JHVEPhoto/iStock Editorial via Getty Images

When it comes to what is the best energy infrastructure company, it’s an impossible question to answer. Too much lies in the hands of personal opinion and speculation. I am invested in several energy infrastructure companies and feel some are more undervalued than others, but none are as diversified as Enbridge (NYSE:ENB). Everyone has their favorites, which is a matter of opinion at the end of the day. What can’t be disputed is that ENB is the most diverse energy infrastructure company, as its operations transcend traditional oil and gas infrastructure, as it operates a multi-billion dollar renewable portfolio and the 3rd largest gas utility company in North America. I think ENB is a quintessential stock for any income investor, which can be a cornerstone of any income-focused portfolio. ENB just announced its 27th consecutive dividend increase, and many more are likely to follow. ENB may be a boring company, but its essential to our way of life. Last I covered ENB in March.

Why energy infrastructure companies are underrated and why I love investing in this sector

Energy infrastructure isn’t an exciting segment to many investors. While it doesn’t have the appeal of big tech, this sector provides a necessity that society can’t forgo. Putting aside viewpoints about renewables and traditional fossil fuels, it can’t be disputed that life would quickly become very different if there wasn’t enough energy to sustain the current demand. Many expect the lights to turn on when a light switch is flicked, or gas comes out of the pump when filling up the tank. What would happen in the U.S. if rolling blackouts became normal? What would happen if there wasn’t enough fuel for heating homes in the winter, or even worse if electronics didn’t work due to a lack of energy?

In many ways, society has become complacent and expects instant gratification without considering the ramifications of insufficient energy. A group of software engineers can form a company, raise money, create a SaaS platform, and compete for business. A group of people can’t raise money and decide to compete in the energy sector. Energy is the foundation of society, and civil unrest would likely occur without a continuous supply, yet some groups won’t invest in the oil & gas sector. Berkshire Hathaway (BRK.A) has become synonymous with energy, yet the allure of Warren Buffett and Charlie Munger overshadow the conglomerate’s investments in the oil patch. In the first 9 months of 2022, BRK.A generated $15.84 billion in revenue from energy businesses within its portfolio. Rather than expanding its pipeline business organically, BRK.A, which has a limitless checkbook, decided to purchase 7,700 miles of pipelines from Dominion (D). For me, this is a critical piece of information that perfectly illustrates the barriers to entry within the energy infrastructure space. To physically build pipelines that will be placed into service, a company needs to map out what facilities the pipelines will connect to, get permits, purchase land, conduct environmental studies, build the infrastructure, and sell contracted services. BRK.A paid roughly $1.26 million per mile, paying $9.7 billion for 7,700 miles of pipeline. This is a lofty premium on the assets, but it shows how valuable these assets are as in many cases, they are as close to being non-duplicable as they can be.

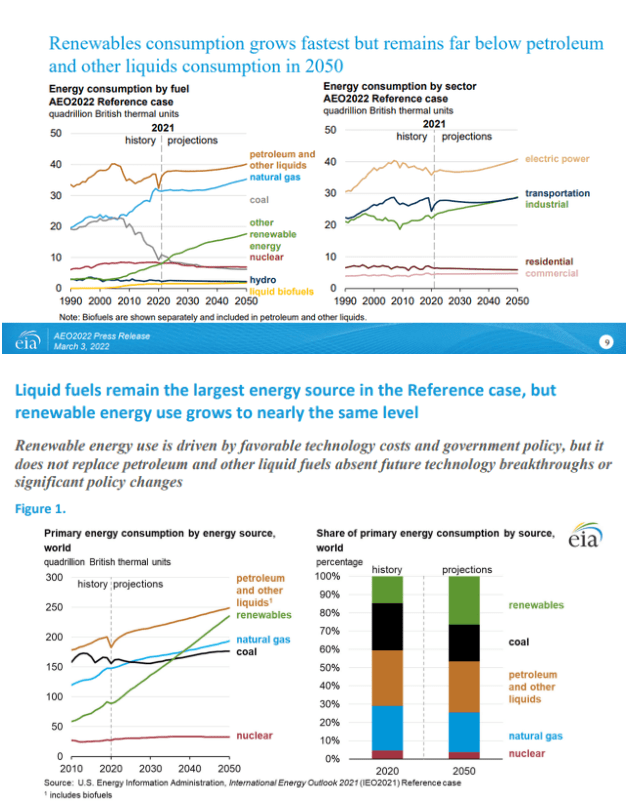

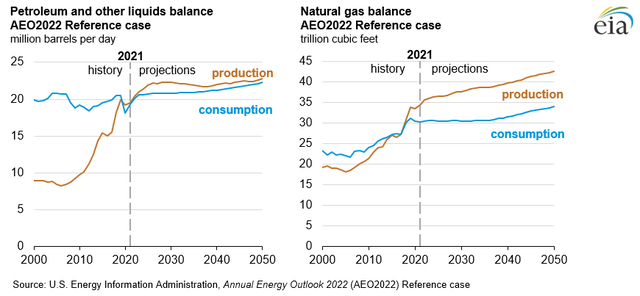

On 3/3/22, the EIA released its 2022 Annual Energy Outlook and concluded that petroleum and natural gas remain the most consumed sources of energy in the United States through 2050 (1st slide below). The EIA publishes its international energy outlook every 2 years, and the last one was published prior to the war in Ukraine. In their baseline case, the global energy demand would increase by 50%, growing from 600 quadrillion BTUs in 2020 to 900 quadrillion BTUs in 2050. In 2050 the global energy mix per the EIA isn’t a scenario where renewables replace or displace oil & gas but an energy mix that incorporates all sources of energy. Petroleum and other liquids are projected to remain the largest energy source, followed by renewables, then natural gas. From now through 2050, oil & gas will both increase their consumption rates in the global energy mix. I truly believe there is a misconception when it comes to what the future of energy will look like, and this has created an entire sector of midstream operators that are unappreciated and, in many cases, undervalued.

EIA

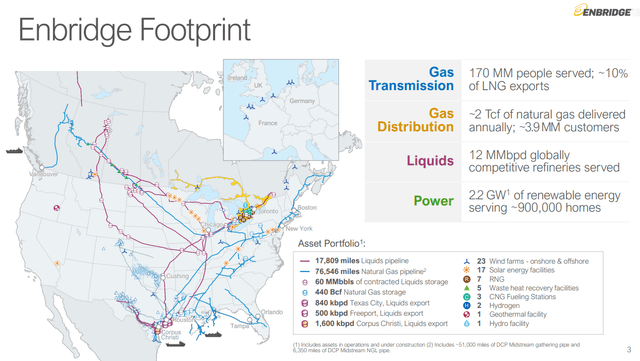

Enbridge is the most diverse energy infrastructure company and plays a critical role across North America, making sure fuels sources are delivered from A to B

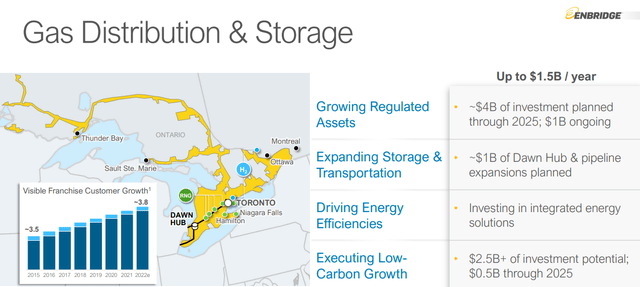

ENB transports the energy that hundreds of millions rely on throughout North America and is a cornerstone of society. ENB is a triple threat as it operates North America’s largest natural gas utility by volume, and third largest by customer count. ENB’s gas utility company and its affiliates deliver utility services to roughly 15 million people in Ontario and Quebec and distributes 5.3 Bcf/d of natural gas daily. Over the past 170 years, this network has grown to 52,505 miles of gas transportation, distribution mainlines, and 41,631 miles of service lines. Unless there is shattering breakthroughs in science that change how energy is generated, ENB owns and operates an irreplaceable utility that provides reliable energy to 3.1 million customers, consisting of over 15 million people. I love this business because the barrier to entry mitigates competition.

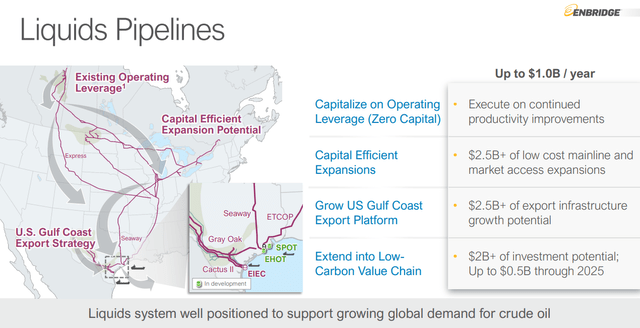

ENB operates the world’s longest crude and liquids transportation system consisting of 17,809 miles of crude pipeline across North America. If these products ceased to be delivered for 1 day, think about the chaos and disarray it would cause. Petroleum products are essential, and when it comes down to it, they aren’t disappearing anytime soon, creating tremendous amounts of security for ENB. Through ENB’s liquid pipelines, they deliver more than 3 million barrels of crude daily, and in 2021 they transported more than 4 billion barrels of crude. ENB transports around 30% of the crude in North America. From an import/export methodology, ENB transports 65% of U.S.-bound Canadian exports and 40% of U.S. crude imports.

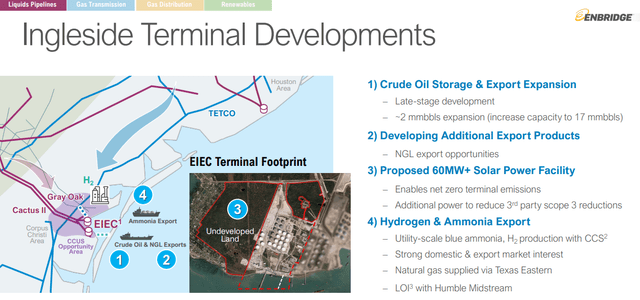

In addition to liquid pipelines, ENB has a large exporting business. The EIA has projected that crude oil exports have primarily increased in response to growing international demand. From 2021 through 2050, crude oil exports will remain near their projected peak and will remain stable as a percentage of total domestic crude oil production. ENB operates the largest crude oil storage and export terminal by volume in the United States. The ENB Ingleside Energy Center connects Permian and Eagle Ford production to international markets. The terminal has direct connectivity to long-haul crude pipelines such as Cactus I, Cactus II, Gray Oak, EPIC, and Harvest. This facility has storage for 15.3 MMBbls and the capacity to load 160,000 barrels per hour through its marine infrastructure.

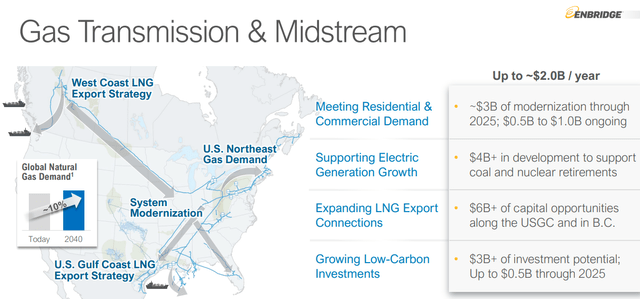

On the natural gas side of the business, ENB’s network moves roughly 20% of all gas consumed in the U.S through 74,364 miles of pipeline. This network spans 30 U.S. states, five Canadian provinces and offshore in the Gulf of Mexico. ENB transports roughly 22.7 Bcf/d and has 161.f Bcf of storage.

Why Enbridge is bound to deliver revenue growth for decades to come

The EIA projects that production for oil & gas in the U.S. will expand through 2050 to meet a growing energy demand that they believe will be roughly 50% larger than it is today. Petroleum and other liquids are projected to increase on the production side by 17% through 2050 from 2021 levels, while natural gas production will grow by almost 24%. For me, it’s a simple equation. If the global demand for energy increases, and production levels increase in the U.S. for oil & gas, then upstream companies will need to transport larger levels of fuels to meet the growing demand. This would logically benefit energy infrastructure companies as additional capacity within their systems would need to be contacted. This should drive larger levels of Adjusted EBITDA and Distributable Cash Flow ((or DCF)) from ENB’s operations over the years.

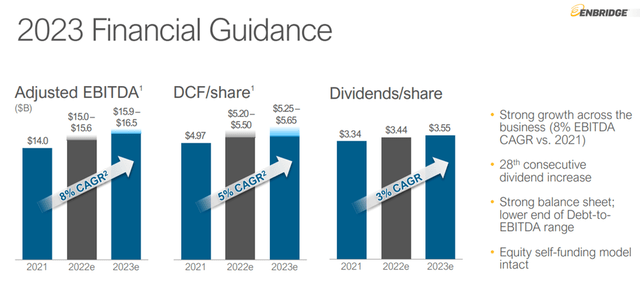

ENB is projecting that they will deliver a 9% CAGR for 2022 in EBITDA and 8% in DCF per share. ENB recently released it’s 2023 financial guidance, and assuming that they low side projections for 2022 and 2023 occur, we would see Adjusted EBITDA grow by $1 billion in 2022 and another $900 million in 2023 while DCF per share grows by $0.23 in 2022 and another $0.05 in 2023. ENB will be placing new assets into service, adding new customers, and recognizing rate escalation In their utility business to drive profitability. ENB has around $17 billion of capital secured for future projects, which will lead to organic growth

Enbridge has been a critical dividend growth company for income investors over the years

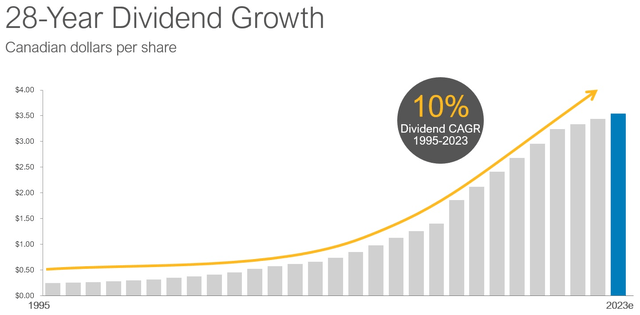

For almost 3 decades, ENB has been providing annualized dividend increases to its shareholders. 2022 marked the 27th annual dividend increase, and the BOD has already stated that shareholders will receive their 28th consecutive dividend increase in 2023. From 1995 thru 2023, ENB’s dividend has a CAGR of 10%. This comes on top of a dividend that can be traced back almost 7 decades, as ENB has paid dividends to its shareholders for 68 years.

The most secure dividend is arguably the one that’s just been increased. In December, ENB announced a 3.2% increase to its dividend, which translates to $3.55 per share in Canadian dollars over the course of 2023. ENB has maintained a dividend payout ratio between 60-70% of its DCF. This allows ENB to grow its dividend responsibly without sacrificing its financial strength or the ability to allocate capital toward organic growth.

From an income investor perspective, ENB has been a strong dividend company. Currently, ENB pays a $2.65 per share dividend in U.S dollars which is a 6.91% yield. There aren’t many companies that can offer a 6.91% yield and a dividend that has almost 3 decades of annual increases. This has been accomplished without sacrificing the financial stability of ENB, and shareholders are able to rely on growing dividends from ENB. Having a payout ratio that doesn’t exceed 70% of its DCF solidifies that ENB will be in a position to provide future increases and grow its return of capital. As ENB drives larger levels of Adjusted EBITDA and DCF from its operations, it’s capital allocation priorities will continue to favor shareholders.

Conclusion

ENB is one of my favorite energy infrastructure companies, as their operations are virtually impossible to replicate. ENB transports around 30% of the crude in North America, roughly 20% of all gas consumed in the U.S., while distributing 5.3 Bcf/d of natural gas daily through its utility company. There is a clear path for ENB to grow its Adjusted EBITDA and DCF as oil and gas production levels are expected to increase over the next several decades to meet the growing global demand for energy. ENB just delivered its 28th consecutive dividend increase and is currently yielding 6.91%. ENB has been a reliable dividend grower, and I believe shares are a great addition to any income portfolio under the $40 level.

Be the first to comment