Andrew Burton/Getty Images News

My objective with this thesis is to assess whether an investment in the BlackRock International Growth & Income Trust (NYSE:BGY) makes sense at this point in time.

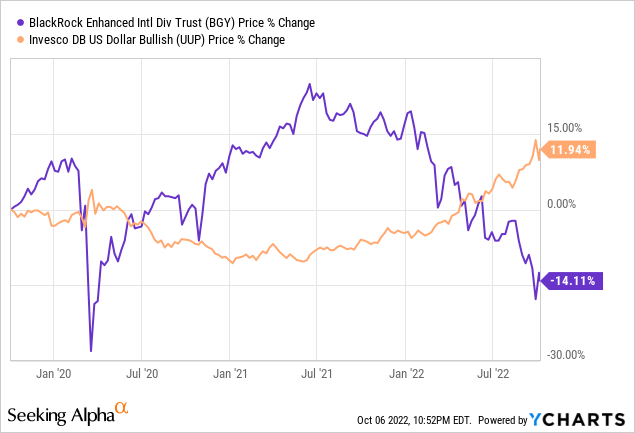

The closed-end fund (“CEF”) has suffered from an above-23% downside during the last year as shown in the chart below, dropping to a low of $4.40. It saw a slight upside to $4.60 during this week, and this coincided with the greenback, represented here by the Invesco DB U.S Dollar Bullish (UUP), faltering slightly as shown in the orange chart

BGY’s inverse correlation to the dollar shown here for a period of three years has to be investigated further for investors wanting to position themselves on the trust. Thus, I start by highlighting the reasons why the greenback showed signs of weakness and whether this could be sustained.

Dollar Path Tied To Fed Actions

On Tuesday, October 4, the new job opening for August dropped by 10% compared to July, indicating that corporations have slashed their human resource budgets possibly because of an economic slowdown fear. Now, the employment number is precisely the sort of indicator that the Fed Reserve looks to gauge regarding whether its fight against high inflation is starting to bear fruits.

For investors, high economic growth often accelerates hiring and boosts the salaries of employees as they produce more to satisfy demand. Now, millions of employees have enjoyed more disposable income as a result of the post-pandemic recovery, in turn, boosted demand for goods and services which increases their prices. This, in turn, results in cost-push inflation, exacerbated by the Ukrainian conflict.

Viewed from this angle, the low job opening numbers implied a pause in the red-hot economy and, by ricochet, on higher inflation which might prompt the Fed to turn more dovish. As a result, global stock markets were up on Tuesday and Wednesday, with the dollar moving downwards as shown in the above chart.

However, the market has given up part of its gains as uncertainty rules again, as the unemployment numbers released on Friday, October 7 showed that more people are employed. This means that the Fed still needs to hike interest rates and there is no impetus for the dollar to stop its relentless ascent against all of the world’s currencies.

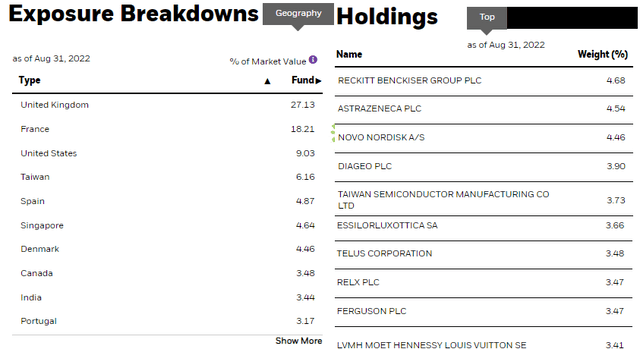

In this respect, developed countries’ economies where most of BGY’s holdings come from as shown in the table below are suffering as well.

BGY Holdings (www.blackrock.com)

Looking at the geography, the trust’s underlying fund has a 27.13% exposure to the U.K. and 18.21% to France. In the third position comes the U.S., with 9.03%.

Consequently, in addition to currency risks, BGY’s price action has also been impacted by what has been recently happening in the U.K.’s economy, especially because of a proposal to reduce taxes by the new government. Thus, the stock market was volatile in the final week of September, and had it not been for some timely action by the Bank of England, there is a high probability that there would have been carnage. Other European markets like France also suffered due to the contagion effect.

Thinking aloud, the BlackRock trust’s downtrend should continue. But, in addition to capital appreciation rhetoric, there is also income.

The Income Rationale

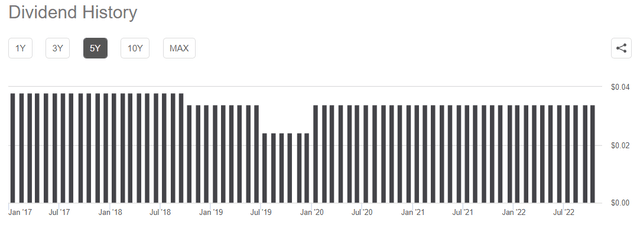

The trust’s primary focus is income, with capital appreciation only coming second, with an aim of investing 80% of assets in non-U.S. companies which pay high dividends. Now, most of us are used to the “Dividend Aristocrats,” or those that not only pay dividends yearly but also consistently increased distributions in each of the past 25 years. On the other hand, European companies seem to have a more flexible approach, consisting of cutting dividends in periods of economic hardships to resume payments as conditions improve.

This flexibility is evidenced in the dividend history for the past five years in the chart below, showing that after decreases, BGY has again increased dividend payments, and effect payments on a monthly basis.

Dividend History (seekingalpha.com)

Investigating further, this ability of the fund to continue delivering income is also explained by covered calls in the same way as BlackRock Innovation and Growth ETF (BIGZ), which I covered last month.

Without venturing too much into the details of writing covered calls, or selling a call option, it enables gains to be obtained by taking advantage of the market dynamics. Some use it to derive income while others use it to get some insulation against market volatility. In the case of BGY, as seen by its downtrend and dividends being sustained, it is income. Thus, the cash premiums it obtains from selling options get added to the distributions made to shareholders along with the investment income (capital gains and dividends from holdings).

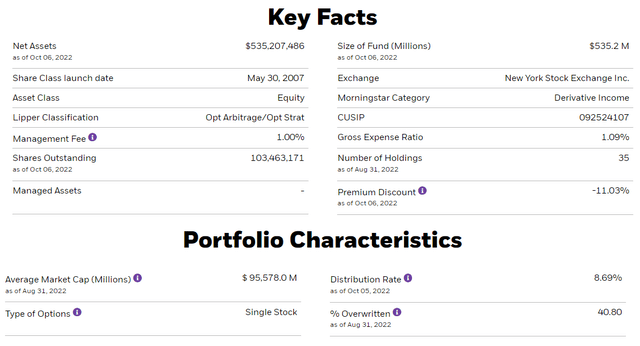

Now, covered calls form part of what is termed as the options strategy, whereby the trust writes a covered call against the position of a stock that is already held. For this purpose, the trust managers disposed of a portfolio consisting of 35 stocks as of August 31 whose market capitalizations can vary. Out of these, 30% to 45% of its total assets are used either for writing covered calls or put options. In this case, the trust has an obligation to buy at a certain strike price or the agreed-upon price with a counterparty.

The Risks and Capital Preservation

Now, one of the risks of this strategy is that it does not necessarily work during all market conditions, especially during rising markets. One example is when the value of the stock against which the covered call has been written climbs significantly above the strike price. This results in a written option or sale to the counterparty with a gain consisting of the option premium and the price appreciation. However, the price at which the option is executed may be below the stock’s actual market value at that time, thereby denying the trust the benefit of the additional share appreciation.

This implies that option writing is better during a flat market or falling markets, and may be the reason why when the market went down as of March 2020, and many companies reduced or suspended payments of dividends due to the uncertainty caused by Covid lockdown measures, the trust increased and sustained its dividend payments.

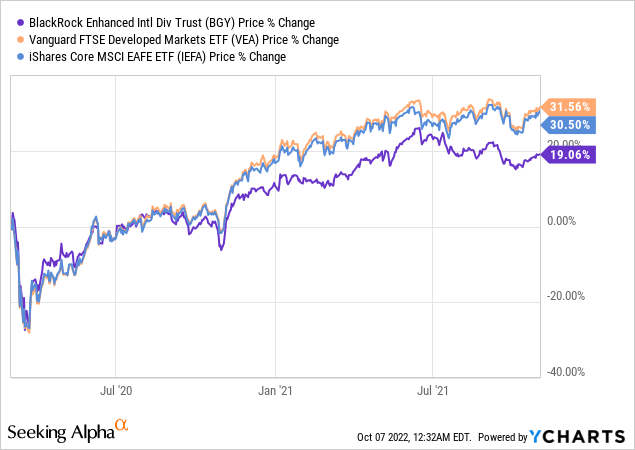

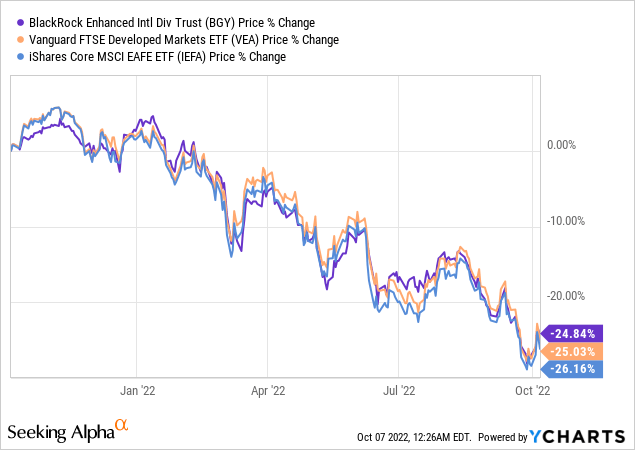

Also, bearing in mind BGY’s second objective, which is capital appreciation, which in the current highly volatile market condition should rather be called capital protection or preservation, I compare its price performance with the Vanguard FTSE Developed Markets ETF (VEA) and BlackRock Institutional Trust Company N.A. – BTC iShares Core MSCI EAFE ETF (IEFA). Both of these hold developed market stocks.

I made the comparison both for three-year (top chart) and one-year (bottom chart) time periods.

The results show that BGY only appreciated by 19% as shown in the blue chart compared to the two passively managed exchange-traded funds (ETFs”), which delivered above 30% gains from March 2020 to November 2021, or during a period that was bullish for the stock market.

On the other hand, the trust has underperformed less or performed better in relative terms, thereby providing better capital protection than the other two funds during the last year, or in a period that has been marked by a much higher degree of volatility.

Conclusion

Volatility is likely to persist as a result of the strong dollar and higher energy costs, given Saudi Arabia’s hawkish stance on the price of oil. Also, there is still uncertainty in the U.K. where the finance minister is trying to regain the trust of his party members.

In light of these, it is better to be patient amid all this market turmoil and wait for a better margin of entry.

Thus, for those who are waiting to buy the dip, actively managed BGY, which charges much higher fees of 1.09% compared to VEA and IEFA, pays a distribution yield of 8.69%, all made possible through the selection of appropriate holdings and a covered call strategy.

Key Facts and Fund Characteristics (www.blackrock.com)

Finally, while the charts show that BlackRock’s trust can provide a certain degree of protection against volatility, the future remains highly uncertain, especially after the latest unemployment report.

Be the first to comment