-Oxford-/iStock Unreleased via Getty Images

FedEx Corporation (NYSE:FDX) stock gained momentum last week on the back of a few interesting developments, including a 50%+ dividend hike. As part of an agreement with hedge fund D.E. Shaw, a well-known activist investor, the company hiked the dividend, announced two new additions to its board of directors, made changes to its executive compensation scheme by adding shareholder return as a performance measurement tool, and announced that executive compensation will also be tied to a lower capital expenditure target. A couple of Seeking Alpha authors have already covered these changes in detail, so in summary, all these changes are aimed at improving the profitability of FedEx while distributing more wealth to shareholders. FedEx is set to report fiscal fourth-quarter earnings after the closing bell today, so the objective of this article is to determine the likely market reaction to the company’s earnings.

Macro Challenges Could Lead To Disappointing Earnings For FedEx

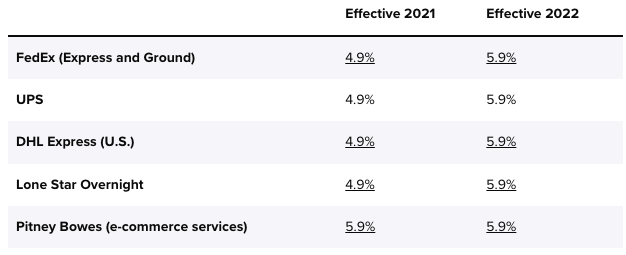

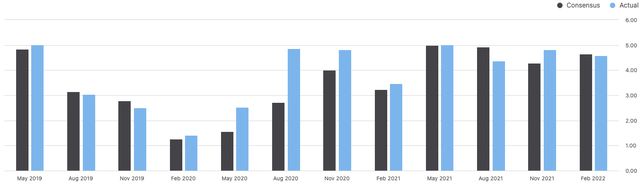

At Leads From Gurus, we believe earnings surprises will lead to market-beating returns in the long run. For this reason, we prefer to invest in companies that are likely to report market-moving earnings surprises, and consistency is something that we would love to see when it comes to selecting investment opportunities. FedEx, as evident from the below chart, has not been consistent in reporting positive unexpected earnings in the recent past.

Exhibit 1: Earnings surprise history

Coming to this quarter, there are a few reasons to believe FedEx could post in-line or worse-than-expected earnings.

- FedEx suspended operations in Russia and Belarus last March in light of the Russia-Ukraine war, and global supply chain disruptions resulting from the uncertainty in Eastern Europe have led to an overall decline in demand for deliveries.

- A new wave of lockdowns in industrial cities in China has further aggravated global supply chain disruptions.

- Oil prices skyrocketed this quarter, leading to a surge in jet fuel prices.

- A decline in overall demand for goods resulting from high inflation.

Costs are rising on all fronts, which is not a good sign for FedEx as the company enters a new business cycle where demand for package delivery could gradually decline for a few quarters on the back of macroeconomic challenges faced by consumers.

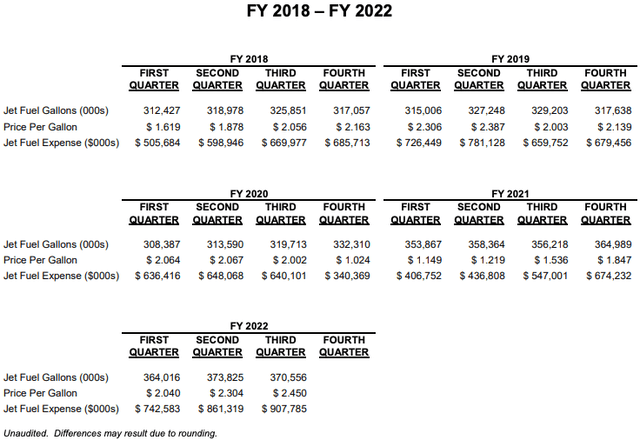

As illustrated below, FedEx reported a cost of $2.45 per gallon of jet fuel in the third quarter of fiscal 2022, which marks a recent high for the company, not surprisingly. Energy inflation did not ease up in this quarter, so the company is likely to report elevated jet fuel costs for the fourth quarter of fiscal 2022 along with a contraction in operating margins.

Exhibit 2: Jet fuel statistics

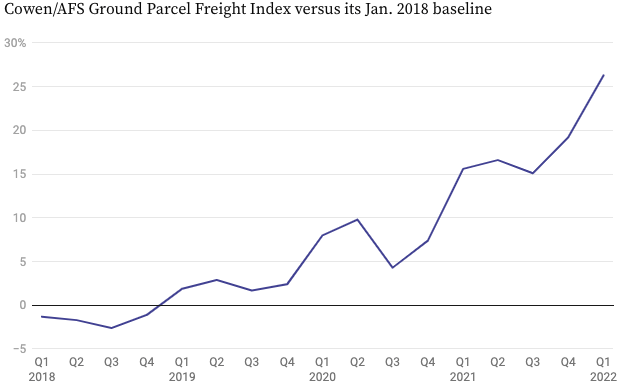

The negative impact resulting from some of the above developments will be negated – to a certain degree – by higher pricing for parcel delivery in both Ground and Express segments. With the pandemic came surging demand for package delivery, thanks in part to the growing prevalence of e-commerce. Also, the package delivery industry experienced tight capacity, shifting the pricing power in favor of shipping companies. As illustrated below, parcel carriers have already hiked their prices across categories in the last couple of years.

Exhibit 3: Announced general rate increases by parcel carriers

Supply Chain Dive

FedEx levies a surcharge on certain deliveries on top of the announced rate increases as well, so it would be reasonable to assume that these rate hikes would have helped the company push margins in the right direction in Q4 FY 2022, although an overall improvement in margins is unlikely amid cost pressures.

The Pandemic Boon Will Gradually Fade

Adjusting for FedEx’s acquisition of TNT in 2016, the company’s revenue only grew in single digits from FY 2012 to FY 2019, and sales declined in FY 2020, not surprisingly. However, the company clocked in blockbuster revenue growth of 21.3% in FY 2021 driven by a few reasons.

- Stellar growth in residential package delivery demand resulting from higher-than-expected e-commerce penetration.

- A recovery of business-to-business delivery demand.

- Pricing power advantages enjoyed by the industry due to strong demand and tight capacity.

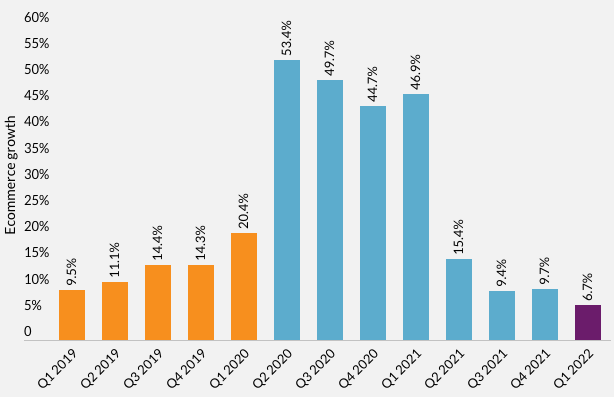

Exhibit 4: Per-package shipping rates have soared since 2018

Supply Chain Dive

The pandemic certainly tilted the odds in favor of FedEx, but things are taking a different turn today, with e-commerce demand slowing as consumers now have the option of striking a balance between online and in-store shopping. Investors and analysts were expecting online sales to decline once mobility restrictions are lifted, but the decline in e-commerce sales seems to be larger than expected.

Exhibit 5: Online sales growth

Digital Commerce 360

This decline in online orders is likely to have a negative impact on FedEx’s short-term earnings, and the shifting narrative of the U.S. economy could deteriorate the investor sentiment toward pandemic winners, thereby resulting in lower stock prices for FedEx, its peers, and e-commerce companies. In the long run, however, FedEx’s Ground segment seems well-positioned to grow at a slow and steady pace, given that e-commerce penetration is likely to increase gradually through 2030.

The company enjoys competitive advantages because of its scale in both ground delivery and the B2B segment, where international delivery is focused on. These competitive advantages should help FedEx remain consistently profitable in the long run, but investors might have to stomach some pain in the short run before operating conditions improve.

The Opportunity Cost Of Rewarding Shareholders

Investments have been the driving force of FedEx, and without these substantial investments in the last decade, FedEx would not have been able to gain a speed advantage over United Parcel Service, Inc. (UPS), its biggest rival in the domestic market. Below are some of the noteworthy investments FedEx carried out since 2011.

- The acquisition of the logistics business of AFL and Unifreight India to expand services in India.

- The acquisition of Polish courier company Opek.

- The acquisition of TNT Express.

- The acquisition of P2P Mailing Limited.

- The acquisition of Israel’s Flying Cargo Group’s International Express business.

- The acquisition of ShopRunner.

- An investment of $1.5 billion to double the capacity at Roissy Airport in France.

Today, FedEx is pivoting to a new strategy where the company will focus on improving margins and profitability by trimming down capital investments. Separately, the company has decided to increase the dividend payout as well. Both these decisions have already sparked interest among investors, but as a long-term-oriented investor, I am skeptical of cutting down investments while rewarding shareholders given that FedEx still has a long runway for growth in the residential package delivery market internationally. If FedEx fails to keep up pace with its rivals, especially in the international market, the company’s long-term earnings power could come into question.

Takeaway

FedEx will report Q4 FY 2022 earnings later today, and I believe the chances of an earnings miss are high. Even if the company reports blockbuster earnings – which has a slim chance – a discussion on cost pressures is likely to spook investors. FedEx’s recent strategic decisions, on the other hand, need to be scrutinized closely to ensure the company will not close the door to new opportunities to grow.

Be the first to comment