JHVEPhoto/iStock Editorial via Getty Images

Price Action Thesis

We follow up with a detailed price action analysis of AMD (AMD) stock after our previous Q1 update. There have been noteworthy developments in its price action, as AMD moved decisively into negative flow (bearish momentum).

Even though AMD had performed in line with the market over the past month, we observed another bull trap in early June that decisively rejected further buying momentum. Notably, it also prevented AMD from retaking its bullish bias. Therefore, the tide seems to have turned on AMD convincingly, even though it’s likely at a near-term bottom, with a potential bear trap.

As a result, investors can still use the current levels to add exposure. However, we implore them to monitor whether AMD can retake its June bull trap or face continued rejection at lower highs.

Therefore, we revised our valuation analysis using a reverse cash flow model to parse market dynamics better. Given AMD’s bearish flow, we have tightened our requirements and assessed that the market seems tentative about AMD’s valuation now.

Even though management has guided for 20% average topline growth over the next three to four years at its recent Financial Analyst Day, the Street (generally bullish) remains unconvinced.

As a result, we urge investors to consider spreading their risks across a series of critical support zones to add exposure.

Therefore, we believe it’s apt to revise our rating on AMD stock from Strong Buy to Buy, given weakening price action dynamics.

Two Significant Bull Traps Sent AMD Into Bearish Flow

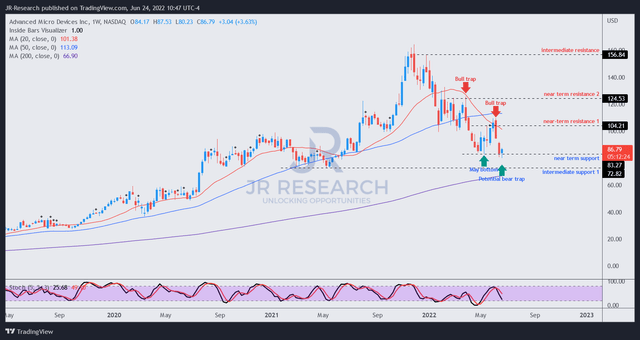

Investors can glean from AMD’s weekly chart above and observe the two significant bull traps in March and June. Our previous Strong Buy call in early May was predicated on a validated bear trap at its May bottom. However, that bear trap has been resolved by June’s bull trap.

Consequently, it sent AMD into a rapid liquidation over two weeks. However, it seems to be forming another potential bear trap (pending June 24’s close), rejecting further selling momentum at the current levels.

While its price action remains constructive, AMD’s flow has turned decisively bearish due to June’s bull trap. As a result, investors should consider that AMD’s price action has weakened considerably, resisted by two lower highs bull traps.

Notwithstanding, the current potential bear trap (if validated) still represents a buying opportunity to layer in. However, we urge investors to observe the strength of its recovery, given its bearish bias.

Therefore, we believe it’s appropriate to consider loosening exposure at its June bull trap if it fails to retake its near-term resistance. In addition, we also urge investors to prepare for a deeper retracement, as the bearish momentum unfolds further.

The Street Is Not Convinced Of AMD’s 20% Revenue Growth Guidance

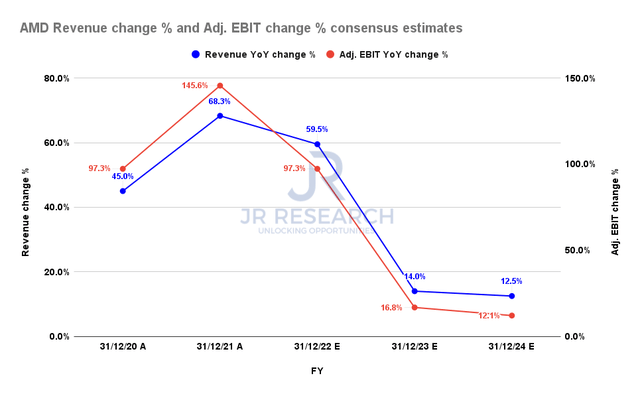

AMD revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

CEO Dr. Lisa Su emphasized at AMD’s recent Analyst Day that she’s confident in delivering 20% average topline growth over the next few years. She articulated (edited):

We think that the markets are very attractive. The product and technology portfolio is very attractive. We can drive approximately 20% CAGR over the next 3 to 4 years. We call the long-term financial model time frame, 3 to 4 years. And then from a free cash flow margin standpoint, we believe we’ll be over 25%, and that’s including the fact that we are making forward-looking capacity investments. (AMD’s June 2022 Financial Analyst Day)

We think Dr. Su was astute in helping to guide the Street in “adjusting” their models accordingly, given AMD’s expanded portfolio. However, the revised consensus estimates suggest the Street’s “nonchalance,” as they modeled markedly lower topline growth estimates.

As seen above, the Street expects AMD’s revenue growth to moderate to 14% in FY23 and 12.5% in FY24. Notwithstanding, Street’s consensus on AMD’s free cash flow (FCF) margins remain robust, as they project AMD’s FCF margins to reach 24.5% by FY24.

| Stock | AMD |

| Current market cap | $141.47B |

| Hurdle rate (CAGR) | 15% |

| Projection through | CQ2’26 |

| Required FCF yield in CQ2’26 | 5% |

| Assumed TTM FCF margin in CQ2’26 | 24% |

| Implied TTM revenue by CQ2’26 | $51.55B |

AMD reverse cash flow valuation model. Data source: S&P Cap IQ, author

Our reverse cash flow model suggests that AMD stock is unlikely to replicate the tremendous 5Y CAGR of 43.36% over the past five years, even with Dr. Su’s guidance. Notably, its performance could be “market-perform” at best if we used Dr. Su’s guidance as a guidepost.

We applied a hurdle rate of 15%, slightly lower than the Invesco QQQ ETF’s (QQQ) 15.5% 5Y CAGR and lower than the iShares Semiconductor ETF’s (SOXX) 20% 5Y CAGR.

As a result, the market is justifiably asking for higher FCF yields to compensate for a markedly lower hurdle rate. Based on AMD’s significant bull traps in March and April, the market seemed to have rejected FCF yields lower than 4.5% (Vs. AMD’s 5Y mean of 2.45%).

Notably, AMD last traded at an FCF yield of 5.3%, as it attempted to form a potential bear trap. Therefore, we believe that a 5% FCF yield is appropriate to model the market’s valuation currently.

Using a TTM FCF margin slightly below the Street’s consensus and Dr. Su’s guidance, we arrived at a TTM revenue target of $51.55B by CQ2’26. As a result, AMD needs to post a revenue CAGR of 21.31% from FY22-CQ2’26. Therefore, AMD will likely miss its revenue target even with Dr. Su’s guidance at its current valuation.

If we revised our entry point near its intermediate support of $70, its valuation would be less demanding. As a result, we can afford to raise our hurdle rate to 20% while keeping the other parameters identical. Consequently, we require AMD to post a TTM revenue of $49.02B by CQ2’26, implying a revenue CAGR of 19.58% from FY22-CQ2’26.

However, all bets are off if the market decides to de-rate AMD stock by considering the Street’s consensus in parsing AMD’s valuation. Given AMD’s bearish flow, we believe the likelihood of a further sell-off to force another rapid liquidation cannot be ruled out.

Is AMD Stock A Buy, Sell, Or Hold?

We revise our rating on AMD stock from Strong Buy to Buy, with a near-term price target of $100 (an implied upside of 16%). Given the significant price action developments, AMD’s flow has become bearish for the first time over the last five years. Therefore, it could be an early warning signal from the market that it intends to digest its massive gains further.

Notwithstanding, a potential bear trap price action could still validate a buying opportunity for investors to layer in. However, investors should be cautious in adding heavily at the current level.

If the current levels do not hold, we see a rapid liquidation to its intermediate support ($70), which would markedly improve its valuation. However, our thesis is predicated on the market’s assessment of accepting Dr. Su’s guidance, given the bifurcation in the Street’s consensus.

Therefore, we believe it’s critical for investors to continue paying close attention to AMD’s price action to parse for vital clues on how the market intends to value its stock moving ahead.

Be the first to comment