spooh

It seemed as if AMD (NASDAQ:AMD) was going to escape the clutches of the weak retail/PC market after issuing a softer but very respectable revenue guide in early August. After Intel (INTC) in late July and Western Digital (WDC), Micron (MU), and Nvidia (NVDA) in early August all issued disappointing reports or pre-announcements, AMD stood out as the sole high-growth semiconductor to buck the trend. For a bit, I thought AMD would offset the weakness in the retail end markets because by flexing its strength in its market share advancement. In the end, however, AMD was hit as badly as the rest. But the result for investors is not to flee AMD but instead begin accumulating shares, as the bottom is now within sight.

Recapping The Pain

Intel’s bombshell of a report and guide in July reeked of its typical internal business chaos. After all, its data center division was down 16% year-over-year, and no one was calling for data center weakness through the summer. So while putting investors on alert, it was hard to take Intel seriously as it hadn’t shown itself to be the bellwether it once was.

But it did start making one think more about Qualcomm’s (QCOM) poor FQ4 guide a day earlier.

The truth began pouring in the following week, though, as other companies started reporting their own bad news; one after the other, each seemingly worse than the next.

First, it was Western Digital with its topline miss in its report and very staggering downside guidance – coming in at $3.7B in revenue vs. expectations for $4.79B. Then, three days later, Nvidia pre-announced it would miss its guidance, missing an $8.1B consensus by $1.4B. A day later, Micron pre-announced it would come in at or below the low end of its guidance – just five weeks after issuing said guidance.

Five companies were all seeing the same end-market weakness – large, big-name companies.

In between Intel and Western Digital, AMD reported and provided light but materially intact guidance. It seemed as if AMD was going to get by largely unscathed.

But the overall bad semiconductor news didn’t end there.

Nvidia and Micron then officially reported and guided well below consensus estimates for the current quarter. Nvidia, for its part, at the end of August, guided $1B below consensus, adding to the pain of its pre-announcement. Micron saw the worst of it as it guided just a week ago for $4.25B in revenue vs. expectations for $5.68B – after already signaling a weak upcoming quarter.

All the while, AMD continued to buck the trend through silence. But, as we now know, the company will ultimately miss its quarter by a large margin, missing $6.71B estimates by over $1.1B. In a few weeks, we’ll likely see the fallout of a below consensus guide, finishing off the pain.

Opening The Barn Doors Now

But not following the stock’s performance over the last two months would not be seeing the whole picture. Additionally, not considering the bottom is finally beginning to be carved out with the downside pre-announcement would mean missing out on the opportunity to build a long-term position for the retail market rebound.

For those who haven’t been picking up AMD during this falling knife scenario and now have a full position, the barn doors have just opened to welcome the horses back in.

Among the ones I’ve mentioned in this article, the best near-term opportunity is Micron, as the bottom in memory will happen more swiftly than logic chips due to the lever of controlling supply. It’s one of several factors, including others, I’ve outlined for my subscribers. But beyond this accelerated timetable for Micron is AMD’s fabless structure and well-managed, well-executing business. So if this retail end-market inventory correction will impact all of these names, AMD is at the top of my list for wanting to be in the recovery end of this downturn.

This pre-announcement takes estimates down so the market’s anticipatory senses can begin seeing at the bottom, but, more importantly, the shift in estimate revisions back up. This is a six-to-nine-month look ahead mechanism the market employs. Therefore, as long as the recovery is within the next three quarters, the market will begin laying the bottom in the stock. Once the market is within two quarters of the recovery and earnings revisions have leveled off, the stock will start making headway higher.

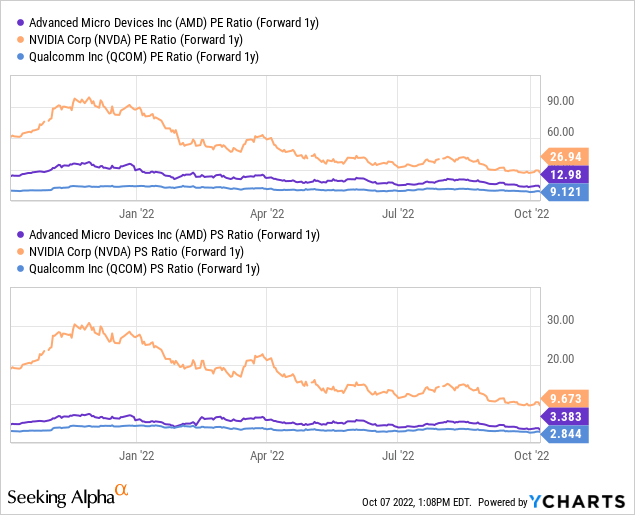

Keeping Valuation Relative

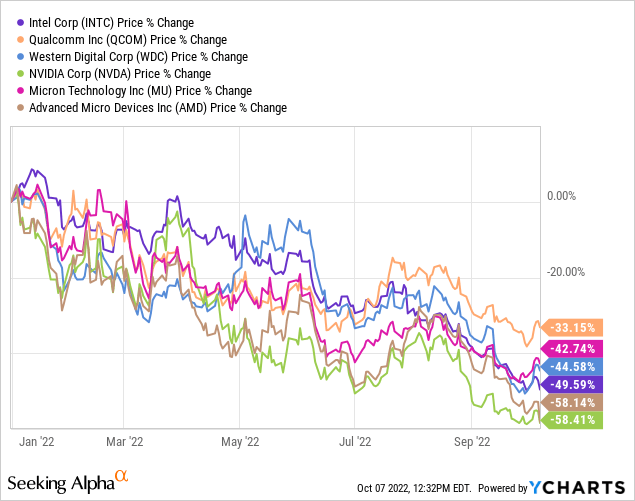

Considering AMD is now the worst performing of the semiconductors I mentioned year to date, second only to Nvidia, the opportunity becomes the best value in this region. Moreover, comparing fabless peers’ valuations (as peers with fabs have inherently lower valuations due to the higher capital costs) shows AMD is well within both relative buy range and absolute buy range.

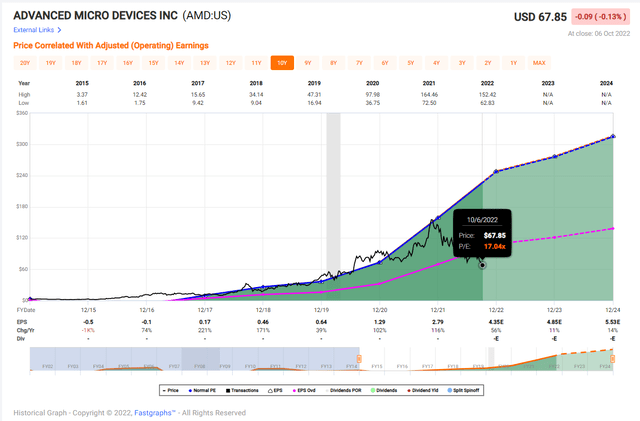

Now, I’m well aware of the danger of using the forward valuations of these companies as their earnings estimates continue to decline. The idea is to also use the historical averages and find the buffer of how undervalued the stock may be. For this, I reference F.A.S.T. Graphs as it charts out the valuation relative to both future expectations and past performance. There hasn’t been a valuation time like this in the last ten years for AMD.

FAST Graphs

Beyond just the basics of earnings, one has to keep in mind the growth rates still expected for AMD relative to peers like Nvidia, where growth is going solidly negative.

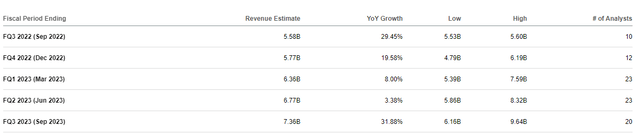

AMD Revenue Estimates (Seeking Alpha)

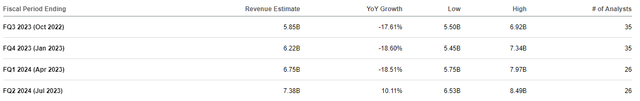

Nvidia Revenue Estimates (Seeking Alpha)

You would expect Nvidia to have the lower valuation as it has lower forward growth rates, but the exact opposite is true. AMD has a higher expected growth rate but a lower valuation. The market may be expecting a more significant turnaround for Nvidia as it currently expects growth to return a quarter sooner than AMD (going back to my point about the bottom being closer) or further downward revisions for AMD, but the gap in valuation does not make up for the risk between the two.

Finally, The Shoe Dropped

AMD’s pre-announcement is disappointing but is in no way surprising considering its peers had entire novels written on the wall. The market was waiting for the AMD shoe to drop so it could begin pricing in the extent of the earnings cuts. With it now in the rearview, a comparison among peers is much easier to work through. It comes down to the company’s ability to push through the retail and inventory correction downturn to the other side.

As I said earlier, Micron will be the first of the group to see upside return, but AMD is at the top of the list when it comes to a less risky semiconductor business structure. As a result, it isn’t just a relative performance issue, it’s also a meaningful difference in relative and absolute valuation. Over the last decade, AMD hasn’t been at this low of a valuation, while Nvidia remains at valuations well over double it.

The least risky, more undervalued play among the semis is AMD. And with the downside pre-announcement out of the way, the market can begin to look to the other end of this challenging environment. It makes this dip into the $50s a serious first opportunity to buy the recovery as a long-term investor.

Be the first to comment