by +5.6% for the quarter. So, they are still chugging along at a decent pace.

I think there are two potential headwinds in 2023 and 2024. The first is that new car inventories are starting to replenish and I expect there will be quite a few people who decide to buy a new car. I am actually in this camp, personally. The average age of my cars is 12 years (just like the national average), but I have refused to pay the inflated prices the past few years to upgrade them. Needless to say, I’ve had to make a few trips to AutoZone for parts.

On the other side of this is the likelihood that we have a recession next year, which I think is quite high. If this happens, maybe people pull back on spending and driving altogether, reducing the miles driven and, therefore, the quantity of repairs. Or, perhaps folks stick with their older cars even longer because they can’t afford new ones, and that benefits AutoZone. It’s difficult to say, but there is probably some limit that is reached eventually, and we should expect slower growth from AutoZone at that point.

Conclusion

Putting all these considerations together, I would expect flattish earnings growth for AZO over the next two years, and for the stock price to stagnate or fall a little bit. But, I don’t see enough risk with the current valuation for me to sell now and go to cash.

AutoZone is a good example of how a stock that has produced very good returns can earn its way to a long-term hold in my portfolio. The first step is to buy the stock at a discount, which is what I did in March 2020. By the time I wrote a public article on AutoZone in a few months later in June of 2020, the stock price had risen over +56% in three months, but because I bought at a discount the stock was still fairly valued. Earnings for AutoZone, from 2020’s earnings of $71.93 per share grew nearly 75% to 2023’s expected EPS of $125.30 in 3 years. That means the stock price is justified rising another 75% more after that initial 56% move. For example, imagine you buy an undervalued stock for $100 per share, it rises $56 to $156 per share with the same earnings and now becomes fairly valued. Now imagine the earnings grow 75%. The price can rise to $273 per share, for a +173% total gain and still not be overvalued at all. That is how a stock can rise a lot in a short period of time and remain a “Hold.” Most stocks don’t do that, but AutoZone did.

Now AutoZone stock is richly valued, but not extremely overvalued. And, relative to the rest of the S&P 500, it’s probably valued about the same as the market here, so it’s not easy to find a simple replacement if the stock is sold. I’m already holding roughly 1/3rd cash right now, so I’m in no need to raise cash. Under these conditions I will continue to hold AutoZone stock unless it becomes more overvalued than it is now.

Be the first to comment