skynesher/iStock via Getty Images

Companies that invest in real estate may be key to investing success in 2022, with consumer prices seemingly out of control. Blackstone Mortgage Trust, Inc. (NYSE:BXMT) has significant investments in floating rate mortgage loans, which act as a natural inflation hedge.

Furthermore, Blackstone Mortgage Trust outperforms its dividend with distributable earnings, and the yield is likely to be sustainable even if the central bank takes time to control inflation rates.

Floating Rate Assets Imply Inflation Protection

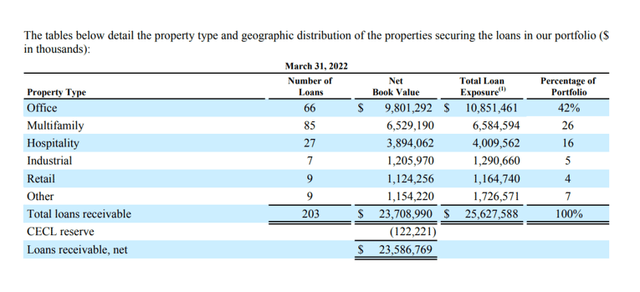

Blackstone Mortgage Trust originates (senior) commercial real estate loans. Blackstone Mortgage is heavily invested in the office (42%), multi-family (26%), and hospitality sectors (16%). On March 31, 2022, Blackstone Mortgage Trust’s total loan exposure was $25.6 billion, representing an increase of 8% over the loan receivable value on December 31, 2021.

Loans Portfolio (Blackstone Mortgage)

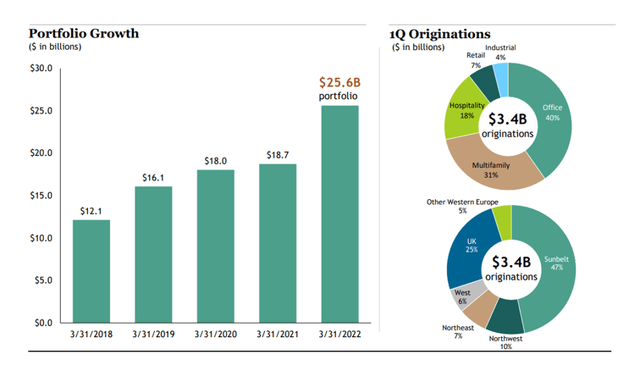

Blackstone Mortgage Trust’s portfolio has grown at a 21% annual rate since the first quarter of 2018. In the first quarter of 2021, the trust continued to benefit from strong demand for commercial real estate financing, originating $3.4 billion in new loans. 40% of the $3.4 billion in new originations were in the office sector, 31% in multi-family, and 18% in hospitality.

Portfolio Growth (Blackstone Mortgage)

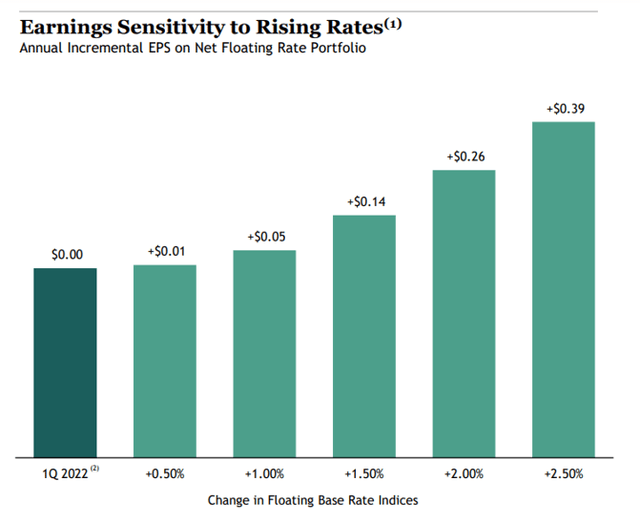

One important feature of Blackstone Mortgage Trust’s senior loan portfolio is that the trust originates floating rate loans, which generate higher interest income as interest rates rise. This appears to be a major issue in 2022, as inflation is on the rise and the central bank is expected to become more aggressive in combating price increases.

If the Fed raises interest rates, Blackstone Mortgage Trust’s floating rate assets will generate more income for the trust: A 1% increase in interest rates is expected to result in a $0.05 increase in earnings per share.

Earnings Sensitivity To Rising Rates (Blackstone Mortgage)

Distributable Earnings And Coverage

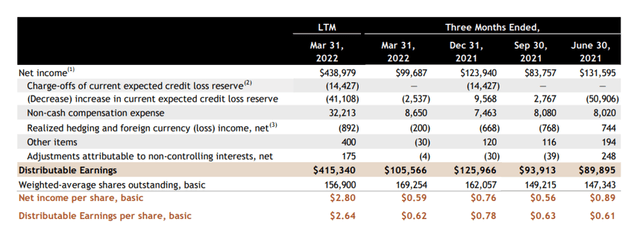

Blackstone Mortgage Trust consistently outperformed its dividend with distributable earnings, indicating a high-quality trust. Distributable earnings are a non-GAAP measure used to evaluate trust performance by adjusting net income for non-cash expenses such as stock compensation and currency gains or losses that are deemed non-recurring, or at the very least insignificant to the trust’s operating results.

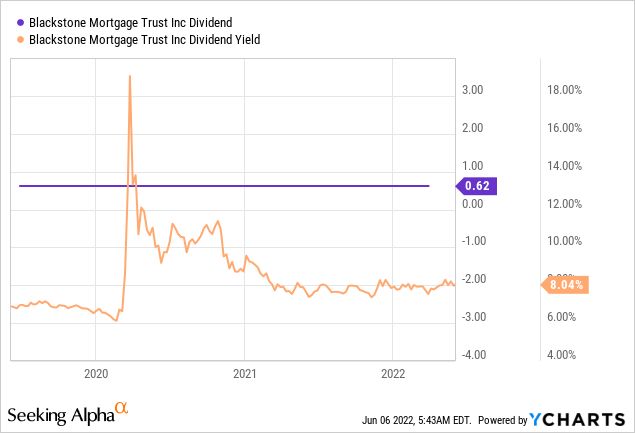

In the previous twelve months, Blackstone Mortgage Trust generated $2.64 per share in distributable earnings, which helped cover the trust’s $2.48 per share dividend. Based on the trust’s last twelve months of distributable earnings, the pay-out ratio was 94%.

Distributable Earnings (Blackstone Mortgage)

Despite the fact that the economy and the commercial real estate sector were under a lot of stress during the Covid-19 pandemic, Blackstone Mortgage Trust maintained its $0.62 per share quarterly dividend. A trust that can maintain its dividend payout in such difficult times is unquestionably of high quality.

Blackstone Mortgage Trust’s P/B-Multiple Is Attractive

Blackstone Mortgage Trust trades at a 14% premium to book value, which isn’t bad given that BXMT is a high-quality mortgage trust.

Starwood Property Trust, Inc. (STWD) trades at a 15% premium to book value. During the pandemic, both mortgage trusts achieved strong operating results and produced covered stock yields.

Why Blackstone Mortgage Trust Could See A Lower Stock Price

Blackstone Mortgage Trust’s real estate and mortgage loan investments are excellent ways to hedge against inflation. Because the value of real estate tends to rise with inflation, the mortgage trust could profit from its large floating rate investments.

On the other hand, there are risks, such as a commercial real estate market correction, which is where Blackstone Mortgage Trust makes its money. A possible increase in credit losses could be problematic for the trust. A severe recession may also limit the mortgage trust’s ability to originate new mortgage loans, potentially resulting in a decrease in portfolio income.

My Conclusion

Blackstone Mortgage Trust should be purchased for two reasons.

The first is that in an inflationary environment, the trust’s floating rate assets generate income upside. Originations were also strong in 1Q-22, indicating that the market is doing well and demanding investment capital.

The second reason is that Blackstone Mortgage Trust’s dividend is well-covered. The pay-out ratio is less than 100%, indicating that the dividend is sustainable.

Be the first to comment